What is a billing statement?

A billing statement is a document that summarizes the financial transactions between a customer and a company during a specific period. It includes all the purchases, payments, fees, and interest charged to the account during the billing cycle.

Quick Read: What is billing, Types, Process, How it Works & Format

Importance of understanding a billing statement

It is essential to understand a billing statement to ensure accurate payment and avoid overpaying or underpaying the balance. It also helps to monitor expenses and check for errors in the account.

Understanding billing statement terms

- Payment terms: The conditions for payment of the balance due, such as the payment due date, the minimum payment, and late payment fees.

- Late payment fees: The charges that are added to the account when the payment is not made on time.

- Minimum payment: The lowest amount required to be paid by the due date to avoid late fees and maintain the account in good standing.

- Credit limit: The maximum amount of credit that a customer can use on the account.

- Annual percentage rate (APR): The annual interest rate charged on the balance owed.

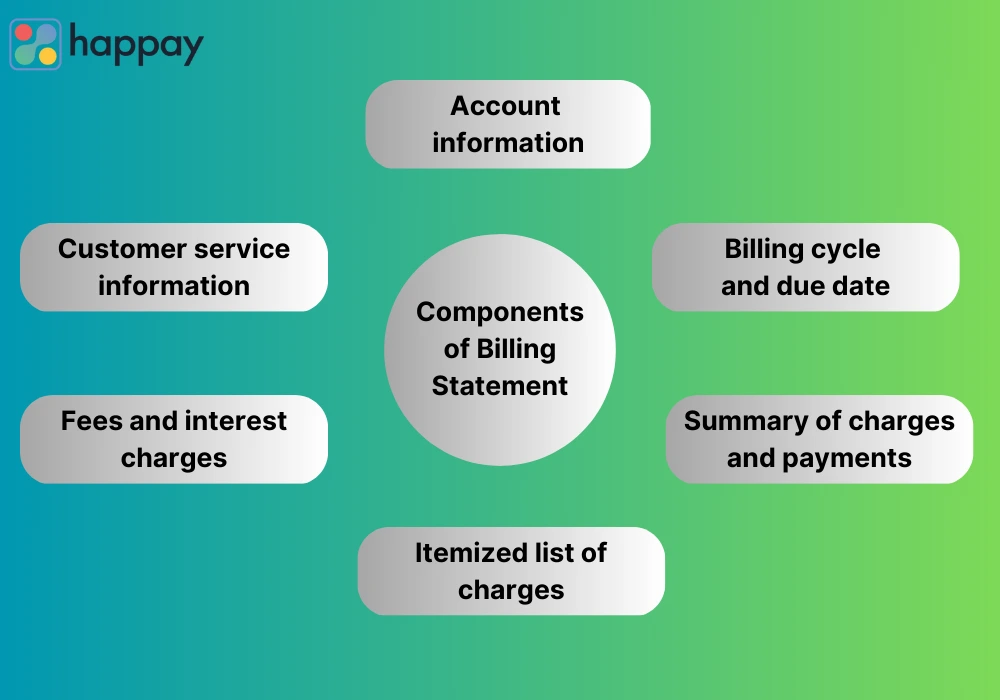

Components of a billing statement

A billing statement includes the following components:

- Account information: Customer name, address, and account number.

- Billing cycle and due date: The period covered by the statement and the date when the payment is due.

- Summary of charges and payments: The total balance, payments, and credits made during the billing cycle.

- Itemized list of charges: A detailed list of all the purchases and transactions made on the account.

- Fees and interest charges: Any fees or interest charged to the account, such as late fees or finance charges.

- Customer service information: Contact information for customer support.

How does a billing statement work?

It works by summarizing the transactions made during a specific period, including purchases, payments, fees, and interest charges. It provides an overview of the balance owed and the minimum payment required to maintain the account in good standing.

Quick Read: Billing Process: What is it, Key Elements, Steps & How to Improve it?

How to create a billing statement?

Creating a billing statement involves a few basic steps, and these steps can vary depending on the billing software or system being used.

Here is a general guide on how to create a billing statement:

- Gather necessary information

Before creating a billing statement, it’s essential to gather all the necessary information about the client or customer. This includes their name, address, and contact information. It’s also important to gather details about the products or services provided, such as the date of service, quantity, rate, and total cost.

- Choose a template

Most billing software or systems offer customizable templates that you can use to create a billing statement. Choose a template that suits your business needs and customize it according to your requirements.

- Add the client or customer information

Once you have selected a template, add the client or customer’s information to the billing statement. Ensure that the information is accurate and up to date.

- Add details about the products or services provided

After adding the customer information, add details about the products or services provided. Include the date of service, the quantity, rate, and total cost.

- Calculate the total amount due

Add up all the costs to determine the total amount due. This should include any taxes or fees associated with the purchase.

- Add payment details

Include details about how the customer can pay the invoice, including payment methods, due dates, and any late payment fees.

- Proofread and review

Before sending the billing statement to the customer, ensure that all the information is accurate and up to date. Double-check all calculations and proofread the statement for any errors.

- Send the billing statement

Once you’re satisfied with the billing statement, send it to the customer via email or mail. Ensure that the customer receives the statement promptly and knows how to make the payment.

Quick Read: What is e-Billing? A Comprehensive Guide for Electronic Billing

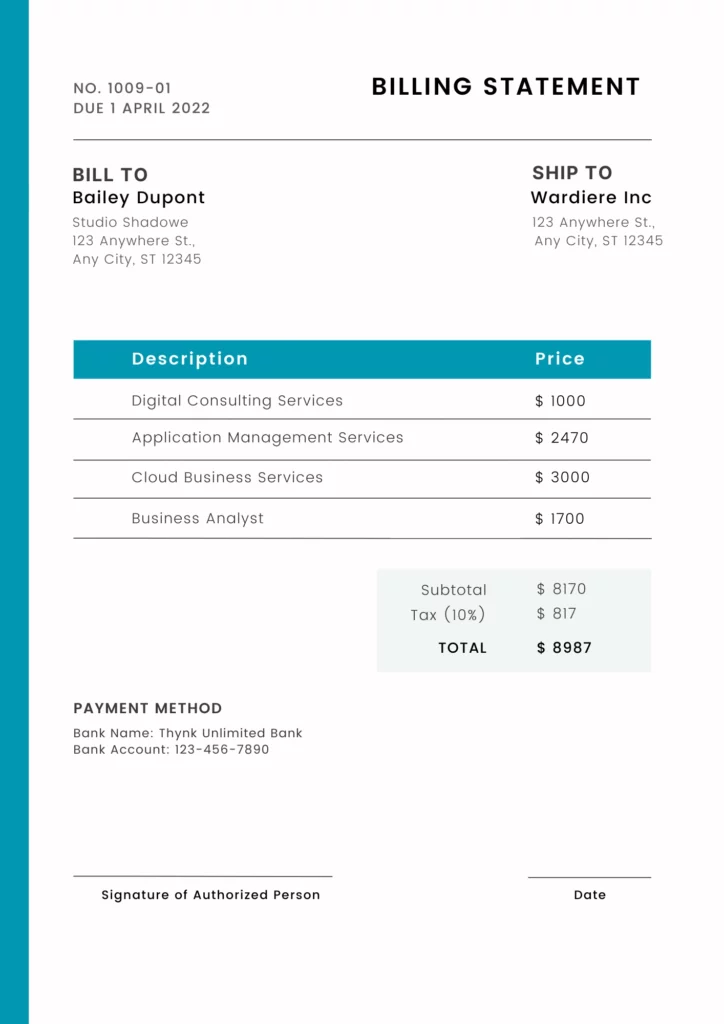

What is the billing statement format?

A billing statement format typically includes the customer’s name, address, and account number at the top, followed by a summary of charges and payments, an itemized list of charges, and customer service information at the bottom.

Difference between invoice and billing statement

Invoice Statement |

Billing Statement |

|

Request for payment of goods or services rendered. |

Summary of the transactions during a specific period. |

|

Sent before payment is due. |

Sent after payment is due. |

|

Includes details of a single transaction. |

Includes all the transactions during the billing cycle. |

|

Does not show account balance. |

Shows the account balance and minimum payment required. |

Quick Read: Difference Between Invoice and Bill: A Complete Guide

Tips for managing billing statements

Managing billing statements can be overwhelming, but it’s essential to stay on top of your finances.

Here are some tips to help you manage your billing statements effectively:

- Set up payment reminders: Missing a payment due date can lead to late fees, increased interest rates, and even damage to your credit score. Setting up payment reminders through email, text, or app notifications can help ensure you never miss a payment.

- Avoid late payments: Paying bills late can cause financial stress and damage to your credit score. To avoid late payments, make sure you have enough money in your account to cover the payment before the due date.

- Pay more than the minimum payment: Paying only the minimum payment on your credit card bill can lead to high-interest charges and prolonged debt. Try to pay more than the minimum payment each month to reduce your balance and interest charges.

- Monitor spending: Regularly reviewing your statement can help you identify unnecessary expenses and opportunities to cut costs. It can also help you track your spending and stick to a budget.

- Check for errors: Billing errors can happen, and they can cost you money. Check your statement every month to make sure the charges are accurate and dispute any errors promptly.

By following these tips, you can effectively manage your billing statements and stay on top of your finances.

FAQs

A billing statement is used by businesses to provide a summary of charges and payments to their customers. It is a document that details the transactions that have taken place between the business and the customer over a specific period of time.

These are typically used for recurring payments, such as monthly utility bills, credit card statements, and other subscription-based services. The statement provides important information such as the total amount due, due date, minimum payment required, and any applicable fees or charges.

Customers can use the billing statement to track their expenses, monitor their payments, and reconcile their accounts. For businesses, billing statements are an important tool for managing their accounts receivables, tracking their revenue, and maintaining accurate financial records.

The process of finding a billing statement may vary depending on the type of bill you are referring to. In general, a billing statement is sent to you by the company or service provider that you are receiving services from, such as a credit card company, a utility company, or a phone service provider.

A billing statement can be called by different names depending on the context and the industry it is used in. It may also be referred to as an invoice, statement of account, customer statement, or simply a bill.

To write a billing statement, follow these steps:

1. Include your business name and contact information: Start by including your business name, address, phone number, and email address.

2. Add the customer’s name and contact information: Include the customer’s name, address, phone number, and email address. If the customer has an account number, include that as well.

3. Include the billing period: State the date range for the services rendered or goods provided. This will help the customer understand what the statement is for.

4. Itemize the charges: List the services or products provided and their prices. Be sure to include any taxes or fees associated with the transaction.

5. Calculate the total amount due: Add up all the charges and include the total amount due at the bottom of the statement.

6. Provide payment instructions: Include instructions on how the customer can pay the amount due, such as the payment methods accepted and the due date.

7. Include customer service information: Provide your customer service contact information, including your phone number and email address, in case the customer has any questions or concerns.

8. Review the statement for accuracy: Double-check the statement for accuracy to avoid any mistakes or disputes.

9. Send the billing statement: Send the billing statement to the customer through email or mail, depending on the customer’s preference.

Remember to keep a copy of the billing statement for your records.

Billing statement and an invoice are two different documents. An invoice is a document that is sent to a customer requesting payment for goods or services that have been provided, usually with a detailed list of the items or services and their prices. A billing statement, on the other hand, is a periodic summary of charges and payments made on an account over a specified period, often a month. It typically includes the account balance, minimum payment due, payment due date, and a summary of charges and payments made during the billing cycle.

Discussion about this post