Corporate credit cards can streamline your expense management processes.

Gone are the days when employees had to maintain and submit long paper trails to be able to make authorized purchases for the company. Modern expense management technology has simplified the process of business purchasing with the introduction of corporate credit cards.

Ineffective expense tracking and management can lead to a plethora of problems. Several roadblocks, like employee overspending, expense fraud, data contamination, etc., can not only lead to monetary losses but also result in employee dissatisfaction.

Corporate credit cards bridge the gap between independent purchasing and transparency that traditional expense management never could. They benefit both ends of the thread by obviating the need for employees to spend out of their pocket and giving managers complete control of the spending.

What is a Corporate Credit Card?

A corporate credit card is a payment tool designed for large companies. It is a payment system that ensures 100% spend visibility in organizations and secures companies against expense fraud, data contamination, and misuse of funds.

Corporate credit cards bring structure and security to the payables management process. Banks issue credit cards directly to companies. Organizations give these credit cards to authorized employees. The cards bear the name of your company along with the name of the assigned employee.

How do Corporate Credit Cards Work?

Corporate credit cards work like personal credit cards but have a few added levels. During corporate travel or while making authorized business purchases, various expenses are incurred by employees. Traditionally, employees pay for these expenses from their own pockets, retain the receipts, and later document and file the expenditures for reimbursement. These reimbursement requests are then reviewed and approved by managers and the finance department.

Like personal credit cards, employees can use company cards to buy flight tickets, pay at the counter for reservations, purchase approved meals, etc. Corporate credit cards eliminate these processes. They are a comfortable and secure way for businesses to pay their employees’ expenses.

Also, Read: Corporate Credit Card Reconciliation

Types of Corporate Credit Cards

We can divide corporate credit cards into two categories.

1. Corporate Liability Credit Cards

In this type, the employer is liable for credit card bill payments and other charges incurred on the purchases. However, the employee still has to report these charges. Only the credit history of the company is checked by the issuer before the issue of the card.

2. Individual Liability Credit Cards

In this type, the employee cardholders are liable for the repayment of the credit card fee. They can then report the expense as a business expense and file for reimbursement. While corporate credit card usage does not affect the personal credit score of the cardholding employee, the card issuer checks and approves the score before issuing the corporate credit card.

Corporate Credit Cards vs Business Credit Cards

Business credit cards and corporate credit cards both give companies flexible financing options and offer better expense planning. However, they are fundamentally different. The key difference between corporate credit cards and business credit cards is accessibility.

While smaller companies and early-stage startups can acquire business credit cards, only companies with a minimum annual turnover can get corporate credit cards. The annual turnover limit differs and is set individually by banks.

Another difference between corporate and business credit cards is the liability. Business credit cards make businesses and employee cardholders personally liable. On the other hand, a corporate credit card offers various liability options. There can be joint liability in which both the employer and employee are liable or individual liability of employer or employee.

Uses of corporate credit card

1. Online payments

You can use corporate credit cards to clear web-hosting charges and pay for online advertising and social media with a click of a button.

2. Travel expenses

Flight bookings, hotel reservations, meal expenses, etc., are hard to manage when many employees travel regularly. It is also hard for employees to keep track of their purchases while traveling. Corporate credit cards negate the need for manual expense reporting and reimbursement processes.

Also, Read: Business Travel Expenses

3. Managing subscriptions

Paying for SaaS subscriptions is a hassle when you manually do it. Corporate credit cards allow you to set up time-bound virtual card payments for recurring subscriptions.

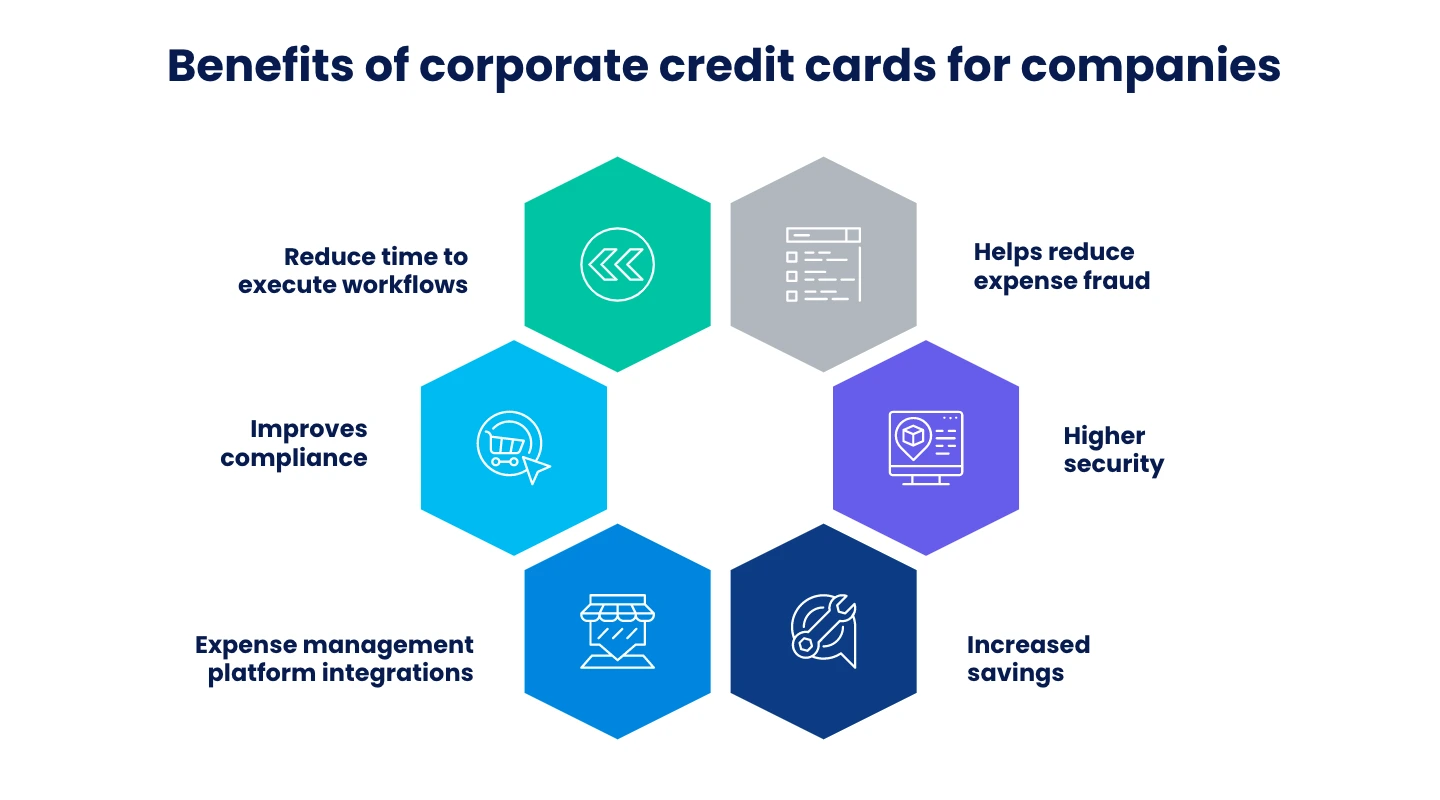

Benefits of Using a Corporate Credit Card for Companies

1. Reduce time to execute workflows

Corporate credit cards digitize the payment processes and reduce paperwork. This helps create a secure data repository of all the purchases ever made by an employee. They also prevent the tedious reimbursement and expense filing processes, saving the time of both employees and managers.

2. It helps reduce expense fraud

Expense fraud can cause a lot of loss to organizations. The most common ways to commit fraud are receipt manipulation, duplicating expenses, inflating expenses, etc. All of these schemes become easy to implement with manual expense filing processes.

Corporate credit cards minimize the need for reimbursement as the employee never has to spend their own money in the first place. They hence significantly contribute to the reduction of expense frauds.

Company credit cards also allow real-time tracking of expenses and hence increase transparency in the purchasing process. It becomes impossible for the employees to engage in malignant practices when every purchase they make is automatically recorded and tracked.

3. Improves compliance

Corporate credit cards allow you to set up specific spending limits. You can also enable or disable credit cards in a matter of minutes. Company cards also allow you to restrict the list of vendors for a specific function and set location restrictions and time validity on purchases. This automatically increases compliance with the expense policy.

Also, Read: 6 Ways to Improve Your Travel Policy Compliance

4. Higher security

Corporate credit cards have several mechanisms that safeguard company funds against misuse, theft, scams, or other losses.

5. Integration with expense management platforms

Corporate credit cards can integrate with your expense management system or accounting apps to enable end-to-end spend visibility. This allows budget tracking, increased oversight, and better quality finance analytics.

Quick Read: Expense Management Platforms

6. Increasing savings

Using a corporate credit card streamlines processes, saves time, minimizes fraud, stabilizes cashflow management, and indirectly saves business owners lakhs of rupees. However, credit cards also make you eligible for various reward points, cashback, airport lounge access, and discounts. They all may contribute to immense savings in the long run.

Also Read: High ROI with Corporate Credit Cards

Benefits of using a corporate credit card for employees

1. Reduced financial pressure

In the traditional expense management process, employees pay for business expenses and then file for reimbursement. It may take a while for them to get their money back. This sometimes imposes a financial burden on the employee. However, corporate credit cards ensure that employees don’t use personal funds to pay for expenses.

2. No need to save receipts and produce payment proofs

Corporate credit cards automatically record every transaction made using them. This means that employees no longer have to manually record every expense they paid for and save receipts and bills to be able to file for reimbursement.

3. Unaffected credit score

Corporate credit cards absolve employees of long-term financial liability. While the credit card payment liability may be shared by the company and the employee for the card, the employee’s credit score remains unaffected.

Quick Read: Impact of Company Credit Cards on Credit Scores

Disadvantages of Corporate Credit Cards

Disadvantages for Companies

While corporate credit cards majorly benefit the expense management practices of a company, there are certain disadvantages and risks associated with them

- Extra cardholders’ fees can add up to a large amount

- Only certain companies with a high annual turnover can get them. Which means small businesses cannot use them.

Disadvantages for Employees

- Employees cannot earn card rewards on their travels

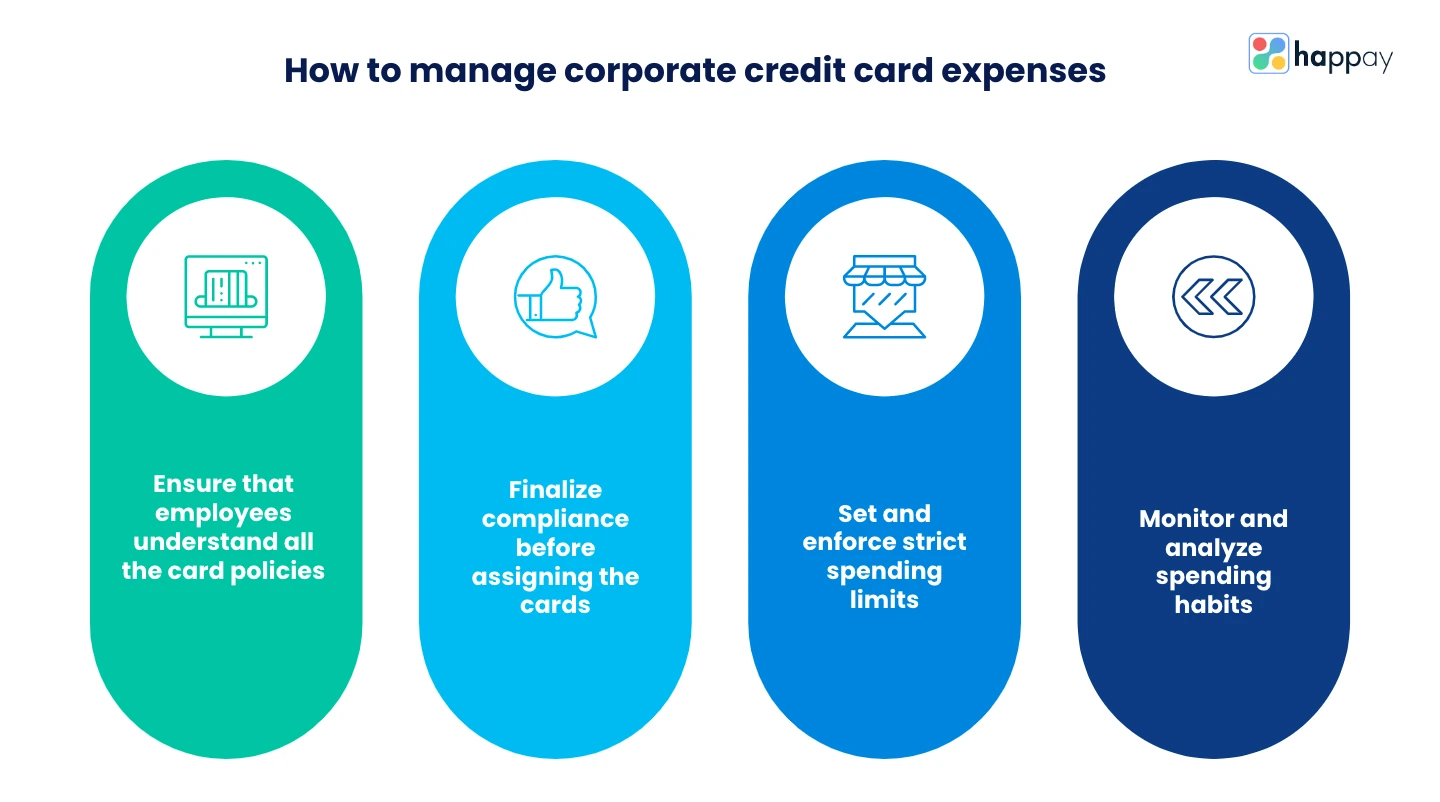

How to Manage Corporate Credit Card Expenses?

Corporate credit cards minimize the stress and confusion associated with manual spend management. However, there are still a few things finance officers should do to make the best of them.

1. Make Sure Your Employees Understand the Card Policies

You must communicate to the employees their responsibilities while using their credit cards and the penalties for mishandling, negligence, or malfeasance.

Hold training sessions with employees and address questions and concerns about using credit cards to ensure proper policy compliance and avoid future conflicts about the same.

2. Finish Compliance Before Assigning the Cards

Before assigning a card to an employee, ensure all the concerned parties have signed all the relevant agreements. TheseThese agreements can detail the policies and the rules of card usage.

3. Set Spending Limits

The finance team should work with team leaders to set specific spending limits for individual employees. Setting pre-spend limits on cards helps employees follow the company’s expense policies.

Quick Read: Spend Management

4. Monitor and Analyze Spending Habits

Corporate credit cards allow you to observe all the employees spending activities in real-time. This feature gets wasted if the finance officers do not take out the time to monitor and analyze these spending habits carefully and use the information to make critical decisions later.

Does Your Company Qualify for a Corporate Credit Card?

The eligibility criteria for corporate credit cards differ from one bank to another. However, banks traditionally issue credit cards to established companies. For example, HDFC requires an organization to be at least 2 years old and have a minimum turnover of 10 crores to be eligible for corporate credit cards.

Companies must also have a high credit score to qualify for a corporate credit card. A score of 700 and above is good, and 800 and above is considered optimal.

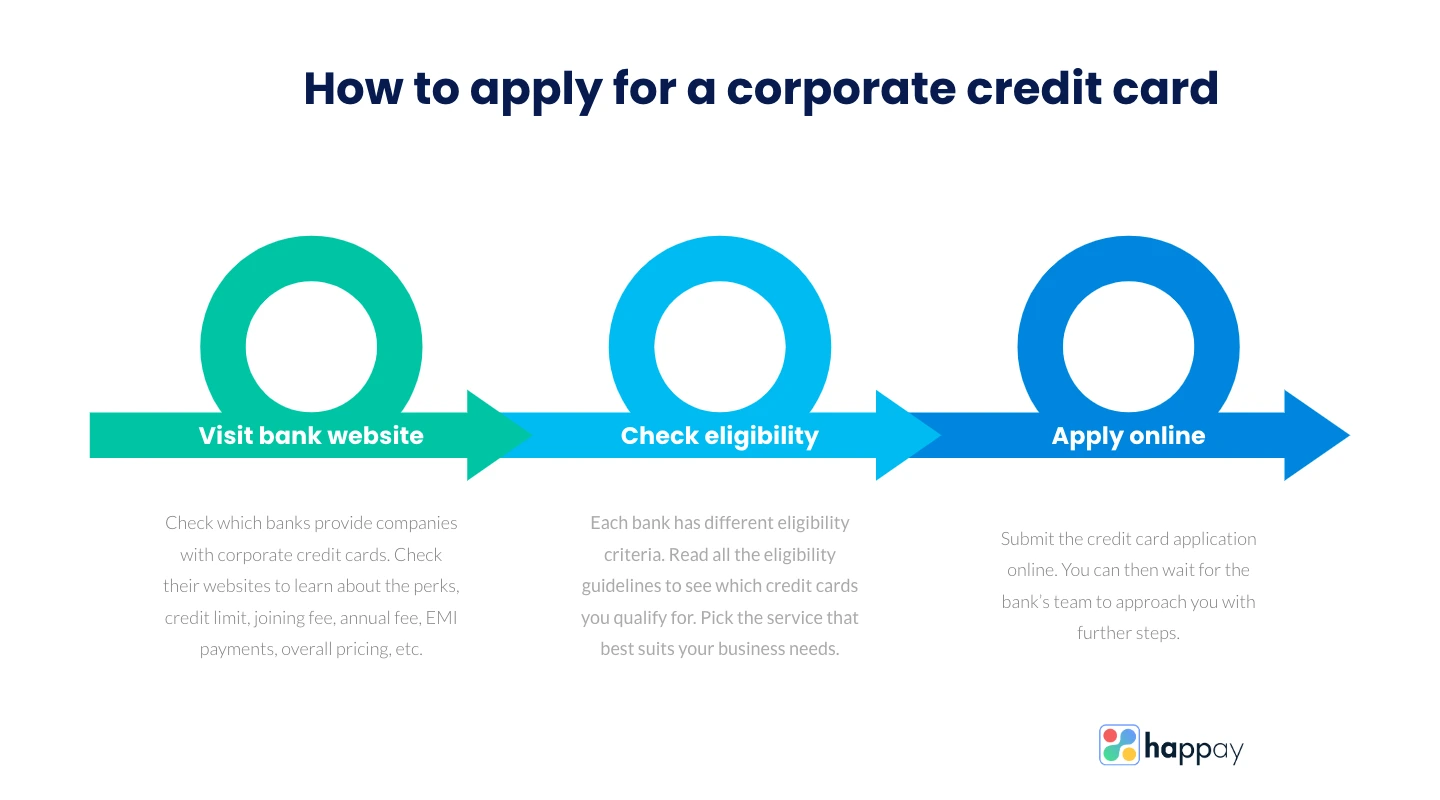

How to Apply for a Corporate Credit Card?

You can apply for a corporate credit card online, as most banks have online application channels in place. Follow these simple steps to apply for a corporate credit card.

1. Visit Bank Websites

Check which banks provide companies with corporate credit cards. Check their websites to learn about the perks, credit limit, joining fee, annual fee, EMI payments, overall pricing, etc., of their respective cards and services. Some banks that provide corporate credit cards in India are HDFC, Citibank, Indusind Bank, Kotak Mahindra, Axis Bank, American Express, etc.

2. Check Eligibility

Each bank has different eligibility criteria. Read all the eligibility guidelines to see which credit cards you qualify for. Pick the service that best suits your business needs.

3. Online Application

Submit the credit card application online. You can then wait for the bank’s team to approach you with further steps.

EPIC by Happay: The corporate card that does it all

EPIC is Happay’s corporate/business credit card that unifies all the best features of modern expense management. It enables real-time spend tracking, integrates with your finance apps, and allows you to control the implementation of your expense policy.

Here are a few corporate card features that are unique to EPIC.

- End-to-end payable management on a digital platform and mobile app

- Centralized visibility and control over transactions across multiple devices

- Virtual cards for online and physical cards for offline transactions

- All utility and compliance payment channels

The best thing about EPIC is its accessibility- you do not have to deposit collateral to get corporate credit cards. Schedule a demo with the Happay team to learn more about the platform and its various offerings.

FAQ’s

1. Who uses corporate credit cards?

Companies who want to streamline their expense management processes and increase spend visibility use corporate credit cards.

2. What is the biggest benefit of corporate credit cards?

Corporate credit cards enable 100% real-time spend visibility and hence enable close monitoring of spend behaviors.

3. Can employees corporate credit cards be used for personal expenses?

Corporate credit cards are obtained for business use only by companies.

4. Who gets to use corporate credit cards?

Employees of companies that spend often on behalf of the business get corporate credit cards.

5. Will corporate credit cards affect your credit score?

No, using a corporate credit card will not affect your personal credit score.