Petty cash book

Thousands of challenges arise, and hundreds of problems must be solved daily while managing an organization’s finances. Petty cash expense and maintaining a petty cash book is one such challenge that you must never take lightly.

You ask us, why spend so much time, effort, and energy on such trivial things? Yes, compared with other business processes and transactions, petty cash is a very minute detail. But remember, in the business world, God resides in the details!

Also, Read: A Guide to Petty Cash

What is a petty cash book?

Part of the manual record-keeping system of a firm, in most companies, a petty cash book is a ledger book instead of a computer record. This is different from bookkeeping which is the process of recording your company’s financial transactions into organized accounts.

Along with a regular cash book, most companies maintain a separate petty cash book to record small and daily expenses like food, fuel, office supplies, electricity, postage, newspaper, travel, etc. The person responsible for recording these transactions is called a petty cash cashier.

A chief cashier in larger enterprises usually tracks and records huge daily transactions. Therefore, recording petty cash transactions on the main cash book could make everything chaotic and complicated. That is why it is recommended to maintain a separate petty cash book for small transactions.

Expense management solutions like Happay offer petty cash management software and prepaid to manage businesses with multiple locations, offices, and outlets. We will talk more about this later in the blog.

What is the system for maintaining petty cash?

Here are the three different systems that are used to maintain petty cash in organizations. The systems are:

1. Open system/ordinary system

The petty cashier is given a lump sum for expenses in this system. After spending the money, the cashier submits the accounts with receipts to the main cashier for approval.

2. Fixed system

In the fixed petty cash system, the chief cashier offers a fixed amount of money for a specified period to the petty cash cashier. After exhausting the amount, the petty cash cashier will submit the account for the money and will be given money for the next period.

3. Imprest system

The imprest system is the most commonly followed system for maintaining petty cash. Under the imprest system, the total amount of money for petty expenses for a specific period is calculated and given in advance to the cashier. After spending the imprest cash, the cashier will submit a detailed account at the end of the period and will receive the advance for the next period. Also, the cash he receives is called the imprest cash.

Quick Read: What is Petty Cash Management?

What are the types of petty cash books?

There are two types of petty cash books. They are:

- Columnar petty cash book

- Imprest petty cash book

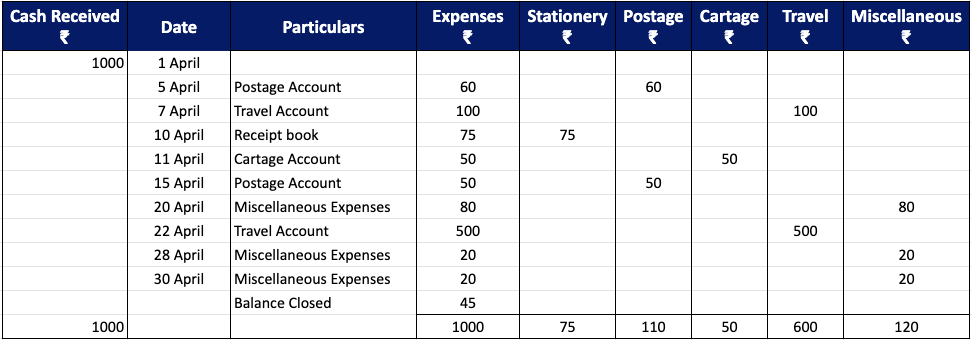

1. Columnar petty cash book

Multiple money columns record daily expenses in a columnar petty cash book.

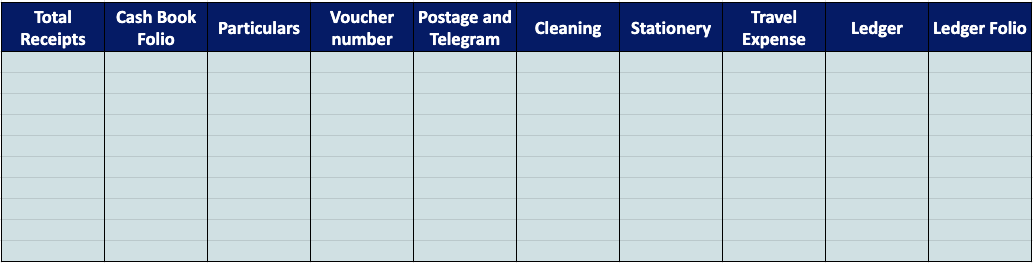

This petty cash book has two sides: the credit side and the debit side. In the particulars column – a single column – the particulars of cash receipts and expenses.

In the other column, the debit and credit dates are mentioned. Additionally, the money received from the head cashier is written on the debit money column. At the same time, the credit side will contain money columns as per the expenses, which will be arranged chronologically. Finally, the total money column on the credit side, which records all expenses, will give the total expense.

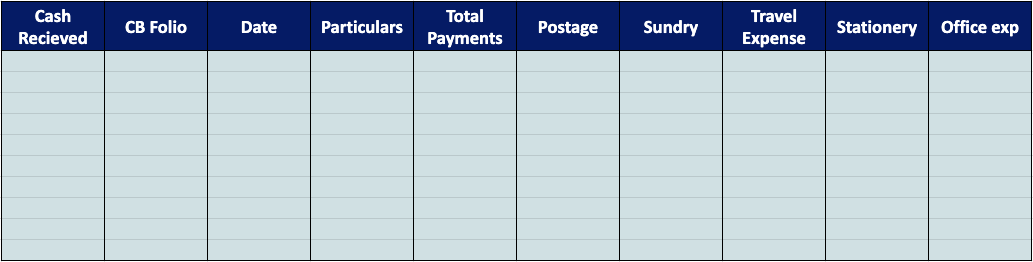

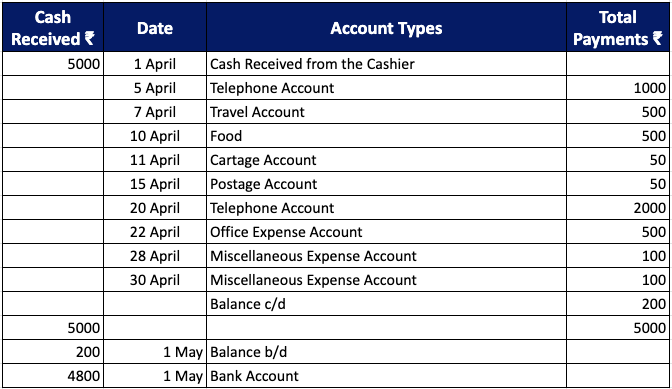

Columnar petty cash book format

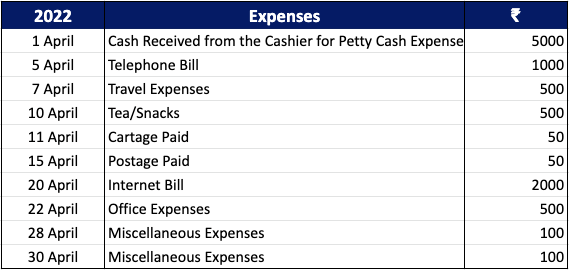

Columnar petty cash book example

2. Analytical petty cash book

The most effective way to record petty cash payments analytical petty cash book is the most effective way to record petty cash payments.

A separate column is assigned for each petty expense on the credit side. Whenever a petty expense is recorded in the total payment column, the same amount is recorded in the relevant petty expense column.

Also, Read: How to Setup Petty Cash Accounting?

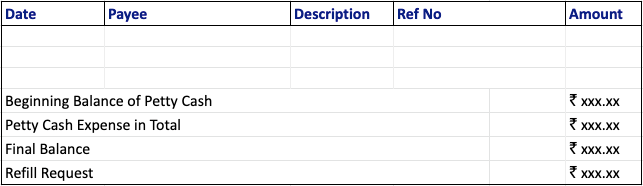

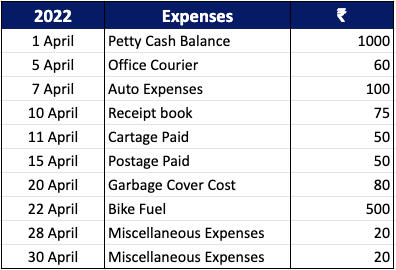

Analytical petty cash book example

Operations of petty cash

In most companies, all cash payments are to be made by cheque. However, in the case of petty cash payment, payment by cheque is not followed.

Business organizations have various day-to-day expenses like office material expenses, postal stamps, conveyance, etc., where payment by cheque is not possible. That is why a petty cash fund is created to handle petty expenses.

Here are the three stages of operating a petty cash fund:

- Creation of fund

- Payments using funds

- Replenishing the fund

1. Creation of fund

In this step, there’s an appointment of a petty cashier who takes care of the petty cash fund. To meet the daily petty expenses, a fund is created, and a cheque is given to the petty cashier.

The petty cashier then encashes the cheque and keeps this money in a box termed a petty cash box. The petty cash fund is always created for a definite amount of money. This means any change in the petty cash fund does not require a new journal entry.

2. Payments using the funds

Now the petty cashier can spend the money on day-to-day expenses according to the company’s expense policies. For example, the management can fix the maximum limit of expenditure, restrict expenses for some items or activities, etc.

Also, for every expenditure, the petty cashier and the recipient must sign a petty cash voucher/receipt. The petty cash fund reduces for every petty cash receipt kept in the petty cash box.

Therefore, the total amount on the petty cash receipts must match the petty cash amount spent. A neutral person, like an auditor, then checks the accounts and verifies if it matches.

3. Replenishing the fund

When the petty cash fund is replenished, the petty cashier is to furnish a requisition for the new fund. In this step, the petty cashier must prepare a statement of petty cash expenditure and send petty cash receipts to the finance department.

The finance team will verify the past expenditures and send a cheque for petty expenditures for the next period.

Quick Read: Expense vs Expenditure

Posting petty cash book to ledger

A list of the sum of the different payment assessment columns from the PCB on the check vouchers.

| Salary | ₹115 |

| Conveyance | ₹ 38 |

| Stationary | ₹ 95 |

| Employees lunch | ₹25 |

| Internet | ₹175 |

| Total | ₹448 |

When a check (for ₹448.00) is given to the petty bank teller the cashier enters the following entry in the primary cash book

- Now in the credit field, the sum of ₹448 is shown as a payment

- They deduct the salary account in the journal by ₹115, followed by the transportation accounts (₹38), stationary account (₹95), employee lunch (₹25), and internet (₹175).

Now the overall accounting equation is in line. Dual entry accountancy does not include the PCB and is similar to a supplementary book.

Quick Read: A Guide to Spend Management

What are the advantages of the Imprest petty cash system?

Here are some of the significant advantages of imprest petty cash book:

1. Labor minimization

Compared to other petty cash systems, the imprest system is not labor intensive and easy to do. Therefore, in this method, the workload of cashiers is minimized significantly.

2. Better control over petty expenses

In this petty cash system, the petty cashier will submit a statement of expenditure for approval at the end of a set period. The head cashier can check and verify the expenses and easily prevent fraud. This way, the head cashier will know where the money is and have better control over all those expenses.

3. Easy to verify

The verification process in the imprest petty cash system is pretty straightforward. At any point in time, if the chief cashier has any doubt

regarding the petty expenses, he can always refer and verify using the imprest petty cash book.

4. Fixed funds

In this method, the head cashier is always aware of the amount provided for petty cash. This helps the head cashier close the account quickly.

5. Prevent expense fraud

In the imprest system, the head cashier controls petty cash. Since the expenses are checked regularly, and the accounts are submitted promptly, this method’s chances of expense fraud are non-existent.

6. Petty cashiers can work comfortably

Since the petty cashier does not have to collect, he can now make the small expense recording more accurate.

7. Determination of expenses

In this, the finance team can be sure of the number of expenses of the same nature for a particular period. This can help greatly in petty cash budgeting.

Also, Read: What is Expense Management?

Disadvantages of petty cash book

- Since there’s a lack of documentation, accounting errors are very common in petty cash systems.

- If there are no limits set on the expenses, there is a high possibility of overspending.

- This method has a high chance of theft of petty cash by employees. And it will be difficult to track the source.

- This method is outdated and inefficient and is not suitable for large businesses.

Petty cash management with Happay

Petty cash books are relics of the past in today’s modern world. Most companies have already moved to the digital petty cash management system. Are you a business with multiple branches, outlets, or store locations? If you are looking for an efficient way to disburse petty cash and track it effectively, Happay is your best bet!

Using Happay’s innovative prepaid card, you can now send petty cash fast digitally in time. Also, thanks to Happay’s state-of-the-art petty cash management software, you can now track expenses in real time. Using Happay, you can reduce up to 75% cash leakage. Want to know how? Schedule a demo with us today and learn everything you need to know about Happay’s amazing features.

FAQs

The petty cash book is seen as a debit since a petty cash account is a current asset. Therefore, the funds are entered as a normal debit balance.

The cash book is the main book, whereas the petty cash book is in support of the cash book. The petty cash book reduces the burden of larger and heavy amounts of cash paid or received.

Petty cash books are prepared using the ordinary system and imprest system.

Particular cash that is used to pay for day-to-day petty expenses in a firm is called petty cash.