What is spend management?

“Balancing your money is the key to having enough.”

― Elizabeth Warren Amelia Warren Tyagin

In the twenty-first century’s capital-driven business world, every cent a company spends must justify itself with quantifiable returns. In 2021, the total global wealth increased by 9.8%, telling business owners worldwide that if you are not turning profits, you are not doing enough.

The onus then fell on the CFOs and finance leaders to create a comprehensive strategy that not just facilitates spend management but also yields returns in the form of savings. This is where spend management came in.

Spend management enables seamless optimization of expenses by streamlining the company’s purchasing processes. The proper procedures can help businesses maximize their savings by enhancing communication with suppliers and trading partners.

Also, Read: What Is Spend Analytics in Procurement?

Importance of spend management

Spend management is a value-adding function in an organization. It organizes end-to-end company expenditure processes through spending categorization, demand identification, sourcing, and analysis. Businesses need a robust technological infrastructure to fall back on if they want to manage these costs effectively.

There are countless expenses that a business has to manage, from small spending like furniture costs to mammoth amounts like property costs. There are daily expenses, monthly expenses, quarterly expenses, improvement spending, training cost, infrastructure cost, and so on. The list does not end. Mismanagement of these expenses can result in high monetary losses for a business.

Thankfully, the past decade has seen significant leaps in the business expense management technology industry. A spend management software can be an exhaustive tool that facilitates spend data analysis, budget allocation, procurement, and compliance with spend management policies.

Spend management prevents all malpractices and increases policy compliance. It uses automation technology to help you streamline your expense processes. You expose your organization to cost leakages, miscommunication, and overspending without a robust spend management structure.

Quick Read: 4 Ways to Simplify Your Expense Approval System

Benefits of spend management

1. Cost optimization

Efficient spend management helps you streamline purchasing and other expense management activities. This boosts communication between departments and helps eradicate bottlenecks in the system. Eventually, it leads to cost optimization and increased cost savings.

2. Policy compliance

Spend management helps ensure that your employees’ spending activities comply with your expense policy. An expense policy is an end-to-end resource that details the best expense practices for all expenses.

3. Prevents expense fraud

Expense frauds consistently deliver blows to the financial health of organizations. Intelligent spend management systems can help you prevent or tackle expense fraud early. You can program your expense management software to automatically detect duplicate receipts, deviations in average spend, and other reporting anomalies.

4. Saves time

According to a GBTA (Global Business Travel Association) report, processing one expense report takes about 20 minutes. A tedious report validation process can cause delays in reimbursements and frustrate employees.

Spend management speeds up the reimbursement process by unifying the expense reporting experience. It enables automatic policy compliance checks and makes report validation quicker.

4 Steps to the effective spend management process

Step 1: Analyze the spend data

Sources of expense differ for businesses. Analyze the spend data and detect all the expense outlets in your company. Common expenditure sources are payroll, rent, salaries, utilities, advertising, marketing, research, etc.

Ensure that you have systems in place to track the cash outflows from all these expense outlets.

Step 2: Centralize and standardize spend data

Centralizing spend data in a single repository increases accessibility. Hence, data standardization helps employees across departments and verticals input, interpret, and analyze data consistently without confusion.

Step 3: Verify and validate the spend data

Data validation is crucial in spend management, as even minor human errors and data contamination can lead to faulty analyses and forecasts. Ensure all the spend data in your repository is reconciled and tallied.

Step 4: Educate employees about the spend management policies

Start with defining the bottom line of your spend management policy. Ensure that all your employees understand the spending policy and are driven toward cost optimization. Encourage them to stay within budget and not overspend. Also, guide purchasing practices to ensure the employees are doing business with the right vendors.

Also, Read: A Guide to Business Travel Cost

What are the spend management best practices?

1. Internal audits

Every organization already has unique reimbursement policies. You must regularly update these policies according to the current needs of the business. The first step to this is internal auditing.

Finance teams, approving managers, and employees may make mistakes in various expense processes. Internal audits can help you identify these mistakes, filter out the root problems of the system that are enabling these mistakes, and then promptly solve the problems.

2. Create and follow an expense policy

Transparency and clarity are two of the most efficient tools for effective expense management. To ensure dedicated compliance with company rules and regulations, avoid fraudulent claims, and eliminate unnecessary expenses, it is always best to create and communicate an exhaustive expense policy.

An expense policy comprises the complete list of directions the employees must follow while reporting on expenses. It clarifies things like maximum spending amount limit, kinds of purchases the employees can make, the method of making reimbursement claims, authorizations on various spend categories, etc.

An expense policy should have every little detail of the company’s expense management infrastructure. Companies should make a conscious effort to make sure that the employees understand the expense policy to avoid future conflicts. Furthermore, all the employees, approvers, and travel partners must understand their role and accountability in the spend management process.

3. Standardize and categorize your data

Standardization of spend data increases communication efficiency, eliminates redundancies, and improves overall data interpretation and management. On the other hand, categorizing direct and indirect spend enables a cleaner and more effective organization. Therefore, ensure that your software collects, stores, and retrieves information in different spend categories.

4. Use the right spend management software

Invest in the right technology for your business by picking a spend management software equipped with the latest features. Leverage the power of automation to cut down on time-consuming processes and streamline your spend management operations.

Automated cost management workflows make the entire process of expense filing and approval easy. The best spend management systems do not have much of a learning curve for the employees and are easy to implement and use. However, the stakeholders still need to be educated on the nitty-gritty of the software.

If you have made the intelligent decision to adopt cost management software into your processes, then the next step is ensuring that all your employees understand the right way to use it.

Quick Read: 9 Expense Management Best Practices for CFOs

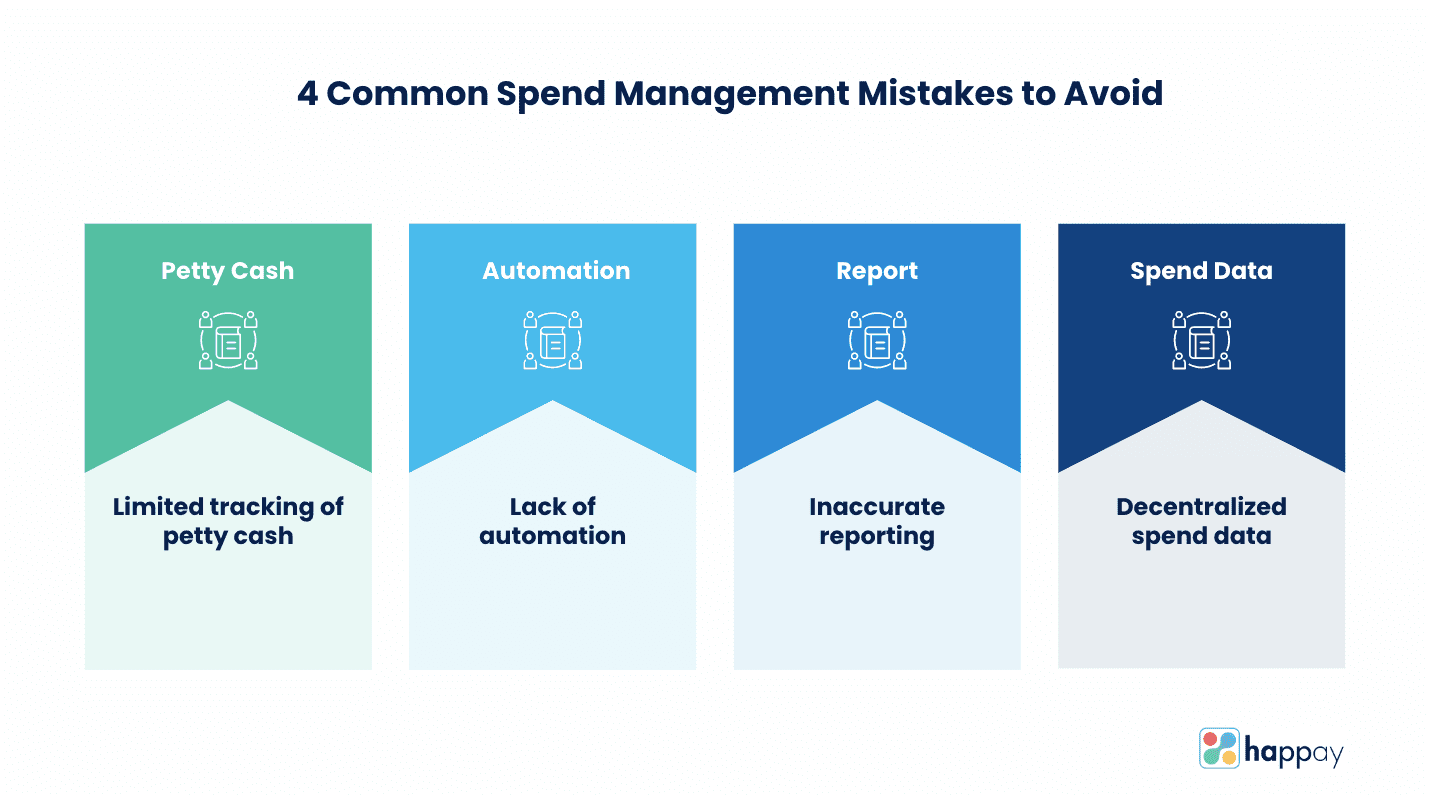

4 common spend management mistakes to avoid

Beware of little expenses. A small leak will sink a great ship.- Benjamin Franklin

1. Limited tracking of petty cash

Honesty in spending processes is essential in any organization. However, humans are known to be a little frivolous with cash. Due to its lower value, finance officials sometimes overlook petty cash tracking. However, that makes the petty cash fund more vulnerable to fraud.

2. Lack of automation

When you have a small team, manual filing and approval of expenses may work. However, businesses with big teams must automate their expense management workflows. Otherwise, the sheer bulk of reports will lead to an inconsistent validation process.

3. Inaccurate reporting

Inaccurate expense reporting can occur intentionally or unintentionally when a strict infrastructure does not support the expense management process. Businesses can lose a large chunk of money because of inaccurate reporting. Furthermore, erroneous expense reports can complicate the expense claim to reimbursement lifecycle.

To avoid erroneous reporting, you must ensure that the software you use has expense limits in place and mandates a thorough approval process.

4. Decentralized spend data

Many companies make the mistake of not centralizing their reporting methods. This may lead to organization-wide confusion. Therefore, consolidating direct and indirect spend standards is crucial as it enables more efficient reporting, filing, and management.

Also, Read: 6 Things You Must Know About Spend Analysis

Challenges with manual spend management process

1. Delayed reimbursements

In business spend management, manual processes heavily rely on the employees’ efforts. It takes a lot of time for the employees to collect all the relevant expense receipts and supporting documents and deliver them to the administration. It takes even more time for the managers to check and approve these documents. As a result, reimbursements get delayed.

2. Lack of transparency

Manual business spend management allows employees to meddle with the numbers as the administration is incapable of real-time updates and accurate expense tracking. This lack of transparency makes the administration vulnerable to malpractices like overstatements, receipt duplication, etc.

3. Confusion about expense policies

Without a strict infrastructural backup, miscommunication about expense policies can be a mutual bane for the employees and the finance team. For spend management to function smoothly, all the stakeholders should understand the spend categories and compliance procedures.

Quick Read: A Guide to Travel Expense Policy

What is Spend Management Software?

Spend management software is a platform that tracks, records, and manages the cash flow movements in a business.

You can use it to centralize spend data and gain insights into pan-organization purchasing processes. It also comes with automated workflows that help simplify the purchase and payment approval systems.

What is the main objective of spend management software?

Spend management software is primarily used to streamline all expense management processes, including expense reporting, validation, accounts payable, subscriptions, etc. It also digitizes all spend data and presents it in a comprehensible format.

Spend management platforms record and maintain the spend data and make audits easier. The information derived from these audits empowers business decisions at the executive level.

Also, Read: 10 Best Expense Management Software

Benefits of spend management software

A spend and expense management software can easily tackle the challenges of manual spend management. Furthermore, efficient spend management software can add big bucks to your cost savings by enabling the following benefits.

1. Increased organizational efficiency

Spend management platforms allow you to automate key expense management processes, in turn reducing the need for error-prone human intervention.

2. Ensures safety

Spend management software reduces dependency on employee honesty and increases transparency. Managers can easily track where the money is being spent, by whom it is being spent, and for what.

3. Saves money

The increase in purchase transparency brought about by spend management platforms helps identify the various bottlenecks of the previous system. Once these waste-causing bottlenecks are eliminated, cost savings automatically increase.

4. Offers insights into data

Business spend management software helps in the categorization and storage of all purchase and expense data. The organized data can derive insights into the company’s spending patterns and aid future cost-cutting decisions. This data can also help you identify the most minor and risk-prone spending areas.

Automated management systems also help you turn your expense data into comprehensive reports that you can use to optimize your internal spending processes.

Furthermore, you can use these reports to understand your employee behavior better. Everything from which employees are the most irresponsible spenders to which ones are the most dedicated savers becomes visible.

5. Better supplier relationships

Spend management software can give you insights into purchase orders, procurement process, vendor contracts, supplier communication, etc. This can expose frequent buying patterns. Y

ou can use that information during future negotiations and get better pricing on products. This strategic sourcing will in turn increase your cost savings, and empower efficient supplier management.

Quick Read: 7 Reasons to Automate Your Expense Management

How to choose the right spend management software for your business?

Businesses have varied expense management automation needs. It is hence imperative to do extensive research before picking out your ideal software. Customizability and flexibility should always be a top priority while making a decision. However, there are certain features that all the best spend-management platforms share.

1. Petty cash management

Petty cash management helps you save time and money by allowing you to distribute petty cash digitally. It also gives you complete control over the daily transactions and makes the processes secure. You don’t have to worry about how the employees use the funds because you have a comprehensive overview of all the spending.

Petty cash management is highly relevant for companies that have a large number of employees and multiple branches. It helps cut down on the costs of the physical distribution of petty cash and optimizes otherwise complex processes.

2. Pre-trip and on-trip travel expenses

Travel expense management is another tricky area that businesses have to tackle. It is a type of expense that leaves much room for obscurity that certain people can take advantage of. A spend management software can help you moderate your employees’ pre and on-trip travel expenses.

Spend management platforms can help you automate the key repetitive parts of travel expense approvals and also allow you to set specific limits on pre-trip expenses. Spend management software also helps you increase travel policy compliance. A complete and holistic travel expense management system saves the organization money and improves overall employee convenience.

3. Audit enablement features

Auditing your expenses can help you identify problems in your expense management system and tackle them. Frequent audits also expose expense fraud. Auditing also detects data contamination and helps avoid inaccurate analytics.

4. Automation and AI in spend management software

Almost all the features that spend management solutions use automation and AI. It forms the very base of a unified platform that has the ability to streamline a complex expense management process.

Automated workflows form the foundation of a time-efficient and cost-optimal business spend management system.

5. Cloud-based platform

A cloud-based platform makes it easy for employees to upload expense claims on the go. It also makes data more accessible, increases security, and enables real-time spend visibility.

6. Credit card integration

Credit card integration gives you real-time visibility of all employee expenses. Credit cards minimize the need for expense report creation and completely do away with the tedious reimbursement process.

7. Integration with your ERP and accounts software

Choose an expense management software that readily integrates with your ERP and accounting software. This allows prompt movement of data between platforms and avoids the hassle of multiple manual processes in the budgeting and accounting process that may lead to data contamination.

Ace the spend management game with Happay

Gone are the days when manual filings and approvals were an acceptable method for managing expenses. Happay’s spend management software offers lucrative features like Smart Audit, intelligent automation, mobile-enabled data capture, multi-level approval, and complete customizability.

Schedule a demo with the Happay team to get the most out of the latest technology that Happay offers.

FAQs

It is the practice of recording, real-time tracking, categorizing, validating, and analyzing business spend data to streamline expense processes and maximize savings.

Effective spend management helps you detect and eradicate waste areas, optimize savings, and supplement budgeting and auditing processes.

Spending management is a more exhaustive and holistic approach than expense management. It includes the three main spending operations- corporate cards, expense reimbursements, and bills.

The four stages of spend analysis are data collection, data cleansing, data classification, and data analysis.