Cash flow management software

Managing and tracking cash flow becomes tricky with several variables at play. After all, isn’t cash flow business’ lifeblood?

Even renowned companies can quickly grind to a halt without it. Cash flow management software help business owners and decision-makers manage their finances in such situations. The software supplies insights and analytics to make informed financial decisions, reduce expenses, and increase revenue.

Take a closer look at the best cash flow management software and how they help businesses manage and streamline finance and keep the cash flow thriving and healthy.

Quick Read: What is a Cash Management System?

Top 6 cash flow management software at a glance

|

Software |

Market Segment |

Free Trial |

Exporting budgets |

Updating budgets |

Forecast Comparison |

|

Small-business |

No |

Yes |

Yes |

Effective |

|

|

Small-business |

Yes |

Yes |

Yes |

Moderate |

|

|

Small-business |

Yes |

Yes |

Yes |

Less effective |

|

|

Mid-Market |

No |

Highly – Appreciable |

Yes |

In-depth |

|

|

Enterprise |

No |

Appreciable |

Not enough data |

Less effective |

|

|

Small-business |

Yes |

Yes |

Not enough data |

Less effective |

6 Best cash flow management software – A detailed comparison

1. QuickBooks

With QuickBooks cash flow management systems, managing your business’s cash flow has never been easier. The cash flow center provides a centralized platform where you can plan, save, and get paid, all in one place.

You can forecast your finances, sync all your accounts, and even open a checking account built into QuickBooks. With custom cash flow planning, real-time tracking, and insightful reports, you’ll have complete control over your business’s cash flow.

Top features of Quickbooks

Below are some popular features of QuickBooks.

- Cash flow planner allows users to forecast their future cash flow by creating a budget and setting goals.

- All-in-one dashboard provides a comprehensive overview of the user’s financial situation, including income and expenses, outstanding invoices, and bank balances.

- Checking account allows users to link their checking account and track all transactions in real-time, making it easy to reconcile the account.

- Custom cash flow planning customizes cash flow plans according to their unique business needs and preferences.

- State of cash flow report shows the user’s cash flow status, including cash in and out, projected balances, and more.

- State of payments report shows all payments status made by the user, including invoices, bills, and expenses.

- Estimates help users create and send estimates to their clients, track their status, and convert them into invoices.

- Contractor payments and expenses can be managed using QuickBooks.

- General reports provide various reports to help users track their financial performance, including profit and loss, balance sheets, and cash flow statements.

- Bill management helps users easily manage and pay bills in Quickbooks, set up recurring payments, and track due bills.

- Workflow automation automates repetitive tasks, such as invoicing and payment reminders, saving users time and reducing errors.

- Data restoration allows users to restore their data from a backup, ensuring they never lose important financial information.

Pricing

Quickbooks has four pricing plans: Simple Start, Essential, Plus, and Advance, which come at $15, $27.50, $42.50, and $100, respectively, when you pay for three months at once. Cash flow is a feature in all plans.

Based on your requirements, you choose the features you want to have in your tools and then select the plan.

Pros and cons of Quickbooks

|

Pros |

Cons |

|

Cash flow planner saves time and effort spent on manually tracking on spreadsheets |

Difficult to navigate for first-time users (G2) |

|

Easy to access and secure |

Hard to customize invoices (G2) |

|

Effective data transfer |

Only syncs with major financial institutions (G2 |

Future Read: 12 Best Invoicing Software for Your Business

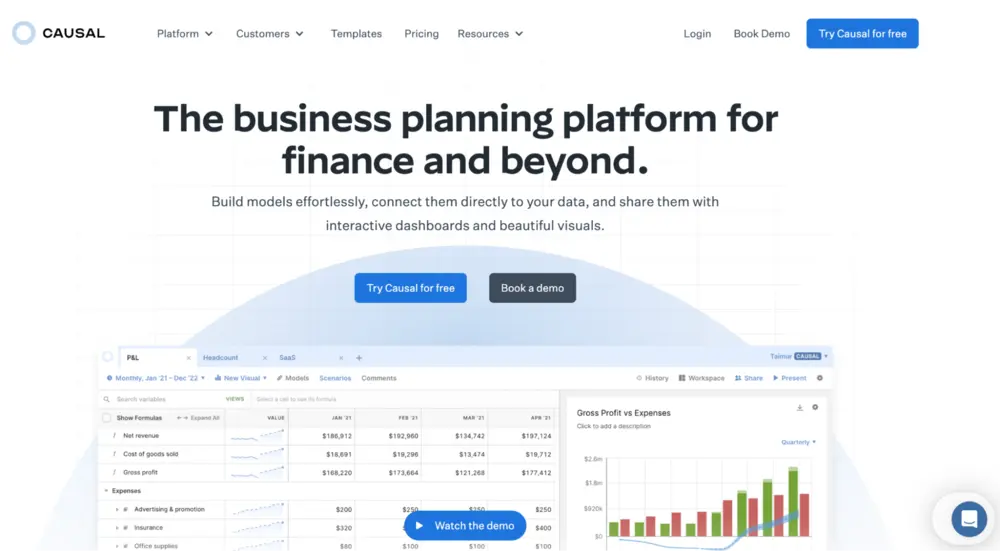

2. Causal

Causal’s cash flow management systems allow you to build financial models effortlessly and share them with interactive, visual dashboards. It helps you create cash flow models with variables that can be easily linked together using simple formulae.

Causal integrates with data sources, from spreadsheet software like Sheets and Excel to accounting platforms like Xero and Quickbooks.

Top features of Causal

Below are some popular features of Causal.

- Category items categorize data, making it easier to organize and analyze.

- Dashboards enable users to view their financial models and data differently.

- Google sheets integration allows users to import data directly from their spreadsheets.

- CSV upload helps users upload their data in CSV format.

- Standard data integration enables Causal to integrate with popular data sources like Stripe, Shopify, and QuickBooks.

- Models and scenarios help users explore different possibilities and make informed decisions based on their data.

- Variance analysis enables users to compare actual data to their forecasts and identify areas where they may need to adjust their models.

- Self-service enables users to create and analyze financial models without specialized training or technical expertise.

- Custom KPIs allow users to track and analyze the metrics that matter most to their business.

Pricing

Causall offers a free plan for individuals and early-stage companies. It offers a Startup plan at $250, ideal for CEOs, founders, and finance teams at 10 to 25-person companies. Furthermore, for companies with 50 to 1000 people, Causal offers a Business plan with custom pricing.

You can book a demo with Causal to get its Business plan’s pricing. Take a look at Causal’s pricing page to get more details.

Pros and cons of Causal

|

Pros |

Cons |

|

Formulas are easy to set up |

Steep learning curve (G2) |

|

Lots of helpful features |

User experience needs work (G2) |

|

Excellent dashboards and chart tools |

Documentation can be improved (G2) |

Quick Read: 10 Best Expense Management Software

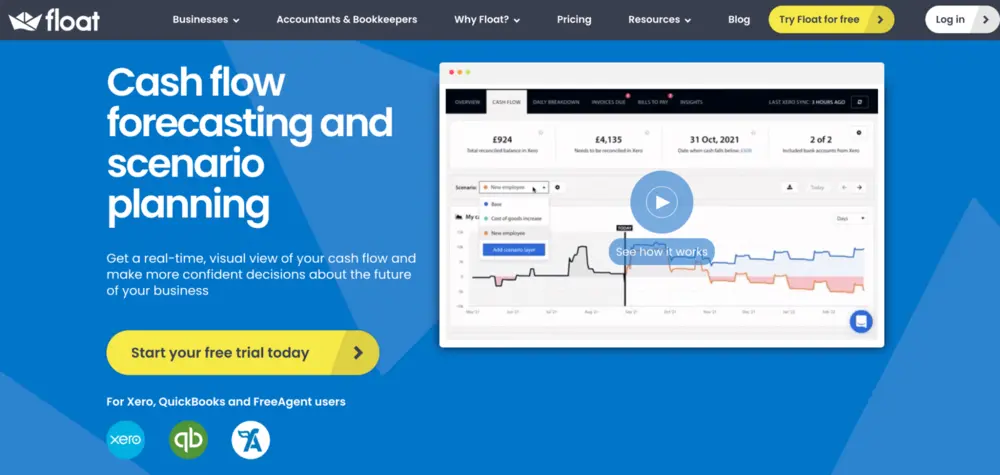

3. Float App

Float is an award-winning cash flow forecasting add-on for businesses using Xero, Quickbooks Online, or FreeAgent accounting software. With Float, businesses can create cash flow forecasts that are more accurate and take a fraction of the time to prepare compared to spreadsheets.

Using the direct method of cash forecasting, Float reads all information on bills, invoices, and other transactions to create robust cash flow forecasts that are visual and easy to understand. Float’s accuracy ensures that businesses are alerted to cash shortages or surpluses well in advance, allowing them to take proactive action.

Top features of Float App

Below are some popular features of Float cash flow forecasting software.

- The weekly cash summary gives a clear picture of the cash position.

- Exporting forecasts to CSV or PDF helps easy sharing of financial data.

- Budget vs. actuals reporting allows users to compare budget amounts to actuals.

- Budget hierarchies create budgets based on the organization’s hierarchical structure.

- Versioning creates and compares different versions of forecasts and budgets.

- Rolling forecasts changes based on actuals and the environment.

- Forecast comparison compares different forecasts to identify trends.

- Workflows to create and manage tasks efficiently.

Pricing

Float App offers a 14-day free trial for users who’re starting fresh. It offers three paid annual plans: Essential, Premium, and Enterprise at $59, $99, and $199, respectively,

The essential plan supports three users, five additional scenarios, and a three-year future forecast. The premium plan comes with ten users and ten additional scenarios. Next, the Enterprise plan accommodates a hundred users and additional scenarios.

Take a look at Float App’s pricing for more details.

Pros and cons of Float App

|

Pros |

Cons |

|

Integrations with Xero, Quickbooks, and other accounting platforms |

Buggy synchronization with financial institutions. (G2) |

|

Scenario planning |

Ability to foresee any negative scenarios (SaaSworthy) |

|

Simple user interface |

Poor user experience (G2) |

Quick Read: 11 Best Billing Software for Businesses

4. Tesorio

Tesorio provides real-time predictions and actionable insights based on behavioral trends, replacing tedious and reactive cash flow forecasting and collections processes.

The software connects with a variety of cloud-based ERP systems to ensure that every single invoice is followed up on quickly and with the right information, freeing up time for strategic account management to maximize the impact collections have on cash flow.

Top features of Tesorio

Below are some of the top features of Tesorio.

- Data exchange provides a platform for businesses to exchange financial data with their customers, suppliers, and other stakeholders.

- Data transfer helps to eliminate manual data entry and reduce the risk of errors.

- Reporting helps businesses to gain insights into their financial performance and make informed decisions

- Historical data enables users to track trends and identify areas where they may need to adjust their cash management strategies

- Estimated vs. actual receipts compare estimated receipts against actual receipts, helping users to identify discrepancies and take corrective action if necessary.

- Cash flow tracking allows businesses to monitor their cash position and make informed decisions about their working capital.

- Self-service customer portal enables businesses to offer their customers easy access to their cash flow data.

Pricing

Tesorio’s pricing information is available on request. You can book a free demo to share your requirements and get custom pricing that fits your needs.

Take a look at Tesorio’s demo page to learn more.

Pros and cons of Tesorio

|

Pros |

Cons |

|

Excellent AR automation |

Needs improvement on in-app PDF reader (G2) |

|

High quality of support |

Search fails when there is too much data (G2) |

|

Ease of setup |

Infrequent lags in updating (G2) |

Quick Read: 9 Best Vendor Payment Management Software

5. HighRadius

High Radius offers a comprehensive solution to businesses for cash positioning and treasury management. The platform provides an autonomous treasury cash management solution that automates bank reconciliation and gathering data from multiple sources.

Users can easily schedule and connect with banks to extract and auto-populate market data, bank transactions, and other data necessary for multi-currency cash positioning.

Top features of HighRadius

Below are some high-rated features of HighRadius.

- Rolling forecasts provide real-time visibility into cash flow projections.

- Income and expenses help businesses to identify areas where they can reduce costs and improve their profitability

- File exports make it easy to share financial data with others.

- Reporting allows users to generate custom reports based on their financial data.

- Auto-classification of bank transactions categorizes transactions based on their type and purpose.

- Automated reconciliation reduces the time and effort required for reconciliation and improves accuracy.

- On-demand cash positioning tracks cash position in real-time.

Pricing

HighRadius’ pricing is available on request. You can reach out to the team to know more about the product’s pricing and share your feature requirements.

Pros and Cons of HighRadius

|

Pros |

Cons |

|

Efficient tracking and reporting |

Bugs in bank integration (G2) |

|

Accounts receivable management |

Slow functionality (G2) |

|

Top-notch customer service |

Integrations with other services like ERP needs improvement (G2) |

Suggested Read: 10 Best Spend Management Software

6. Agicap

Agicap offers a management software that helps you perform cash flow analysis with all data in one place. It helps you follow up and collect customer receivables while synchronizing and categorizing all your banking transactions automatically.

By connecting your management and ERP tools, you can have reliable and exhaustive information in real-time on Agicap.

Top features of Agicap’s

Below are some popular features of Agicap.

- Cash flow monitoring allows businesses to track their cash position and identify any potential cash flow issues.

- Cash flow forecast enables businesses to predict their future cash position.

- Mobile app allows users to access their cash flow data on the go.

- Consolidation helps businesses consolidate their cash flow data from multiple sources, providing a comprehensive view of their cash position.

- Integrations with management and ERP tools sync financial data and automate cash flow management processes.

- Dashboard and reporting allow users to access and analyze their cash flow data.

Pricing

Agicap offers a free trial for users who’re starting fresh. The company has introduced gamification on its pricing page, where you can select the number of bank accounts and companies you wish to manage and connect with Agicap.

It also requests you to fill in your Turnover and submit relevant details to prepare a custom pricing that suits your business.

Pros and cons of Agicap

|

Pros |

Cons |

|

Provides a global financial overview |

Invoice module needs improvement (G2) |

|

Easy-to-use cash management software |

Unavailability of live support (G2) |

|

Possible to set up several financial scenarios |

Quite an expensive tool (Capterra) |

Quick Read: 10 Best Spend Analysis Software

What is cash flow management software?

Cash flow management software helps businesses track and regulate their cash flow and position. They aggregate income statements and balance sheet information to generate a cash flow statement and report, helping them drive real-time insights into their cash flow nuances.

Businesses can track financial transactions, forecast future cash flows, and create budgets using such software. You can monitor accounts receivable and accounts payable, manage invoices and bills, and automate payment reminders.

Reports and financial statements generated through such automated cash flow management processes provide a comprehensive overview of the cash flow situation.

Why do businesses need cash flow management software?

Cash flow is the movement of money in and out of business, and it’s crucial to maintaining financial stability and growth. In addition, there are several reasons why businesses need software to manage cash flows:

1. Accurate financial tracking

Automated software tracks a business’s financial transactions, including incoming and outgoing funds. It helps them monitor accounts receivable and accounts payable, manage invoices and bills, and monitor their cash flow in real-time.

2. Forecasting

Automated ways to manage cash flow help entrepreneurs forecast their cash flow and plan for future expenses and investments. This is crucial for seasonal businesses or those with a fluctuating revenue stream. In addition, planning future expenses allows companies to prepare for slow periods while ensuring they have sufficient funds to cover expenses.

3. Budgeting

Such software allows businesses to create and manage budgets, which is especially helpful for small businesses or startups. It empowers businesses to make informed decisions about growth and investments.

4. Automating financial tasks

It automates financial tasks such as invoicing, payment reminders, and accounts reconciliation, saving time and reducing errors.

Suggested Read: What is Global Cash Visibility?

What are the different types of cash management tools?

Cash flow management software helps businesses in their decision-making process to optimize cash flow, minimize risks, and enhance profitability.

Below are five types of cash flow management tools.

1. Checking account

A checking account, sometimes referred to as a transaction account, is a useful financial tool that allows for the transfer of deposited funds to facilitate cash purchases.

2. Savings account

A savings account is a financial tool that allows individuals to hold onto money not immediately needed for daily expenses or consumption. You can make frequent deposits and withdrawals, making them easily accessible for individuals to store money for emergencies or to temporarily hold onto funds that are not immediately needed.

3. Money market deposit accounts

Money market deposit accounts are popular financial tools offered by most depository institutions, and they come with government insurance to provide peace of mind to account holders. These accounts have a minimum balance requirement with tiered interest rates.

4. Certificates of deposit (CDs)

Certificates of deposit (CDs) are certain types of insured, interest-earning savings instruments that provide account holders with restricted access to their funds. These financial tools are typically offered by depository institutions that accept deposits for a predetermined length of time, ranging from seven days to eight years. Deposits for CDs can range from $100 to $100,000.

5. Savings bonds

Savings bonds are an excellent option for conservative savers who prioritize low-risk investments and prefer government-secured savings instruments. As the government backs them, they are considered affordable and safe investment options.

Quick Read: Capital Expenditure (CapEX) – Meaning, Types, Examples

How to choose the right cash flow management software?

Choosing the best cash flow management system for your business is crucial to ensure efficient and effective management of your finances.

Below are some factors you should consider.

1. Needs

Assess your business needs to determine what features and functions are important for your business management.

2. Ease of use

Look for software that is user-friendly and intuitive. It should be easy to navigate and provide a clear overview of your cash flow.

3. Integrations

The software should integrate with other financial tools that your business uses, such as accounting software, payment processing tools, and bank feeds.

4. Security

The software should have robust security measures in place to protect your financial data. Look for software that uses encryption, multi-factor authentication, and regular backups to keep your data safe.

5. Costs

Consider the cost of the software, including any ongoing fees or subscription costs. It’s crucial to weigh the cost against the software’s benefits.

When you want to find the right software for your business, start by jotting down your requirements for features and functionalities. Select the option that complements your industry needs and caters to your unique pain points. It’s also crucial to determine the processes you would automate and the workflows to create.

Also, Read: Petty Cash Management: A Process Set Up Guide

Best practices for managing cash flow

The best way to manage cash flow is to have a proactive approach to monitoring and controlling the movement of money in and out of your business.

Here are some best practices for effective cash flow management:

1. Create a cash flow forecast

A cash flow forecast is an essential tool for predicting how much money your business will have in the future. This forecast will help anticipate potential cash shortfalls and plan for any upcoming expenses.

2. Stay on top of invoicing

Invoice management (with prompt and accurate invoicing) can significantly improve cash flow by ensuring that payments are received on time. Consider automating your invoicing process to avoid any errors or delays in payments.

3. Manage expenses

Controlling your expenses is another critical element of cash flow management. Review your expenses regularly and identify areas where you can reduce costs, such as renegotiating contracts or switching to lower-cost suppliers. Digitizing your expense management with expense management software can contribute significantly towards better cash flow management.

4. Negotiate payment terms

Negotiate payment terms with your customers to ensure timely payment. For example, you could discount early payment or impose late payment fees to encourage customers to pay on time.

5. Use software

It can help you automate cash flow management tasks, such as invoicing, expense tracking, and cash flow forecasting.

How much does cash flow management software cost?

The cost of such software varies depending on the features, functionality, and size of the business. Some software solutions charge a flat rate, while others charge a subscription fee based on the number of users or the volume of transactions.

The basic software is available free of cost. Such software helps individuals or early-stage companies manage and regulate their cash flow. A paid subscription can cost anywhere between $50 to $250 a month for a premium plan.

On the other hand, enterprise software can be priced at hundreds or thousands of dollars per month, depending upon the number of users and integrations with CRM, ERP, cash analytics tools, or other service software providers.

Some software may offer a free trial or a limited version for a lower cost to allow businesses to try out the software before committing to a subscription. Ultimately, the cost will depend on the specific needs of your business and the features and functionality required to manage your cash flow effectively.

Cash flow management software – FAQs

The best way to manage cash flow is to take a proactive approach to monitor and control the movement of money in and out of your business. Create a cash flow forecast to predict future cash flows, stay on top of invoicing to ensure timely payments, manage expenses to reduce costs, negotiate payment terms with customers, and use cash flow management software to automate tasks and ensure accuracy.

Different types of cash flow management tools are checking accounts, savings accounts, money market deposit accounts, certificates of deposit, and savings bonds.

There is no such thing as the “best” tool for cash management. The right tool depends on the specific needs and size of your business. Some of the most popular tools for cash flow management include QuickBooks, Causal, Float App, Tesorio, High Radius, and Agicap.

Cash flow refers to the movement of cash in and out of business. Positive cash flow occurs when more cash comes into the business than goes out, while negative cash flow occurs when more cash goes out.

Cash management, on the other hand, refers to the processes and strategies businesses use to manage their cash flow effectively. Cash management involves monitoring and controlling the inflow and outflow of cash to ensure that the business has enough cash to meet its financial management obligations.

Discussion about this post