A first-hand account of V-Guard’s digital transformation from a 40-year-old practice to a fully automated expense management solution that yielded measurable and healthy ROI.

Year 1977: ₹1 Lakh Investment Capital | 2 workers | 1 visionary entrepreneur

Year 2018: ₹ 23.11 Billion in revenue | 2000+ Employees | 22 product categories

This is a snapshot of V-Guard’s meteoric rise to become one of the biggest brands in India for electrical and electronic goods from humble origins.

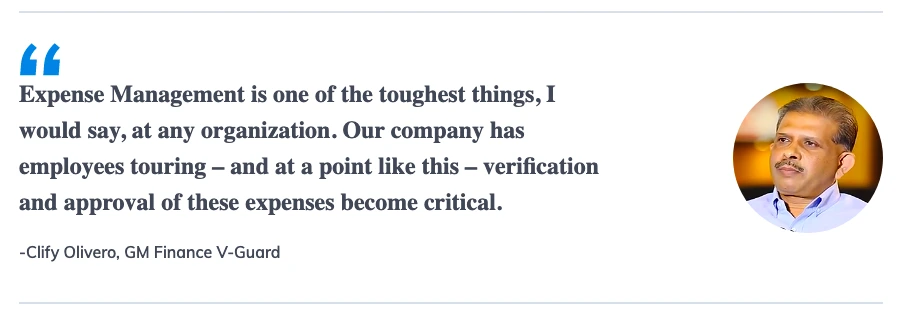

While the business flourished for the public company, growing year after year and recording a 115% growth in profits in 2019, the biggest concern for V-Guard’s Finance and the commercial team was handling the travel and business expenses of its globetrotting workforce as the company still relied on manual processing and semi-automated systems.

Globetrotting workforce

With approximately ⅔ of its employees (1500+) traveling for business every month, the finance team at V-Guard had to process 800-1000 expense reports on average in the form of vouchers every single day.

- 1500+ employees on business travel every month

- 10-15 days average travel duration per month

- 800-1000 claims processed every day

- 45 – 60 minutes of processing time per claim

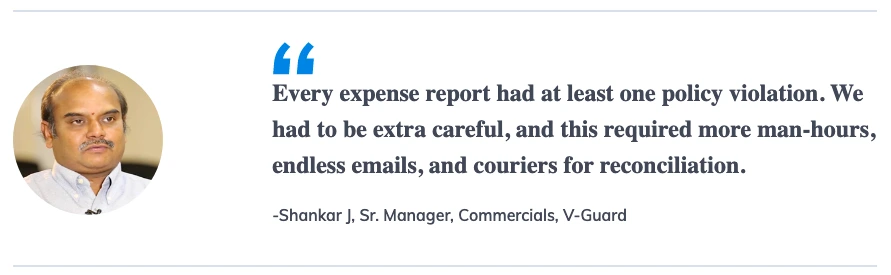

Buried under receipts and concerned with policy violations

Each expense report was cumulative of receipts of all the expenses, including travel, lodging, food, and miscellaneous expenses, incurred by the employee during the business trip.

The picture below mimics a single expense report accompanied by tens and hundreds of receipts. V-Guard processed 800-1000 of these reports every day.

This resulted in stacks of receipts, mountains of paperwork, and lost and faded bills. This required that the finance team manually verify every single bill and voucher, check the merchant category code and cross-verify it against the permitted expense limit for the employee’s cadre, tally it with the advance amount issued, and make the final settlement.

The ambiguous OTHERS section

Having a paper-based system also meant that whenever a new type of expense was incurred, employees often added it under the ‘Others or miscellaneous category’, which made the verification process harder for the Finance Team. Moreover, they were unable to accurately capture the cost of sale associated with a particular product, division, or geography.

Lengthy reimbursement cycle and restive employees

The typical workflow involved the expense report of an employee getting approved by the manager or HoD, and then being couriered to the Head office. Since the majority of the managers were also on constant business travel, this made the reimbursement process even longer. All the while, the employees had to wait for the reimbursement without knowing the status of the claim, and the finance team getting bombarded with inquiry calls from the employees.

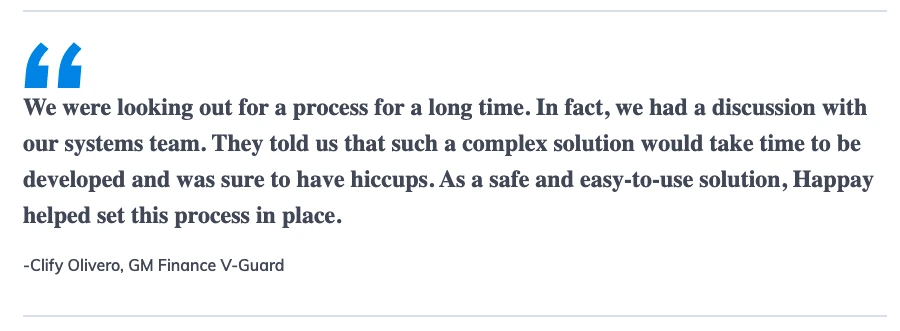

In search of an apt solution

V-Guard was in search of the right solution for their expense management. The issue was so prominent that the company even considered building one in-house.

An apt solution for V-Guard meant it had to:

- Meet the needs of the IT team in terms of trust and safety

- Seamlessly integrate with their existing system

- Be flexible to suit the organization structure of V-Guard

- Be easy to adopt for its employees

Happay’s Travel and Expense Management Solution

Happay offered the complete suite to V-Guard: the cloud-based expense management software, mobile application, and Happay prepaid cards.

With Happay’s flexible modules and V-guard-specific configurations, the company was able to adopt policies and workflows which were best suited for its business practices.

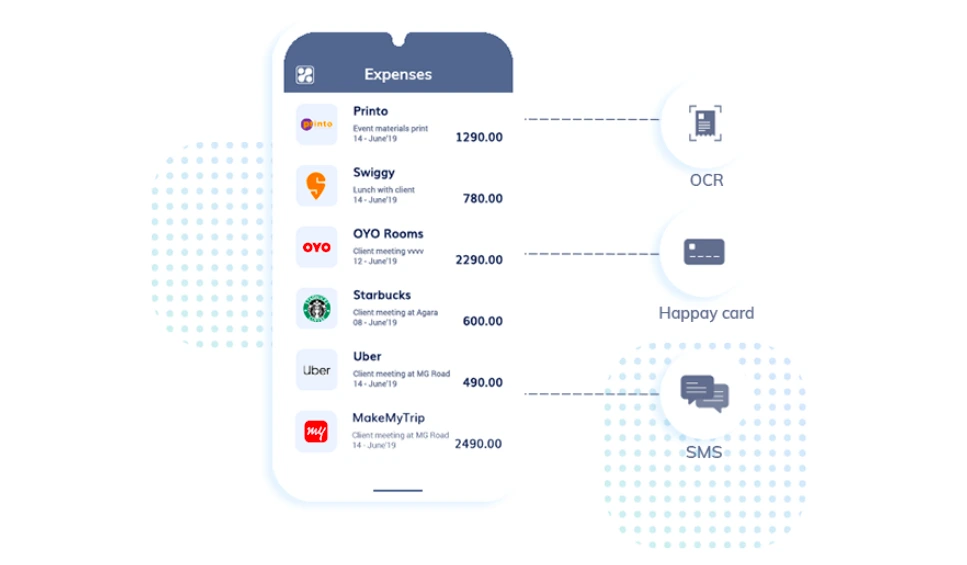

Mobility and automatic expense capture

Happay’s mobile application made a world of difference to V-Guard employees, HODs, and the finance team. With automatic expense capture and advanced Optical Character Recognition (OCR) features, employees were able to capture and report expenses on the go.

The mobility solution also allowed approval, reconciliation, and settlement of claims instantaneously.

With the majority of the transactions done through Happay Cards, the number of cash transactions and the requests for cash advances also reduced significantly.

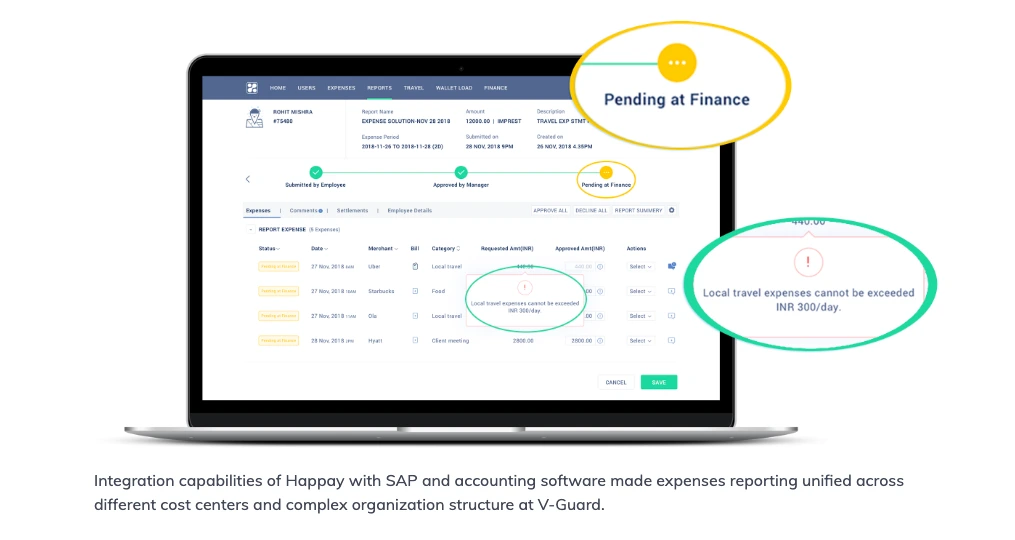

Automatic policy enforcement

Happay automatically enforced encoded policies and alerted the users whenever a violation occurred. With the auto-approve feature that automatically approves compliant reports, the finance team had to deal with fewer claims.

Integration capabilities of Happay with SAP and accounting software made expense reporting unified across different cost centers and complex organizational structures at V-Guard.

Seamless product adoption

When it came to product adoption, there was very little resistance, and the employees of all ranks were able to adopt the product quickly.

Even employees who were part of the Finance team from the pre-desktop era found it easy and beneficial.

Overall, V-guard was able to eliminate almost all policy violations, capture expenses accurately, save plenty of man-hours, and reduce the reimbursement cycle.

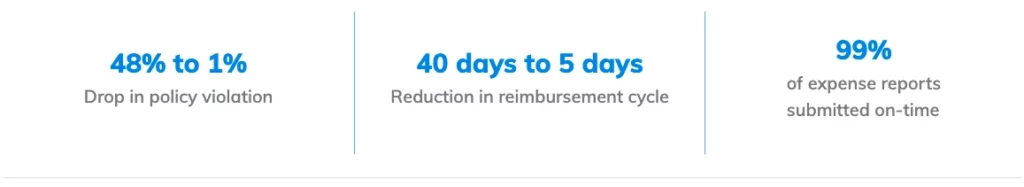

Outcome

- The reimbursement cycle reduced from 40 to 5 day

- Policy violations are down to <1% from 48%

- 99% of the reports were submitted on-time

Having gained complete visibility and the ability to forecast expenses accurately, V-Guard has adopted the Happay T&E solution for over 75% of its employees.

Now, Happay expense management solution is part of V-Guard’s employee induction program.

Discussion about this post