Managing hundreds of expense claims manually in large enterprises is a terrifying task – we know that better than anyone else. And don’t fret, we’re here to help you.

Introduction – Expense approval process

Do your company’s employees and approvers dread the never-ending expense approval and reimbursement process? Are you spending too much time and money on your company’s expense approval process?

A Global Business Travel Association survey states it costs $58 to process one expense report. Sadly, according to the survey, 19% of employee expense reports are filled with errors, and it takes a minimum of 18 minutes and another $52 to change the mistakes committed.

Now imagine the total approval time and amount for your entire organization – sounds mind-boggling, right? You can save a lot of money and time with expense approval automation.

Before you learn how to make the expense approval process efficient, let’s dive deep into its definition, types, and elements to understand it better.

What is an expense approval process?

One of the most important aspects of expense management is the expense approval process. One misstep in this process can create complete chaos in the entire expense management workflow.

In this step, for approval, the managers and the finance team review the expense report filed by the employees and check if it complies with the company’s travel and expense policies. Reports that pass the compliance check are approved, and the ones that do not comply with the expense policies set by the firm are sent back or rejected.

Furthermore, expenses not approved in time by managers or finance teams put a tremendous burden on resources, affect vendor payments, and reflect poorly on your customer service.

There are multiple steps involved in the expense approval process. Let’s have a look at them.

Read also – 4 Ways to Simplify Your Expense Approval System

Types of expenses approvals

Expense approvals can be categorized into these categories:

1. Pre-approved expenses

As the name suggests, in this type of approval, the manager verifies and approves the pre-approved amount before the employee spends it. In these types of expenses, the budget is updated in real-time, and there is better spend visibility.

2. Post-expense approvals

The employee incurs the expense and submits proof of expenses, like bills, receipts, and invoices, to get them approved and reimbursed.

Read also – Operating Expenses

Image Credit: psohub.com

Basic elements of the expense approval process

The expense approval process includes different elements. Here are some of them:

- Setting up travel cost limits and allowances

- Reimbursing employees

- Employee spend tracking

- Implementing an expense policy

- Notifying the employee when expenses are non-policy compliant

- Analysis of spend data for irregularities

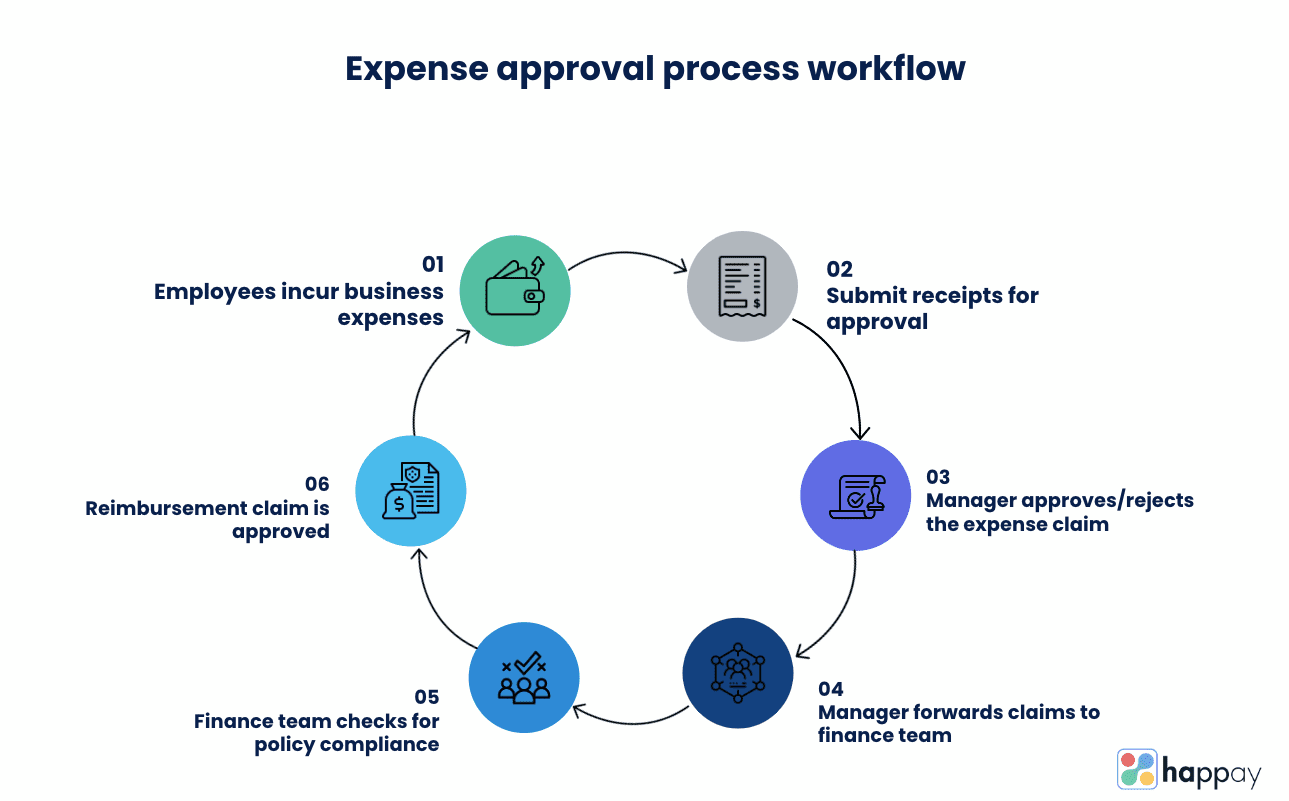

Expense approval process workflow

An expense workflow usually follows these steps:

- Employees incur business-related expenses like trip expenses, event expenses, client gifts, etc.

- The employee saves the receipts and submits them to the manager for approval and reimbursement.

- The manager approves or rejects the expense claim and then forwards it to the finance department.

- The manager forwards the claim to the finance department for approval.

- The accounting department or finance team checks for policy compliance and approves or rejects the expense reports.

- The employee is reimbursed if the claim is approved. Sometimes the rejected claims are sent back to the employee for revision.

As you can see, the expense approval process involves multiple stakeholders, each of whom has a different turn-around time (TAT). The process is fast or slow, depending on the number of claims and the amount of automation involved.

Large companies still follow the traditional manual-spreadsheet method and often take weeks or months to complete the process. The more advanced the automation technology is, the faster and more efficient the process is.

What types of business expenses need approval?

There are multiple types of business expenses that an employee will incur while working. Here are the categories that require expense approval:

- Travel expense: After payroll, companies’ most common business expenses are travel expenses. It comprises all the policy-compliant expenses that employees will incur for the business, such as flight tickets, hotel rooms, etc.

- Cash advance: Cash advances are provided for employees who require an upfront amount. Depending on the expense, employees will request a cash advance, which managers can approve/reject. In almost all companies, cash advances are provided to employees after approval.

How to streamline your expense approval process?

In most companies, employees manually fill out the expense reports and attach the bills, receipts, invoices, etc., along with the report as proof. It is then forwarded to the department head, line manager, and finance department for approval.

After initial verification, the line manager or the department head forwards the report to the finance team. The finance department then has to meticulously go through proofs submitted by the employee and make sure it’s compliant with your company’s expense policy.

In this process, the finance staff must go through every proof submitted by the employee and ensure it matches the figures mentioned in the report. This entire process is long, exhaustive, and time-consuming.

This could sound simple to many, but, in reality, the task is challenging and laden with difficulties. Imagine the finance department doing this for the whole company. The amount of time and effort that goes into this can be spent on something more useful.

To save time, effort, and of course, money, it’s best to automate your expense approval system.

Why should you automate your expense approval system?

Manual reimbursement cycles are not just a waste of crucial time but also a waste of resources and money. They burn a big hole in your revenue and negatively impact your employees’ morale.

Save all this money and time with a fully automated expense approval system. Automating your expense approval process reduces the processing time and helps you save plenty of company resources in the long run.

Read also – 7 Reasons to Automate Your Expense Management

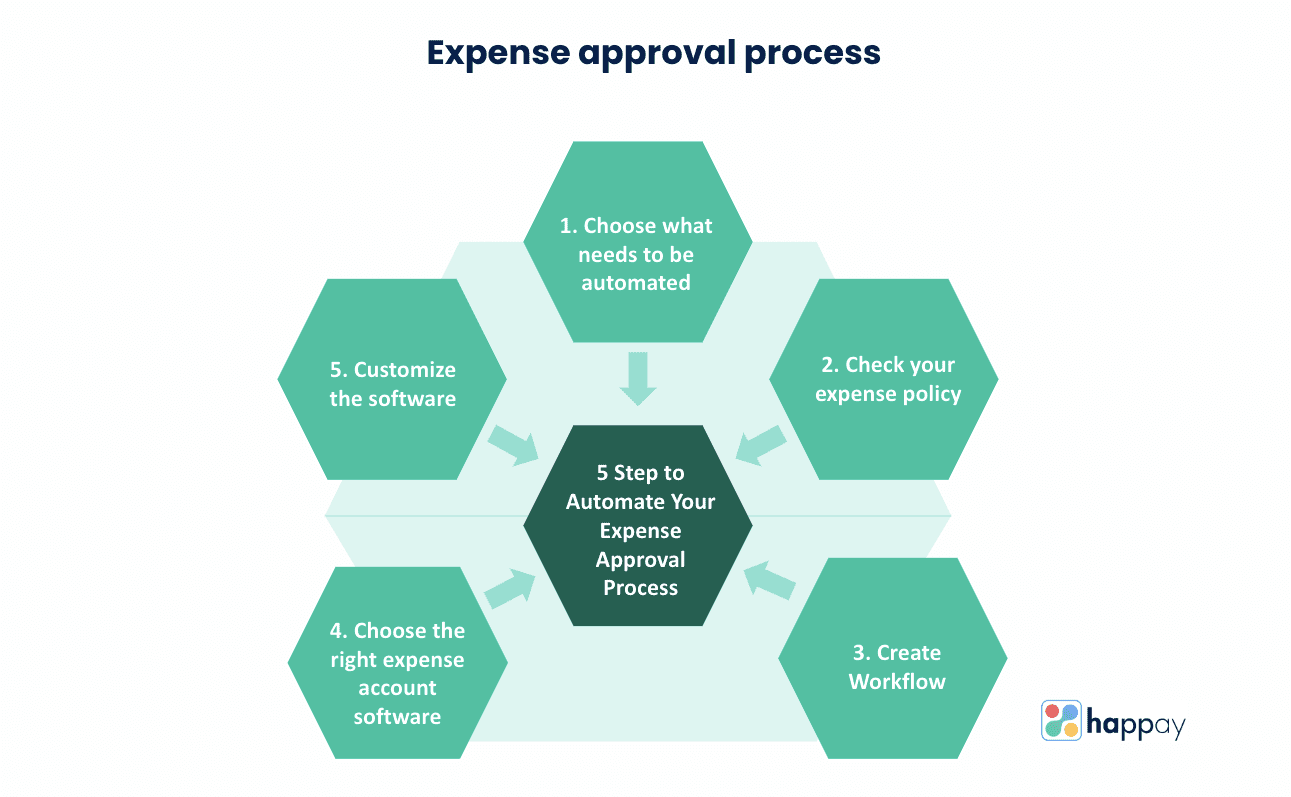

5 steps to automate your expense approval process

Here are 5 significant steps that you must follow to automate the expense approval process in your firm:

1. Choose what needs to be automated

Are you still asking employees to file physical expense reports? If you are still using spreadsheets to track expenses, it is high time you stop doing them. The first step to making your expense approval system agile is choosing the right areas that need automation. Talk with your employees, managers, and finance team and learn their difficulties to understand this better.

2. Check your expense policy

Use a well-defined expense policy that brings all your employees, finance team, and managers on the same page. Also, create an expense policy that is easy to understand and follow company-wide. In your expense policy, clearly define which managers are supposed to make final decisions and ensure it contains details about the approval workflow in your firm.

3. Build a new workflow

Build a new workflow that is easy for everyone. Consult with your finance department and managers while building a new workflow. The main objective of reworking your workflow is to reduce approval time.

4. Choose the right tools

Pick the right tools that will help you in this process. Pick expense automation software that integrates your existing accounting software and helps you report automatically.

Choose a software that offers the best user experience for your team and, simultaneously, offers you great visibility.

5. Customise the software

After picking the right software, familiarize yourself with the software. Also, customize the software to the needs of your business. Conduct company-wide training sessions and provide users with reading materials.

Read also – Expense Management Workflow

Benefits of automating your expense approval process

1. Reduced approval time

In organizations that follow the manual method, expense approval usually takes several days. This delay could be caused by the manager, the finance team and inaccurate expense reports that don’t comply with the company policy. In such cases, an employee must anxiously wait for the reimbursement and follow up repeatedly.

However, by automating the process, you can drastically reduce the expense approval time in your firm. Furthermore, your employee can find out who’s yet to approve the claim in the expense software and contact them directly.

2. Increased efficiency

By automating the approval process, you can lighten the workload of your finance department. They don’t have to go through endless expense reports and bills submitted by the employee.

The finance staff can now look at the reports and proofs in expense management software and check for compliance on one screen. Also, they can now approve or reject the expense report with a single click.

3. Higher compliance rates

Thanks to the automated expense management system, it can automatically red-flag policy violations and notify the employee and the finance team. The finance team can reject expense reports that don’t comply with the T&E policy. Therefore, by automating the expense approval process, you can increase the policy compliance rate in your firm.

4. Automated reminders

Expense management software has automated reminders. This means there’s no place for bottlenecks. Also, your employees need not get stuck in an endless follow-up cycle.

5. Rich data

You can access rich real-time data regarding your expenses on expense management systems. As a CFO, you can use this data to control the current expenses or forecast future expenses.

6. Employee happiness

Reduced expense approval time + faster approval process = happy employees.

Your employees don’t have to fill out a ton of forms and wait for days together for the money to be reimbursed.

Read also – 10 Best Travel Management Software

Why automate your expense approval with Happay?

Happay is an integrated platform for travel bookings, expense management, and payments. Here’s how Happay’s advanced expense approval automation can help your organization:

- For managers, we offer a one-click approval system with clear visibility of policy violations & missed savings

- Happay can streamline your fragmented approval system and make the whole process simple and hassle-free

- Configure unique workflows based on teams, grades, amounts, exceptions, and deviations is simple. Happay also gives a complete trail of the approval process, including comments and actions.

- Approvers get notified of expense reports within seconds via the web and mobile applications, and employees get real-time updates on their requests.

To learn more about how to automate your expense approval process, schedule a demo with Happay today.

Expense approval process – FAQs

1. What is the expense approval process?

It is a crucial step in the expense management process. In this step, managers and the finance team review the expense reports for approval.

2. What is expense management?

Expense management is the process of monitoring and controlling expenses in your firm. This ranges from setting up policies and procedures to determine how employees should spend money to deciding how employees will be reimbursed.

3. Why is expense approval important?

The expense approval process in a firm plays a vital role in deciding how good the entire expense management process is. If your firm doesn’t have a robust approval process, it’s high time you fix it before it wreaks havoc on your business.

4. What are the common expense management issues?

Below are some of the common expense management issues that most companies face:

- Budget management issues

- Improper planning

- A long queue of pending approvals