Expense Reports

63% of respondents in a recent BCD travel survey (1,349 business travelers across the world) felt that the time taken to create expense reports was the biggest pain point in the expense process.

Let’s accept that managing an enterprise’s expenses is no simple feat, period. There are multiple things finance leaders must take care of for a company to function smoothly. Expense reports are vital to any expense management system, and CFOs must never take them lightly.

To efficiently manage the expense reporting process in your firm, you must fully understand everything there’s to know about it. Here’s our detailed guide on expense reports and six steps to creating one.

Also, Read: Expense vs Expenditure

What is an expense report?

Broadly, an expense report is a form that contains an itemised list of expenses made by the employee on behalf of the company. The reports could be physical sheets of paper or digital documents.

The employee typically itemises expenditures like travel, office supplies, fuel, and lunch in the report. And they are expected to submit the details of the expense incurred for each item and attach a receipt, invoice, or necessary documents.

The report is then sent to the concerned manager and finance team for approval. In some instances, employees take an initial advance for expenses. In such cases, the employee must submit proof of the payment and return any remaining amount.

An organisation’s expense reports are generated on a yearly, quarterly, or monthly basis. As a CFO or head of finance, quarterly, yearly, or monthly expense reports help track your firm’s expenses in that period. Moreover, it also helps you identify areas where you can reduce costs to maximise profit.

On the other hand, yearly reports can be used to deduct expenses on your organisation’s tax returns.

Quick Read: What is Capital Expenditure?

Expense reporting process – An overview

The expense reporting process can differ depending on the method your firm follows. For example, if your organisation still uses traditional reporting methods, then brace yourself for error-filled reports. Allow us to explain.

First, your employee must fill out expense form(s) and submit corresponding bills along with their report. The request is then forwarded to the line manager or department head for review. After the manager’s review, the report is sent to your firm’s finance department. The finance department staff needs to check the report’s authenticity and ensure the reports don’t violate any expense policy set by your firm.

The entire process is both lengthy and laborious. That means the chances of the error being committed by the employee or the finance department are high. To avoid all this hassle, automating the entire process using expense reporting software is the way to go. We’ll discuss more on expense report software later in this post.

What to include in an expense report?

The expense report breaks down or itemizes expenses incurred by the employee for business purposes. Employees must attach receipts and bills associated with the expenses to be reimbursed.

Depending on the company, the details included in the expense report vary. However, here are some of the fundamental details that must be included in an expense report:

1. Date

The expense report contains the date on which the expense was incurred. The date must match the date mentioned in the receipt.

2. Seller

Name of the seller or service provider from whom the product or service was bought from.

3. Nature

Types of expenses, such as meals, air tickets, car rental, hotel accommodation, etc., are part of this.

4. Total Amount

This is the total cost of an expense incurred, including taxes. Such an amount matches the amount specified on the related invoice.

5. Account

The account to which the expense is charged or the customer for whom the expense was incurred. Most businesses use account numbers for such customers/companies.

5. Description

It is the description of each business expense and what it is about.

7. Subtotal for each expense

The expense report will have a subtotal for each expense incurred by the employee.

Quick Read: How to Manage Expense Claims?

What does an expense report look like?

The type of expense reports used can vary based on the company’s size. For small businesses, expense reports could be a simple spreadsheet with only a little essential information.

On the other hand, some large companies use multi-page documents with various categories, columns, and codes for each expense. Today, most enterprises have switched to expense management software to manage their expense reports efficiently.

Type of expense reports

T&E reports can help organizations in analyzing and track expenses accurately. In most companies, for T&E expenses, the employees fill out weekly expense reports detailing their out-of-pocket expenses, such as client meals, mileage charges, hotel accommodations, etc.

Here are the types of expense reports that companies use to track their spending:

1. Monthly expense reports

The monthly expense reports help track and analyze all business expenses. Moreover, monthly expense reports help you monitor your current budget, forecast future budget, and help reduce costs.

2. Long-term expense reports

Expense reports typically containing details about a company’s annual or quarterly expenses are called long-term expense reports.

3. Recurring expense reports

Expense reports containing fixed, regular expenses such as rent, utilities, and salary for which companies spend money regularly are called recurring expense reports.

4. Departmental expense report

The concept of expense report can also be used for a detailed listing of expenses incurred by each department of a company for a particular reporting period. This report can be used to check if the information mentioned differs from expectations. If this happens, the management can investigate these variances.

Also, Read: What are operating expenses?

Types of expense reporting process

Depending on the size of the organization, the expense reporting process changes. Small-sized companies with fewer employees can use the manual expense reporting process to manage their expenses effectively.

In most large enterprises, the expense reporting process is either partially or fully automated. That’s because, in enterprises, hundreds of employees travel for business, and reporting expenses every time is a hassle manually.

1. Manual expense reporting process

In the manual expense reporting process, employees must physically submit manual expense reports with physical bills and receipts for reimbursement.

The manager needs to approve or reject the expense report based on accuracy. The accounts department then verifies the expense report for policy compliance.

2. Automated expense reporting process

From expense report creation to expense submission, the entire expense reporting process is automated. Employees can submit expense reports without any hassle anytime, anywhere. What’s more, in automated expense reporting systems, the approver can approve the report in a single click, and the finance team can verify the reports accurately.

Also, Read: 5 Steps to Automate Your Expense Approval Process

Why do we need expense reports?

Here are some of the benefits of using expense reports:

1. Helps in efficiently tracking expenses and controlling costs

Expense reports data can give you a better view and understanding of your company’s spending over a period of time. This data can help you identify the categories where your employees are spending money and how much they are spending.

What’s more, expense reports can also help identify loopholes in your policy that lead to increased expenses.

2. Budgeting help

Detailed and accurate expense reports can allow companies to make smart financial decisions and plan for the future. What’s more, CFOs can use this information to decide the budget limits for different departments and categories.

3. Reimburse accurately

Whenever an employee pays out of their pocket for business expenses, the organization must pay the money back accurately. Also, it is important that your company does not end up paying more than what they have spent.

That is why it is vital to have a standardized expense reporting process that ensures the reimbursement claims are accurate and legitimate. What’s more, a detailed expense reporting process will ensure all the claims filed in your organization are policy compliant.

4. Easy tax deductions

Most business expenses incurred by the employees while working are tax deductible. However, this is possible only if proper proof of expenses is submitted. This is why expense reports come into play. It simplifies the entire process of expense tracking, and your finance team can effortlessly write them off during the tax season.

Common business expense categories in an expense report

Here are some of the common business expense categories you can find in most expense reports:

- Advertising

- Business travel expenses

- Employee benefits program

- Insurance

- Mortgage

- Interest

- Legal expenses

- Office expenses

- Lease or rent

- Maintenance and repair

- Meals

- Utilities

- Wages

Suggested Read: Different Types of Expense Categories

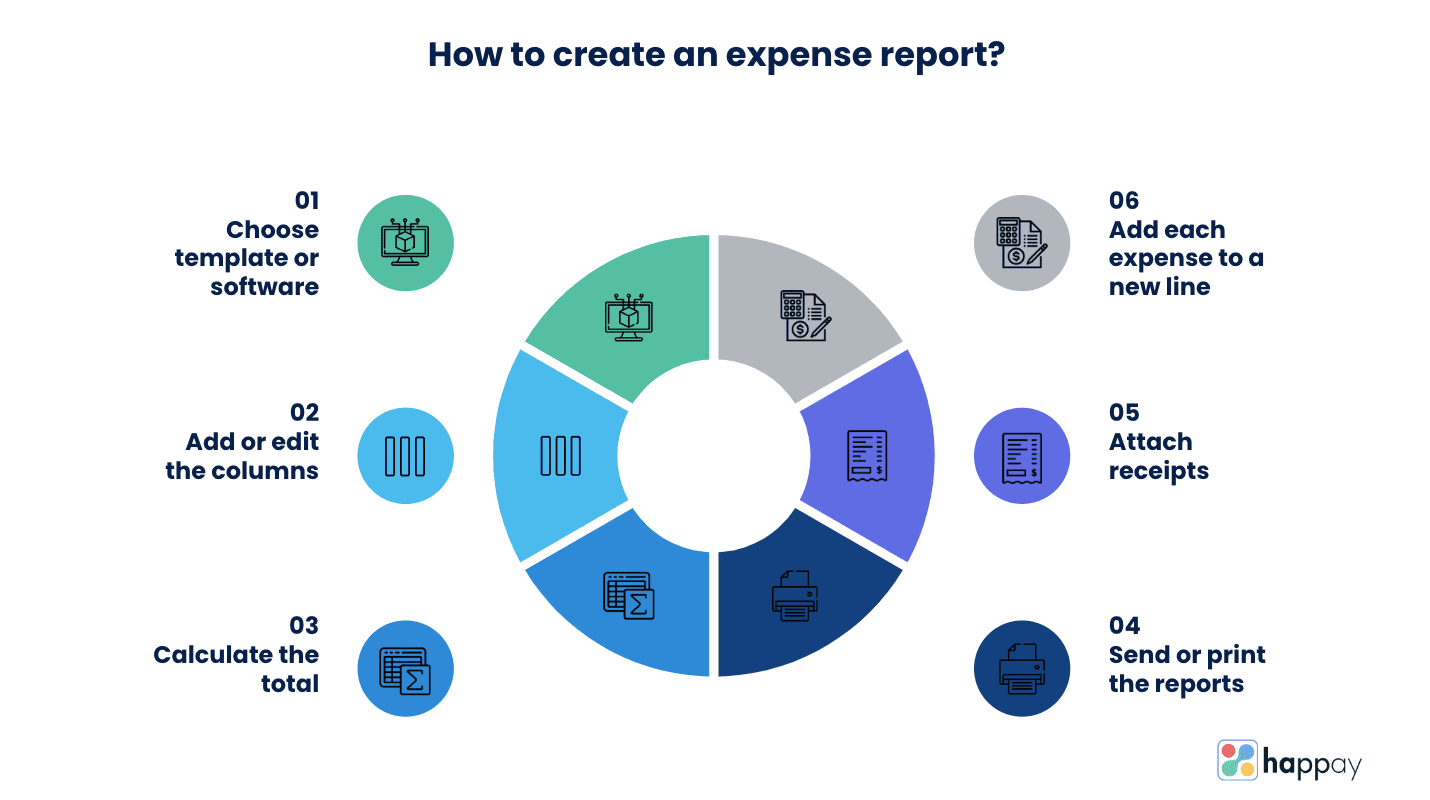

6 steps to creating an expense report for your business

Here are six steps you can use to create an expense report for your business:

1. Choose a template or software

First, decide if you want to use an expense reporting template or expense management software for your company. Remember, creating an expense report from scratch is time-consuming. That is why it is best to use either of these options for expense reporting.

You can find plenty of free expense report templates online. Pick the one that best fits your requirements. Using expense reporting software for managing your expenses is the best bet if you are an enterprise.

2. Add or edit the columns

Most expense reporting templates come with pre-existing expense categories. Ideally, the columns must reflect the type of expenses related to your company. For example, if most employees in your firm regularly travel for business-related trips, your expense report must contain a travel and meals column.

3. Calculate the total

Each category will have a subtotal on an expense report and a grand total for all expenses. This category in the expense report can help you understand how much you are spending in each category.

4. Add each expense to a new line

Ensure you add each expense in a new line and fill out as much information as possible. To accurately track expenses, enter client name, project expense, taxes, etc.

5. Attach receipts

To prove the authenticity of the expense reports, employees must submit expense receipts, bills, invoices, and other documents along with the expense report.

If your company follows the manual expense reporting process, your employees must submit a physical copy of the receipts. On the other hand, in the automated expense reporting process, employees submit soft copies of the receipts.

6. Send or print the reports

After filing expense reports, read and verify all the details mentioned in your expense reports. Ensure the figures and the total mentioned in the report match the receipts submitted.

Also, Read: What is Expense Reconciliation?

Go paperless with automated expense reporting software

Most large companies choose paperless expense reports for the multiple benefits they offer. These are:

1. No lengthy paperwork and lost receipts

In paperless expense reports, employees no longer have to fill out multiple forms. Also, submitting the receipts without losing them is a challenging task. In paperless expense reports, your employees can now click and upload pictures of receipts on the go.

2. Reduced expenses on office supplies

Lesser paperwork means fewer office supplies and costs – a win-win situation for employees and the company.

3. Easy to file taxes

If you’re using paper-based expense reporting, we’re sure your finance department searches for all the receipts and bills during tax time. And if they are lucky, they find it, but this seldom happens! Businesses can avoid this by switching to paperless expense reports. With a few clicks, your finance department can access all the receipts submitted by your employees.

4. Saves time and effort

By switching to paperless expense reports, you reduce the time taken by employees to file the report and get reimbursement. Thus making the whole expense reimbursement process simple and hassle-free.

Now, all employees need to do is log into the software, enter their expenses along with proofs and submit it for approval. The manager and the finance team then verify the report to approve or reject it. Using the automated expense report software, your organization can automate the entire expense management process and make it paperless.

Suggested reading: Beyond Budgets: A Guide to Project Expense Management

How to manage expense reporting and finance operations?

A well-integrated T&E management system will increase efficiency, improve user experience and enhance the use of data for better budgeting and cost control in your firm. For all large firms using automated expense management software to track expenses is the way to go. Here are some of the advantages of using automated expense reporting software.

1. For employees:

Using an automated expense management system, your employees can create expense reports without hassle. They can easily capture a picture of the bill or paper receipts and upload them. Some automated systems like Happay auto-populate the fields by extracting spend data from the receipts and invoices. The final step is submitting the report for approval.

2. For reporting manager:

The reporting manager can then look at the report and make sure it’s compliant. In most automated systems, the software flags expenses that violate expense policy. Upon verification, the reporting manager can send the report for approval to the finance department.

3. For the finance team:

The finance team can approve or reject the request with a single click. Moreover, some automated systems also allow you to integrate your firm’s accounting software.

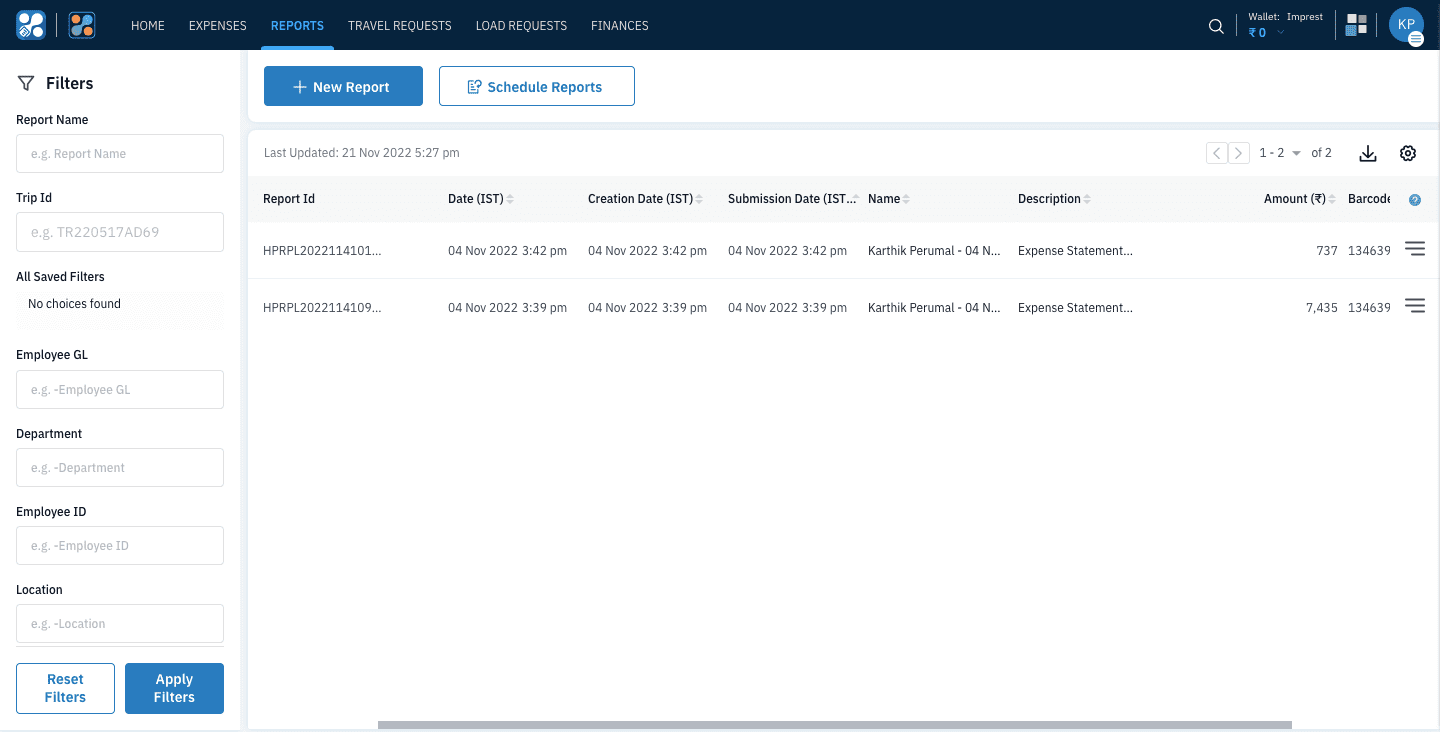

Why choose Happay for expense reporting?

Looking to ace the expense reporting game? Happay can quickly help solve all your expense reporting discrepancies and make it robust. Using Happay, you can bring all your employee expenses into one platform, offering you centralized visibility.

Not just that, with Happay, you have better control over all expenses incurred by the employees in your organization. Here are some of the advantages of using Happay’s expense management software:

- Use Happay’s web and mobile interface from anywhere, anytime

- Take advantage of Happay’s end-to-end expense report automation

- A centralized place where you can find all your expenses

- Smart audit to prevent expense fraud

- Define multiple approval workflows in your system

- Happay’s real-time analytics gives you accurate expense data

- Define expense categories and set cut-off dates

Want to make your firm’s expense reporting robust? Schedule a demo with Happay today.

Expense reporting FAQs

An expense report is a document that contains the itemized and categorized list of expenses the employee made on behalf of the company. It lets the employer know how much the employee spent on each item.

Here’s a list of items that can be included in an expense report:

a) Nature of expense (Air tickets, meals, cab, parking, hotel)

b) Total amount

c) Vendor/supplier account

d) Date

d) Account

f) Total

Some examples of expenses are:

1) Utilities

2) Rent

3) Salaries

4) Wage

5) Maintenance

6) Insurance

7) Software subscription

8) Fuel

9) Parking

10) Laundry

An expense is a cost that companies bear while running their business. In most cases, the expenses incurred by the companies can be used for tax deductions.