Documenting financial transactions is crucial for organizations looking to track sales records, file sales taxes, manage cash flow, and analyze financial performance. Keeping invoices and receipts helps them stay on top of purchase, return, and exchange-related transactions.

A discussion about invoice vs receipt is incomplete without understanding their meaning and importance. An invoice and a receipt record transactions, but businesses use them for different purposes.

Whether you’re a small business owner, mid-market company manager, or an entrepreneur researching the best bookkeeping method, this article walks you through the differences between an invoice and a receipt, when to use them, what to include in each, and when to issue them to customers.

Related Reads: Invoice Management

What is the difference in a invoice vs receipt comparison?

While these documents are similar sales documents, they have different purposes. An invoice vs. receipt analysis will offer details about the main differences. The main difference is that businesses use invoices to collect outstanding payments but issue receipts after completing customer transactions.

An invoice represents a payment request and requires more information than a receipt. Businesses issue invoices to customers purchasing goods and services on credit. These customers use credit accounts to pay at a later date. Some organizations may split the total due amount into more than one invoice and accept payments in installments.

In contrast, a receipt serves as proof of payment, and a completed sale appears in the income statement. Businesses issue receipts only after receiving the total amount from customers. However, the buyer can raise refund or replacement claims, which the seller must fulfill, depending on the terms and conditions of the sale.

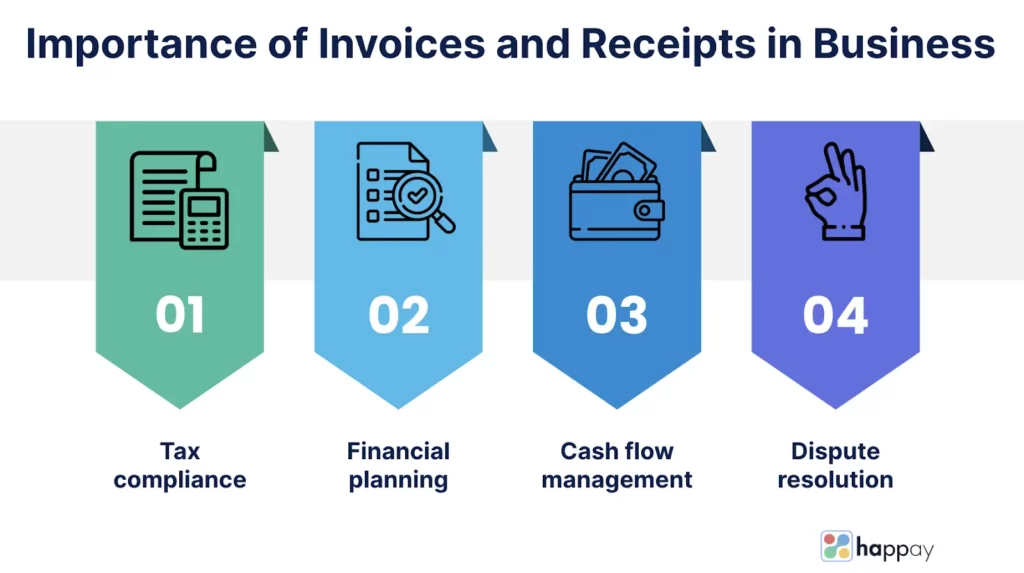

Invoice vs. receipts: Importance

Invoices and receipts are essential because they aid businesses in accurate record-keeping and managing business-to-business (B2B) and business-to-customer (B2C) transactions. Both help organizations evaluate monthly running costs and get an overview of total business expenses.

Below are the reasons why organizations pay attention to accurate invoice and receipt management.

- Tax compliance: Accurate tax reporting requires sellers to maintain sales and payment records. While invoices are proof of sales, receipts reveal customer payments during a financial year. Keeping a record of these sales and payment proofs enables organizations to meet tax filing requirements and tackle ad hoc audits.

- Financial planning: Receipts and invoices provide organizations with historical data for better financial planning and budgeting. Companies can analyze financial records to discover spending patterns, identify cost-cutting measures, project future expenses, and make strategic decisions.

- Cash flow management: Accurate sales and payment records enable enterprises to monitor credit sales better, resulting in timely cash inflow and payment issue resolution. They can also analyze accounts receivable and payable to plan expenses and manage debt and working capital.

- Dispute resolution: Invoices contain the agreed-upon term of sales, whereas receipts reveal whether buyers and sellers have met these terms. Keeping these documents helps buyers and sellers maintain financial transparency, comply with legal regulations, and resolve future disputes.

Now, let’s look at the components, purposes, and examples of invoices and receipts.

Read More about Types of Invoices

Invoice vs. receipts: Overview of invoice

An invoice is a time-stamped transaction record itemizing all products a vendor sells to a buyer. Sellers providing goods and services on credit also include sales terms and available payment methods in their invoices. This section walks you through invoice components, examples, and templates.

Definition and purpose of an invoice

An invoice, or a bill or tab, refers to a comprehensive business document that an organization or service provider issues a customer for the goods and services they purchase. This itemized list clearly states the total due amount, unit costs, shipping and handling charges, and the preferred payment method.

Depending on the payment terms, sellers may allow one-time payments or installments. Tracking and managing invoices enables companies to record sales transactions, ensure a steady cash flow, and meet accounting control standards. Depending on the nature of the commercial transaction between two parties, issuing businesses may provide different types of invoices.

Below are the different purposes of an invoice.

- Accurate bookkeeping: Tracking sales records is essential for balancing sales and expenses, which enables businesses to control net profit, asset turnover, and net margin. Invoices also help them monitor payments, follow up with clients with due payments, and estimate earnings.

- Tax filing: Bills also provide organizations with reliable data sources while filling tax forms or performing audits. That’s why retaining income, deductions, and credit-related documents is crucial for businesses of all sizes.

- Inventory tracking: Using invoicing software enables organizations to accurately predict future customer demands and inventory requirements based on past data. Organizations can also use manual tracking systems to track sales invoices and optimize inventory.

- Legal protection: Professional invoices protect businesses from lawsuits accusing them of non-delivery of goods. That’s why organizations must get customers’ signatures on invoices to make them legally enforceable and prove that both parties understand business terms.

Now, let’s look at the components businesses must include in invoices.

Suggested Reads: What is an Invoice

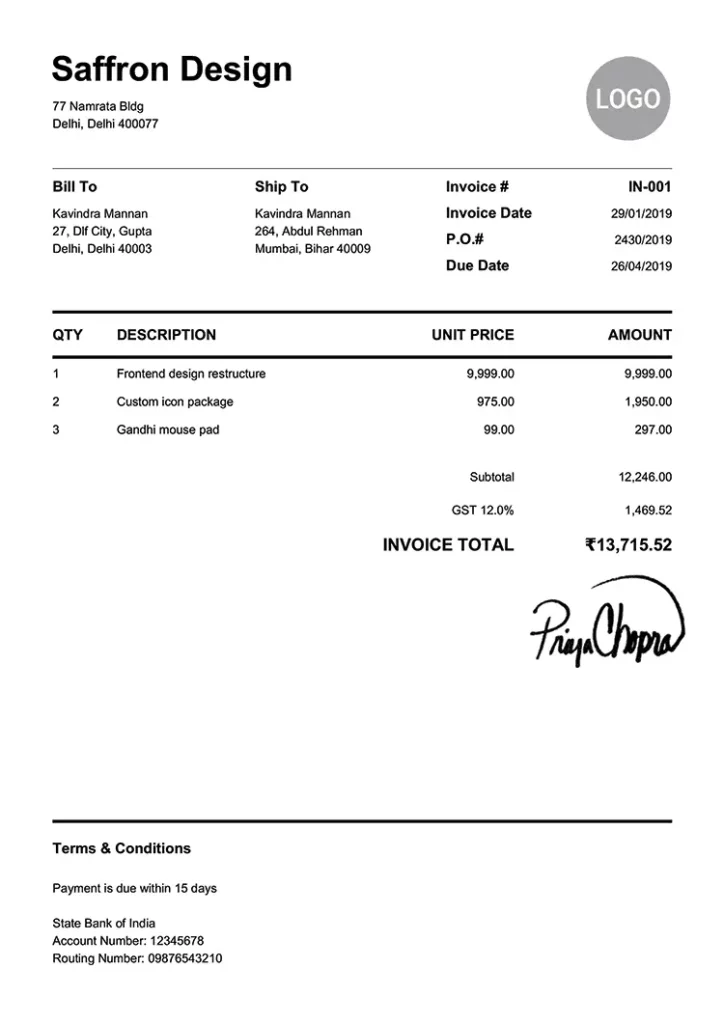

Components of an invoice

While businesses may follow different invoice templates depending on their industry, most add the following components in invoices.

- The company logo and the word ‘invoice’ are a must-have to distinguish invoices from other business documents.

- A unique invoice number includes a unique identifier, such as a purchase order number, an invoice number, or a reference number, to help a business differentiate invoices. Most e-invoicing software solutions auto-generate invoice numbers to help an organization distinguish and organize invoices.

- Invoice date refers to the date the transaction took place between a buyer and seller.

- Business contact information includes the seller’s business name, email address, phone number, website URL, and physical address. This information helps customers contact sellers in case of questions.

- Buyer contact information contains the customer’s name, phone number, email address, and physical address.

- The product and service details section has an itemized description of each product, task, or service a business renders or sells.

- Product unit cost reveals the price a buyer charges a seller for each product or service. Business invoices multiply the total quantity of each product by unit cost to find the total price. Service providers may add a flat fee or an hourly rate instead of product cost.

- Tax rate denotes the taxable amount of the total cost of products and services sold.

- Subtotal shows the sum of all product and service costs, along with applicable taxes and discounts.

- The total amount due and payment due date denotes the total amount a customer owes the vendor in what currency and by which date.

- Payment terms outline the mode of payment (debit card, credit card, wire transfer, cash, and check) a business accepts and inform buyers whether payment is due upon receipt, completion of product delivery, or by a future date.

Importance of accurate invoicing in business transactions

Accurate invoicing is crucial for improving supply chain efficiency, financial decision-making, and eliminating financial discrepancies. Invoice analysis helps organizations identify purchasing patterns and visualize future purchases, enabling them to optimize procurement to maximize revenue. They can also avoid the risk of invoice discrepancies such as missing information, wrong quantity, or price details with robust invoicing practices.

Invoice examples and templates

While enterprises use invoice software to generate bills, small businesses may use online invoice generators or templates to create tax invoices for customers. Below is an easy-to-use invoice template organizations can use.

Related Reads: Tax invoice

Invoice vs. receipts: Overview of receipt

A receipt is proof of transaction that a seller sends to a customer upon completion of payment. It serves as documentary evidence of the amount a customer pays, goods and services purchased, the payment method used, and additional taxes. Receipts help businesses with tax calculations and customers with reimbursements and accounting.

Definition and purpose of a receipt

A sales receipt is a written acknowledgment of a transaction between a buyer and seller. B2B and B2C consumers receive receipts from vendors or service providers after-sales transactions or purchases.

Depending on the nature of the transaction, sellers may issue different types of receipts, including cash register receipts, hand-written receipts, packing slips, delivery notes, and carbon copies.

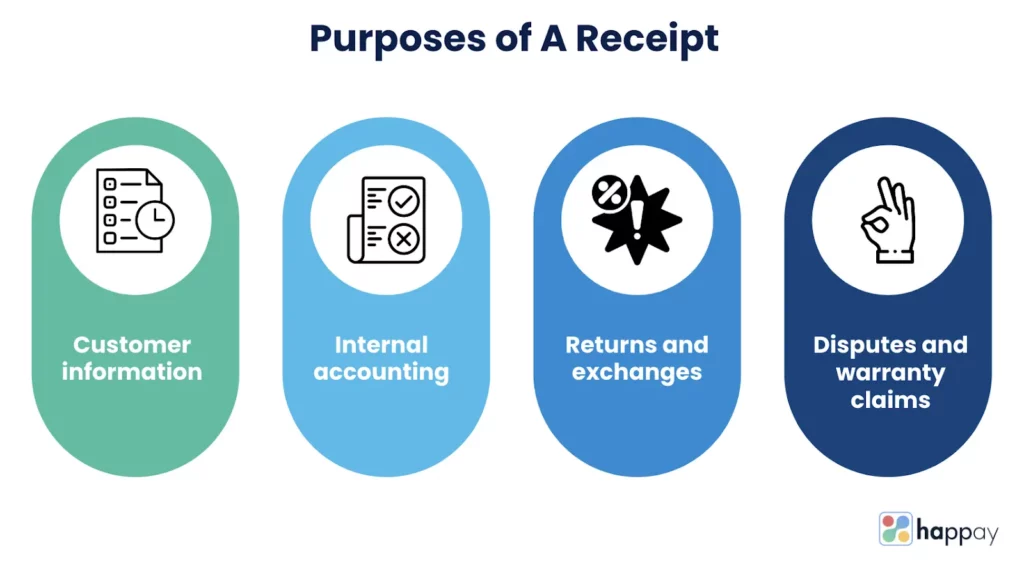

Below are the different purposes of a receipt.

- Customer information: Receipts provide crucial purchase-related information, including itemized products and services, prices, subtotals, and taxes.

- Internal accounting: Accounting teams rely on receipts for tracking sales transactions and filing tax returns, both critical for accurate financial reporting.

- Returns and exchanges: Receipts convey return policies, making it easier for buyers and sellers to align in case of an item exchange. Businesses also rely on receipts to verify the authenticity of transactions and prevent fraudulent returns or exchanges.

- Disputes and warranty claims: Sales receipts also play a crucial role in helping customers establish the validity of a transaction and produce proof during dispute-related and warranty claims.

Let’s look at the elements a business must include while creating receipts.

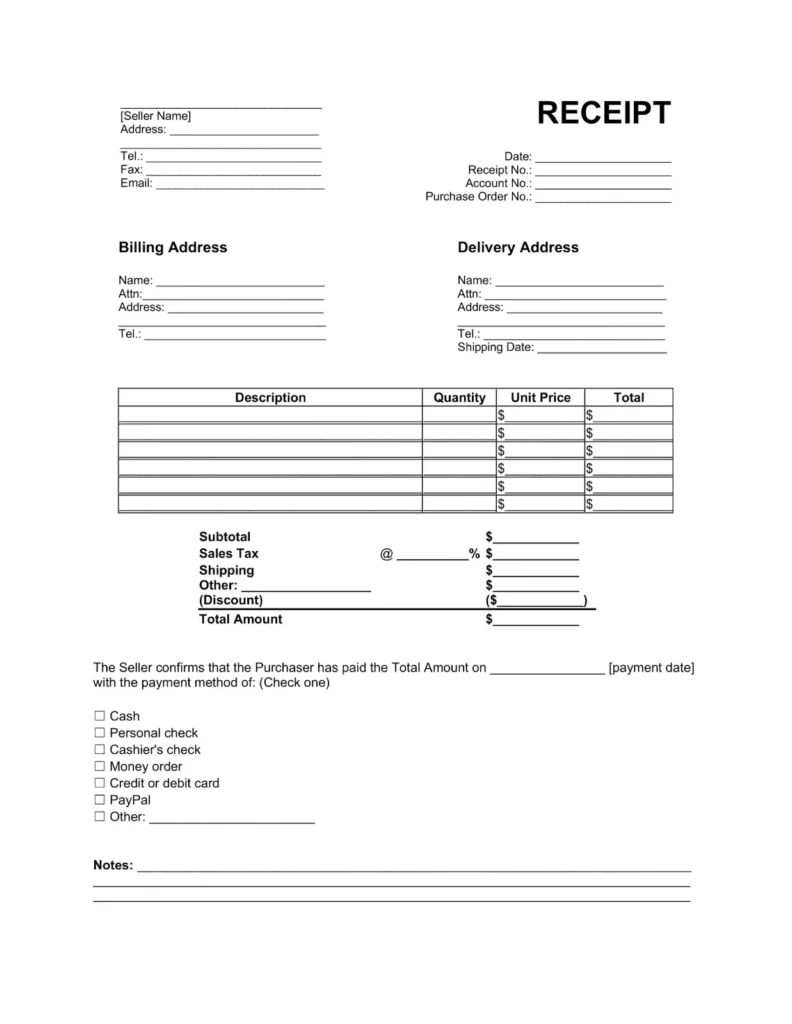

Components of a receipt

Businesses typically include the following elements in sales receipts.

- Business name and contact information refers to the seller’s registered business name and contact details, including phone number and email address.

- Customer name is the person or company who purchases products or services from a seller.

- Transaction date and time reveal details of when the transaction took place.

- A product and service description lists products or services customers purchase.

- Price per unit helps customers understand the cost breakdown per item and total taxes.

- Additional details may include a return policy, the payment method, and applicable sales terms and conditions.

Now, let’s understand why businesses pay attention to providing and receiving receipts from customers and vendors respectively.

Importance of providing and collecting receipts

Providing receipts helps businesses document evidence of raw materials and other purchases. They can also analyze receipts to track business expenses, optimize spending patterns, and prepare financial plans. Receipts also help them accurately declare expenses and income during the tax season.

Examples and templates

While businesses can customize their receipts, here’s a basic receipt template to get started.

What is a payment receipt?

A payment receipt is a business document that a seller issues to a customer after receiving a partial or full payment for goods and services sold. This document reveals the outstanding balance a buyer still owes the seller in partial payments. Cash payment receipts help sellers create detailed financial statements and remind customers of outstanding balances.

The only difference between sales and payment receipts is that sales receipts provide more details about the sales, including tax, product description, payment methods, and time and date of sale. On the contrary, payment receipts offer proof of the money a seller received for goods and services sold.

Payment receipts are also different from remittance advice. A customer sends remittance advice to a business after making a payment. Companies match this advice against the payment during reconciliation.

Key differences in invoice vs receipts

In an invoice vs. receipt article, it is important to look at the purpose to identify the main difference. Businesses issue invoices to collect payments from customers but share receipts only after the completion of a transaction.

The goal of an invoice is to request payment, where a receipt confirms payment. Also, organizations record invoices under accounts receivables as they’re yet to receive payment. However, they treat receipts as records of income.

Aspect |

Invoice |

Receipt |

|

Definition |

A business document a seller sends a customer to request outstanding payment for goods and services delivered. |

An acknowledgment that a seller issues after receiving the payment from a customer. |

|

Usage |

Organizations issue invoices for products sold on credit and single or recurring sales. |

Sellers share receipts to provide customers with proof of payment. |

|

Issuance time |

Invoices are issued after the delivery of goods and services. |

Receipts are issued after payment is made by a customer. |

|

Importance |

Invoices are crucial for sales tracking, accounting, and tax filing purposes. |

Receipts help organizations and individuals with tax deductions, product returns, reimbursements, and tax filing. |

|

Accounting |

Companies can’t use invoices to record sales as finalized income. |

Organizations can use receipts to record sales as income. |

Invoices and receipts may appear similar but aren’t interchangeable. The sole purpose of an invoice is to request payment, whereas a receipt shows proof of payment.

Quick reads: Difference Between Invoice and Bills

Invoice vs. receipts: Conclusion

Understanding Invoice vs. receipts is as critical as learning about efficient receipt and invoice management. It is crucial for organizations aiming to prevent payment delays, achieve efficient reconciliation, file taxes, and prepare for financial audits. Organizing receipts and invoices enables enterprises to match company expenses in the ledger, analyze cash flow, and improve financial performance. However, manual invoice and receipt management can be challenging. That’s why organizations are adopting e-invoices and receipts to strengthen their financial operations.

FAQs

It’s not wrong to send an invoice after payment. However, accounting professionals don’t recommend this practice because customers can’t know the total amount due without an invoice.

Invoice payment terms are agreed terms of payment between a buyer and seller. Businesses add payment terms in invoices to inform customers about the total due amount, when the payment is due, and payment methods.

An invoice is an outstanding formal agreement showing a customer has requested certain goods and services. However, it isn’t proof of purchase since it doesn’t reveal whether a customer has paid for the products.

Since an invoice is a payment request, businesses can’t use it as proof of payment.

An invoice must contain supplier information, GSTIN, buyer details, issue date, product description, quantity, tax breakdown, supply location, and signature to be legally valid.

Three types of invoices are commercial invoices, customs invoices, and proforma invoices.

You shouldn’t include incorrect product details, unclear payment terms, hidden fees, or wrong customer names in an invoice.

Both sales invoices and official receipts are evidence of the transaction, but their purpose is different. A sales invoice is for property or goods sales. In contrast, an official receipt is for selling services or property leases.

An invoice doesn’t indicate that a customer has paid the business for goods delivered. Instead, it notifies the customer about the outstanding payment.

You may issue both an invoice and a receipt, depending on the nature of the transaction. For example, you may not need to issue an invoice when a customer pays immediately after goods and services delivery. In such cases, you can provide a receipt as proof of payment.

Discussion about this post