Introduction to operating expenses

It takes a village to run a business, and it takes another one to pay for running it. Out of the million expenses a company incurs, the expense of conducting day-to-day operations is the most dynamic. That is why operating expenses make up a large portion of overall company spending.

Like a living entity, businesses have needs that differ with time and growth. Therefore, the costs involved with business operations are challenging to measure, analyse and even define.

Many of these expenses are also hard to categorise as they simultaneously empower more than one business function. However, they can be put under the umbrella term of operating expenses.

Suggested Read: What are Non-operating Expenses and Examples?

What are operating expenses?

Operating expenditures are all the costs incurred that facilitate the everyday core operations of an organisation. Also known as OpEx, these expenses cannot be avoided as they enable the basic foundation of activities that generate revenue.

One of the finance leaders’ critical tasks is managing these expenses through budgeting, allocation and monitoring. Owing to their diverse nature, operating expenses are also first in line during budget cuts. They give flexibility to the finance team while allowing priority-based budget restructuring when the goal is to maximise savings.

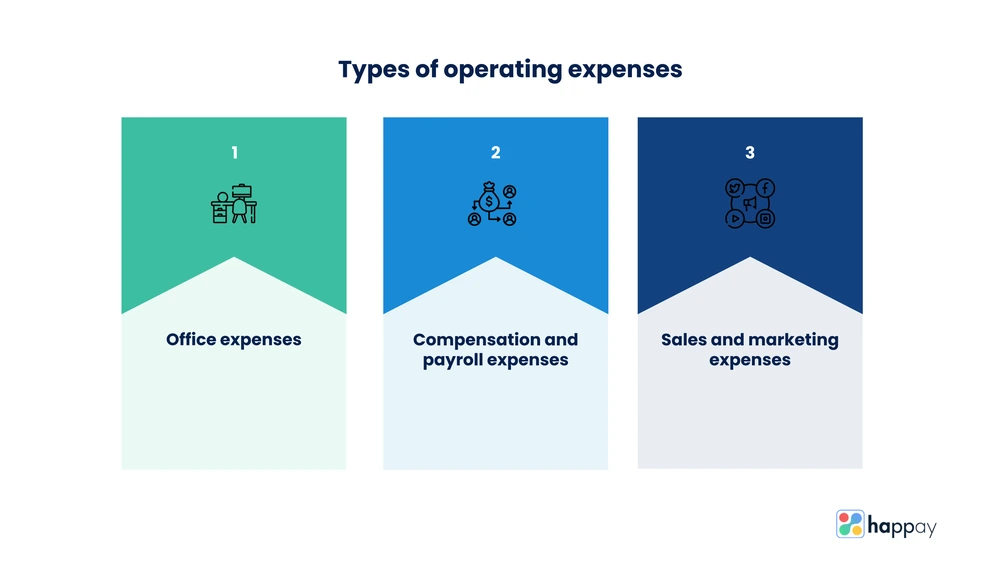

Types of operating expenses

All expenses not directly related to the production and procurement of goods and services can be classified as operating expenses. They can include various types of selling, general and administrative expenses. We can categorise these expenses based on the core function they enable.

Quick Read: CapEx vs. OpEx: A Guide to Understanding the Differences

1. Office expenses

These costs fund all the fixed and variable administrative expenses like

- Rent and utility

- Insurance

- Depreciation of non-production fixed assets

- Non-production area rents

- Office furniture

- Office supplies

- Property taxes

- Accounting expenditures

- Legal fees

- Real estate

- Research and development

2. Compensation and payroll expenses

Compensation-related operating expenditures include the money spent on employees not directly involved in production. Examples of compensation-related expenses are listed below.

- Salaries, commissions

- Employee benefits

- Pensions

- Payroll tax etc.

3. Sales and marketing expenses

Sales and marketing operating expenses include marketing, distribution and selling costs. A few examples of sales and marketing-related expenses are

- Advertising

- Promotion

- Events

- Sales-related travel

- Sales materials

- Sampling

Also, Read: What are Business Expenses?

Operating expenses vs Non-operating expenses

Operating expenses are the core costs that fund everyday business activities. On the other hand, non-operating expenditures are costs that are unrelated to the primary business operations. They include costs like interest expenses, unusable inventory charges, derivatives, law settlements, restructuring expenses, and losses.

The most significant difference between operating and non-operating expenses is the occurrence frequency. Operating expenses are mostly recurring, while non-operating expenses are uncommon and generally occur singularly.

How to calculate operating expenses?

Step 1: Track and categorise expenses

Make a list of all your company spending in the chosen time period. Use the list given above to segregate operating expenditures from other types of expenses

Step 2: Add all operating expenses

This will give you a final picture of your operating costs.

Operating Expense= Salaries + Promotional and Advertising Cost + Supplies + Furniture + Supplies + Sales Commision + Property taxes + Insurance…

Operating expenses formula

Another way to calculate operating expenses is by subtracting the operating income and cost of goods sold from the total revenue.

Operating Expense= Revenue – Operating Income – COGS

Is increase in operating expenses a bad sign?

If the increase in operating costs is accompanied by static or decreased revenue, your business might be making less profit. However, an increase in operating costs can also signify growth.

The critical thing to remember is that you cannot assess the expense situation by only looking at isolated figures. A more telling factor of company performance is the operating expense ratio.

The operating expense ratio is the cost incurred for using a piece of equipment or property divided by the income it generates. A high ratio indicates better performance, while a low ratio signifies that some things may need improvement.

Quick Read: Expense vs Expenditure

How to reduce operating expenses?

Here are a few ways in which you can manage operating costs-

- Automating tedious tasks

- Pay bills in advance to avoid late fees

- Identify and remove waste areas

- Go paperless

- Negotiate better deals with vendors

- Use an expense management platform to increase savings

Best ways to manage operating expenses

As opposed to capital expenditures, non-operating costs, and production costs, operating expenses are more flexible. Constantly under scrutiny, operating expenses are often the primary subject of reductions.

There are multiple theories that direct operating expense management decisions. Company leaders can adopt various operating models to optimise operating expenses and maximise savings.

- Some businesses choose the ‘high cost, high returns’ model and invest heavily in operating expenses to increase the company’s overall profitability. They believe that initially incurring high costs will eventually yield minimal wastage of resources, higher customer acquisition and hence, increased profits.

- Other companies take a ‘savings-first’ approach and only spend on what is essential. They either do not yet have the funds to spend on non-essential utilities or believe they would not benefit directly.

- Many companies adopt a custom operating expense model to decide which operating expenditures are crucial and invest in them more.

Quick Read: Difference Between Capital Expenditure and Revenue Expenditure

Expense management platform- Manage operating expenses the smart way

An expense management platform streamlines the expense management process. A few benefits of using an expense management software are listed below.

1. Obviates manual tracking

Manual data tracking can lead to errors and eventually result in faulty expense analysis. In the longer run, this can lead to decisions that cause more harm than good.

Expense management software helps you avoid manual expense reporting. It does so by setting up real-time spending with the help of pre-paid cards and digital tracking. This eventually saves you from data contamination.

2. Custom analytics

An expense management platform can automatically develop comprehensive reports using recorded data. This not only saves time but also allows more efficient analysis and fast-tracks decision-making.

3. Visibility

Expense management platforms let you leverage the power of automation to make expense reporting easier for employees. It also makes the process highly transparent and ensures that there is no false reporting or overstatement of expenses. This can help safeguard the business against losses due to expense fraud.

4. Better categorisation

Expense management platforms enable the efficient categorisation of expenses. The final reports give a comparative view of costs across operational departments and processes.

You can review data department-wise, location-wise, or project-wise to understand spending patterns across the tangents. This knowledge can inform your decisions during resource planning.

Suggested Read: Selling Expenses: Types and 4 Steps to Calculate It

Choose savings by choosing Happay

Businesses can save a lot of valuable resources by pre-planning their operating costs models. Expense management technology can help them enforce their policies.

Happay’s end-to-end business spend management platform is an excellent tool for CFOs and business owners. It has a complete T&E suite with a mobile app that helps you manage petty cash, employee tax benefits, subscriptions, payments, and more.

Happay self-managed corporate liability cards give you robust internal controls that prevent fraud and misuse by increasing spend visibility. Schedule a demo with the Happay team to learn more about the platform’s amazing features.

Operating expenses – FAQs

Spend management software tailored to the needs of your business promises better execution of policies, boosts compliance and enables savings. All finance leaders need to do is find the right platform for their business. Once they decide to adopt it, savings and efficiency will soon follow.

Paperless expense management ensures a higher level of expense visibility. It also means that receipts do not get lost and unaccounted for. It enables instant policy checks and enables easy access to receipts.

Operating costs fund all the operational activities that drive the commercial operations of a company and generate earnings.