Introduction

Imagine you setting off on a long road trip with your eye only on the destination and ignoring to check if you have enough fuel in the tank to get there. Well, this would be equivalent to focusing only on your business’s profit and loss statement and not paying attention to the Cash flow.

The movement of cash is a constant in any business. Cash moves from customers to a company (inflows), some of which gets diverted to employees and suppliers to sustain normal business operations (outflows).

Cash flow is this in-and-out movement of money in a business. A profitable company needs a positive cash flow where the cash inflows exceed the cash outflow.

Cash flows into a business from three main channels, operations, investing, and financing.

What is cash flow from financing activities?

Cash flow from financing activities (CFF) is the net cash flow used to raise capital for your business. It covers all cash and equivalent transactions involving debt, equity, and dividends.

These transactions include

- Adding or changing loans,

issuing and selling more stock, - Paying cash dividends.

CFF is the cash flow between a company and its owners and creditors. It gives investors an insight into how well a company’s capital structure is managed.

Importance of cash flow analysis in financial management

“Never take your eyes off the cash flow because it’s the lifeblood of business.” – Richard Branson

As a business owner, you must track your cash flow as it is the pulse of the financial health of a company.

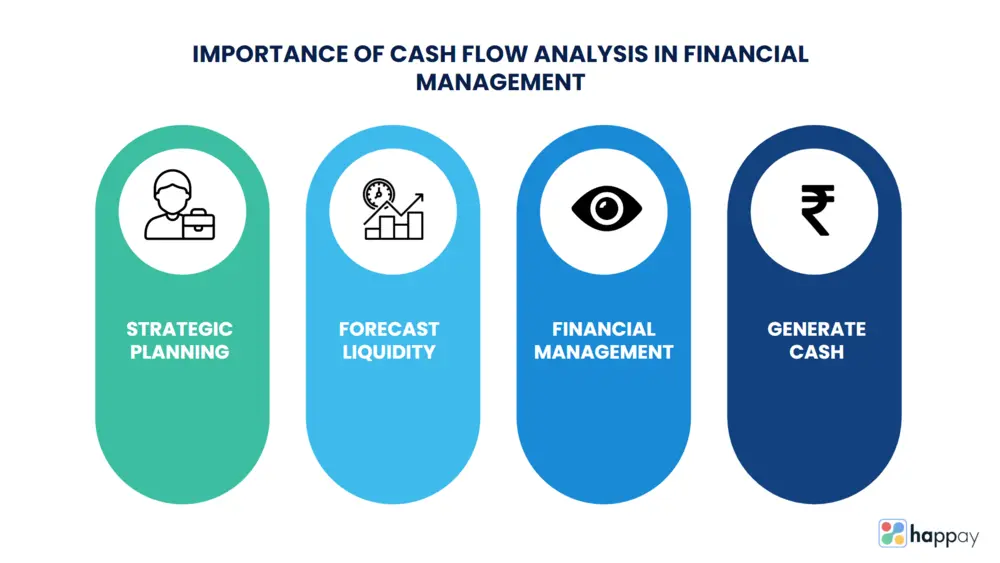

For several reasons, cash flow analysis can be critical in financial management,

- To assess the ability to generate cash: By analyzing the cash flow, you can determine if your business is causing enough money to meet short-term and long-term financial obligations and support current operations and future growth.

- To forecast liquidity problems: Cash flow analysis can highlight potential liquidity problems, like the inability to pay bills or repay debt on time.

- To evaluate the financial management strategies of your business: Analysis of the cash flow statement can throw light on whether the company’s financial management practices are effective. For example, consistent negative cash flows may nudge you to re-evaluate the financial management strategies being practiced.

- To support strategic planning and decision-making: Cash flow analysis can help you make educated decisions for the future. For example, you could plan expansion into new markets or invest in new equipment with a positive cash flow in your business. In contrast, a negative cash flow may need you to focus on cost-cutting measures or additional ways of financing.

Cash flow analysis is also one of the best measures of business performance.

- As cash can be quantified, it can be measured and used to compare two companies even in different sectors

- Cash flow analysis gives an accurate picture of a business as it is tough to falsify and inflate cash flow

- As the value of cash is universally accepted, it is a tangible store of value

Overview of cash flow statements

“Cash is King” is an age-old saying that holds even today for any business. Then tracking the cash becomes imperative for a company to strive.

A cash flow statement (CFS) is a financial document that helps analyze the cash flow. The CFS includes the cash flow from all three categories: operating activities, investing activities, and financing activities for a specified accounting time period. The sum of these three cash categories will give you the net cash flow.

The cash flow statement is equally important to the owner, investors, and creditors. Investors can determine the financial value and strength of your business. Creditors can determine how much cash is available to fund the businesses’ operating expenses and pay debts. You can understand business performance and adjust strategies as an owner or entrepreneur.

Quick Read: How to Prepare a Cash Flow Statement Using the Indirect Method?

Explanation of the three categories in a cash flow statement

A cash flow statement is a comprehensive statement with three main components,

1. Cash flow from operating activities (CFO): Operating activities are your company’s main revenue-producing activities. These operating activities may include:

- Salary payments to employees

- Rent payments

- Sales of goods and services

- Interest payments

- Income tax payments

- Payments made to suppliers

- Any other operating expenses

Operating activities can vary depending on the business domain. For example, in an investment company, receipts from the sale of loans, debt, or equity instruments will also be included in this section as they are business activities.

2. Cash flow from investing activities (CFI): generally includes the cash flows associated with buying or selling property, plant, equipment (PP&E), and other non-current and financial assets.

Cash payments for purchasing PP&E (Capital expenditure, CapEx) would include new office equipment such as computers, printers, or unused land and building necessary for business operations. These investments are an outflow of cash and will thus negatively impact the net increase in cash from all the activities.

3. Cash flow from financing activities (CFF): Your business’s capital composition can change due to cash flow from financing activities. These activities include

- Cash flows associated with short-term borrowings and long-term borrowings

- Repaying bank loans or bonds,

- Issuing and buying back shares.

- Dividend payments

These activities can either be a cash outflow or a cash inflow. For example, the cash inflow would be from investors, such as banks and shareholders, and the cash outflow would be to shareholders as dividends.

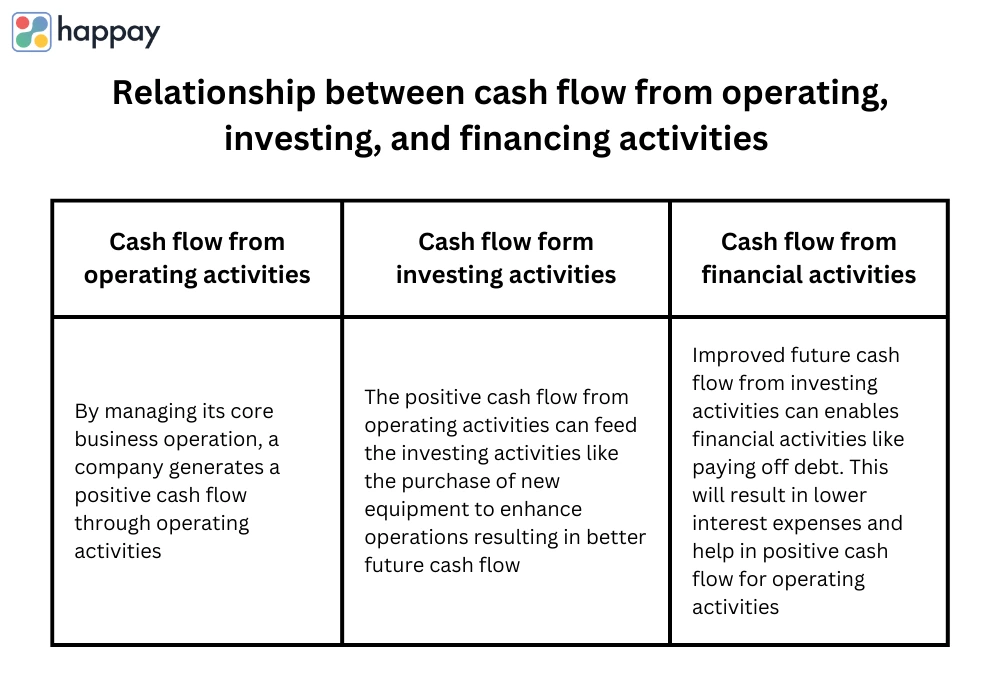

Relationship between cash flow from operating, investing, and financing activities

Cash flows from each of these activities can help fuel the other activities and result in a financially stronger business.

Read More: Understanding the Difference Between Cash Flow and Fund Flow

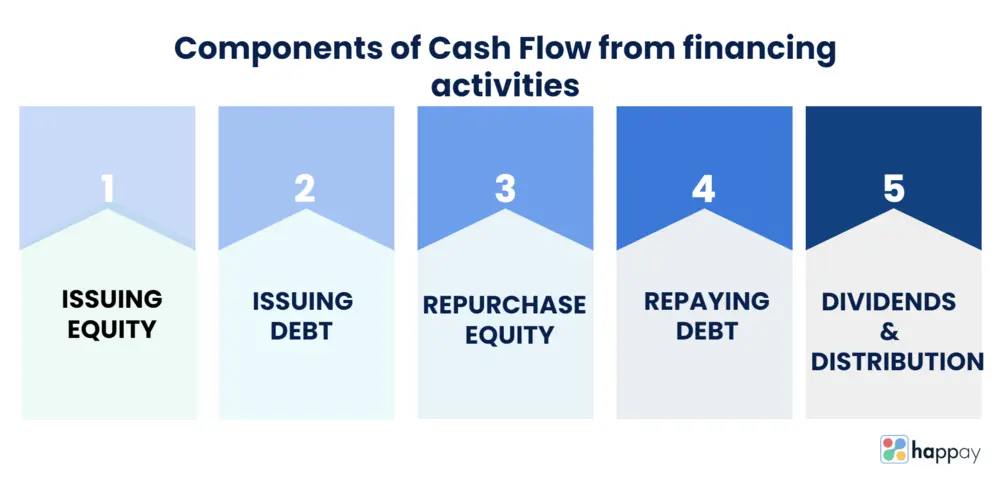

What are the main components of cash flow from financing activities?

Cash flows from financing activities include the various transactions that affect the capital structure of your business.

For example, if you issue Debt to fund your operations, it is a cash inflow as investors act as lenders. However, when you repay these debt investors, the repayment is a cash outflow. Similarly, if you issue equity, it is a cash inflow. On the other hand, if you repurchase equity, it is a cash outflow.

Let’s scrutinize the components of cash flow from financing activities.

1. Issuing equity

In simple terms, issuing equity means the sale of new equity or shares by a company to investors. By selling shares, you effectively finance your business by selling ownership of your business in return for capital. It is a means to raise money for your short-term or long-term business plans.

Equity financing can be from a variety of sources,

Initial Public Offerings (IPOs): IPO is the first time a company offers shares to the public to raise capital from public investors.

Secondary offerings: This refers to the sale of shares bought in an IPO by an investor to the general public.

Private placements: These involve the sale of shares or bonds to investors and institutions you select rather than publicly offering them on the open market.

2. Issuing debt

Issuing Debt refers to the company offering new bonds or other debt instruments to raise capital. It is a financial obligation wherein the issuer, the company, promises regular interest payments and repayment of the initial principal amount per the contract terms.

Following are the debt instruments used by companies,

Bonds: A bond is a loan taken by the company to raise capital without having to sell ownership. The company needs to make periodic interest payments and repay the loan when the bond reaches maturity.

Loans and lines of credit: These are two types of banks issued debts.

Loans have a non-revolving credit limit and one-time access to funds.

Lines of credit have revolving credit lines, access to either the total amount or in smaller increments.

Debentures: Companies issue debentures to raise capital. They need no collateral backing. your creditworthiness and reputation as the issuer become crucial.

3. Repurchasing equity

Repurchasing equity is when a company repurchases its stock from existing shareholders. Doing this will effectively be “re-slicing the pie” of profits into fewer slices and leaving more for the remaining investors.

Repurchasing equity helps in company consolidation, increases equity value, and makes the company look financially attractive.

Repurchasing equity can be done by

Share buybacks: A transaction whereby you buy back your shares from the marketplace. When you have cash on hand, and the stock market is on the up trend, it is a good time for this transaction.

Stock repurchase programs: These programs help you pay shareholders the market value per share and re-absorb that part of your ownership distributed among the investors.

4. Repaying debt

Disciplined debt management and financial planning can help repay debt without facing legal or financial penalties.

Debt repayment in a payment plan has two components.

Principal payments: The component of debt repayment that directly goes towards the principal amount borrowed.

Interest payments: Interest payments are made towards funds borrowed. It is the cost of borrowing.

5. Dividends and distributions

The company distributes a portion of the profits to the shareholders in two ways.

Dividends are typically paid out in cash but oftentimes in stocks too. A distribution is an additional cash payment made to investors by smaller corporations.

You could pay dividends in any of these ways,

Cash dividends: These are dividends you pay in cash or through bank transfer, generally yearly, on a per-share basis.

Stock dividends: These are non-cash dividends in the form of additional shares, as a fraction of the total shares owned, rather than cash payments.

Dividend reinvestment plans (DRIPs): The shareholders automatically reinvest their cash dividends into additional company shares, with a set limit on the number of shares that can be purchased in one transaction.

Also, Read: Cash Flow Forecasting: What is it, Components, Methods, Process & Formats

Cash flow from financing activities formula

Stock prices are closely connected with the cash flow of a company. So, an investor, analyst, and owner would all want to be keenly aware of the subtle shifts in a company’s cash flow.

Cash flow from financing activities(CFF) tells the story of the company’s financial strength and how well the capital structure is being managed. The story gets even better clarity if this cash flow can be quantified.

To quantify the cash flow from financing activities, the following formula is used,

CFF = CED – (CD+RP)

Where:

CED = Cash inflows from issuing equity or Debt

CD = Cash outflows in the form of dividends, interest, repayment of lease obligations, dividend distribution tax

RP = Repurchase of Debt and equity

How to calculate cash flow from financing activities?

Cash flow from financial activities is the amount you arrive at after subtracting the total cash outflows from the total cash inflows.

Let’s go through this step-by-step,

- Determine the issuance of equity

- Determine the issuance of Debt

- Add the above two amounts to give you CED, that is, the total cash inflows

- Determine dividend payments, interest payments, lease obligations, and other cash outflows.

- Determine the repurchase of equity

- Determine the repurchase of Debt

- Add the amounts from steps 4,5 and 6 (CD+RP) to give you the total cash outflow

- Now, you can plug the amounts from steps 3 and 7 into the formula,

CFF = CED – (CD+RP)

CFF gives you the cash flow from financial activities.

Read More: Free Cash Flow (FCF): A Comprehensive Guide

Cash flow from financing activities example

Let us now consider an example to get more clarity on the cash flow from financing activities in a company.

We will track the financing activities of a fictional company, XYZ Corporation. Following are the activities the company has reported under the financing activities section of the cash flow statement for a specific time period,

Issuing Equity: XYZ Corp. issues 100,000 shares of common stock at $20 per share to raise capital for expansion.

Equity raised = 100,000shares x $20per share = $2,000,000.

Borrowing Long-Term Debt: XYZ Corp. obtains a loan from a bank to fund a new manufacturing facility.

The company borrows $3,000,000 with a repayment period of 5 years.

This is a cash inflow for the company.

Repurchasing Shares: Later in the period, XYZ decides to repurchase 20,000 of its shares at $25 per share from the open market in a stock buyback program.

Amount spent on the repurchase = 20,000 x $25 = $500,000.

Repaying Debt: XYZ makes a principal repayment of $500,000 on its existing long-term Debt.

Dividend payments: XYZ Corp. pays dividends to its shareholders totaling $1,000,000 in this period.

These financing activities of XYZ Corp. would reflect as follows in the cash flow statement for that period:

An example of a statement that shows cash flow from financing activities

Cash from issuing stock $2,000,000

Cash from borrowing a long-term loan $3,000,000

Payment for stock buyback ($500,000)

Repayment of long-term Debt ($500,000)

Payment of dividends ($1,000,000)

Net cash flow from financing activities $3,000,000

In this example, the company has a positive cash flow in the given period, which can be used for its other financial obligations.

Read More: Cash Flow Problems- 4 Best Ways to Solve It

Positive and negative cash flow from financing activities

To make a solid prediction of your cash balance in the coming months, you need to create a cash flow forecast. Doing this will help you make the right decisions for future planning.

As we have seen, financing activities can generate either a positive or a negative cash flow.

To make the best of the cash flow forecast, you must understand the impact of positive and negative cash flow on your business.

1. Impact of positive cash flow from financing activities

A positive cash flow on the cash flow statement indicates that you have more capital entering than leaving. This means an increase in cash reserves which translates into an increase in overall assets.

A positive cash flow will help to

- Handle cash obligations smoothly

- Invest in your business for future growth, like upgrading equipment or technology

- Consider expansion to additional locations

A financial plan that makes the best sense for your business will be helpful.

2. Consequences of negative cash flow from financing activities

Negative cash flow means that your business is spending more money than it is earning. Continuous negative cash flow cycles will deplete your bank accounts over time and result in a cash crunch. This scenario is expected for a period when your business is new, or it is going through a growth and expansion phase.

It is imperative to monitor your cash burn rate (cash you are burning every month) and runway (how long you can stay alive at this burn rate). It would help to have a solid plan and targets to return to positive cash flow. The key is to monitor the progress toward this goal.

Otherwise, it may lead to

- Increased bank charges and interest rate risks

- Sour relationships with suppliers and vendors

- Employee dissatisfaction if salaries are delayed

Must Read: 6 Best Cash Flow Management Software in 2023

Analyzing cash flow from financing activities

A cash flow analysis can throw light on the status of a business. It reveals if your business is going through a transition or a decline. It must be analyzed in its entirety, considering each section contributing to the overall cash flow change. This will give you perspective and impact of the resulting positive or negative cash flows.

1. Evaluating the cash flow statement as part of financial analysis

Knowledge is Power!

Evaluating the cash flow statement lets you know the cash position of your business in advance. This knowledge helps you take proactive measures to run your business operations optimally.

Cash flow statements can also help in,

- Short-term planning and keeping control over cash

- Providing details of cash spent. This can help you target areas to cut costs

- It helps in making a more accurate cash budget

- Helps in long-term planning of growth and expansion

- It helps in analyzing the working capital

2. Significance for investors and creditors

The cash flow statement is an essential financial document for investors and creditors while conducting due diligence and making projections of your business.

It can help them decide if the company is worthy of their investment by giving an insight into the financial situation of the company in various ways,

- The historical cash flows will provide them with information to project future cash flows

- Helps analyze operating, investing, and financing activities

- Gives information about the cash-generating capabilities of the core activities

- It allows them to compare the quality of earnings with other companies

Investors and creditors can approximate the timing of repayments of long-term debt obligations.

3. Assessing financial health and stability

The cash flow statement gives you a complete picture of cost versus revenue. It reveals whether enough cash is available in the business to meet financial obligations, invest in growth, or pay dividends to shareholders.

It gives a bird’s view of the financial condition of your business. Furthermore, using the current cash flow scenario, you can make sound projections of the long-term cash situation and company profits and identify opportunities for investment in your business.

The cash flow statement is a reliable financial performance indicator to assess your business’s financial health and stability.

Read About: Cash Flow Analysis: What is it, Methods, Objectives, How does it Work, Example & Key Metrics

Differences between cash flow and profitability

Cash flow and profitability (or profit) are often used interchangeably. Let’s look at what each means.

Cash flow is money flowing in and out of your business anytime. On the other hand, profit is the money remaining from your sales revenue after subtracting all your costs.

Cash Flow |

Profitability |

|

Cash flow is the capital that keeps a business running. It measures the company’s ability to pay bills. |

It is a business’s goal and measures its ongoing sustainability. |

|

It communicates the trends for positive and negative cash flows. |

It forecasts sales and overall expense trends. |

|

It gives you a day-to-day understanding of your business’s financial well-being. |

It shows how successful your business is but can’t tell you if you have enough money to survive long-term. |

|

It is reported on the cash flow statement. |

It is shown on the income statement. |

Tips for individuals and small businesses

According to a study from Intuit, 61% of small businesses worldwide struggle with cash flow. Almost one-third of those surveyed could not meet payment obligations due to cash flow problems.

Paying close attention to cash flow can help you and your business avoid financial troubles. If you have a cash deficit, you can look into options like applying for a loan, speeding up the collection process, liquidating assets, delaying payments to vendors, or cutting back on spending.

If you have a surplus of cash, make the cash work for you. This can be done by making short-term investments and using it to pay off Debt faster.

1. Applicable strategies for small business owners

Simple tips to increase cash flow and manage your business

- Avoid delays in sending out those invoices. Send them out as and when jobs are completed to improve cash flow

- Adjust your inventory by selling off items that don’t sell well at a discounted price and stock up on those that do sell well

- Leasing your equipment is a better option than buying

- Borrow money when the business is running smoothly to open a business line of credit. This will avoid the risk of rejection later

- Streamline your business processes by adopting technology

- Restructure your payment and collection dates to create a more balanced income for your business

- Re-evaluate your business operations. For example, you could identify parts of the processes that could be outsourced

- Keep an eye on the flow of the money

If you have a surplus of cash, make the cash work for you. This can be done by making short-term investments and using it to pay off Debt faster.

2. Managing personal finances with cash flow from financing activities

Effectively managing personal finances involves saving first, spending later, budgeting, tracking expenses, planning goals, managing payment cycles, and managing liquidity.

A personal cash flow helps to track your net income flow, where it is coming from, and how it is being spent. This will help you tweak your everyday expenses so that you have a surplus to put toward your future goals.

Personal finances can broadly have two distinct phases in your financial journey: the initial accumulation phase and the later withdrawal phase. The accumulation phase creates surplus money with cash inflows exceeding the cash outflows. This surplus money can be prudently invested in financing activities to create a corpus.

Ideally, 30% of the inflows should go towards savings. Effective cash flow management should ensure planning for emergencies. You may still need to take out a loan for big purchases like a house or a car. The EMI is an outflow that becomes part of personal cash flow management.

At any point in time, you will have to maintain a balance between current needs and saving for the future. Ultimately the goal is for the corpus to grow to achieve financial freedom.

By cash management, the corpus created during the accumulation phase should service the outflows of the withdrawal phase.

Strategize withdrawals during this phase with a systematic withdrawal plan (SWP).

Read About: Cash Management System – Types, How It Works and Best Practices

Conclusion

A company’s cash flows from financing activities refer to the cash inflows and outflows due to the issuance of equity, dividend payments, and existing stock repurchase. This cash flow section shows how a business raises capital from debt and equity sources. It also shows how the company pays off these financial obligations over time.

The investors, creditors, and owners actively analyze this section of the cash flow statement. Owners get information to strategize for the future, investors use this to decide if it is an attractive investment opportunity, and creditors determine whether it is a good idea to loan the company.

Cash flow from financing activities is directly linked to a company’s capital structure.

“It doesn’t matter whether a company is big or small. Capital structure matters. It always has and always will” – Michael Milken

FAQs

Net cash flow is the difference between all the company’s cash inflows and outflows for a specific period.

A financing activity refers to issuing bonds, repurchasing bonds, selling stock, or stock buybacks, where the cash flows between a company and its owners and creditors. Investing would include cash activities on long-term assets, such as equipment and facilities.

An equity transaction involves buying or selling ownership shares in a company, typically in the form of shares or stock. A debt transaction is a transaction between two parties where one party lends money to another party, with a legal obligation to repay the borrowed amount with interest over an agreed specified period of time.

The two types of financing activities are.

Issuing Equity: The company issues new shares to public or private investors to raise capital.

Issuing Debt: Obtaining capital by borrowing money by issuing bonds to investors.

Investing involves the allocation of resources with the expectation of future returns. It could be in the way of investments in other companies or the acquisition and disposition of assets. Financing involves transactions that affect the company’s capital structure, liabilities, and equity—for example, issuing equity and borrowing.

A cash flow statement is a financial statement that summarizes the flow of cash that comes in and goes out of a company. It details the cash flow from operating, investing, and financing activities. The financing activities statement highlights the financial activities related to raising and managing the operations and growth of a company.

Issuance of stock options to employees is an example of a financing activity that does not show up in cash flow from financing activities.

The term “net” is the remaining amount in the business after deducting all operating, interest, and tax expenses over a given period.

It helps investors see how often a company raises capital, by how much, and from what sources. This helps them gauge the financial strength of the company.

Cash flows from financing activities result from transactions with the company’s owners and creditors, like issuing and repurchasing stock, borrowing, and repaying Debt. Cash flows from operating activities are from core business operations, like revenues, expenses, and changes in working capital.

Transactions that improve cash flow from financing activities

1. Issuing equity or stock, which is sold to investors

2. Issuing Debt from a creditor or a banking institution

3. Issuing bonds, which is Debt that investors purchase

Yes, as these transactions affect the capital structure of the company. However, to get the full picture of the company’s financial health, the cash flows from financing activities must be analyzed in conjunction with other financial statements like balance sheets, income statements, profitability ratios, and other indicators.

For a small business, it would be more frequent for a small business, which would mean either monthly or quarterly. Larger corporations with dedicated financial analysts do monitor regularly. Cash flows from financial activities are analyzed more frequently around strategic events like mergers and acquisitions. An annual statement is a must for any business.