Cash flow from operating activities helps you discover how effectively your business’ core operation can turn into revenue.

It shows a periodical inflow and outflow of money. This paints a fine picture of a company’s operational efficiency and gives signals to invest, expand, or become more resilient.

This article will help you calculate it with an example. When assessing your financial health, you can dive deeper into the components and understand their limitations and challenges.

What is cash flow from operating activities?

Cash flow from operations is the money an organization brings in through its primary operations, such as providing services or manufacturing and selling products. It helps finance teams understand a company’s performance in its core business.

It’s the first section in a company’s cash flow statement. Cash flow from operations doesn’t cover any long-term expenditures or investment revenue and expenses. It includes aggregate sales of goods and services, payments to suppliers, employee wages, and other costs incurred in production.

It’s also known as operating cash flow or net cash from operating activities. Executives use the net cash as a benchmark to evaluate if a company can sustain or expand its existing business operations financially.

Suggested Reads: Difference Between Cash Flow and Fund Flow

Why is cash flow from operating activities important in financial analysis?

Cash flow, in general, paints a picture of how money moves in and out of a business. It directly affects a company’s liquidity. Cash flow from operating activities provides more precise insights into cash transactions related to primary business operations.

During financial analysis, it gives a clear indication of how well a company could turn profits if it relied solely on its core business. If positive, you can fund growth projects, pay off the company’s debts, or pay dividends to increase investors’ trust.

However, a negative cash flow from operating activities indicates a company relies on external sources to fund its operations. Although negative cash flow seems concerning, it may not completely indicate an organization facing problems. Some businesses burn cash heavily to capture or expand faster and save on opportunity costs. They might have a negative cash flow from operating activities. Investors look for profitability in the long term in such cases.

When you want to raise investment, an upward-trending cash flow from operating activities centers investor negotiations in your favor.

Components of cash flow from operating activities

Such cash flow is a part of the cash flow statement a company releases every quarterly or annually. Below are the primary components included in cash flow from operating activities.

- Net income is the starting point for calculating cash flow from operating activities. It includes revenues minus expenses, taxes, and costs.

- Adjustments for non-cash items are made for items recorded in net income but which did not involve actual cash flow. Common non-cash items include depreciation, amortization, deferred income taxes, and stock-based compensation.

- Adjustments for changes in working capital involve adjustments for changes in current assets and current liabilities. You should consider inventories, accounts receivable (AR), accounts payable (AP), accrued expenses, and unearned revenue.

Depending on business operations, the company might factor in various other components, such as dividend payments, if they’re a part of your ongoing operations. It might include unrealized gains or losses from foreign exchange differences.

Related Reads: Income Statement

Cash flow from operating activities formula

The formula to work out cash flow from operating activities differs from company to company as the balance sheet differs for each organization.

Here’s a generic formula organizations can use as a reference:

Cash Flow From Operations = Net Income + Non-Cash Items + Changes in Working Capital

Net income comes from the income statement.

Non-cash items can include the following:

- Depreciation and amortization. This includes expenses spread out over the estimated useful life of a physical asset like machinery or vehicles. Similarly, amortization refers to the expense of intangible assets spread over their useful life.

- Stock-based compensation. It is a non-cash expense in the form of a company’s shares. It’s added to the net income since no cash flow is involved.

- Deferred taxes. Adjustments for deferred tax liabilities and assets, which arise due to timing differences in recognizing revenues and expenses for accounting and tax purposes, are non-cash.

- Impairment charges. If a company writes down the value of an asset, this impairment charge is a non-cash expense.

Moreover, changes in working capital include:

- Accounts receivable. An increase in accounts receivable implies the company has made sales but has yet to receive cash. Deduct AR from net income. On the other hand, a decrease in accounts receivable suggests that money has been collected on previous sales. Add AR decreases to net income.

- Accounts payables. Deduct any decrease in AP from net income as it informs the company that it has already paid up its liabilities.

- Accrued expenses. Companies adopting accrual accounting recognize these expenses but haven’t paid them yet. Any increase is added, while decreases are deducted from net income.

Inventory. A decrease in inventory suggests the company sold and turned revenue in. Add any reduction in inventory to the net income.

How to calculate cash flow from operating activities

You can calculate cash flow from operations through indirect and direct methods. Financial professionals prefer the indirect method since it links financial statements. (Statement of cash flow to the income statement)

Although the direct method provides a much clearer picture of the actual cash flow running in and out of business, it requires precisely detailed accounting information. This is another reason why many companies prefer the indirect method. Let’s dive into the indirect way to calculate cash flow from operating activities.

How to calculate cash flow from operations with the indirect method

The indirect method starts with the net income from the income statement and makes adjustments for non-cash transactions and changes in working capital expenditures and gains. Here are the steps:

- Start with net income. The net profit or loss is reported on the income statement.

- Adjust for non-cash expenses. Add back non-cash expenses like depreciation, amortization, and stock-based compensation.

- Adjust for changes in working capital. Consider accounts receivable, inventory, accrued expenses, accounts payables, and so on, as described in the above section.

Use the indirect method formula:

Cash Flow From Operating Activities = Net Income + Adjustments For Non-Cash Items + Changes in Working Capital.

How to calculate cash flow from operations with the direct method

The direct method considers the amount of cash transactions that happened in the time period. Take into account the following items to calculate cash flow operating activities through the direct method:

- Cash received from customers

- Cash paid to suppliers

- Cash paid for operating expenses

- Cash interest

- Cash payments for income taxes

- Other cash received or paid

Adding all these would give you the net cash from operating activities.

Examples of cash flow from operating activities

In an income statement, assume sales were $1000 and gross profit is $500. There is a $100 expense in selling and administrative costs. Opening balances for AR, inventory, and AP are $800, $600, and $400. The closing balance for AR, inventory, and AP is $900, $500, and $550.

Consider a non-cash expense, depreciation, of $100.

First, we will prepare an income statement to find the net income.

|

Sales |

$1000 |

|

Cost of goods sold (COGS) |

$500 |

|

Gross profit |

$500 |

|

SG&A |

$100 |

|

Earnings before interest and taxes (EBIT) |

$400 |

|

Interest |

$0 |

|

Earnings before taxes (EBT) |

$400 |

|

Tax |

$100 |

|

Net income |

$300 |

Cash Flow from Operating Activities = Net Income + Non-Cash Expenses + Changes in Working Capital

We will add the non-cash depreciation of $100. Next, calculate changes in working capital.

- Changes in AR = $800 -$900 = -$100

- Changes in inventory = $600 – $500 = $100

- Changes in AP = $550 – $400 = $150

Here, changes in inventory and AP are cash inflows, while changes in AR are cash outflows.

Cash flow from operating activities = $300 + $100 – $100 + $100 + $150 = $550

Limitations and challenges of cash flow from operating activities

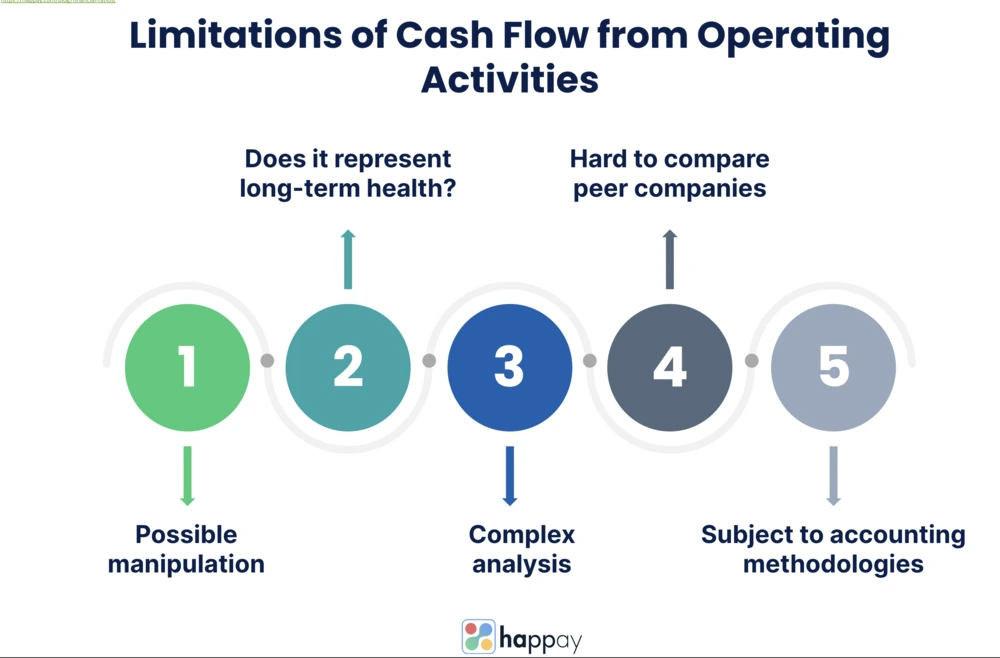

Although cash flow from operating activities tells a lot about a company’s core business performance, it needs to be looked at alongside other financial information to get a complete overview. As a standalone insight, it has limitations and challenges:

- Prone to manipulation. Companies can time their receipts and payments to make their cash flow appear stronger, especially toward the end of reporting periods.

- Doesn’t reflect long-term health. It only shows how cash moves in and out of a business in the short term. It doesn’t tell you about long-term investments, debts, or financial stability.

- Complicated to analyze. Understanding cash flow from operating activities can be complex. It involves many adjustments that can take time to follow.

- Limited use for comparing companies. Different industries have different cash flow models, making it hard to compare cash flow from operating activities across different sectors.

- Subject to accounting policies. Other accounting practices can affect how cash flow is reported, which might not truly reflect the company’s cash position.

Know More about Cash flow Statement

What does a negative cash flow from operating activities mean?

When a company has a negative cash flow from operations, it’s spending more cash on its day-to-day operations than it’s bringing in. This situation can happen for a few reasons.

The company might be selling its products or services on credit, which means it’s making sales but not receiving cash immediately. This situation can lead to a buildup of accounts receivable on the balance sheet, but it doesn’t bring in immediate cash. On the other hand, a company might spend a lot on inventory or other operating costs. Expenses such as buying raw materials or paying for labor are critical for daily operations. If these costs are high compared to the cash the company gets from its sales, the cash flow from operating activities can be negative.

A negative cash flow from operating activities isn’t always a bad sign, especially if it’s short-term. Sometimes, businesses invest heavily to grow, temporarily resulting in negative cash flow.

It can mean the company needs to manage its cash properly or make more sales to cover its operating expenses. It’s best to monitor cash flow closely and understand why it’s negative to make sure you’re aware of your financial health.

Cash flow from operations vs. net income

Cash flow from operations focuses on the actual cash transactions. It indicates how much cash is generated or used by the business’s core activities. It clearly shows the company’s ability to generate some money.

Conversely, net income is a broader measure of profitability, including all revenues and expenses.

Check out the table below for a detailed comparison of cash flow from operations and net income.

Cash Flow from Operations |

Net Income |

|

Money generated from normal business activities. |

Profit or loss after expenses are deducted. |

|

Reflects the actual cash inflow and outflow. |

Represents accounting profit or loss. |

|

Indicates the liquidity and cash-generating ability. |

Shows profitability of the company. |

|

Used for understanding the cash position for operations. |

Used for assessing overall financial performance. |

Cash flow from operations vs. EBITDA

Cash flow from operations directly indicates how much cash a business can generate from its regular operations.

Earnings before interest, taxes, depreciation, and amortization (EBITDA), on the other hand, provide an insight into the operational profitability of a business by removing the effects of financing and accounting decisions.

Cash Flow from Operations |

EBITDA |

|

The cash a company generates from its regular business activities. |

It represents earnings before interest, taxes, depreciation, and amortization are deducted. |

|

Shows the actual cash inflow and outflow from core business operations. |

Represents profitability before deducting certain expenses. |

|

Used to assess the company’s liquidity. |

Used to evaluate a company’s operating performance without non-operating factors. |

|

Includes the effect of taxes and interest payments. |

Excludes taxes and interest expenses. |

Bottom line

Cash flow from operating activities is a crucial measure showing a business’ running cash flow from its core activities. A positive cash flow opens up new opportunities for growth, while a negative one puts the company into speculation.

FAQs

This money goes out of a business to cover its day-to-day costs. These costs include paying salaries, buying materials, or spending on marketing. It’s like a family’s regular expenses, such as grocery bills or rent, showing what it costs to run the business normally.

For a finance company, this cash flow shows money from core activities like giving loans, receiving loan payments, or trading securities. It’s different from other businesses because these financial activities are their primary way of making money.

Negative cash flow from operating activities means a business spends more money on its day-to-day operations than it’s making. It’s a warning sign, like spending more than your income. It can mean trouble if it continues, as the business might not have enough cash to keep running.

This metric offers a deeper insight into a company’s financial well-being beyond mere profits. It reveals whether the business is genuinely generating cash from its core operations. This understanding is crucial for confirming the company’s ability to settle its obligations, invest in new opportunities, and expand.

Cash flow from operating activities is all about the cash a company makes and spends in its day-to-day business. It includes money from selling products or services and money spent on things like salaries, rent, and supplies. This cash flow shows whether a company can profit from its core business.

On the other hand, cash flow from investing activities deals with how a company spends and earns money on big, long-term investments. This includes buying or selling long-term assets like buildings, equipment, or shares in other companies. It’s like when you buy a house or invest in stocks. This cash flow gives us an idea of how a company plans for its future, whether expanding, upgrading, or maintaining its assets.

Cash flow from operating activities, Cash flow from investing activities, and cash flow from financing activities are the three types of cash flow. Operating activities are about daily business operations, investing activities are about buying and selling assets, and financing activities involve money from investors or loans and paying them back.

Discussion about this post