Introduction to cost control

Did you know that according to recent studies, approximately 82% of businesses cite cost control as a top priority for sustainable growth? It’s no wonder that organizations across industries are increasingly focusing on optimizing their expenses to improve profitability and drive long-term success.

Whether you’re a seasoned business owner or an aspiring entrepreneur, understanding the art of cost control is crucial in navigating the competitive landscape and maximizing your bottom line.

What is cost control?

Cost control refers to the process of monitoring and managing expenses within an organization to maintain financial stability and achieve profitability. This process involves identifying and analyzing various cost factors, such as operational expenses, production costs, and overheads, and implementing measures to reduce or optimize them.

It aims to strike a balance between minimizing costs without compromising the quality of products or services. By effectively controlling costs, businesses can enhance their competitiveness, improve operational efficiency, and generate higher profits, ultimately leading to long-term growth and success.

Read More: A Complete Guide about Business Expenses

Importance of cost control

Cost control is vital for organizations for multiple reasons. It helps maximize profitability by optimizing expenses, enabling businesses to generate higher profits and improve financial performance. What’s more, it ensures financial stability, minimizing the risk of crises and cash flow problems.

It facilitates strategic decision-making by providing insights into cost drivers and spending patterns, enabling informed resource allocation and investment choices. In short, cost control is a strategic tool that balances financial stability, profitability, and growth, empowering organizations to thrive in a dynamic business environment.

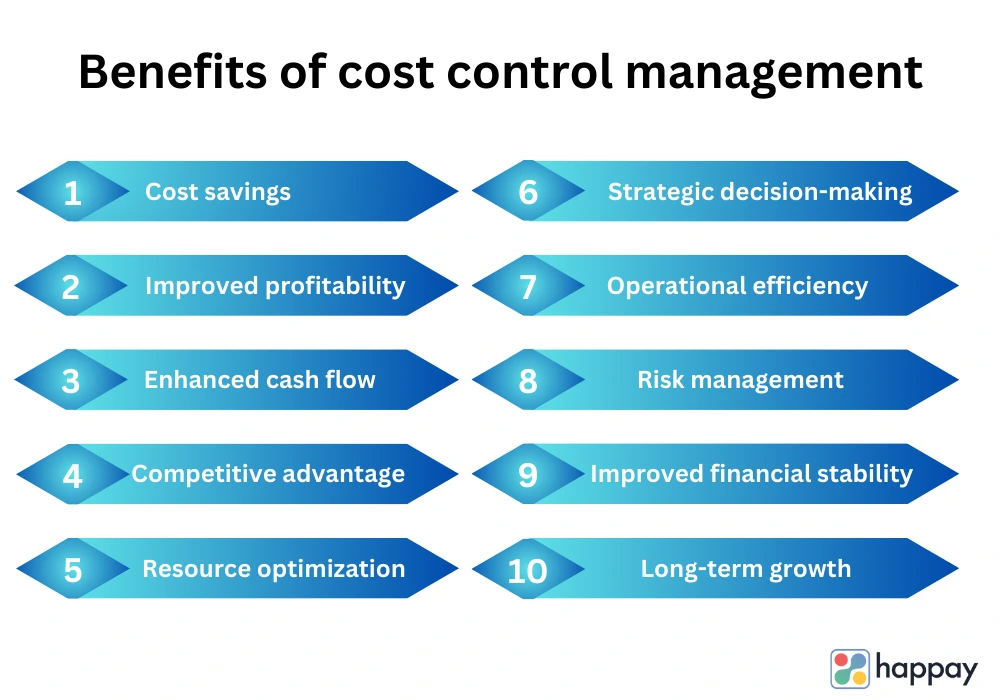

Benefits of cost control management

Cost control management offers numerous benefits to your organizations.

Here is a list of its key advantages:

1. Cost savings

Effective cost control management helps identify areas of excessive spending, inefficiencies, and waste. By implementing cost-saving measures, businesses can reduce expenses, optimize resource allocation, and improve their financial position.

2. Improved profitability

By reducing costs and increasing efficiency, cost control management directly contributes to improved profitability. It enables businesses to generate higher revenues, enhance profit margins, and achieve sustainable financial growth.

3. Enhanced cash flow

Proper cost control management ensures that cash flow remains healthy and stable. By minimizing unnecessary expenses and managing payment cycles effectively, organizations can maintain a steady flow of funds, meet financial obligations, and invest in growth initiatives.

4. Competitive advantage

Cost control management allows organizations to offer competitive prices while maintaining the highest level of quality. This pricing strategy helps attract customers, retain market share, and gain an edge over competitors in the marketplace.

5. Resource optimization

It helps ensure that resources, including materials, labor, and equipment, are utilized efficiently, eliminating any instances of underutilization or excess capacity.

6. Strategic decision-making

Cost control management provides decision makers with valuable insights and data that helps immensely in the strategic decision-making processes. With accurate cost information, organizations can make informed choices regarding pricing strategies, product development, market expansion, and investment decisions.

7. Operational efficiency

Effective cost control management streamlines processes and improves overall operational efficiency. What’s more, it helps identify bottlenecks, implement process improvements, and optimize workflow, resulting in higher productivity and smoother operations.

8. Risk management

Organizations can mitigate financial risks by actively monitoring and controlling costs. It helps identify potential cost overruns, budget deviations, or unforeseen expenses, allowing proactive measures to be taken to prevent or minimize such risks.

9. Improved financial stability

It’s no secret that maintaining a strong financial position is vital for business sustainability. Cost control management helps in financial stability by reducing unnecessary expenses, avoiding inessential debt, and enabling organizations to weather economic uncertainties or market fluctuations.

10. Long-term growth

By optimizing costs and improving profitability, cost control management frees up financial resources that can be reinvested in growth initiatives. This capital can be utilized for research and development, marketing campaigns, talent acquisition, technological advancements, or market expansion, fostering long-term growth and success.

Quick Read: What is Cash Flow Forecasting and their Advantages & How to Ace It?

Key components of cost control

Here are some of the key components of cost control:

1. Budgeting and planning

An effective cost control process begins with creating an expertly done budgeting process that outlines the expenses that can occur and the projection of revenues for that time period. On the other hand, planning makes sure the financial resources are allocated strategically and align with the organization’s business goals.

Read More: What is Business Budgeting and their Types, Components and Importance

2. Cost analysis

Cost analysis involves examining the various cost components within an organization. It includes identifying direct and indirect costs, analyzing cost drivers, and understanding the factors that contribute to expenses. This analysis helps in identifying areas where costs can be minimized or optimized.

3. Expense tracking

Tracking and monitoring expenses play a vital role in controlling cost. Organizations must keenly track the expenses and compare it with the budget planned. What’s more, by tracking expenses in real-time, organizations can identify any deviations, take corrective measures promptly, and ensure that costs remain within a decided limit.

Quick Read: A Comprehensive Guide to Choosing the Right Expense Tracking Software

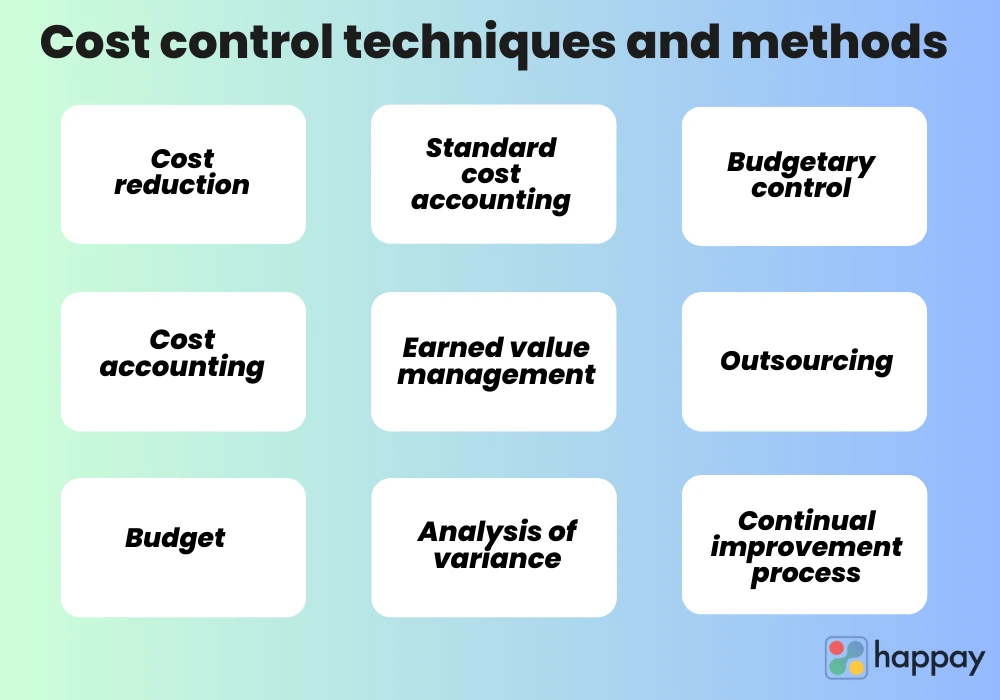

Cost control techniques and methods

Here are some the widely used techniques and methods:

1. Cost reduction

This involves identifying and implementing measures to minimize expenses without compromising product or service quality. For effective cost reduction organizations can renegotiate supplier contracts, optimize operational processes, and improve efficiency.

2. Cost accounting

It is the process of focussing on tracking and analyzing the costs associated with producing goods or services. Cost accounting can help organizations understand the cost structure, allocate expenses accurately, and make informed decisions regarding pricing, resource allocation, and project cost control strategies.

Read More: Expense Accounting: Meaning, Types, Methods, Procedures & Software

3. Budget

In organizations the budget is a financial plan that outlines projected revenues and expenses over a specific period. It serves as a benchmark for cost control efforts by setting limits and targets for various cost categories. Monitoring actual expenses against the budget allows organizations to identify deviations and take corrective actions. This in turn will help your company’s baseline.

4. Standard cost accounting

Standard cost accounting sets predetermined standard costs for materials, labor, and overhead. In this process actual costs are compared with the standard costs, enabling organizations to identify and address cost variances. This technique helps in measuring cost performance and improving cost control measures.

5. Earned value management

Earned Value Management (EVM) is a project management technique that integrates cost, schedule, and performance data. It helps in tracking the value of work completed in relation to the planned budget and schedule. EVM helps organizations to monitor project costs effectively, assess performance, and take corrective actions.

6. Analysis of variance

Analysis of variance (ANOVA) is a statistical technique that is used to analyze and understand the differences between planned and actual costs. ANOVA helps in identifying the causes of cost variances, such as changes in material prices or production inefficiencies.

7. Budgetary control

Budgetary control involves monitoring and controlling expenses based on the approved budget. It includes periodic reviews, tracking actual expenses and actual expenditures, comparing them with budgeted amounts, and implementing corrective actions when necessary. Budgetary control helps organizations maintain financial discipline and ensures effective cost control.

8. Outsourcing

It is the process of delegating specific tasks or functions to external vendors or service providers. Outsourcing can help organizations reduce costs and decarese operational expenses.

9. Continual improvement process (CIP)

It is the systematic approach to drive ongoing enhancements in cost control. This involves identifying areas for improvement, setting goals, implementing changes, and measuring the impact of those changes.

By employing these cost control techniques and methods, organizations can proactively manage expenses, optimize resource allocation, and drive financial efficiency and stability.

Quick Read: Capital Expenditure (CapEX): Meaning, Types, Examples & Formula

Cost control in different industries

Cost control practices vary across industries due to unique operational characteristics and cost structures.

Here are some examples of cost control in different industries:

1. Manufacturing industry

In manufacturing, cost control focuses on optimizing production processes, reducing material waste, and improving operational efficiency. Techniques such as lean manufacturing, just-in-time inventory management, and automation are employed to streamline operations and minimize costs without compromising quality.

2. Healthcare

Due to the rising medical expense in the healthcare sector, cost control has now become essential. The cost control process in the healthcare industry involves strategies like negotiating contracts with suppliers and service providers, implementing cost-effective healthcare technologies, and optimizing resource allocation.

3. Hospitality

In the hospitality industry, cost control is implemented by optimizing expenses related to food and beverage, labor, and energy consumption. Additionally, it involves effective inventory management, menu engineering to optimize profitability, implementing energy-saving measures, and optimizing staffing levels while maintaining the quality of the service.

4. Retail

In the retail sector, cost control focuses on inventory management, operational cost reduction, and supply chain optimization. Techniques such as efficient inventory systems, vendor negotiation for favorable pricing, shrinkage monitoring, and cost-effective marketing strategies are employed to achieve these goals.

5. Construction industry

Cost control reduces project expenses, optimizes material usage, and enhances labor productivity in the construction industry. The following techniques are employed to control costs and improve project profitability in the construction industry: value engineering, effective project planning and scheduling, accurate cost estimation, and diligent procurement practices.

6. Information technology industry

Cost control in the IT industry entails managing expenses related to hardware, software, and technology infrastructure. This involves techniques such as careful technology solution selection, leveraging cloud computing for cost-effective resources, optimizing software licensing, and implementing efficient IT service management practices.

7. Transportation and logistics industry

Cost control in the transportation and logistics sector focuses on fuel costs, fleet management, and supply chain optimization. Strategies include route planning and optimization, fuel efficiency programs, load consolidation, effective maintenance practices, and leveraging technology for real-time tracking and resource utilization.

8. Professional services industry

In professional services such as consulting or legal firms, it includes managing overhead expenses, optimizing project management processes, and ensuring efficient resource allocation. Techniques may include project budgeting and monitoring, optimizing staffing levels, leveraging technology for collaboration and document management, and adopting efficient workflow processes.

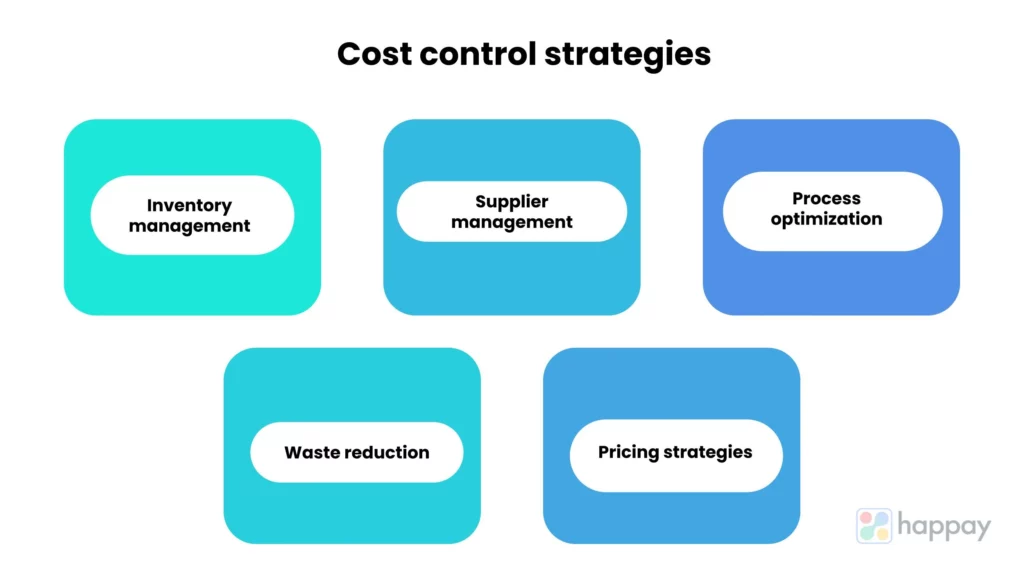

What are the cost control strategies?

Companies implement numerous cost control strategies to reduce expenses.

Here are some of the best strategies that can give you the actual results:

1. Inventory management

In this strategy the inventory levels are effectively managed to avoid overstocking or understocking. By monitoring and controlling inventory, organizations can minimize carrying costs, reduce the risk of obsolete stock, and optimize cash flow.

Quick Read: 8 Best Inventory Management Software

2. Supplier management

This focuses on developing strong relationships with suppliers to negotiate favorable pricing, terms, and conditions. What’s more, effective supplier management also involves selecting reliable and cost-effective suppliers, maintaining clear communication, and fostering collaborative partnerships to drive cost savings and improve overall supply chain efficiency.

3. Process optimization

Process optimization aims to streamline operations, eliminate inefficiencies, and reduce costs. This is done by analyzing and improving workflows, identifying bottlenecks, automating repetitive tasks, and enhancing productivity through continuous improvement initiatives.

4. Waste reduction

The waste reduction strategy aims to minimize waste generation and maximize resource utilization. This is achieved by implementing recycling programs, optimizing production processes to minimize scrap or rework, and promoting sustainable practices.

5. Pricing strategies

Pricing strategies involve setting competitive prices that balance customer value and profitability. This may include strategies such as value-based pricing, cost-plus pricing, or dynamic pricing. By analyzing market dynamics, customer demand, and cost structures, organizations can optimize pricing to maximize revenue and achieve profitability.

Quick Read: What is Cost of Capital, Types, Formula & How to calculate it?

Cost reduction strategies

Implement well thought cost reduction strategy by identifying areas where costs can be reduced without compromising quality or performance. This could involve renegotiating contracts with suppliers, optimizing operational processes, improving energy efficiency, or implementing technology solutions that automate tasks and streamline operations.

1. Financial controls

By establishing financial controls you can ensure budgetary guidelines are followed, this in turn will prevent overspending. Approval processes for expenses, setting spending limits, and implementing monitoring systems to detect any potential financial irregularities, are some of the examples of financial controls.

2. Performance measurement

Measuring performance against cost targets and benchmarks is one of the most effective ways to control cost. To assess the efficiency of your cost management effort you can track key performance indicators related to cost, such as cost per unit, cost variance, or cost-to-revenue ratios.

Quick Read: 10 Best Financial Management Tools

What are the key performance indicators for cost control?

Multiple key performance indicators (KPIs) are used to measure the success.

Here are some of them:

1. Cost variance

Cost variance is a key performance indicator that measures the difference between the actual cost of a project, process, or activity and the planned or budgeted cost. It helps evaluate cost management effectiveness by identifying if the actual costs are over or under the budgeted amounts.

2. Cost of Goods Sold (COGS)

COGS is a metric that represents the direct costs incurred in producing goods or delivering services. It includes expenses such as raw materials, direct labor, and direct overhead. Monitoring COGS helps assess the efficiency of cost control measures and determine the profitability of products or services.

3. Return on Investment (ROI)

ROI measures the profitability and financial performance of an investment by comparing the gain or return generated from the investment to its cost. It is calculated by dividing the net profit or return on investment by the initial investment cost. ROI provides insights into the efficiency of cost allocation and helps assess the overall success of an investment.

4. Gross margin

Gross margin is a metric that calculates the percentage of revenue remaining after deducting the direct costs associated with producing goods or delivering services. It indicates profitability at the initial stage of the value chain. By monitoring gross margin you can assess pricing strategies, cost efficiency, and the overall profitability of products or services.

5. Operating expenses

Operating expenses, also known as OPEX, represent the ongoing costs of running a business, excluding the cost of goods sold. It includes expenses such as rent, utilities, salaries, marketing, and administrative costs.

Quick Read: CapEx vs. OpEx

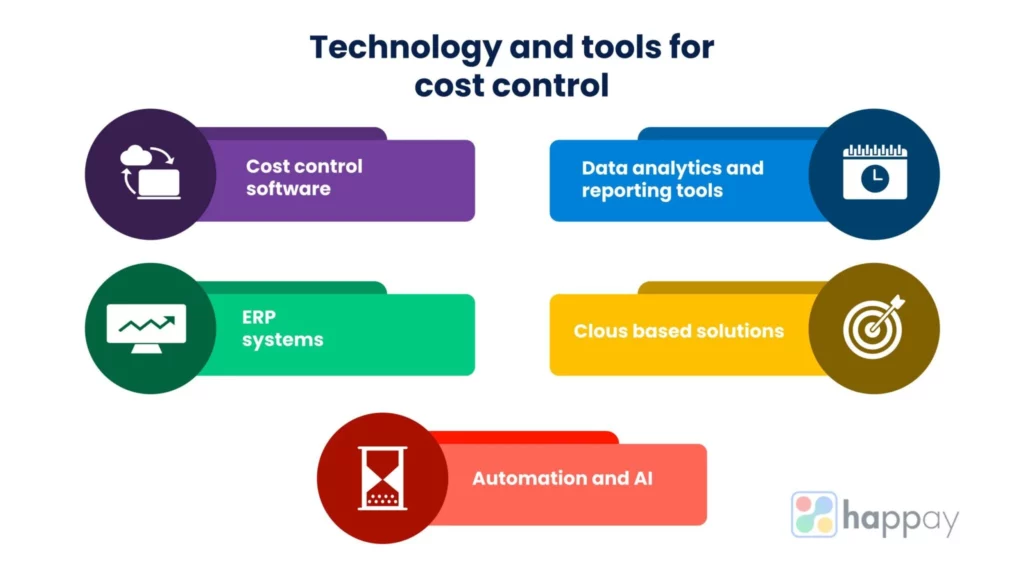

Technology and tools for cost control

In the cost control world, leveraging technology and utilizing appropriate tools can significantly enhance an organization’s ability to monitor and manage expenses efficiently. From automation to data analytics, these technological solutions offer valuable insights and streamline cost control processes:

Cost control software

Cost control software plays a vital role in helping organizations effectively manage and optimize their expenses. These software solutions provide features such as budget tracking, expense monitoring, analytics, and reporting, enabling businesses to identify cost-saving opportunities, streamline processes, and make informed financial decisions.

Here are five top cost control software options:

- SAP Concur: A comprehensive expense management software that automates the entire expense process, provides real-time visibility into spending, and offers robust reporting capabilities.

- Coupa Expense Management: A cloud-based solution that simplifies expense management, streamlines approvals, and offers spend analytics for better cost control and compliance.

- Expensify: An intuitive expense management platform that automates expense reporting, receipt tracking, and reimbursement processes, reducing administrative burdens and improving accuracy.

- Procurify: A cloud-based spend management platform that helps control expenses through automated purchase orders, invoice tracking, and budget monitoring, facilitating better financial control and cost optimization.

- Certify: A user-friendly expense management software that offers seamless expense reporting, automated workflows, and integration with accounting systems, improving visibility and control over expenses.

These cost control software solutions can empower organizations to proactively manage expenses, reduce wasteful spending, and achieve greater financial efficiency.

Quick Read: 10 Best Expense Management Software

Data analytics and reporting tools

Data analytics and reporting tools play a crucial role in extracting valuable insights from data and presenting them in a meaningful and actionable format. These tools enable businesses to analyze large datasets, uncover patterns, trends, and anomalies, and make informed decisions based on data-driven insights.

Here are five top data analytics and reporting tools:

- Tableau

- Power BI

- QlikView

- Google Data Studio

- Looker

Quick Read: 10 Best Spend Management Software

Enterprise Resource Planning systems (ERP)

Enterprise Resource Planning (ERP) systems are comprehensive software solutions that integrate various core business processes and functions into a unified system. These systems facilitate efficient management of resources, streamline operations, enhance collaboration, and provide real-time visibility into business data.

Here are five top ERP systems:

- SAP ERP

- Oracle ERP Cloud

- Microsoft Dynamics 365

- NetSuite ERP

- Infor ERP

These ERP systems help organizations optimize their processes, improve efficiency, enhance data-driven decision-making, and drive overall business growth.

Read More: 10 Best ERP Software

Cloud-based solutions

Cloud-based solutions have revolutionized the way businesses operate by providing flexible and scalable software and infrastructure services over the internet. These solutions offer numerous advantages, including cost savings, ease of implementation, accessibility, and automatic updates.

Here are five top cloud-based solutions:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Salesforce

- Dropbox

Automation and artificial intelligence

Automation and Artificial Intelligence (AI) play a crucial role in cost control by streamlining processes, improving efficiency, and providing valuable insights for better decision-making. These technologies automate repetitive tasks, reduce manual errors, and enable businesses to optimize their cost management practices.

Best practices for effective cost control

- Establish clear goals and objectives: Clearly define cost control goals and objectives that align with the overall business strategy. This provides a clear direction and focus for cost management efforts.

- Conduct regular cost analysis: Regularly analyze and review costs across various areas of the business to identify inefficiencies, cost-saving opportunities, and areas for improvement.

- Implement robust budgeting and forecasting: Develop comprehensive budgets and accurate financial forecasts to set cost targets and track performance against those targets.

- Monitor KPIs: Define and monitor relevant KPIs to measure cost performance, such as cost variance, cost of goods sold, and gross margin. This helps identify deviations and take corrective actions.

- Emphasize cost awareness and accountability: Foster a cost-conscious culture within the organization by promoting cost awareness, accountability, and responsibility at all levels. Encourage employees to contribute cost-saving ideas.

- Streamline processes and eliminate waste: Continuously review and streamline business processes to eliminate unnecessary steps, reduce waste, and optimize resource utilization.

- Vendor and supplier management: Negotiate favorable terms with vendors and suppliers, explore competitive pricing options, and maintain strong relationships to ensure cost-effective procurement.

- Embrace technology and automation: Leverage technology and automation tools to streamline cost control processes, improve accuracy, and gain real-time visibility into expenses.

Challenges in implementing cost control

- Cost monitoring and analysis: Implement a robust system for monitoring and analyzing costs across different departments and projects to identify cost drivers and areas of improvement.

- Cost tracking and reporting: Implement effective cost tracking mechanisms and reporting systems to provide accurate and timely cost information to stakeholders.

- Employee engagement and communication: Engage employees at all levels by providing training and awareness programs on cost control strategies. Foster a culture of cost consciousness through regular communication and incentives.

- Change management: Address resistance to change and ensure smooth implementation of cost control initiatives through effective change management practices.

- Continuous improvement: Encourage a mindset of continuous improvement by regularly evaluating cost control strategies, seeking feedback from stakeholders, and adapting to changing business needs.

- Risk management: Identify and manage potential risks that could impact cost control efforts, such as market fluctuations, regulatory changes, and unforeseen events.

- Benchmarking and best practices: Conduct benchmarking exercises to compare cost control practices with industry peers and adopt best practices for improved cost management.

By implementing these best practices, organizations can enhance their cost control efforts, optimize resource allocation, and achieve sustainable financial performance.

Future trends in cost control

Here are some of the future trends in cost control:

1. Digital transformation in cost control

The adoption of digital technologies, such as cloud computing, automation, and artificial intelligence, will revolutionize cost control practices. Organizations will leverage advanced tools and analytics to optimize cost management, improve efficiency, and gain real-time insights into financial data.

2. Sustainability and green cost control

With increasing focus on environmental sustainability, organizations will integrate green practices into their cost control strategies. This includes reducing energy consumption, optimizing waste management, and implementing sustainable procurement practices, ultimately leading to cost savings and a positive environmental impact.

3. Predictive analytics for cost control

Predictive analytics will play a significant role in cost control, enabling organizations to anticipate cost trends, identify potential risks, and make proactive decisions. By leveraging historical data and advanced algorithms, predictive analytics will enhance forecasting accuracy and improve cost control strategies.

4. Risk management in cost control

Effective risk management will become an integral part of cost control. Organizations will proactively identify and manage risks that may impact cost performance, such as supply chain disruptions, market fluctuations, and regulatory changes. This will involve implementing risk mitigation strategies and robust contingency plans.

5. Cost control in the era of disruption

Rapid technological advancements and market disruptions will necessitate agile cost control practices. Organizations will need to adapt quickly to changing market conditions, adopt flexible cost structures, and leverage innovative solutions to maintain cost efficiency and competitiveness.

How does Happay help in cost control management?

Happay is a comprehensive expense management solution that aids organizations in effective cost control management.

Here are ways in which Happay helps in cost control:

1. Expense automation

Happay automates the end-to-end expense management process, eliminating manual tasks and reducing the risk of errors. By digitizing expense reporting, receipt capturing, and approval workflows, Happay streamlines the entire process, saving time and resources.

2. Policy enforcement

The platform enables organizations to enforce expense policies and business rules, ensuring 100% policy compliance. Happay’s intelligent algorithms automatically flag non-compliant expenses, reducing the chances of overspending and preventing unnecessary costs.

3. Real-time visibility

Happay provides real-time visibility into expenses through interactive dashboards and reports. Organizations can track expenses, monitor cost trends, and gain insights into spending patterns, empowering them to make informed decisions and take necessary cost control measures.

4. Data-driven insights

Happay leverages data analytics and reporting tools to provide valuable insights into spending patterns, cost drivers, and potential cost-saving opportunities. These insights enable organizations to identify areas where costs can be reduced, allocate resources efficiently, and optimize their cost control strategies.

5. Integration with ERP systems

Happay integrates with enterprise resource planning (ERP) systems, enabling seamless synchronization of financial data. This integration ensures accurate and up-to-date financial information, enhancing the effectiveness of cost control measures.

By leveraging Happay’s expense management solution, organizations can streamline their cost control processes, reduce manual effort, enforce policy compliance, and gain better visibility into expenses. This ultimately helps in optimizing costs, improving financial management, and driving overall cost control effectiveness.

FAQs

Cost control refers to the process of managing and reducing expenses to ensure they align with budgeted targets and organizational goals.

Examples of cost control include implementing efficient procurement practices, optimizing resource allocation, reducing waste, and enforcing expense policies.

Cost control is used to monitor and manage expenses, maintain budgetary discipline, improve financial performance, and maximize profitability.

Five cost control methods include budgeting and forecasting, process optimization, vendor management, waste reduction, and implementing technology solutions for automation.

The main objective of cost control is to manage and minimize costs while maintaining or improving the quality of products or services.

The main advantage of cost accounting is that it provides detailed insights into costs, allowing organizations to make informed decisions, identify cost-saving opportunities, and improve financial planning.

Cost control focuses on managing and keeping costs within predefined limits, while cost reduction aims to actively reduce costs to achieve specific targets.

Cost control is a subset of cost management, which encompasses a broader range of activities including cost estimation, cost planning, cost analysis, and cost optimization.

Direct cost control involves managing and reducing costs that are directly attributed to specific products, services, or projects, while indirect cost control focuses on managing and reducing shared or overhead costs that benefit multiple areas of the organization.

Discussion about this post