Just like you need a traffic signal to regulate traffic and a teacher to guide a class of students, an expense approval system ensures your employees stay within the lines drawn in your company’s travel and expense policy!

Expense approval system

An expense approval system exists so your organization can control and manage expenses efficiently and effectively. When you work with limited resources, expenses cannot exceed their means.

A streamlined and structured workflow ensures that employees spend only the permissible amount while allowing businesses to collect essential data.

The accumulated data offers enough insights to more accurately predict future decisions about permissible limits and other budgets.

Expense approval systems may be automated, manual, or partially automated. Either way, it is essential to work on a travel and expense policy as this works as a good foundation for all other related processes.

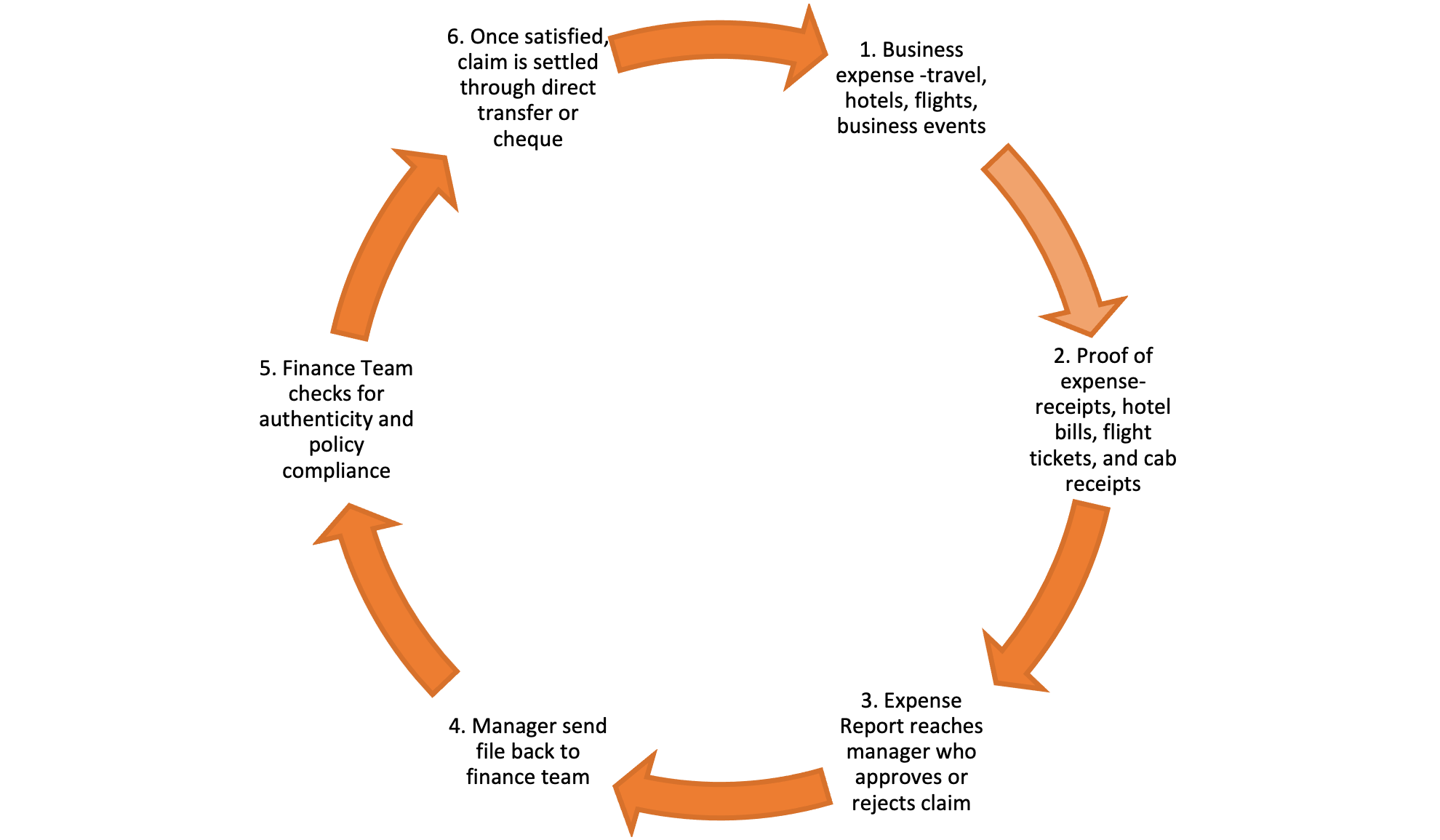

Expense approval process

How should a proper expense approval process work? What are the most important elements in a workflow?

Before you simplify the expense approval system, you must understand the existing process and its various components.

1. Submission

When employees incur expenses on behalf of the business, they file an expense or a reimbursement claim. Such claims filed as expense reports will contain all expenses incurred as part of a business trip, internal documents, invoices, or purchase quotes.

2. Managers/Approvers

Approvers approve/reject expense claims (in manual cases, most often, these happen post expenses/trip) based on these expense reports.

3. Permissions and Limits

You must know the travel and expense policies and approval limits as an approver before you approve or deny claims. Finally, once approvals are in place, these claims are settled by the finance department.

4. Time Limitations

You must complete the expense approval process within a reasonable time so reimbursements are quick and easy. It benefits both employers and employees.

Based on the number of such claims, the complexity of expense reports, the number of business units, and the company’s growth, the expense approval process may be lengthy and cumbersome.

5. Bookkeeping

Maintaining records of the approval process is vital for transparency and helps to access and track the transaction from start to finish. If operations are manual, you may have to maintain and manage expense reports (accompanied by receipts, bills, and other documents as proof of expense).

Expense reconciliation is an entirely different ball game, as the finance teams must ensure that the documents are authentic and accurate through a manual process of matching bills against the claims. This is time-consuming and requires much effort from the finance department.

Read also – A Comprehensive Guide to Bookkeeping

4 ways to simplify your expense approval system

1. Discover automation

Whether you are traveling or not, imagine being able to approve, reject, or ask for clarifications on expenses raised by employees through your mobile device. No more time delays!

It may seem like a cliché to say that automation is the answer to your problems. However, nothing may be more accurate in these circumstances. While you can also streamline manual expense approval systems, it is an arduous process.

Automation can help in numerous ways to transform the entire expense management process, including the approval system. You can incorporate Business rules (the foundation of any expense management system) into the software system’s architecture.

It helps in automatically checking the approvals of a particular expense as you can route it to the right manager in the hierarchy. After that, the approver/manager can instantly approve or reject an expense claim (in most cases, as and when you incur the expense).

Further, where an expense does not meet the criteria or is non-compliant with the expense policy, the system throws up appropriate messages asking the employee to either alter the expense claim or provide additional documentation.

Another instance is where the claim amount exceeds the permissible limits (for the employee). Based on individual policies, the software platform may reroute the transaction to a higher authority for approval (in some cases, it may not allow employees to proceed unless corrected).

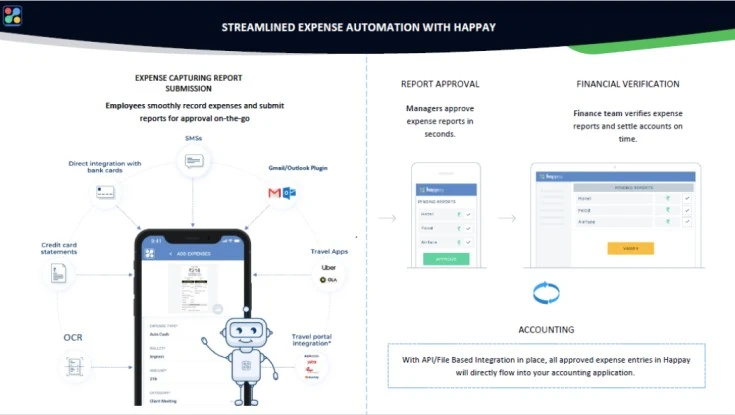

How can Happay help with the expense approval system?

Happay’s system, available on the web and mobile, is built on three primary pillars- Better employee experience, financial efficiency and accuracy, and T&E spend visibility and control.

Happay’s expense management system offers to simplify the expense workflow while simplifying the expense approval system. It saves time while ensuring that all the claims that pass through the system are 100% verified, accurate, and compliant.

As employees record and submit the expense claims on the go, the expense claims are sent for approval instantaneously. Managers can approve expenses quickly, and finance teams can release payments and settle claims without delays.

Here’s a look at how Happay’s expense approval system works to simplify your expense management system.

2. Ensure approvers know your travel and expense policy

As a manager, it is not the only thing you do, so you are probably surrounded by a million other things competing for your “quick” attention. The ideal expense approval process is seamless- just a simple click of a button!

However, manual processes could be more straightforward.

So, expense reports find themselves lowest on the list of priorities. It delays the process of settling the employee’s claims and can cost your business a lot of money.

A report by GBTA (Global Business Travel Association) states that approximately 19% of submitted expense reports contain errors. Further, teams processing these reports spend about 18 minutes processing a single expense report (multiply this by the number of reports you get in a single day).

Such delayed settlement of claims ultimately affects employee experiences. This should give you an idea of how manual processing complicates workflows.

Approvers must know your policies, and for this, you must initiate a review process that makes it simpler for the finance team. A simple, comprehensive training program ensures approvers know policy violations, limitations for each bracket (employee grade), and everything else in the travel and expense policies.

The time spent in this process will compensate for a quicker and more efficient approval process. It will help finance teams ensure that claims are accurate rather than worry about policy compliances.

3. Review the expense approval system

For the best version of anything, you must re-examine and review constantly.

Examining and modifying the approval chain must be an ongoing process. Businesses must constantly check workflows, so the approvals are clear and consistent. If a specific category of expenses qualifies instantly, managers must be allowed to give bulk approvals without many cross-verifications.

Automated software simplifies expense approval systems, making this process easier for everyone. For instance,

- Systems may be designed to send email reminders so you can submit travel expenses on time.

- Employees can submit their claims easily through mobile devices or a web-based application.

- Managers get intimations as soon as any employee files an expense report.

- Any non-compliant filings are flagged to indicate that managers must look closer at such submissions.

- Irrespective that policies are unique to every business, automated expense approval systems make it easy for you. You can include many levels of approvals and customize the system according to your requirements (hierarchy, policies, and project)

4. Audit consistently and regularly

“Audit findings are easy to come up with, and successful change from findings is true internal audit value” -Michael Piazza.

One of the most significant reasons for conducting audits is to ensure that the current processes are accurate and legitimate. Further, it also ensures that you have tight control over business expenses. In manual processes, it is hard to maintain an adequate level of control as there is no visibility of expenses until they have been incurred.

Regular audits also ensure that your business can account for the expenses appropriately. Without control, you may either under or over account for the same. An additional purpose it serves is that you can display that your business is not mishandling the company funds in any way.

Manual audits can create stressful situations as expense reconciliation processes require that you match records (accounting entries) against proof of such expense. So, if the documentation is not preserved or is not immediately accessible, it can raise important questions about the effectiveness of your business’s expense approval system.

Expense management systems like Happay come with inbuilt audit support capabilities and features. The features allow you to implement risk control measures that save your approvers and finance team time and effort. One of the other advantages of the “Smart Audit” feature is that it reduces the expense report verification time by up to 80%.

Expense approval automation

In 2021, the time spent to review and approve claims is considered one of the top 5 pain points in T& E management. Furthermore, one of the leading organizational pressures to improve the T&E processes is the lack of predictability and lengthy reimbursement cycles.

You know as well as everyone that automation automatically eliminates data entry woes and frees up your team’s time for other, more meaningful tasks. A tech-enabled company attracts top talent; even a few hours saved (with automation) can mean no more exasperated employees!

Another significant benefit of automation is an intuitive expense approval process automatically means a better employee experience for travelers.

Read also – 5 Steps to Automate Your Expense Approval Process

Benefits of expense approval systems

Progress does not come from early risers but from those lazy people who are looking for easier ways to do things!- Robert Heinlein

Expense approval systems certainly make expense approval and management easy and efficient. Let’s look at some of the benefits of automating the process.

- Customized workflows mean you do not have to deviate from your “way” of working.

- No need to foot the food bills of the night owls (read finance teams spending nights reconciling those travel and expense reports).

- Employees can conveniently file their expense reports through their mobile devices.

- Automatic capture of receipts eliminates the need to store all those papers, documents, and receipts your employees attach to the expense reports.

- No matter where they are, managers and approvers can approve/reject on the go.

- No more delays, as managers or approvers can take advantage of automatic reminders.

- You can enjoy stress-free tax and audit sessions as the audit trails make everything easily accessible.

- Spend visibility and strategizing abilities improve as you can track and access real-time data.

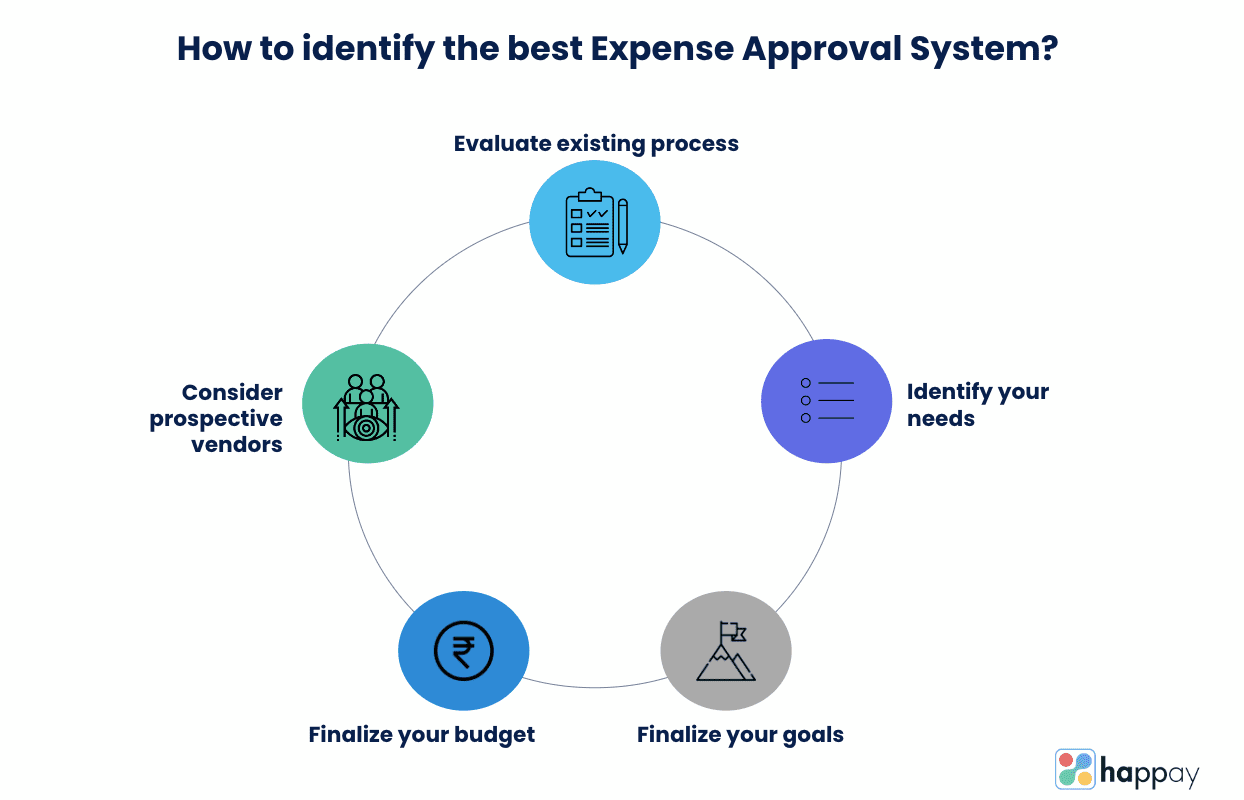

How to identify the best expense approval system for you?

Project Management is like juggling three balls: time, cost, and quality! – G Rein

1. Evaluate your existing processes

You must understand your existing process to identify the best system for your organization. So, ask yourself a couple of questions.

- What are the challenges you are currently facing?

- Do you know the pain points in your existing system?

- How long does it take for expense approvals?

- Are you aware of the problems employees have during the expense reporting process?

If you gather as much data as possible in this stage, you will be better prepared for the following stages.

2. Identify your needs

The previous process should set the stage for this process. If you are aware of the problems you are facing with the workflows, you can quickly identify the project’s needs.

Many large enterprises choose to set up a project management team to handle a possible transition from start to finish. Some questions you must ask in this stage are:

- What do the stakeholders require from the expense management software?

- What features are critical to the success of the project?

3. Finalize your goals

Set tangible and measurable goals for the right software. For instance, you may need to address these questions before selecting the right goals.

- What is the one problem that you are trying to address?

- Is expense fraud a concern, or are you trying to lower the turnaround time for reimbursements?

- If you are considering a reevaluation of existing software, is it just an upgrade? Or are you trying to increase security?

- Set a budget

4. Budget

Budget is always a huge point of contention whether you propose or oppose it. However, a well-thought-out and presented budget rarely faces opposition.

For instance, a stand-alone expense management solution may seem like a great option but looking at the long-term ROI; you may have second thoughts about the same.

5. Talk to providers

Once you have gone through the above stages, you are ready to look at prospective expense management software vendors. Some questions you may ask prospective vendors for suitability.

- Does the system have mobile compatibility?

- Can the software be customized to suit your individual needs?

- What kind of reporting and analytical capabilities will the software bring?

- Does the software have the capacity to itemize and categorize expenses?

- How does the software deal with foreign currency expenses?

- Is the mobile application capable of handling mileage tracking?

A guide to expense approval automation

Designing or investing in an expense approval automation is not complicated but for a smooth and efficient process, you must pay attention to a few things.

1. Expense capture

One of the most significant pain points for employees is saving the physical receipts (proof of expenses) and filing (or couriering) them with the expense reports. So, now, no more saving physical receipts! Changing the workflow to allow your mobile device and an expense tracking app to capture the receipts digitizes the process completely.

2. Expense approval

Imagine your manager is traveling for work, but you need approval for your upcoming travel rather quickly. Traditionally, the only option was sending an email or a text with a reminder of the pending approval. Of course, and then praying they respond!

Automatic approvals are possible, thanks to the software’s expense approval systems. Whether you have multi-level approval or linear workflows, you can customize modern expense management software easily to accommodate your needs.

3. Policy compliance

You can easily manipulate the system’s architecture to incorporate your travel and expense policies. It offers multiple benefits for everyone in the organization.

For instance, when an employee books a ticket (pre-booking stage itself). You can approve a request even if you are traveling (mobile compatibility), and no more frustrating back and forth for your finance teams (as they authenticate expense claims).

4. Corporate credit cards

Always consider offering integrated corporate credit cards for traveling employees. Using these cards for business travel expenses makes it easy for employees and ensures the reconciliation process is far more efficient and quick.

5. Reimbursements and integrated solutions

Make sure you offer the best way to reimburse your employees. For instance, a direct transfer into their bank accounts is ideal as this eliminates any extra efforts employees may have to make to access the money.

An integrated expense management software provides a wholesome solution for your challenges. Rather than just addressing your challenges, consider a solution that offers additional features that have you covered for the future.

Read also – Travel Expense Reimbursement

Expense approval system – FAQs

1. How to implement an automated expense approval system in 3 steps?

Automating the entire expense management system offers many advantages for those looking to improve their expense approval system. However, you can implement a simple automated expense approval system in 3 simple steps.

- Design an expense report form

- Once your form is ready, you must design an expense approval system workflow. This must incorporate all essential checks you need to control expenses and the visibility of the spending.

- Communication cannot be overemphasized; employees and managers must be aware of your policies for it to be a success.

2. What actions can an approver take in an expense approval system?

As a person approving the business expenses of an employee, an approver or manager can

- Ask for clarifications on any expense report

- Approve the claim

- Transfer the file to a higher authority or another manager for approval

- Reject the expense claim

3. Who approves expenses incurred by employees?

Business expenses are generally approved by the manager responsible for the same. However, depending on the individual T&E policies designed, managers or persons approving expenses may vary.

For example, while the marketing manager may approve marketing expenses, expenses incurred for an event organized by the finance department may only be approved by the finance manager.

4. How can you ensure that an expense report is accurate?

To ensure that the expense approval system works, you must ensure that the expense report filing is accurate. Here are the steps you can follow.

- As soon as a report is filed, make sure you file receipts according to the order mentioned in the report.

- Verify expense items against relevant policies.

- Make sure manager approval is present.

- Make sure the numbers add up to the total amount claimed.

5. How do you process expense reports?

Expense reports are filed so employees can claim a reimbursement of business expenses.

Here’s how you can process these expense reports.

- First, you must create an expense policy that defines, categorizes, and explains the treatment of every kind of business expense that employees may claim.

- Collect data at every stage.

- Consider digitizing the entire expense management process, as this will reduce the time taken to process claims while making expense claims 100% compliant.

- Track errors and frauds through an audit process.

Enforcing accountability is essential as it helps your employees better understand the policies.