Expense reconciliation

The scene in a company’s accounting department- 9:00 am:

Akshay: So, Mithun, did you even leave work yesterday night?

Mithun: No, I am on my 5th coffee and need to wrap up the expense reconciliations by EOD. There’s no end in sight as either the employees are traveling or the approving manager is. Everything is lost in emails, which I am trying to sort!

Akshay: By the way, my expense claim submitted last month is also on your list. What’s the delay?

Mithun: rolling his eyes!

Expense reconciliation is often associated with long extended hours of matching numbers in expense claim forms against the approvals and accounting entries.

Do you know everything there is about expense reconciliation? Read on as we take you through it all.

What is expense reconciliation?

Expense reconciliation means matching the actual expenses of a business with the entries in your accounting books. Regular reconciliations ensure that there is no mismatch between the numbers. If there is a discrepancy, you may need to verify transactions against bank statements and other documents to identify the source of the mismatch.

Reconciliation meaning

The term broadly indicates the accounting process that attempts to match two records to ensure that figures recorded in both books agree. Reconciliation may be used for business and personal expenses.

Whether it is business or personal expenses, reconciliations may be done according to activity; weekly, bi-weekly, or monthly.

General accounting principles govern business accounts. It requires that businesses follow double-entry accounting methods. Here, the transactions are recorded in general ledger accounts books in two places. Therefore, reconciliation efforts entail comparing these two books to ensure that the numbers match.

Also, Read: Corporate Credit Card Reconciliation

Expense reconciliation process

The double-entry bookkeeping method is simple as it dictates that every entry must have a debit and a credit, eventually balancing out the account.

Cash |

Debit |

Credit |

|

Cash |

10,000 |

|

|

Printer |

10,000 |

|

|

Income |

12,000 |

|

|

Accounts Receivable |

12,000 |

As you can see in the above example, the idea is that your debits must match the credits, balancing the account to zero.

What are the types of reconciliation?

a) Business

In business, expense reconciliation is only one aspect of reconciliation. Businesses reconcile accounts regularly, and that includes income and expenses. This allows you to have better control over money received and spent. Apart from better control, account reconciliations give you a clearer picture of the firm’s bottom line.

b) Personal

In the personal context, reconciliation of your income against expenses (cash or credit card) gives you an idea of monthly expenses and a clear picture of your financial standing during a period. This allows you to take care of any discrepancies, especially unexplained ones.

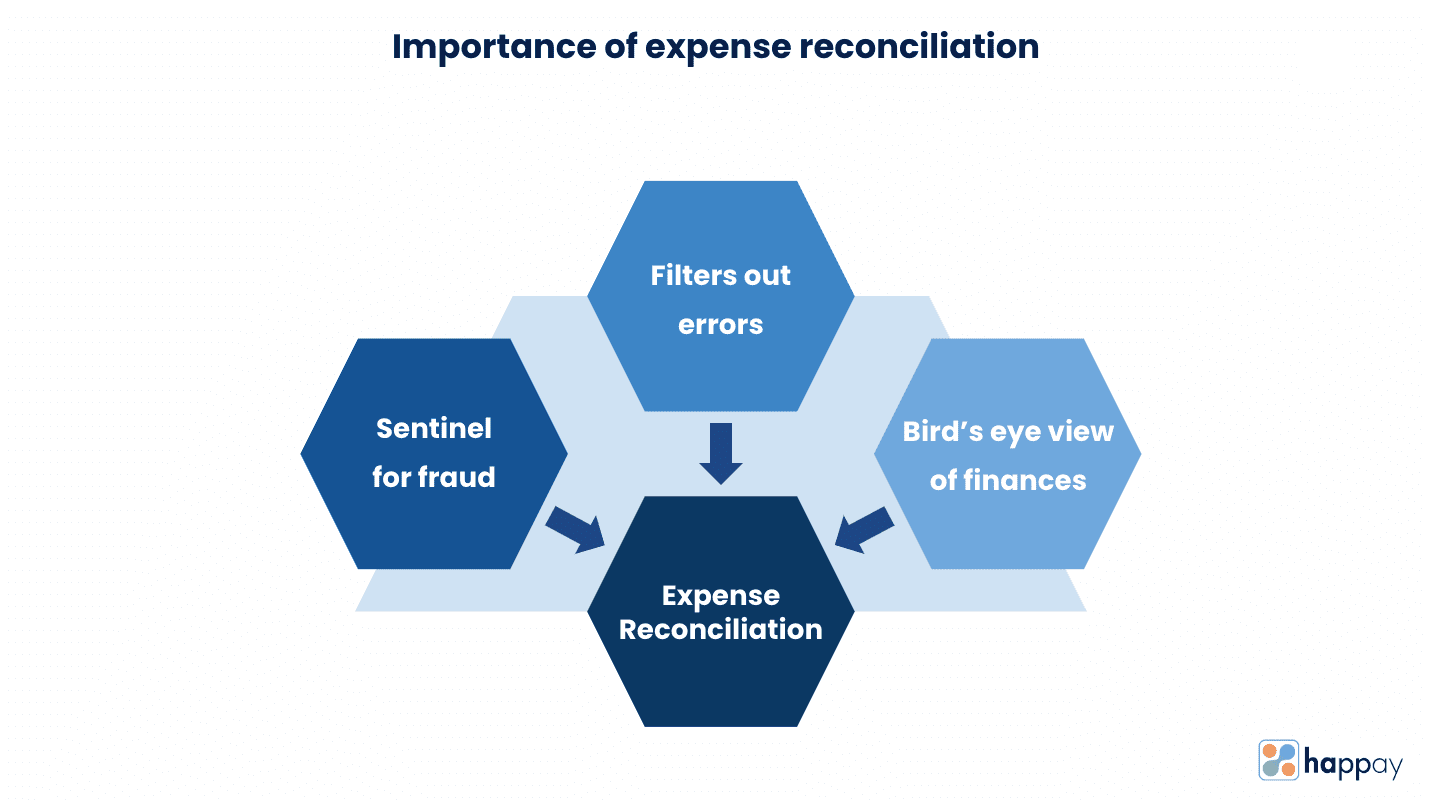

Why is expense reconciliation so important?

The expense reconciliation process is a vital part of your business. It helps to monitor the overall health of your business by assuring you that the expense numbers per your accounts are accurate.

Apart from this, expense accounting and reconciliation gives you an idea of the business expenses so that you can budget for the future better. As you reconcile your accounts, you have a better handle on the cash flows of your business too.

Let’s look at why the reconciliation process is essential.

1. Sentinel for fraud

Reconciliation statements from the bank act as the perfect sentinels for organizations looking to identify suspicious or mysterious transactions. Any charges that may reflect erroneously, duplicate entries, or unapproved cash transfers from the bank account must be identified and addressed as early as possible.

Scheduled reconciliation processes take care of these issues before they balloon into something significant.

2. Filters out errors

Errors may be unavoidable, but you must address them as soon as possible. Even if you are dealing with a small number, ignore too many of these, and they can quickly add up. Whether it is errors in office expenses, calculation of income, or any other kind of mistake, regular reconciliations will help to fix them quickly.

Commonly, there are account balancing errors, such as missing transactions or duplicate entries. The reconciliation process allows you to keep an eye out for minor mistakes which may snowball if not corrected immediately.

3. Bird’s eye view of finances

Whether it is a small or a large business, visibility of your expenses is essential. Expense reconciliation is a simple but effective way to get a bird’s eye view of the finances in a certain period. Further, reconciling often helps to identify trends for future planning.

For instance, repeated late settlements (especially by the same customer) require closer attention. While you must indulge in a reconciliation process as often as possible, the size of your business may pose a challenge.

However, if such reconciliations are automated, then reconciling continually or periodically gives you an edge regarding forecasting or budgeting for your expenses.

Recommended Read: How to Identify and Prevent Expense Fraud?

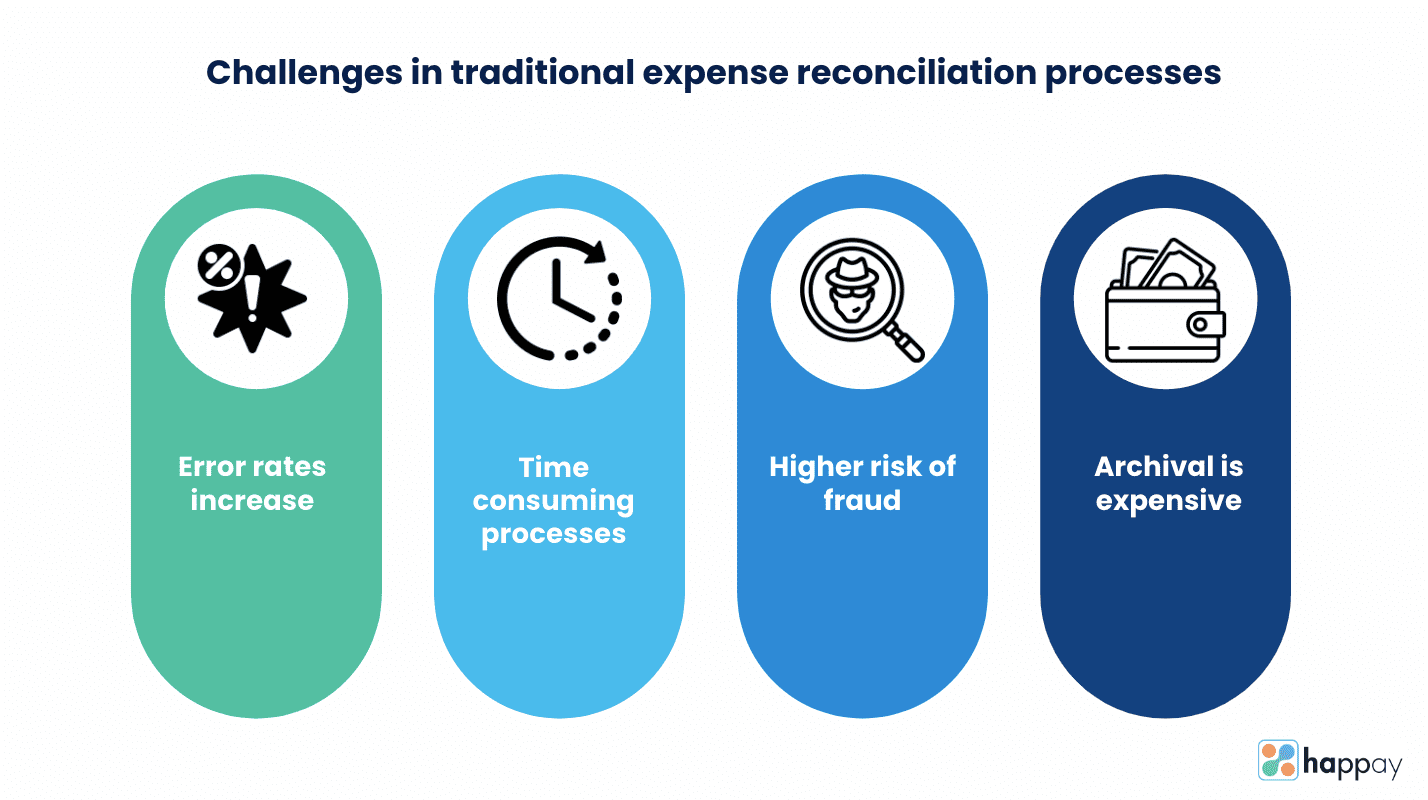

Challenges in traditional expense reconciliation processes

There are several challenges in expense reconciliation. However, here are the main issues that most businesses contend with.

1. Error Rates

Manual data entry is prone to human errors and can become a significant pain point for your business. As the business grows, the chances of such errors increase, and the cost of such errors can also amplify. Manual entries must be reconciled more often as it is essential to rectify any errors at the earliest. However, if reconciliations are also manual, the errors may not drop much further.

While this can cost your business money, it can also significantly affect your business decisions.

2. Semi-automated reconciliations are time-consuming

Businesses may have automated their bookkeeping and accounting. However, when it comes to reconciliations, they must depend on bank reconciliation statements. While these bank statements may be accessed digitally, they do not come in a single standard format.

You must first standardize the file, so your ERP or accounting system can recognize the same. This is time-consuming; if the files are large, your finance department spends more than just a few hours on this every few days.

3. Reconciliation processes could increase fraud

While the idea of reconciliations is to detect fraud or errors swiftly, it isn’t very sensible to indulge in expense reconciliations without proper controls. With enough experience and knowledge about the functioning of the business, dishonest employees may hide or alter information in such reconciliation statements.

Whether it is manual reconciliations or an automated reconciliation process, it is essential to have multiple checks in the form of third-party audits to prevent fraud.

4. Storage of documents

If the processes are manual, archiving and auditing physical documents can be challenging. If the business is small, the number of files and documents may not be too great. However, as the business grows, the records grow in numbers too.

Plus, there is the issue of storing them safely and making them available for auditors in time. This is expensive to maintain (the cost of renting a physical space) and cumbersome for employees to access. It may be frustrating to go through the files and trace the required information.

Also, Read: 7 Top Expense Management Challenges

Methods of expense reconciliation

1. Manual

In manual expense reconciliations, finance teams spend hours, days, and weeks going through books, matching them to the bank’s financial statements. If there are discrepancies, they must go through the books again with a fine-tooth comb to identify the reason for the mismatch.

For example, reconciliation statements received from the bank indicate a mismatch of ₹ 90. After an extensive manual effort, the finance team could zero in on the invoice payments. On matching invoice amounts to actual amounts transferred, they could see that against an invoice of ₹ 3,564, the vendor was paid an amount of ₹ 3,654.

Manual expense reconciliation means

1.1 Paper-based

Paper records or manually entering information into books is a method that is prone to errors and is time-consuming too.

1.2 Spreadsheets

On the other hand, using Excel to reconcile your expenses will reduce the number of mistakes. However, it is pretty static, so any in-depth or customized reporting may be challenging.

2. Automated

You can easily match accounts and reconcile your books with smart technology that makes expense reconciliation a breeze. The software or technology replaces the manual tasks of going through the ledgers and comparing them with the bank statements.

While an organization’s financial standings are maintained by a customized accounting system, any records received from the bank (a suitable digital file) may be easily compared with the firm’s accounts to identify discrepancies. This makes the reconciliation process quick and efficient.

One of the most significant advantages of an automated expense reconciliation system over the manual method is its scalability and adaptability. These systems offer great insights and customized reports making expense reconciliation efficient and effective.

2.1 Expense Management Software

One way to speed up the reconciliation process is to consider expense management software. Expenses (employee and otherwise) form a considerable portion of the accounts; therefore, automating this element guarantees a significant change. Starting from recording expenses, filing reports, policy cross-checks, approvals, and finally, recording expense entries can be quickly and efficiently completed.

For instance, Happay’s expense management solution can help

- businesses become paperless as expenses can be captured on the go

- streamline workflows to support your needs better

- Flag non-compliant expenses

- Auto-reconcile GST and other tax calculations

- Integrate with your existing HRMS and ERP systems.

Want to know how Happay can transform your expense management and reconciliation? Click here

Quick Read: Expense Management Automation: Process and Benefits

How automation can simplify your expense reconciliation?

Several automated software systems may provide an ideal solution for moving from manual reconciliation processes to completely automated workflows. Certain RPA (Robotic Process Automation)-systems automate the bank reconciliation process. The system compares the bank reconciliation statement data with your financial statements here.

This eliminates the manual process of uploading bank statements and physically comparing them. Further, account and expense reconciliations which are essential for financial closing or other month-end processes, are expedited.

The more significant advantage is the accuracy of the data. The systems eliminate the element of human errors. Further, finance teams can efficiently go through the statements and cross-check any discrepancies the systems throw up.

Examples of automated expense reconciliations

As a business, there may be numerous complications in your day-to-day accounting procedures. So, you may be making entries for purchases or sales in various currencies, direct payments by clients, and disbursements to vendors or suppliers. Automated systems can make entries easy while assuring a straightforward income and expense reconciliation process.

Some examples of reconciliations that automated systems can handle for you

- Intra-company accounts – There may be instances where you may be dealing with money sent between two companies within a single organization. Automated software can accurately post entries, making reconciliations more straightforward and accurate.

- Foreign currency reconciliations – The changing differentials in currencies may pose a challenge as the chances of human error are more significant. Automated systems make calculations accurate and easy. Further, since lesser discrepancies (or none) are identified.

- Balance Sheet Reconciliations – Whether a small or large business, automated reconciliations ensure that your quarterly, half-yearly, or annual balance-sheet reconciliations are quickly completed. This allows you to track actual numbers easily.

Tips to speed up expense reconciliation

Automation clearly impacts organizations as they move from manual processes to system-based solutions. This is especially true regarding expense management. However, many companies are not entirely ready to automate.

In that case, here are a few ideas on how you can improve or speed up the expense reconciliation process.

1. Planning is everything

Planning is essential in any business as it indicates how you plan to organize your business. Apart from determining your approach to future challenges and opportunities, paying attention to the available funds and how you plan to use them is essential.

Accurately forecasting your expenses is key to ensuring that you do not deviate from your plan.

Additionally, categorizing the expenses, budgeting, and tracking the same will help speed up the reconciliation process. You can use templates and tracker sheets to compare deviations and adjust your budgets in the future.

2. Consider going paperless

To speed up the reconciliation process, you may consider digitizing your documentation. Spreadsheets, reports, ledgers, and other books are slowly becoming ancient as more companies digitize.

Apart from accounts, supporting documents may be needed for audits and other purposes. Maintaining them is not only tedious but can drain time and resources.

3. Devise easy and effective workflows

The idea is to have

- Error-free documentation

- Expense entries that match financial statements

- Supporting documents for expenses in the accounts

- Non-compliant expenses are identified easily

For this, it is crucial to develop workflows that make reconciliation easy and efficient. For instance, ensure standard templates, formats, policies, and rules are strictly followed so finance teams can identify any deviations quickly and easily.

FAQs

Expense accounts that are maintained individually must be summarised, and the total is matched against the amount reflected in the business’s income statement.

Reconciliation may be personal or business-related. Personal reconciliation means you match your expenses against the income received (for a period). Similarly, business reconciliation seeks to match the number (income and expenditure) in their accounts against the number reflected in the bank account.

The primary purpose of reconciliations in business is to verify and authenticate financial information.

Expense management refers to managing the entire process of recording, tracking, and accounting for business expenses. However, expense reconciliation verifies the accuracy and authenticity of the expenses recorded in the business’s accounting books.