Petty cash

All successful companies pay great attention to their expenses and invest hugely in tracking them. But what about petty cash? Do you have a method to disburse and efficiently track petty cash expenses in your organization? Don’t worry – we can help you out. Here’s all you need to know about petty cash and how to manage it. Keep reading to know more.

Petty cash meaning

In a company, writing a check for every single expense is an arduous task and is not entirely possible. That is why paying through a small amount of cash is a much easier option for minor expenses like office supplies, meals, etc. This is where petty cash comes in handy.

Petty cash is a small amount of money a company keeps for small, incidental expenses. These minor payments include office supplies, stationery, meals, client lunch, stamps, etc. The number of petty cash funds could change depending on the organization’s size.

For instance, a huge organization with hundreds of employees will have a petty cash fund for each department.

On the other hand, in small companies, a single person is usually in charge of petty cash. A petty cash management solution like Happay is an excellent option for businesses with multiple branches and store locations.

Petty cash expenses list

For small transactions in large organizations, petty cash provides greater flexibility when compared to demand drafts or bank cheques. Here are some of the transactions for which petty cash is used for:

- Employee lunch

- Employee reimbursements

- Office supplies

- Stationery

- Rent

- Refreshments for clients

- Internet bills

- Repairs

- Postage

- Manual labor payroll

Read More – What are Business Travel Expenses?

Types of petty cash

Here are the different types of petty cash:

- General Petty Cash: Money that is set aside for small, miscellaneous expenses that is typically used for office supplies, postage, and minor employee reimbursements

- Imprest Petty Cash: It is the money that is periodically replenished. A fixed amount of money that is set aside to reimburse employees for expenses related to business travel is an example of imprest petty cash

- Emergency Petty Cash: It is money set aside for emergency purposes

- Discretionary Petty Cash: It Is money that is available for use at the discretion of a manager or supervisor.

What are the requirements for petty cash?

Petty cash funds are very flexible and come in handy for legitimate and legal business expenses. But this does not mean anyone can access the cash for any purpose.

Companies must introduce strict internal policies and controls to manage petty cash. Many companies employ internal controls to manage the fund. In most organizations, a few individuals called petty cashiers are appointed to authorize and approve petty cash disbursements.

The petty cashier will be responsible for the petty cash drawer and making the right accounting entries. Additionally, the petty cash custodian is also responsible for distributing the cash and collecting bills and receipts for all expenses caused by the petty cash.

How to record petty cash?

Step 1: Create petty cash policies and procedures

A petty cash fund can do a world of good for your organization. It can speed up the reimbursement process, and your employees need not spend money out of their pockets for immediate and petty expenses.

However, to effectively use your organization’s petty cash fund, you must create a list of petty cash policies and best practices that your employees must follow diligently.

a) State allowable expenses

Create a list of allowable expenses for which the petty cash fund can be used. For example, small expenses such as postage stamps, office expenses, parking, etc., can be paid using petty cash. Ensure you also set a limit within which the expenses can be made.

b) Appoint a petty cash custodian

Appoint a petty cash custodian who will be responsible for handling and fairly distributing the petty cash. Moreover, the petty cash custodian is responsible for safekeeping the petty cash box and the receipts box.

c) Set reimbursement limit

Companies often maintain a petty cash fund balance, and this amount will vary based on your company’s needs. Depending on your expenses, it could be anywhere between INR 500 to INR 5000. Therefore, always set a reimbursement limit to avoid cash leakage and to overpay.

Also, Read: A Guide to Expense Reimbursement Claims

Step 2: Store the petty cash in a box

After procuring the petty cash, the custodian will store the petty cash in a box and lock it. The petty cash custodian will be the only person who can access the box. The box will contain cash and receipts.

Step 3: Reimburse and record it in petty cash logs

Always ask your employees to submit receipts and then reimburse their expenses. Next, lock the receipt in the box and record the expense in the petty cash log.

Here are some of the fields used in petty cash logs:

- Date: The date on which the reimbursement was made

- Reference Number: The receipt number. If there is no receipt number, you can leave it empty.

- Payee: Name of the employee who asked for reimbursement

- Description: Briefly explain or reason for the expense

- Amount: The total amount that needs to be reimbursed

Step 4: Reconcile regularly

Whenever the cash is replenished, the petty cash custodian must reconcile it. Sometimes, custodians perform a weekly or monthly reconciliation to track the cash balance. Petty cash must be reconciled when the cash is replenished.

The reconciliation process is pretty straightforward. Every time cash is spent from the petty cash fund, the receipt of the same amount must be replaced in the box. Therefore, during the reconciliation process, the receipts and remaining cash in the box must equal the original petty cash amount.

Step 5: Log petty cash

Whenever cash is needed, or every month the petty cash custodian must summarize the petty cash log by expense account. Also, he must record a journal entry debiting each expense and crediting petty cash.

The beginning balance is the petty cash fund balance. In the total amount column, enter the total petty cash expenses, and this is the amount you’ll ask for as petty cash reimbursement. So, the ending balance in the petty cash log is the difference between the beginning balance and the total petty cash expenses. The amount left inside the box should be equal to the ending balance.

Step 6: Reload the cash

The cash must be taken from the checking account to replenish the petty cash box after the bookkeeper records all expenses in the books. The cash transfer must be recorded by debiting petty cash and crediting the checking account.

Also, Read: What is Spend Management?

How to reconcile petty cash?

- Petty cash must be reconciled periodically to ensure the fund’s balance is correct. Whenever the petty cash balance reaches a preset level, the petty cash custodian will apply for additional cash from the cashier.

- During this time, the sum of all receipts is calculated, and it must be ensured that it matches the funds disbursed from petty cash. When new funds are needed, the cashier writes a new check and, in exchange, submits the petty cash receipts from the expenses that depleted the cash.

- In short, the petty cash reconciliation process ensures that the remaining fund balance equals the difference between the original balance minus expenses stated on the receipts and invoices.

- It is a shortage if the remaining balance is less than what it should be. And it is an overage if the remaining balance is more than what it should be.

- Whenever there is a discrepancy in this it means it is usually because of expense fraud, missing receipt, etc. By setting up better internal control you can prevent such discrepancies.

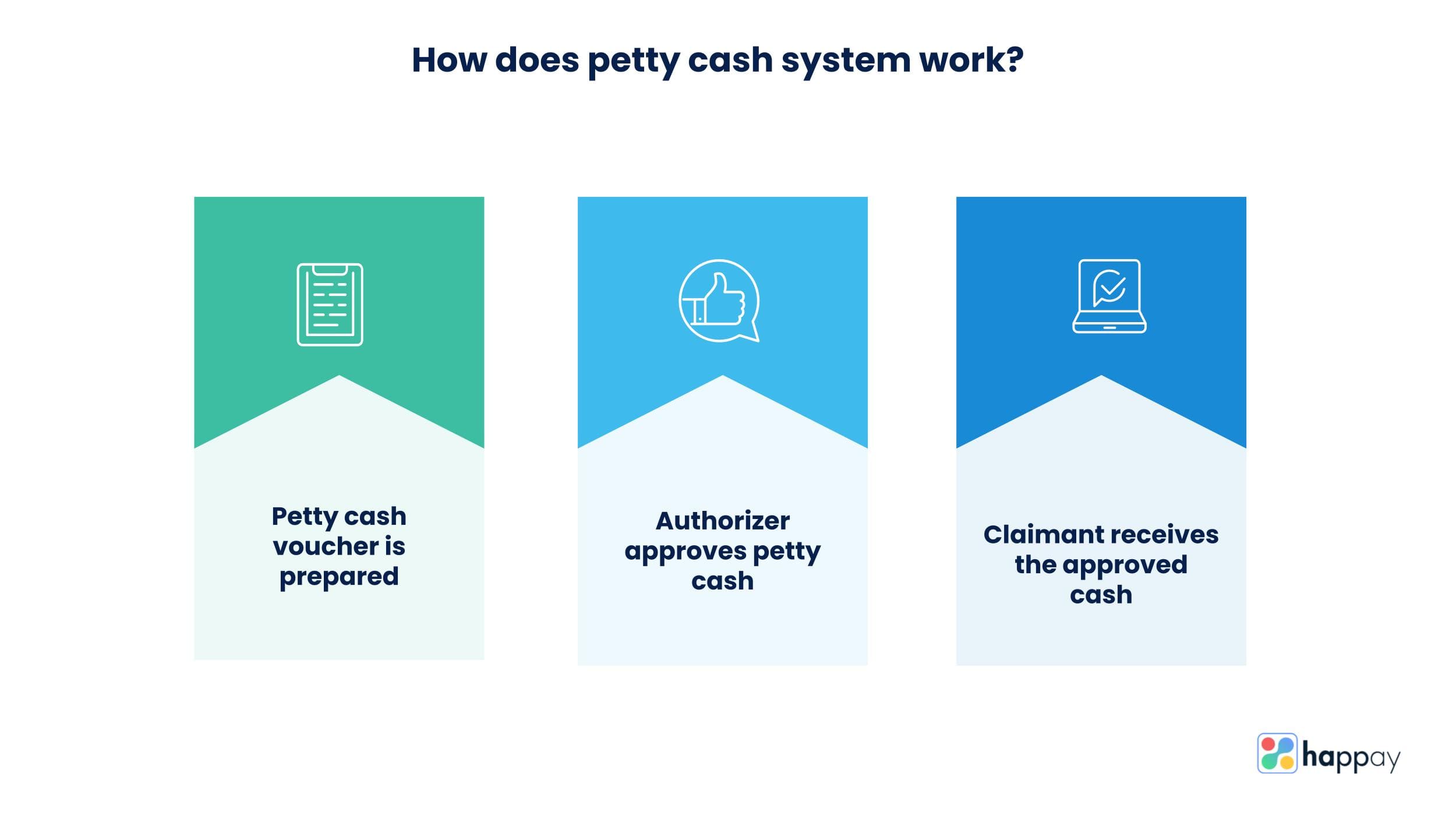

How does the petty cash system work?

As we mentioned earlier, petty cash is used instead of cash or check to pay for small expenses in a company. Also, it takes a considerable amount of time for the check to be signed and processed. Therefore, companies always resort to cash for payment to avoid all this hassle.

Furthermore, a petty cashier is responsible for accounting and reconciling petty cash expenses in most companies.

In most companies, this is what the petty cash transaction flow looks like:

- First, the cashier prepares the petty cash voucher and receipt

- Next, the authorizer, usually a top-level manager, approves the petty cash

- The claimant next receives the approved cash

Also, Read: Cash Management System

Petty cash accounting

After estimation, the organization will get an approved amount of cash needed for a specific time range. The specific time could change from organization to organization, and it could be weekly or monthly.

Next, the amount is withdrawn from the bank to settle cash expenses. Finally, the amount withdrawn – paper money or coins – is deposited with the custodian. The petty cash custodian then issues receipts and a petty cash voucher for the required cash.

The petty cash transaction is then recorded on financial statements. The expenditures or purchases made using this cash are not part of the journal entries.

As we mentioned earlier, the journal entry is only made when the custodian asks for more cash than the approved limit. The journal entries are made only when the custodian receives new funds in exchange for the receipts.

Whenever a small amount is utilized to settle expenses, it must be replenished. The custodian must gather all slips and vouchers issued to different people in the firm. These details are recorded in the general ledger as credits to the petty cash account and as debit detail to other expense accounts. As soon as the petty fund is replenished, it is recorded as a debit to the petty cash account and credit to the cash account.

When petty cash fund is replenished by check, it is represented as follows:

Also, Read: How to Setup Petty Cash Accounting?

Petty cash example

To better understand how petty cash accounting is done. Here’s an example:

Suppose company A has a petty cash fund for which it approved INR 100. This is what the entry looks like:

Particular |

Debit |

Credit |

| Petty cash | INR 100 | |

| Cash | INR 100 |

Now the custodian will let the cash balance go till INR 10 before replenishing it. Afterward, the cashier will issue a check worth INR 90 to replenish the fund.

This is how the entry will look now:

Particulars |

Debit |

Credit |

| Petty cash | INR 90 | |

| Cash | INR 90 |

The expenses, as recorded by the cashier, along with the amount used for replenishment, are entered as follows:

Particulars |

Debit |

Credit |

| Office expenses | INR 90 | |

| Petty cash | INR 90 |

The petty fund amount, therefore, is now back to the authorized amount worth INR 100.

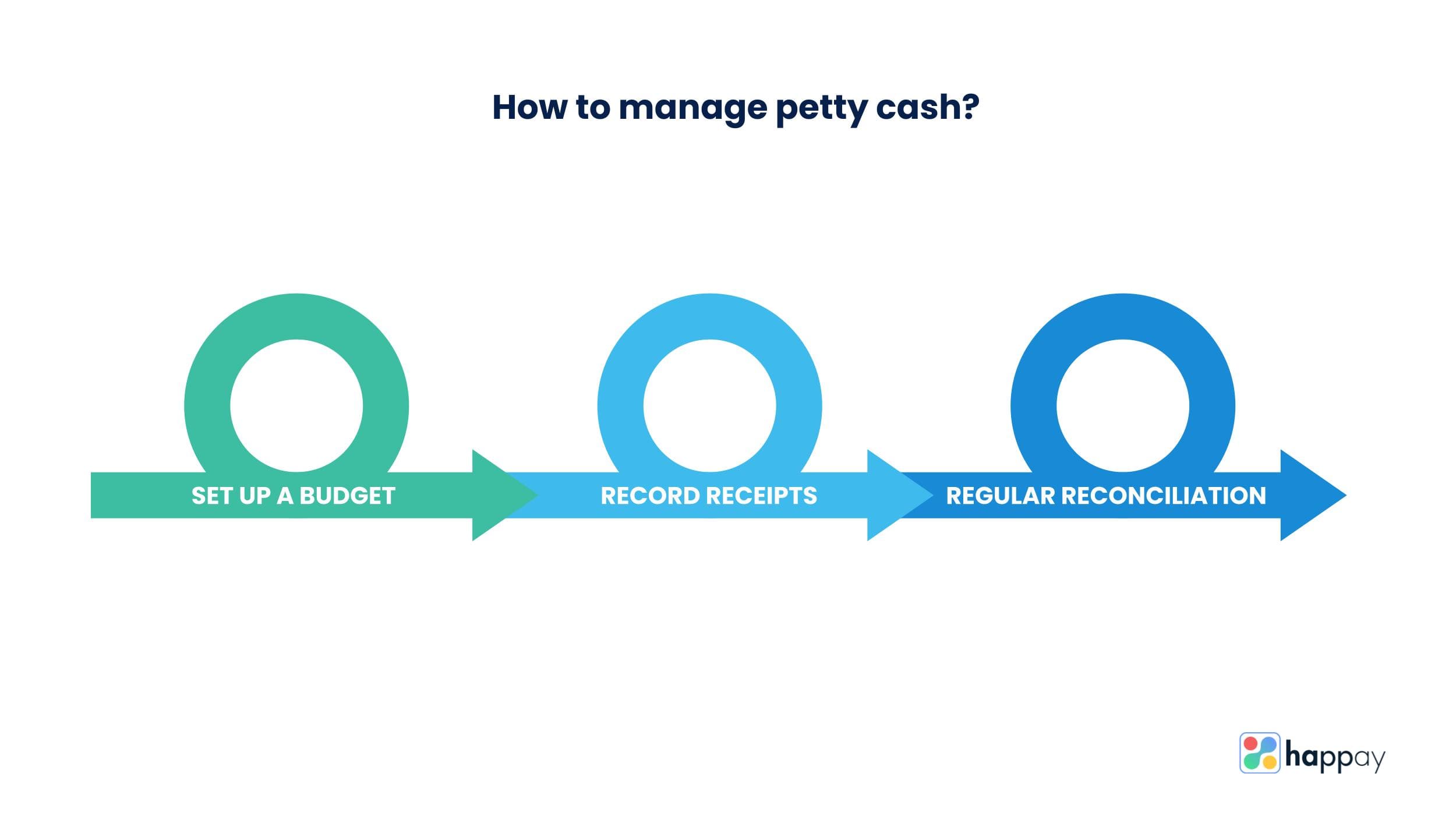

How to manage petty cash?

If you don’t carefully track petty cash, you could easily waste your firm’s money, which can adversely affect the company’s financial health. By following the steps given below, you can control excessive petty cash spending:

1. Set up a budget

By setting up a budget, you can avoid immediate expenses by your employees. Observe the spending pattern of your employees. Check the items for which they are spending, how much, and how often they are spending. This will effectively help you in setting up a budget.

2. Record of receipts

Give out petty cash vouchers or slips whenever employees use petty cash funds. The petty cash voucher must contain the price with the date and amount. Make sure to record the employee’s name, the name of the service provider or vendor, and the name of the person who authorized the cash.

3. Regular reconciliation

By regularly reconciling petty cash funds in your organization, you can avoid inefficiencies and unauthorized use. For some organizations, monthly reconciliation works for small businesses, whereas for large organizations weekly reconciliation can get the job done for others. Therefore, choose a reconciliation system that works for your firm.

Read More – A Guide to Petty Cash Management

What is the difference between petty cash and cash on hand?

Although petty cash and cash on hand sound similar, they are different terms. Here’s a detailed difference between the two terms:

Cash that a company keeps for minor expenses is called petty cash. Most firms use the petty cash fund for such expenses since it is an easier option when compared to cheques and cards.

On the other hand, cash on hand is an accounting term that generally refers to a company’s liquid assets. This could be in the form of cash in bank accounts, debt instruments, and other sources of cash. These can be easily accessed when needed.

Advantages and disadvantages of petty cash

From convenience to be easily accessible, there are multiple advantages to petty cash. But, it also has its own fair share of disadvantages. Here are some of the pros and cons of petty cash:

Advantages

- It is the quickest and the easiest way of payment for small and minor expenses

- Petty cash funds are easily accessible. In most cases, you need no authorization or permission for the cash

- Petty cash is helpful for emergency expenses

- Don’t have to wait for the money to be credited from the main account

- Petty cash is much faster than cheques

Disadvantages

- Petty cash funds are susceptible to fraud and theft

- For large corporations, if you do not have petty cash management software in place, tracking and record-keeping is a humongous task and will be the reason for many discrepancies

- Manual petty cash disbursements are archaic and old-fashioned. Also, in most cases, they are error-ridden

Also, Read: Solving Top 5 Petty Cash Problems with Happay

What are the drawbacks of manual branch petty cash management?

As mentioned, manual branch petty cash management systems are filled with multiple drawbacks, like a petty cash book. Here are some of them:

- Since each branch needs money for day-to-day expenses, physically distributing cash is a cumbersome process

- While physically distributing cash, there’s a lot of travel and effort involved

- There are always chances for theft, fraud, and damage in this system

- There is too much dependency on bank

- Cannot track cash flow in real time. You will never know if a particular branch has excess or insufficient fund

- There is no spending visibility. You will not know where and when the cash is being used

- It is challenging to forecast the optimum cash requirement for each branch

- Chances for cash leakage

- Weak policy enforcement will translate to inadequate policy compliance

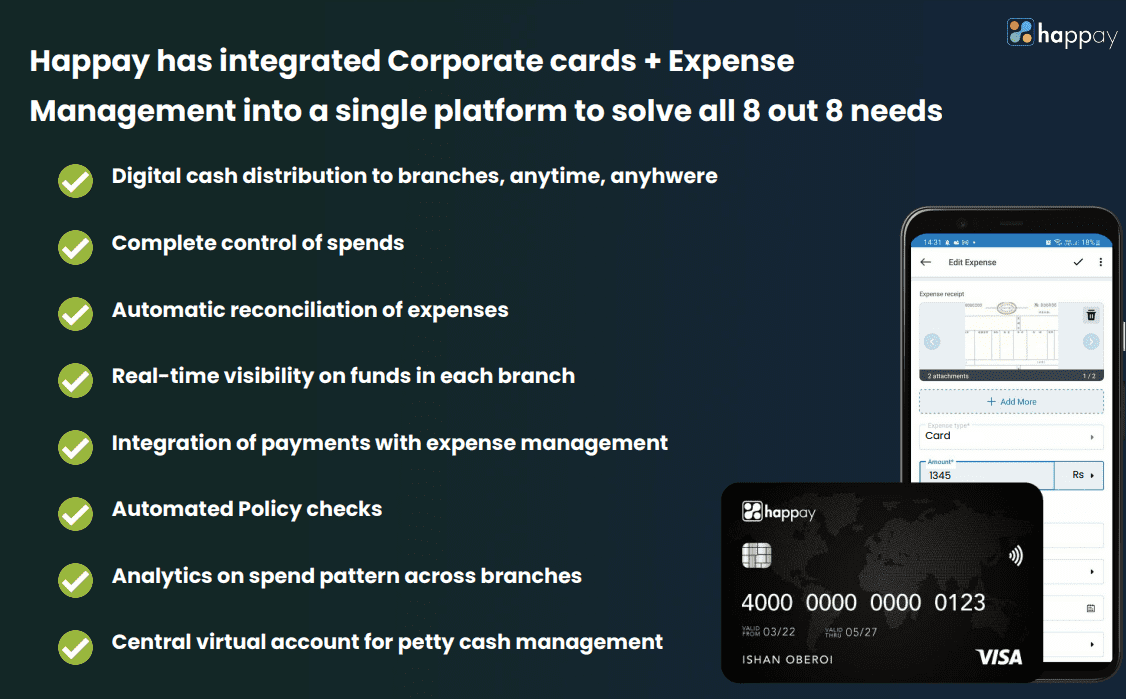

Are you a business with multiple branches and store locations? Do you find it difficult to disburse funds physically to each branch?

What if you could, with a single tool, safely distribute and efficiently track all your branch petty cash expenses and prevent cash leakage? Lucky for you – Happay lets you do all of these.

Branch petty cash management with Happay

Here are some of the fantastic features of Happay which make it an excellent choice for branch petty cash management:

- You can now track and control cash using Happay corporate credit cards. Assign it to employees under branch or location and add usage configuration. No longer have to send money to an employee bank account

- Digitally load money to different branches, locations, and outlets with just a few clicks, without any hassle

- You have real-time visibility on branch-wise spending. Using real-time data to forecast future petty cash spending

- Set spending limits and restrict usage at ATMs, online, or POS. This prevents cash fraud and leakage.

- Enable or disable the card in a single click

- Since data is available on a single dashboard, the finance team can reconcile expenses easily

To know more about Happay and how to manage your branch petty cash more efficiently, schedule a demo with us today.

Final thoughts: Recommendations for better petty cash management

Consider the Spend

Think carefully about the expenses covered by petty cash and establish clear guidelines. Petty cash should cover small, necessary expenses that require immediate funds. It’s also crucial to consider how your business operates and what it needs to function efficiently. Setting a limit on petty cash funds and specifying replenishment levels can help maintain control and prevent fraud.

Recording Petty Cash Transactions

There are both offline and online methods for recording petty cash transactions. For offline, petty cash transactions can be recorded using slips, also known as petty cash vouchers, which detail the transaction and help maintain transparency within your company. For online, apps like Money Manager Expense & Budget provide a digital means to record, review, and edit petty cash transactions, offering a secure and efficient way to manage petty cash funds.

Setting Up a Petty Cash Fund

Begin by appointing a petty cash custodian responsible for managing the fund. Secure the petty cash in a lockbox or cash register to ensure safety. Fund the fund through a withdrawal from an ATM or by writing a check, marking it clearly in your accounting records. Establish a petty cash log for detailed and thorough tracking of all transactions. This log should run on vouchers collected by the custodian in exchange for cash disbursements.

Managing Petty Cash Effectively

Ensure all petty cash expenses are meticulously accounted for, as even small expenses can significantly affect your accounting. Develop a petty cash policy to inform employees about the reimbursement process and what constitutes a petty cash expense. Regularly replenish the petty cash drawer to keep the fund adequately funded for necessary expenditures.

By following these additional recommendations and utilizing digital tools for recording transactions, businesses can enhance their petty cash management practices, ensuring more accurate and efficient handling of small, incidental expenses.

FAQ’s

Petty cash is the small amount companies use for minor business needs and expenses. Traditionally in most companies, the petty cash is stored in a cash box or drawer under the custody of the petty cashier.

Here are some of the uses of petty cash:

a) Employee lunch

b) Office supplies

c) Stationery

d) Rent

e) Internet bills

f) Repairs

g) Postage

Although petty cash is cash in hand, they are not the same. Remember, cash on hand is not always petty cash.

The petty cash account is considered a current asset in financial accounting, and the funds are entered as an average debit balance.

The amount of petty cash that is allowed changes depending on the company’s internal policies. Depending on the size and frequency of transactions, this amount is set.