Petty cash is a small amount you reserve for minor or incidental expenses in your organization. You treat petty cash expenses as any other expense account in the organization.

Whether it is maintaining and recording cash logs periodically or regular reconciliations, petty cash management is critical.

An impromptu lunch for the hardworking employees, greeting cards or flowers for customers, seems like a harmless business expense for branches, right? However, these transactions can quickly become a major source of distress without automation or adequate control.

Read on as we walk through the top 5 petty cash problems and solutions.

Top 5 Petty Cash Problems and Solutions:

Problem 1: With so many branches how can I improve control?

Using corporate cards can resolve this challenge and eliminate the lack of control.

Health and Glow struggled with the physical distribution of cash across their 150+ stores. Happay’s tailor-made petty cash solution with a web dashboard helped centrally manage Health and Glow’s branch expenses. Now, the 150+ stores receive petty cash funds digitally, removing the need for dedicated manpower.

Cash disbursement is a major petty cash problem for organizations with many branches. There are several issues to consider:

- The physical movement of cash from the head office to the individual outlets is cumbersome. The security risk presents a cost and an operational challenge.

- Digital transfer of funds requires constant monitoring of numerous branch accounts and the additional stress of reconciliation of multiple bank accounts.

Also, Read: Petty Cash Book: Types and Format

How Happay helped Health and Glow control and improve their operations?

Happay’s petty cash management software is designed specifically for businesses with multiple branches, stores, and outlets in numerous locations.

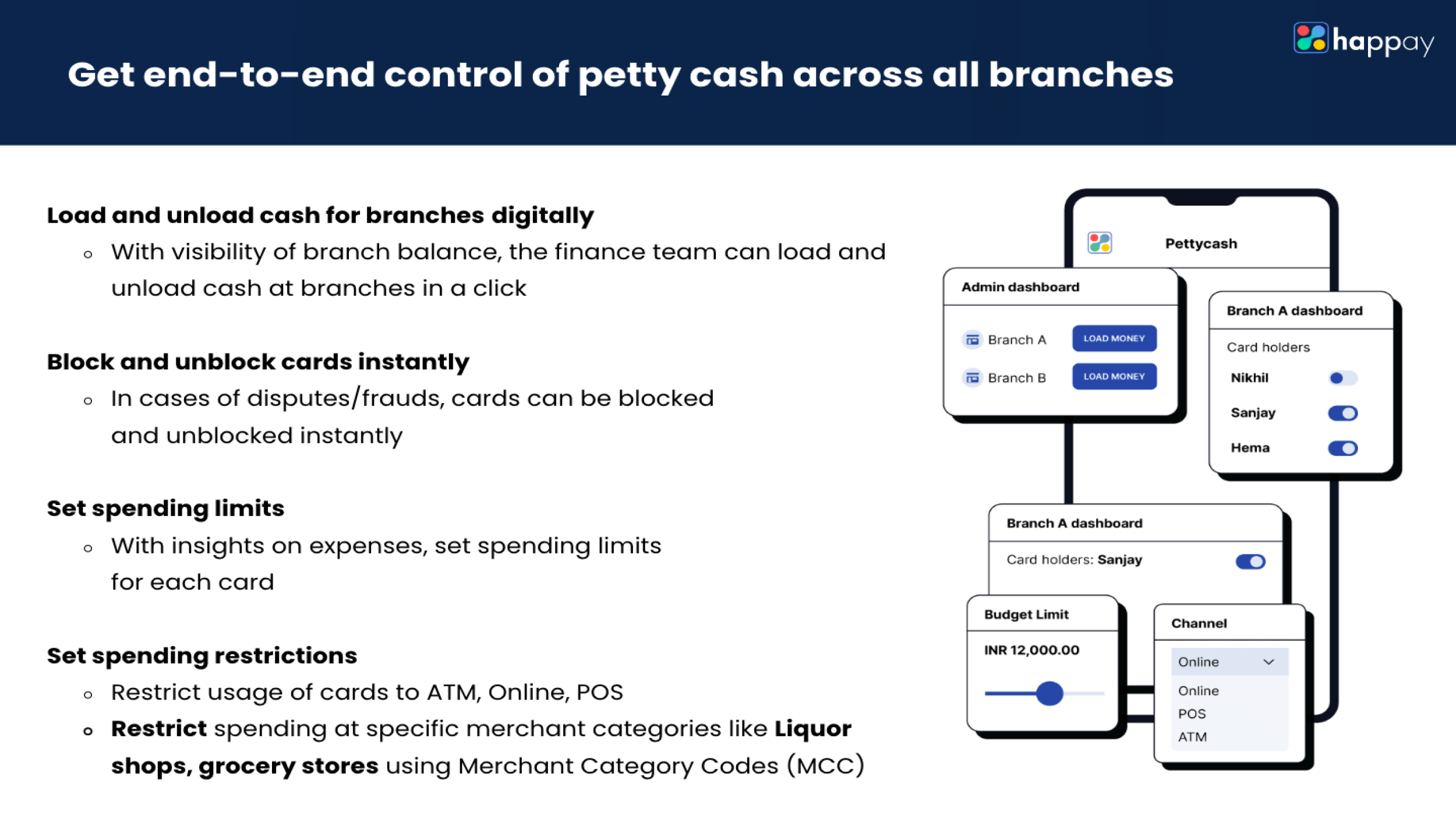

You can replace your petty cash fund with Happay’s prepaid cards. You can easily load and unload cash, block/unblock them when required, and restrict spending based on individual criteria.

With dedicated branch cards, you can track expenses centrally. Further, our cloud-based platform helps you to customize control across branches or locations.

Petty cash problems you can address:

- View branch balances and digitally load and unload cash for branches.

- Block and unblock cards instantly

- Have better control as you can set spending limits on all types of routes, ATM, Online, and POS.

- Restrict usage of cards to merchant categories (liquor shops) using MCC (merchant category codes) ATM, Online, and POS.

Also, Read: What is Global Cash Visibility?

Problem 2: What can I do about cash leakage?

Complete visibility into your spend will give you 100% control over branch cash leakage.

GR Infraprojects, an EPC company, was experiencing extensive cash leakages and gaps in reconciliations. Happay cards eliminate manual processes and the use of physical cash, taking care of cash leakages completely.

As a CFO, you will agree that cash leakage is often one of the biggest challenges for organizations when it comes to petty cash. What leads to cash leakages?

- Unauthorized spending

- Non-compliant expense claims

- Usage of employee’s personal accounts for petty cash funds leads to zero tracking and tax complications.

Visibility and control over petty cash expenses offer the best solution for this problem.

How Happay helped GR Infraprojects solve their cash leakage problem?

Happay’s prepaid cards help you tackle one of the most significant petty cash problems effectively. Daily branch petty cash transactions such as phone or internet charges, small wages, maintenance, repairs, or utility bills add up quickly. With cards, you need not dip into your sales cash to pay for your everyday spend.

Petty cash problems you can address:

- Stop using multiple bank accounts as you disburse cash to your branches from a central account.

- Worry less about cash in hand in branches as you enforce cashless spending by assigning credit cards to branch employees.

- Stop worrying about reimbursing employees, as you can configure rules that govern the usage of prepaid cards to reduce fraud and errors.

Quick Read: What is Petty Cash Accounting?

Problem 3: Can I make expense filing quick and accurate?

Yes, the right software can make that possible for you.

Relaxo, with its numerous retail stores nationwide, struggled with an error-filled, paper-intensive process leading to reimbursement delays. With Happay’s end-to-end real-time solution and automated expense capture, employees no longer send in physical receipts.

Employees often must contend with the cumbersome process of sending expense proof physically to head offices. It leads to reimbursement delays and frustrated employees. Further, the lack of visibility and control over the expenses adds to the CFO’s woes.

How Happay helped Relaxo save time with an all-in-one platform?

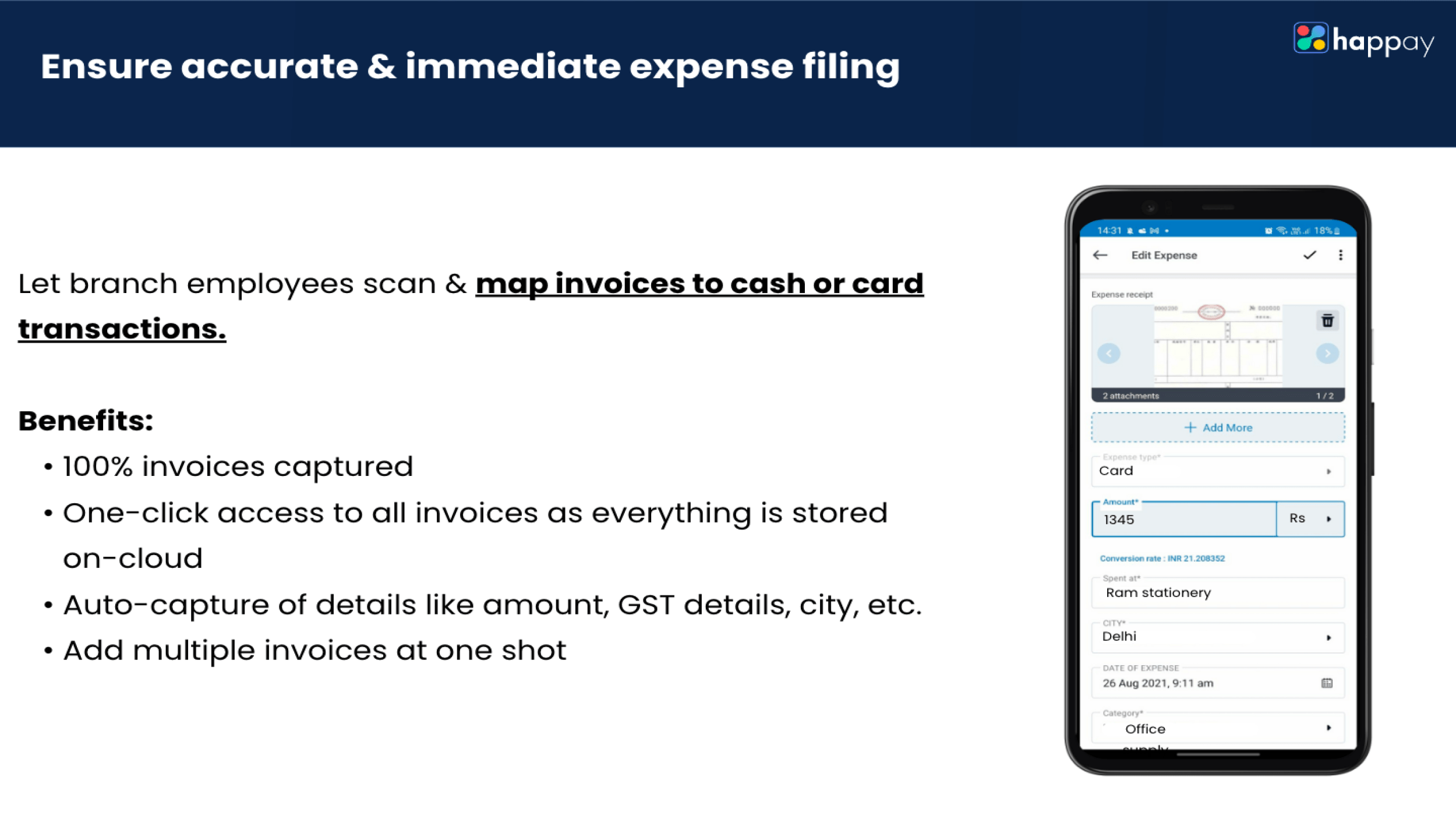

Happay’s end-to-end automation eliminates the cumbersome process of manual expense filing, allowing employees to stay accountable easily. The intelligent mobile app ensures employees can scan invoices, receipts, or bills to cash credit card transactions.

Petty cash problems you can address:

- Capture 100% invoices, receipts, or bills

- Access everything easily, anytime, as the information is recorded and stored on the cloud.

- Automatically capture critical information such as GST details, amount, date, city, etc.

- Attach multiple invoices and bills in a single capture.

Also, Read: A Guide to Solve Cash Flow Problems

Problem 4: Is “zero-effort reconciliation” a myth?

No, It is not a myth; zero-effort reconciliation is possible!

Cars 24 struggled with a paper and resource-heavy reconciliation process that was manual and unscalable. Happay tackled the inefficient branch petty cash problem with a customized end-to-end solution. By assigning Happay cards to the outlets, they manage and monitor all branch petty cash transactions centrally.

For a finance leader, one of the most pressing issues is the time spent reconciling branch petty cash transactions. The biggest contributor to this petty cash problem is the use of manual and traditional workflows.

- Multiple bank accounts (branches or sometimes even employee accounts) means double the reconciliation.

- Post-expense reconciliation requires double the effort in authentication or verification, which is both frustrating and time-consuming.

- Post-expense reconciliations only highlight the errors or fraud but fail to prevent them.

Besides worrying about visibility, cash leakages, and policies to control store and employee expenses, CFOs and their teams spend unreasonable amounts on month-end reconciliation processes.

How Happay solved Cars 24’s reconciliation woes?

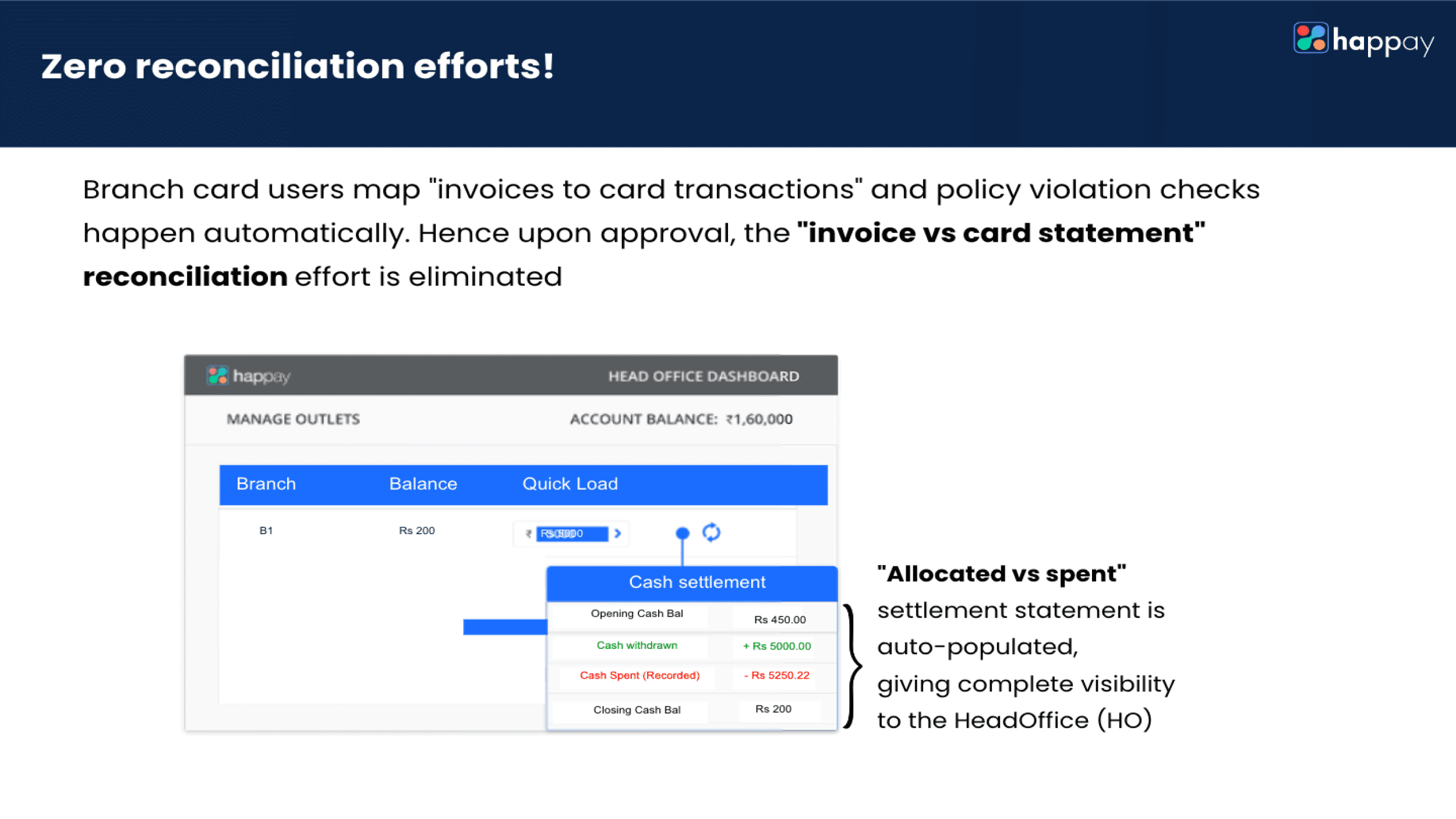

Multiple bank accounts for branches lead to accounting and auditing challenges. Individual matching of invoices against journal entries in cash books or bank statements is replaced by intelligent and automatic reconciliation. This is replaced by a centralized head office account that manages and controls funds added to dedicated branch credit cards.

Using Happay’s prepaid cards helps finance teams save time and effort.

Petty cash problems your finance team can address

- Load and unload funds for branches digitally.

- Employees can scan and map invoices to card transactions using the mobile app.

- Happay’s Smart Audit feature identifies policy violations.

- Expense approvals are instant and on the same platform.

- Automatic reconciliation of invoice vs. card statements.

Also, Read: Corporate Credit Card Reconciliation

Problem 5: Accurate budgeting is impossible when there is no visibility!

Xiaomi presented the twin challenges of a lack of transparency and budget control in offline marketing spends. Approvals for distributor’s promotional campaigns over emails assured a complete lack of visibility.

Happay’s distributed and integrated petty cash solution helped automate the entire approval, reimbursement, and payment process. The result was real-time transparency, tracking, and visibility into the expense claims leading to a 90% increase in productivity.

As a CFO, strategic decisions, budgets, and forecasts are far more accurate when you have visibility of branch expenses. Strong analytics, insightful reports, and precise expense data about trends offer great value.

Isn’t a proactive approach a much better option than a reactive one?

How Happay helped Xiaomi budget more accurately?

You can view the expenses category-wise, such as per month, per employee, and any other customized classification that makes sense for your organization. Based on the numbers, your finance team can analyze branch petty cash flows and offer insights to help you prepare more accurate budgets and forecasts.

How you can address the petty cash problem of more accurate budgeting?

- Real-time view of all expenses

- Complete visibility of idle cash (allowing you to withdraw or deposit or move cash between branches/departments).

- Working capital optimization

Get Your Petty Cash Management Software with Happay

Conclusion

Say goodbye to traditional ways of managing branches and retail outlets. Petty cash management software eliminates

- the cumbersome distribution of cash

- Use of multiple personal bank accounts

- The problem of fund imbalances in branches

- Unauthorized spend

- Time-consuming reconciliations

While the ease of use and simplicity of the software is an attractive feature, the prepaid cards are what makes the case well for you. Prepaid cards allow you to transfer funds to the cards, move excess cash to other branches, and block cards if needed.

So, even insignificant amounts are tracked, recorded, and accounted for accurately.

Schedule a demo with us to learn more about how Happay can help transform your petty cash.