Introduction

Accounting and finance are two essential pillars that stand tall in business management. It is common for people to use these terms interchangeably. However, they possess several distinct characteristics that set them apart. Together, accounting and finance help with the administration and management of an organization’s assets.

While they still work collectively, their scopes and focuses diverge significantly. Understanding them is crucial when assessing and formulating strategies for your company’s financial well-being. So, let’s take an in-depth look at what these two terms mean, how they differ, and the value they bring to an organization.

Difference between finance and accounting

Here are the basics of accounting and finance and their key differences.

Accounting |

Finance |

|

|

Scope |

Primarily concerned with recording, classifying, and summarizing financial transactions and producing financial statements. |

Broader in scope, encompassing the management of funds, investments, and financial planning. |

|

Focus |

Emphasizes accurate and detailed record-keeping to ensure compliance with accounting principles and regulations. |

Focuses on optimizing the allocation of resources, managing risk, and making strategic financial decisions. |

|

Evaluating Financial Performance |

Analyzes financial data and generates reports to measure a company’s financial performance, profitability, and liquidity. |

Assesses financial performance by analyzing financial statements, interpreting trends, and evaluating the company’s ability to generate value for stakeholders. |

|

Understanding Value |

Primarily concerned with historical financial data and compliance with regulations. |

Focuses on estimating and maximizing the present and future value of investments, projects, and business opportunities. |

What is accounting?

Accounting is the language of business that includes recording and summarizing financial transactions. These activities offer a comprehensive view of an organization’s financial health. Employing different accounting standards ensures an organization’s financial information is reliable and compliant with regulatory requirements. Let’s now look at an example to understand the significance of accounting.

Consider a manufacturing company that supplies goods to other businesses. Accounting has the following role to play here:

- Capture and document the financial aspects of the entire transaction.

- Record the sale details when the company sells its products to the customer. The details include the date, quantity, price of the items sold.

Accurate accounting is crucial for tracking revenue and managing the accounts receivable function for the company. The customer that buys goods from the manufacturer will also have their accounting process. They will record the purchase upon receiving the shipment.

The transaction helps the customer with the following:

- Maintain accurate inventory

- Record expenses

- Maintain accounts payable records

Also, Read: Payroll Accounting: Meaning, Process, System Setup, and Calculation

Types of accounting systems

The types of systems depend on the method to record and track financial transactions. The two primary systems include single-entry accounting and double-entry accounting.

Let’s explore each of them in detail.

1. Single entry accounting

It is a straightforward system that small businesses or individuals use to maintain essential financial records. You can record a single aspect of a transaction, either inflows or cash outflows. For example, imagine you operate a small consulting business. With single-entry accounting, you would record your revenue when you receive payment from a client and your expenses when you pay a vendor. You can record these transactions in a simple cash book or spreadsheet.

While single-entry accounting is relatively easy to understand and implement, it has limitations. It does not provide a comprehensive view of the financial health of a business. The reason is that it fails to capture the total impact of transactions on different accounts. Additionally, it may not comply with generally accepted accounting principles (GAAP) and may not be suitable for businesses requiring more complex financial reporting.

2. Double entry accounting

It is the foundation of modern accounting systems and is widely used by businesses of all sizes. It follows the principle that every transaction has dual effects on at least two accounts: a debit and a credit. The system ensures that the following accounting equation remains balanced.

In double-entry accounting, when you receive payment from a client, you would record the revenue as a revenue account, a credit, and a debit to the cash account. Similarly, when you pay a vendor, you would record the expense as an expense account debit and a cash account credit. The method ensures every transaction affects multiple accounts. There is thus a comprehensive record of financial activity.

Double-entry accounting offers numerous advantages. It provides accurate and detailed financial information. Furthermore, it facilitates the preparation of financial statements and enables a more sophisticated analysis of a business’s economic performance. It also ensures adherence to accounting principles and allows improved tracking of financial discrepancies.

Difference between single-entry and double-entry accounting systems

Let’s understand the significant differences between single-entry and double-entry accounting systems with the help of a comparison table.

Single Entry Accounting |

Double Entry Accounting |

|

|

Method |

Records only one aspect (cash inflow or outflow) of a transaction. |

Records both aspects (debit and credit) of a transaction. |

|

Complexity |

Relatively simple and easy to understand. |

More complex and requires a deep understanding of accounting principles. |

|

Financial View |

Provides a limited view of financial transactions and does not capture the full impact on different accounts. |

Provides a comprehensive view of financial transactions and ensures the accounting equation remains balanced. |

|

Reporting |

May not comply with generally accepted accounting principles (GAAP) and may not be suitable for businesses requiring complex financial reporting. |

Enables accurate and detailed financial reporting, facilitating the preparation of financial statements. |

|

Analysis |

Limited ability for sophisticated financial analysis. |

Enables more sophisticated analysis of a business’s financial position and performance. |

|

Accuracy |

May be more prone to errors and discrepancies. |

Provides a systematic and balanced approach to recording financial transactions, reducing errors. |

|

Usage |

Commonly used by small businesses or individuals with basic financial needs. |

Widely used by businesses of all sizes and industries. |

Types of accounting methods

There are two primary accounting methods. These include cash accounting methods and accrual accounting methods. Let’s dive into each form and understand its characteristics.

1. Cash accounting method

It takes a straightforward approach that recognizes revenue and expenses. It happens when cash is received or paid. In other words, transactions are recorded when the actual cash inflows or outflows occur.

The method is standard in small businesses or individuals due to its simplicity. Imagine you provide consulting services and receive payment in cash from a client. With cash accounting, you would record the revenue when the money is physically received. Similarly, expenses are recognized when cash is disbursed for goods or services.

2. Accrual accounting method

The accrual method considers revenue and expenses when earned or incurred, regardless of when cash gets exchanged. The technique adheres to the matching principle, which aims to match revenues with the costs associated with generating those revenues.

For example, you may provide consulting services to clients in June but invoice them in July. The revenue would be recognized in June under the accrual method when you offered the service rather than waiting until cash is received.

Accrual accounting provides a more accurate depiction of a business’s financial position and performance over time. It considers accounts receivable and accounts payable, providing a more comprehensive view of a company’s financial obligations and future cash flows. The method is standard with larger businesses as it is essential for financial reporting under generally accepted accounting principles (GAAP).

Must Read: Expense Accounting: Meaning, Types, Methods, Procedures & Software

What is finance?

Finance is the lifeblood of any organization. It ensures efficient financial resource utilization and alignment with strategic objectives. Finance empowers businesses to navigate economic challenges and seize growth opportunities. Employing financial expertise and analytical tools allows finance professionals to contribute to the success of organizations.

Finance consists of three key pillars: investment, financing, and risk management. Investment involves assessing and allocating funds to assets or projects to generate returns. Financing focuses on determining the most suitable sources of funds to support these investments. Risk management comes into play to evaluate and mitigate potential risks that may impact the stability and profitability of the organization.

For example, imagine a manufacturing company planning to expand its operations. The finance department would analyze the financial feasibility of the expansion. They would consider the cost of acquiring new machinery, the expected return on investment, and the availability of funds. Furthermore, they would explore financing options and assess the best combination of debt and equity to fund the expansion.

Learn more: Understanding the Differences Between Bookkeeping and Accounting

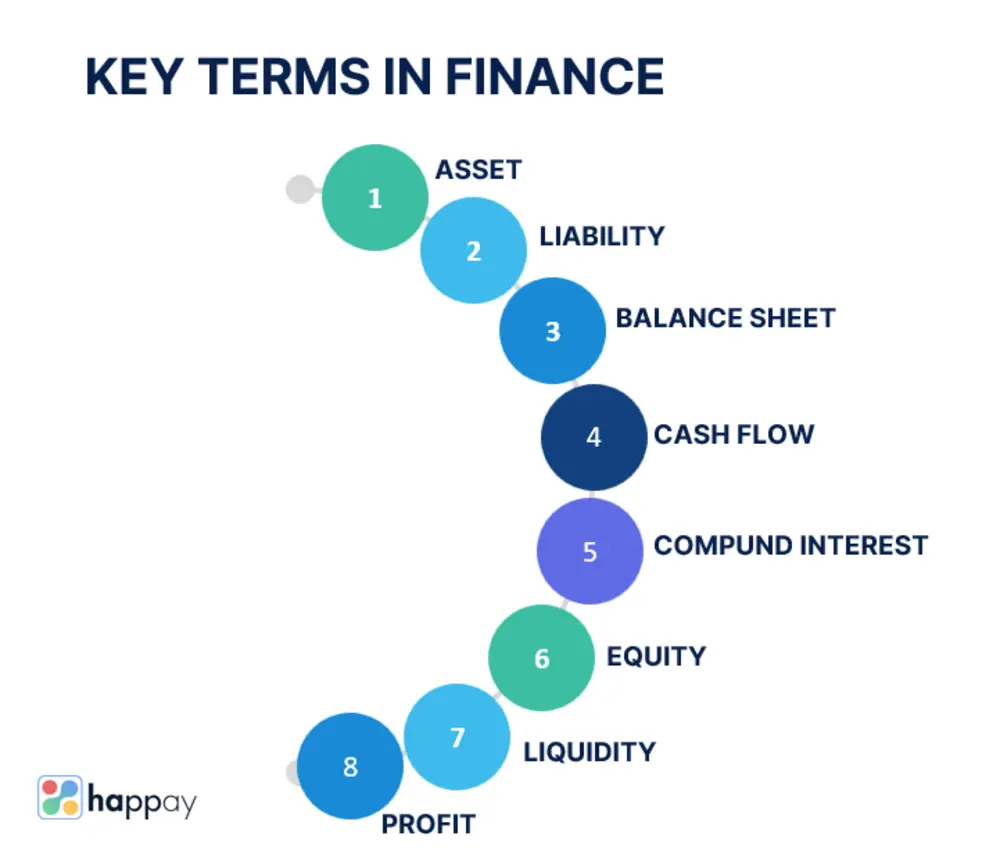

Key terms in finance

Let’s explore some fundamental terms and better understand their significance in finance.

1. Asset

Assets are resources owned by an individual or organization with economic value. They can be tangible, like buildings or inventory. Alternatively, they can also be intangible, like patents or trademarks. Assets represent the potential to generate future economic benefits.

2. Liability

Liabilities are obligations or debts an individual or organization owes to external parties. Examples of liabilities include loans, accounts payable, or accrued expenses. Liabilities need fulfillment in the future.

3. Balance sheet

A balance sheet is a financial statement offering a snapshot of an organization’s financial position. It presents a summary of its assets, liabilities, and equity. It helps assess solvency, liquidity, and financial health.

4. Cash flow

Cash flow involves the movement of funds into and out of business over time. It tracks the cash inflows and outflows. Understanding cash flow is crucial for managing liquidity and assessing the ability to meet financial obligations.

5. Compound interest

Compound interest is determined by calculating interest on the initial principal and the accumulated interest of an investment or debt. It allows for exponential growth or accumulation. When borrowing or incurring debt, it can amplify the overall cost.

6. Equity

Equity is the ownership interest in a company or individual’s net assets. You can calculate it by deducting liabilities from assets. Equity can be in the form of ownership shares in a corporation or an individual’s net worth. It reflects the residual interest after satisfying all liabilities.

7. Liquidity

Liquidity is the simplicity with which you can convert an asset or investment into cash without significantly impacting its market value. Highly liquid assets can be readily bought or sold, while illiquid assets may require more time and effort to convert into cash. Liquidity is essential for meeting short-term financial obligations and maintaining financial stability.

8. Profit

Profit is a business or individual’s financial gain after deducting expenses, taxes, and other costs from revenue or income. It measures an organization’s success and reflects the ability to generate surplus funds.

Read More: 6 Best Cash Flow Management Software

Types of finance

Let’s explore and understand the importance of two prominent types, public and corporate finance.

1. Public finance

Public finance is crucial for the public sector as it manages funds at the governmental level. It focuses on allocating and controlling financial resources by governments and public entities. Public finance is vital in the provision of public goods and services. These include infrastructure development, education, healthcare, and more.

It involves budgeting, taxation, public expenditure, debt management, and fiscal policy formulation. Managing public finances allows governments to ensure economic stability and promote equitable resource distribution.

2. Corporate finance

Corporate finance serves as the financial backbone for businesses of all sizes. It revolves around managing the activities and decisions within a company. The focus is maximizing shareholder value and achieving the organization’s strategic goals.

Corporate finance includes financial planning, capital budgeting, investment analysis, fundraising, risk management, and financial reporting. It involves making crucial decisions about evaluating investment opportunities and ensuring efficient use of financial resources. Corporate finance is critical to driving business growth and maintaining the financial health of companies.

Both public finance and corporate finance play integral roles in shaping the economic landscape for governmental agencies and private organizations. Navigating the complexities of finance in these domains helps financial professionals contribute to the overall stability and growth of the public and private sectors.

Must Read: Financial Planning: What is it, Types, Objectives, Steps & Benefits

How does financial accounting work?

Financial accounting works diligently behind the scenes to provide a clear picture of an organization’s financial performance. It captures and organizes financial data to create meaningful narratives about a company’s economic activities.

Financial accounting involves the systematic recording and summarizing of financial transactions. It adheres to specific accounting principles and standards, like the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). The goal is to ensure consistency and comparability in financial reporting.

The process begins with the identification and measurement of financial events. Each transaction, like sales or purchases, is carefully documented. Accountants capture relevant details like the date, description, and monetary value. These transactions then get classified into revenue, expenses, assets, liabilities, and equity.

Furthermore, accountants consolidate the transactions into financial statements. The critical financial statements include the income statement, cash flow statements, balance sheet, and more. These statements provide a comprehensive overview of the company’s financial performance, position, cash flows, and changes in equity.

Financial accounting follows accounting principles and practices to ensure accuracy and transparency. These principles guide the recognition, measurement, and disclosure of financial information. They include principles like historical cost, revenue recognition, matching, and full disclosure.

Suggested Read: Financial System: What is it, Importance, Components, Functions & Challenges

The role of accounting and finance teams in an organization

Accounting and finance teams play integral roles within an organization. Together, they function as the financial backbone and guide the decision-making processes. Let’s explore the essential responsibilities and contributions of an organization’s accounting and finance function.

1. Maintaining accurate and detailed financial records

Accounting and finance teams diligently record, classify, and summarize financial transactions to ensure the integrity and completeness of financial information. A meticulous approach to documenting revenues, expenses, assets, and liabilities, allows accounting and finance to provide a solid foundation for financial reporting and decision-making.

2. Ensuring legal compliance

Financial accounting navigates the intricate landscape of accounting principles, regulations, and tax laws. The goal is to ensure the organization adheres to applicable financial reporting standards. Accounting and finance professionals must stay current with changing rules and maintain compliance. It helps them safeguard the organization’s reputation and mitigate the risk of legal consequences.

3. Preparing budgets

They collaborate with other departments to create budgets that align with the organization’s strategic goals. Budgeting involves forecasting revenues and expenses, allocating resources, and setting financial targets. Developing accurate budgets is crucial to provide a roadmap for financial planning and resource allocation.

4. Evaluating performance

Accounting and finance teams analyze financial data and assess the organization’s financial health and performance. Accounting and finance professionals provide insights into the organization’s profitability, liquidity, solvency, and efficiency through financial ratios, trend analysis, and benchmarking. The evaluation helps identify areas of improvement and optimize resource utilization.

5. Serving as bridges for internal and external communication

They collaborate internally with other departments to provide financial insights and guidance to support operational decision-making. Externally, they engage with investors, lenders, and regulatory authorities to provide reliable financial information. Effective communication facilitates trust and promotes accountability within the organization.

6. Creating the financial strategy of an organization

They participate in strategic planning that helps provide financial analysis and insights. Evaluating investment opportunities and identifying growth avenues help accounting and finance professionals shape the organization’s long-term financial strategy. Their expertise enables the organization to make informed decisions and adapt to dynamic market conditions.

Also, Read: 10 Best Business Budgeting Software & Tools

Accounting vs. finance: which one is better?

Accounting and finance are complementary instead of being competing disciplines. It is essential to recognize that accounting and finance serve distinct purposes and play crucial organizational roles. Let’s explore their unique contributions to an organization.

Accounting follows a meticulous approach to record-keeping and financial reporting. It provides a comprehensive snapshot of a company’s financial transactions and performance. Furthermore, it ensures compliance with accounting standards and regulations to maintain transparency and support decision-making. Without accounting, organizations would lack the solid foundation of financial information necessary for financial reporting and analysis.

On the other hand, finance takes a broader perspective. It involves financial management, investment decisions, risk assessment, and strategic planning. Finance professionals evaluate investment opportunities, manage funds, analyze financial data, and create strategies that drive the organization’s growth. Finance brings the forward-thinking perspective required to optimize resource allocation and manage risk.

Recognizing the interdependence and collaborative nature of accounting and finance is crucial. Accounting provides the necessary data and information that finance relies on to make informed decisions. Without accurate accounting records, finance would lack reliable information to evaluate investment opportunities and develop effective financial strategies.

Successful organizations recognize the importance of both accounting and finance. They understand that they work together to achieve financial stability and long-term growth. It’s a matter of leveraging the strengths and expertise of each discipline to ensure a holistic approach to financial management.

Quick Read: 10 Best Financial Management Tools for CFOs

About accounting and finance software

Accounting and finance software has become invaluable for businesses today. These software solutions streamline and automate financial tasks to enable accuracy and enhanced decision-making capabilities. Let’s explore their benefits.

1. Wide range of applications

Accounting and finance software encompasses several applications. These include everything from essential bookkeeping tools to advanced enterprise resource planning (ERP) systems. These software solutions simplify recording transactions, managing accounts payable and receivable, generating financial statements, and performing complex analyses.

2. Automate repetitive tasks

Tasks like data entry, transaction categorization, and financial calculations get streamlined. It reduces manual errors and saves time. Automation allows finance professionals to focus on higher-value activities, like financial analysis and strategy development.

3. Real-time visibility

These software solutions offer up-to-date insights into key financial metrics by consolidating data from various sources and presenting it in a user-friendly interface. The metrics include cash flow, profitability, and budget performance. It enables finance professionals to make informed decisions promptly and adapt to changing business dynamics.

4. Integration with other business systems

Integration with customer relationship management (CRM), inventory management, and payroll systems, among others, allows for seamless data flow across departments. The integration enhances data accuracy and eliminates duplicate data entry.

5. Security

These solutions offer robust security measures, including data encryption and user access controls. Safeguarding financial data and ensuring compliance with data protection regulations allow the software to provide peace of mind to organizations and their stakeholders.

6. Scalability

As companies grow and their financial requirements become more complex, these software solutions can scale accordingly. Whether it’s handling increased transaction volumes or managing global operations, accounting and finance software remain customizable.

Best accounting and finance software

Several exceptional solutions have earned acclaim for their features, functionality, and user-friendliness. These accounting and finance software solutions offer varied capabilities to meet the diverse needs of businesses of all sizes.

Here is a list of some of the best accounting and finance software available:

- QuickBooks

- Xero

- Sage Intacct

- NetSuite

- FreshBooks

- Wave

- Zoho Books

- SAP S/4HANA Finance

- Oracle Financials Cloud

- Microsoft Dynamics 365 Finance

Read More: 9 Best Accounting Software for Small Business

Bottom line

Accounting and finance are the dynamic forces driving the financial well-being of organizations. Together, these disciplines create a harmonious partnership. They leverage their unique strengths to ensure accurate financial information and maximize profitability.

Furthermore, accounting and finance software is invaluable in offering unmatched automation capabilities to finance professionals. These software solutions streamline financial processes and empower finance professionals to focus on strategic analysis and decision-making. From bookkeeping to financial analysis, these software options provide businesses with the tools they need to thrive in a competitive marketplace.

So, remember that accounting and finance are integral pieces of the financial puzzle. Embrace their symbiotic relationship, leverage cutting-edge software solutions, and empower yourself with financial knowledge to make informed decisions for your organization. With accounting and finance as your guiding forces, you hold the keys to unlocking financial success for your organization.

Learn About: 10 Best Business Management Software in 2023

FAQs

An organization’s Finance and accounting involves managing and controlling financial resources. Finance focuses on financial planning, investment decisions, and risk management. On the other hand, accounting involves recording, summarizing, and reporting financial transactions to provide reliable financial information.

Accounting and finance are crucial to an organization for several reasons. They provide insights into financial performance, facilitate informed decision-making, and ensure legal compliance. They also support resource allocation, enable financial planning, and enhance transparency and accountability.

An organization’s finance and accounting operations involve managing financial resources, tracking financial transactions, and preparing financial statements. The function also deals with analyzing financial data, managing budgets, forecasting, risk management, and providing financial insights to support strategic decision-making.

Accounting is vital in an organization as it records financial transactions and maintains accurate financial records. It also helps prepare financial statements and assess financial performance to ensure compliance with accounting principles and regulations.

Companies use financial accounting to track and record financial transactions, prepare financial statements, and analyze financial performance. They also leverage it to evaluate profitability, comply with regulatory requirements, and communicate financial information to stakeholders.

The primary objective of financial accounting involves providing accurate and reliable financial information about an organization’s financial performance. It aims to ensure transparency, enable informed decision-making, and demonstrate the organization’s compliance with accounting standards.

Discussion about this post