Introduction

Not all superheroes wear capes. Some love numbers and take care of finance in enterprises. They are called CFOs. And their supervillain- suboptimal expense management processes.

Remember, every hero needs help. After all, no one can save the world, in this case, a company, single-handedly. You don’t have to worry. We’re here for you as a resourceful sidekick. Here’s all you need to know about the expense management process. What’s more, use our nine expense management best practices that will transform you into a super CFO.

Explore About: Happay Expense Management Software

What is the expense management process?

T&E is the second-largest controllable expense for organizations. This makes it essential for organizations to focus on expense management best practices and make it a vital metric to monitor and control.

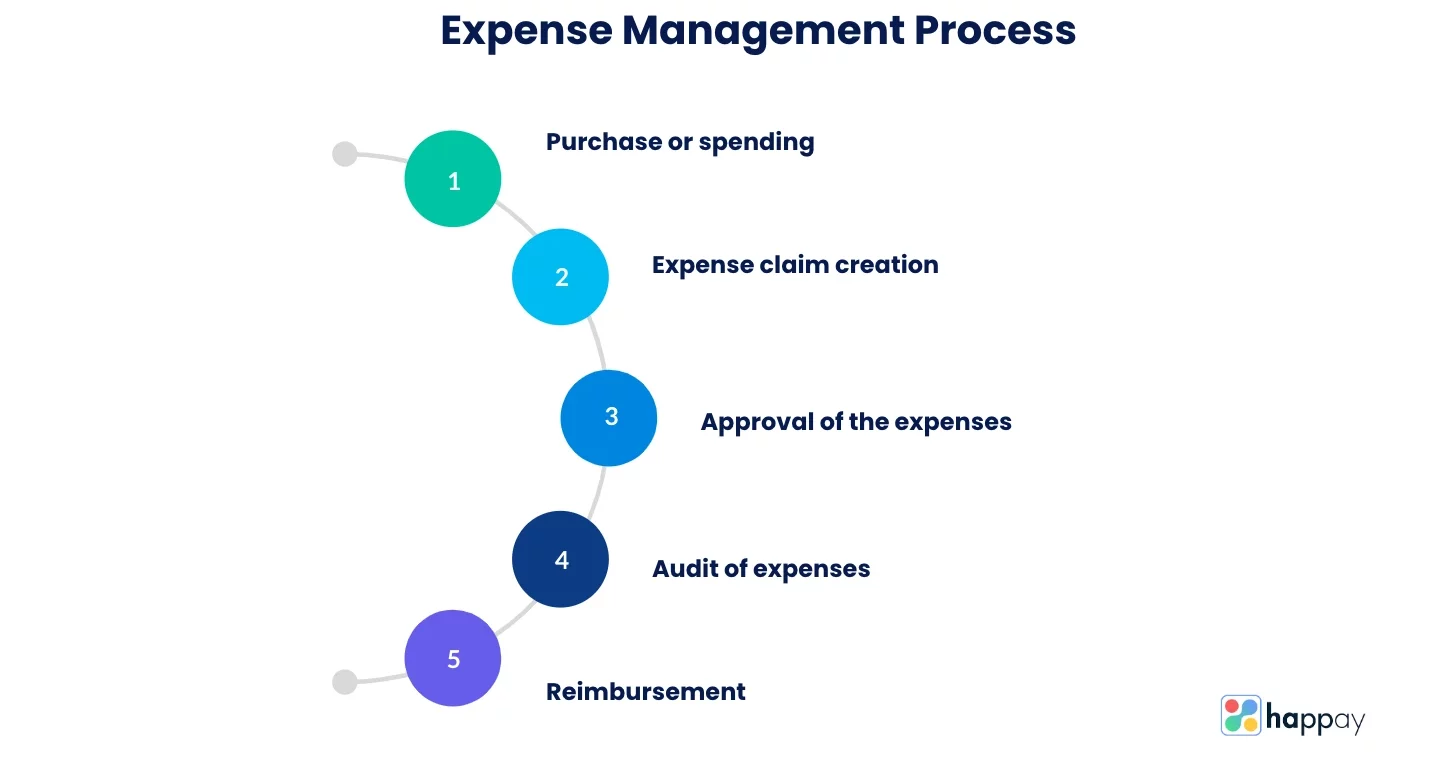

The expense management process involves various steps like expense claim filing, approval, reimbursement, etc. It is different depending on the size and type of business. However, these steps are common to all systems.

- Purchase or spending: The employee pays for service on the company’s behalf. For example, while on a business trip, the employee covers the cost of meals and becomes eligible for reimbursement.

- Expense claim filing: The employee has to create an expense report that details purchases and business expenses. The report lists the date, purchase details, and the reimbursable amount.

- Approval: The expenses filed for reimbursement need approval from the managers and sometimes the finance team. The reimbursements cannot get through if they do not get the approval. This step is crucial as it safeguards the company against expense frauds like receipt duplication, overstatement of expenses, etc.

- Audit: Auditing expense reports is the next step in the process. It includes the verification of receipts and brings various errors and frauds to attention.

- Reimbursement: In the final step, post-approval, the employee receives the amount spent.

Must Read: 10 Best Expense Management Software and Tools

What are expense management best practices?

Expense management is the system that facilitates the processing, reimbursement, and audit of expenses made by employees. Numerous employee-initiated expenses, including travel and entertainment costs, require multi-step approvals, validation, and audits. These processes exhaust many financial resources.

Expense management best practices help you ensure optimal use of these resources. With streamlined processes, you can maximize the firm’s savings.

According to the Global Business Travel Association, processing one expense report takes about 20 minutes and $58 on average. Sadly, over 19% of reports submitted by business travelers have errors, and correcting them takes an additional 18 minutes per report.

Now, that is a lot of time lost just on reports- and we have not even considered the time it takes to create the reports in the first place.

This is where expense management best practices come in. They help safeguard you against several avoidable challenges like cost leakages, expense frauds, etc.

Suggested readings:Top 10 Expense Management Tips for Your Business

Why do you need best practices for expense management?

Managing expenses in an organization is no simple task. The entire process is tedious and needs a great deal of human effort and financial resources. Add to this the process of tracking expenses and forecasting future spending. Sounds mind-boggling, right?

Yes, you can solve most of these issues using an expense management system like Happay. However, to make the spend management system in your firm robust and error-free, you need to follow some best practices.

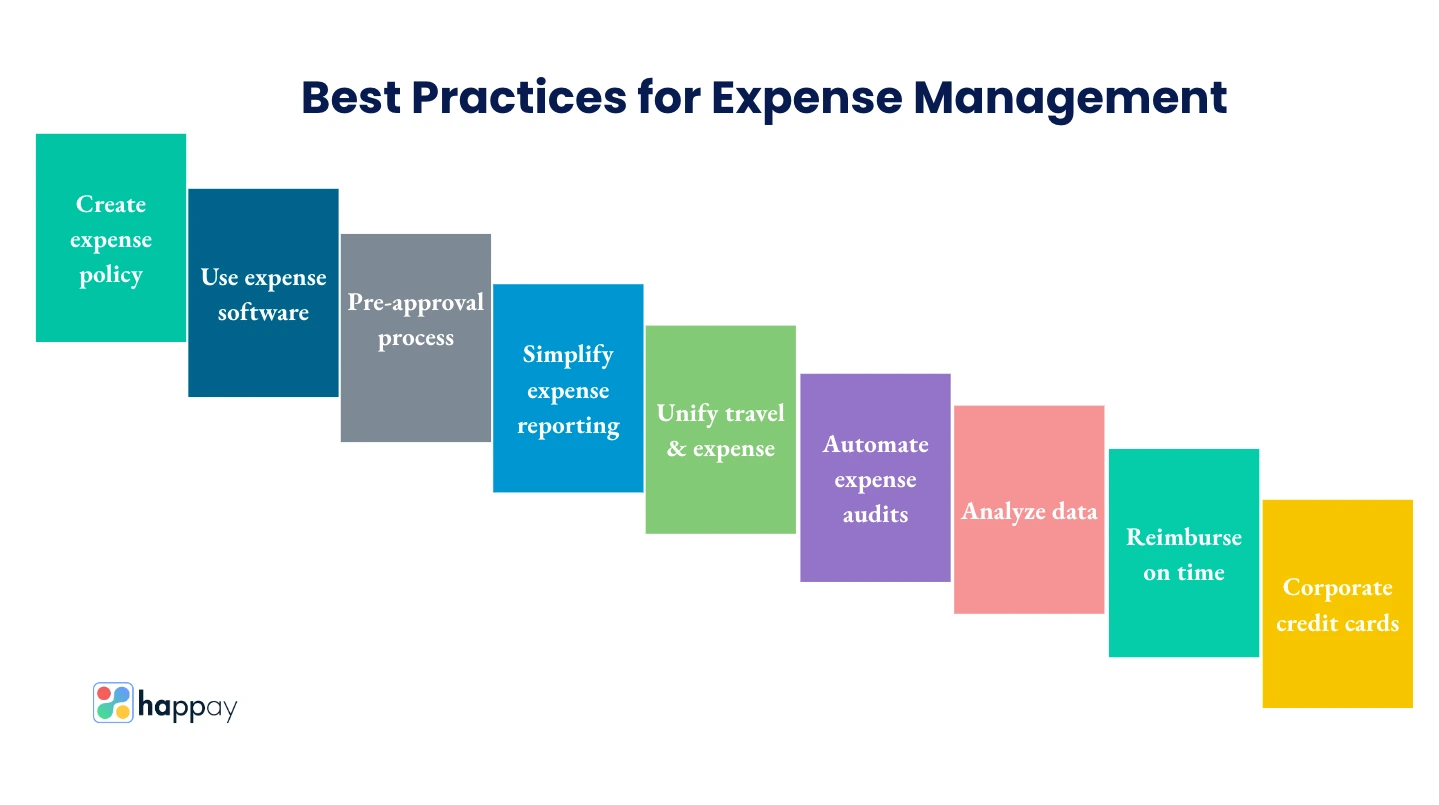

9 best practices for expense management

Here are the nine top expense management practices for CFOs and business owners.

1. Create an expense policy

By implementing an expense reimbursement policy in your workplace, you can have greater control over employee spending in your organization. A good expense policy will clearly define what kind of expenses are permissible under the company policy, and it will also have details on non-policy-compliant expenses.

Another significant advantage of implementing a company-wide expense policy is that it will simplify the reimbursement process. A well-defined and automated expense policy will help your finance team approve or reject expense reports quickly.

This means less effort for the finance team and quicker employee reimbursement time – a win-win situation for all.

2. Use an automated expense management software

Manual expense management processes are often error-ridden and cumbersome. Some businesses and large companies still rely on tons of paperwork and spreadsheets to manage expenses in their organization.

Employees often find expense reporting frustrating and time-consuming in organizations that follow manual expense management methods. Worse, your finance team will drown in a sea of paperwork.

To eliminate all these hassles, use expense management software to automate and streamline the expense management process.

Also, expense management software allows employees to file an expense report using a mobile device with just a few clicks. The finance team can quickly reimburse employees for policy-compliant expenses.

Furthermore, expense management software will help you track your expenses in real-time. This feature will help you know if you are on track and use the data from the system to forecast future budgets.

3. Implement the pre-approval process

It does not matter if your organization uses an automated expense management system or uses a manual method to process expenses. By mandating pre-approvals, you can drastically reduce out-of-policy spending.

For example, employees need their managers’ pre-approval before purchasing flight tickets and hotel reservations. This way, the chances of expenses not complying with your policies getting approved are significantly less.

4. Simplify the expense reporting process

Ensure the expense reporting process in your firm is simple and easy to follow. Some companies still follow the traditional method, where employees must manually fill out countless forms for reimbursement.

Another major issue that employees face is the responsibility of collecting and safeguarding bills, receipts, and tickets. Therefore, make sure you pick an expense management system with automation features like optical character recognition (OCR).

5. Unify travel and expense in one place

Did you know business travel is responsible for 70% of enterprise expenses? Having two separate software for them can lead to poor vendor management, money leakages, lack of data visibility, etc.

Therefore, the smartest thing would be to have it on one single platform. Choose a unified T&E system that will create a hassle-free booking and expense management experience for your employees, approving managers, and finance team.

6. Enable automated expense audits

If your firm approves significant expense reports regularly, non-policy-compliant expenses could also be reimbursed. How do you solve it: for regular audits, install expense management software that can help you audit all your expenses.

A spend management system with an automated auditing feature can help you find fraudulent claims, duplicate bills, and others. Thus allowing you to eliminate cash leakages completely.

7. Reimburse on time

Reimbursing your employees on time plays a major role in boosting their morale. In most cases, while they are on a business trip, employees spend the money out of their pocket.

That is why delays in reimbursement can make them feel frustrated, and this can have an adverse impact on their productivity. Therefore, have a mechanism in place that allows you to reimburse quickly after expense reports are filed.

8. Analyze data

As they say, data is the new oil. But if it is unrefined, you cannot use it. Use an expense management system like Happay that gives you real-time spending data. What’s more, you can also use the data obtained from the expense management system to understand spending categories, behavior, expense patterns, etc.

9. Use corporate credit cards

Allocate corporate cards to frequent travelers. Doing so allows you to track expenses, set spending limits, and disburse money without a hassle. This way, you can eliminate the cumbersome expense filing, reporting, and reimbursement process.

Furthermore, corporate cards provide many rewards and offers, which companies can take advantage of.

Must Read: 10 Best Expense Reporting Software Systems and Tools

Issues that expense management best practices solve

- Expense frauds – A report by the Association of Certified Fraud Examiners claims that expense reimbursement fraud accounts for 11%of fraud in large businesses and 21% in small businesses. Expense management best practices like using corporate cards, automating expense reports, enforcing expense policy, etc., increase spend visibility and reduce the risk of fraud.

- Loss due to errors- Manual processes are always prone to human error. Automation is a best practice that can solve this problem. It also ensures the centralization and standardization of data, decreasing the likelihood of errors and data contamination.

- Confusion and unclear communication- Manual expense management processes require constant back and forth. The best practices mentioned above don’t just speed up the processes but also reduce the time otherwise wasted on communication. They also ensure more transparency in the reimbursement process.

- The financial burden on employees- Delayed reimbursements often mean that the employees have to bear the brunt of a business expense for longer than they should. This deters them from going on business trips in the future. A few best practices, like corporate credit cards and automated reimbursements, help avoid this.

Suggested readings: Benefits of Expense Management Software

Let Happay take your expense management troubles away

Happay‘s expense management solution is a complete and automated expense management software with receipt capture, corporate card, auto SMS capture, and email plugins. As a complete Travel & Expense ecosystem on a single platform, it ensures your travel and expense management is entirely streamlined.

It also offers solutions for petty cash management, invoices, corporate payments, and corporate cards. Happay’s end-to-end integration, security, complete visibility, and control allow you to manage multiple workflows on a single platform.

Here’s what Happay can do for you

1. Xpendite

One of the most frustrating aspects of business travel is collecting expense receipts and saving them to file an expense report later on. Eliminate this cumbersome and manual process to replace it with Happay’s Xpendite, as it automatically captures data at the source.

The most significant benefits of this feature are

- Quick and easy expense capture as it automatically reads invoices- physical and digital.

- Error-free and accurately capturing relevant information from invoices such as vendor name, invoice amount, etc.

- Better visibility and control over expenses

- Improvement in the employee experience

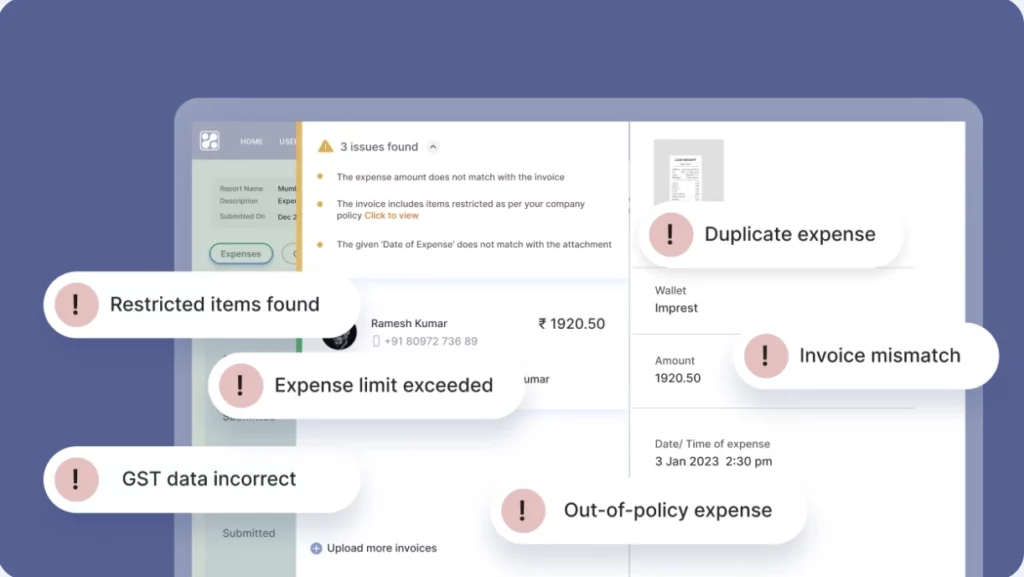

2. Smart Audit

How would you like it if your expense management solution could

- Identify and highlight policy violations to approvers.

- Flag off potential fraud and errors

- Save time for your finance teams

- Give you real-time visibility of budget utilization.

With Smart Audit, it is far easier than you can imagine. Compliance has consistently ranked as one of the biggest challenges in expense management. So, whether it is tracking, identifying, or addressing, Smart Audit assures

- Time and effort savings for finance teams

- 100% policy compliance, 0 violations

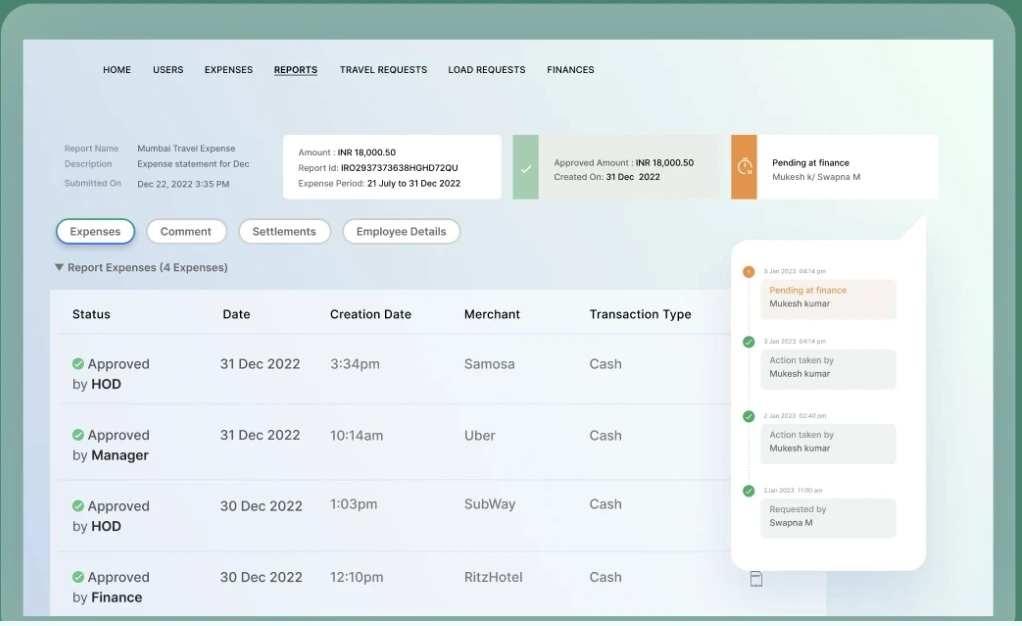

3. ApprovNow

If delayed approvals are your nemesis, it is indeed time to change it.

Happay’s ApprovNow gives you real-time updates to transform your approval cycles. So, approvers, employees, or your finance team can enjoy the following benefits.

- Customized approval workflows to suit a scenario, department, or cost center.

- Transparent and clear approval process with Happay’s integrated dashboard (available on mobile and web).

- Soft or hard blocks to eliminate out-of-policy claims (prevent claims with hard blocks, notify and confirm to proceed with soft blocks).

- Add another layer of approval with “Adhoc” approvers (can be added right in the app).

- Eliminate delays using reminders and delegation features of ApprovNow.

- Bills, comments, violations, and approvals are all available for review, making sure you are always audit-ready.

4. DeepAnalyze

A feature that is common in both travel and expense categories, DeepAnalyze helps you make well-informed and more intelligent decisions.

360o visibility in travel and expense can be a reality with Happay’s DeepAnalyze. With this feature, your regular data becomes insightful information. Imagine being able to

- List the top spenders

- Identify the top violators

- Calculate the time taken for approvals, reconciliations, or reimbursements.

Based on the thought that you cannot control what you cannot see, DeepAnalyze equips you with the information you need to remove the guesswork in your decision-making.

Happay’s DeepAnalyze offers 360o visibility in travel and expense. Your regular data becomes insightful information as you list the top spenders, Identify the top violators, or calculate the time taken for approvals, reconciliations, or reimbursements.

Schedule a demo with us today to learn more about how the product can empower your expense management system.

FAQs

Installing an expense management system like Happay is the way to go to manage expenses efficiently in any organization. You can now use expense management software to make the expense reporting, tracking, and reimbursement process error-free.

Installing an expense management system like Happay is the way to go to manage expenses efficiently in any organization. You can now use expense management software to make the expense reporting, tracking, and reimbursement process error-free.

Expense management is vital to manage expenses, reimbursing money to employees, and ensuring employees comply with the company’s expense policies.

Efficiently streamline expense reporting by implementing digital tools for receipt capture and approval workflows. This reduces manual tasks, enhances accuracy, and speeds up reimbursement.

CFOs can implement robust spending policies, set clear spending limits, and employ automated alerts for potential overspending. Regularly analyzing expense data helps identify trends and areas for optimization.

Balance policy adherence and flexibility by creating well-defined spending guidelines. Regularly communicate policy updates and provide training to ensure employees understand the rules while allowing some discretion when needed.

Data analytics offers insights into spending patterns, helping identify cost-saving opportunities and areas of concern. It aids in informed decision-making and optimizing resource allocation.

Automation streamlines processes, reducing manual errors and saving time. Use automated approval workflows, expense categorization, and integration with financial systems for seamless expense tracking.

Prevent fraud by implementing a separation of duties, requiring receipts for all expenses, and conducting regular audits. Encourage a culture of transparency and report suspicious activities promptly.

Leverage expense management software to track expenses in real-time. This provides a clear overview of spending, enables proactive decision-making, and ensures timely corrections.

Centralizing data allows for better visibility, simplifies reporting, and enables accurate forecasting. It also facilitates benchmarking against industry standards and aids in negotiating vendor contracts.

Effective expense management aligns with financial goals, optimizing resource allocation and promoting cost-consciousness. It frees up funds for strategic investments and fosters financial stability.

When choosing a solution, prioritize integration with existing systems, user-friendliness, scalability, and robust reporting capabilities. Ensure the solution aligns with your organization’s unique needs and goals.

Discussion about this post