Expense Reimbursement Claims

At this year’s marathon, there was a surprise podium finish. We learned later that the winner was not in the race. He was merely sprinting to get his travel vouchers in before the next pay period !!

If you are a frequent traveler, you will totally relate to this. Isn’t it a mad dash to ensure receipts are attached, the expense report is completed, and it is submitted in time so you get your expense reimbursement claim as quickly as possible?

According to Phocuswright’s US Corporate Travel Report 2020-2024, the top priority for travel managers is to automate the trip-related expense capture. Numerous metrics can help finance teams to assess a company’s expense management system. However, the key metrics are

- The average time taken for reimbursement

- The time taken to complete monthly reconciliations

Unfortunately, only about 12% automate reimbursements (within policy), about 6% identify corporate card misuse accurately, and 25% don’t have an automated expense management process.

If you are here, you are most likely trying to improve the reimbursement claim process in your organization. If so, read on as we dissect the term and give you everything you need to design an effective expense reimbursement claim process for your organization.

Also, Read: A Guide to Expense Management

What are expense reimbursement claims?

When employees of your company travel for work, they file their business travel expenses as expense reimbursement claims. When they complete their trip, employees file a reimbursement claim form along with proof of expenditure.

Most of the time, expenses that employees claim relate to travel. However, it need not always be the case. There may be instances where the employee spends for other purposes. For example, your employee may organize a meeting on behalf of the company.

On the other hand, employees may pay for stationary and other small equipment needed for the office. Such expenses are claimed later as business expenses. You may reimburse employees for minor cash expenses using the petty cash fund (reserved for such expenses).

While the reimbursement claim process is not complicated (as it requires filing a report with proof of expenses), the process may be time-consuming and frustrating for employees and employers unless your company has clear-cut reimbursement policy guidelines.

First, let’s look at a typical expense reimbursement claim process.

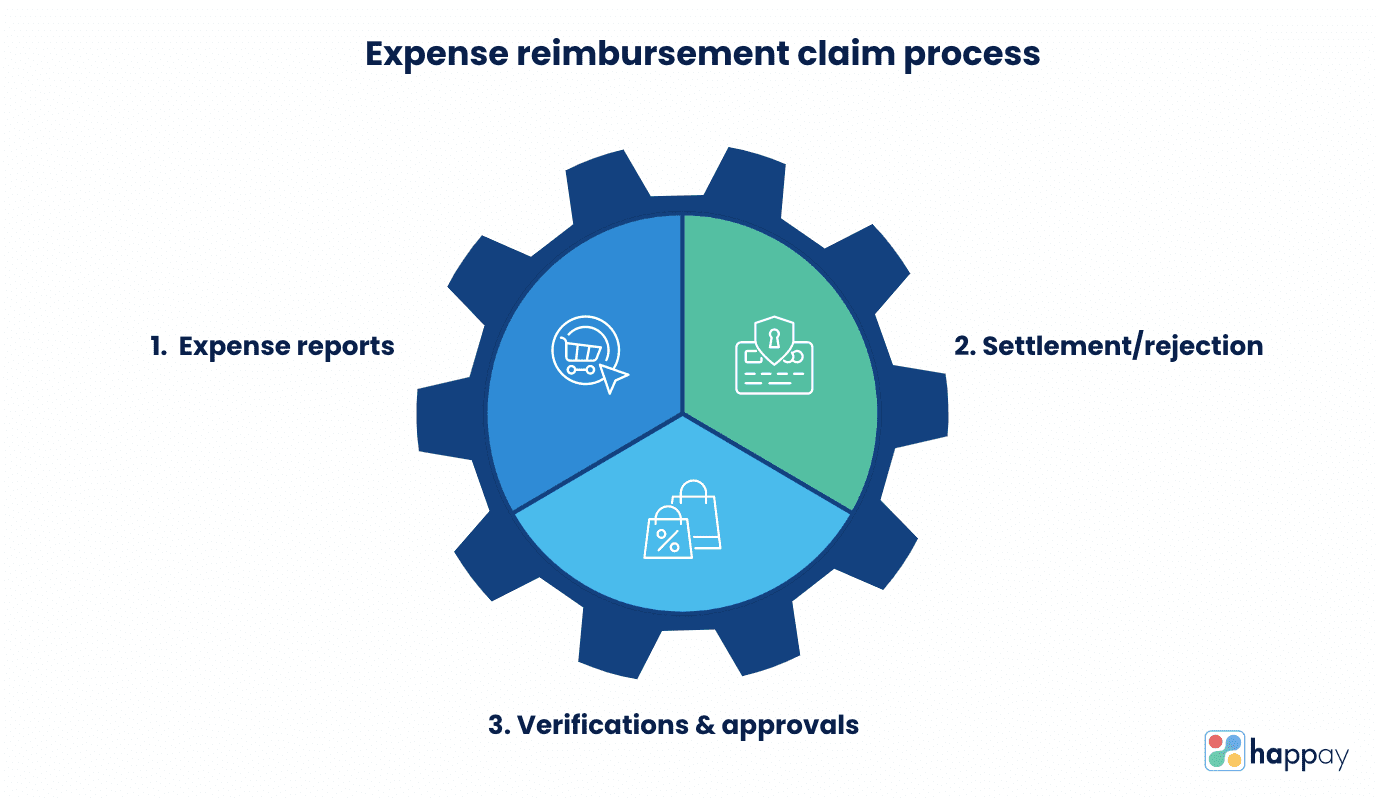

The expense reimbursement claim process

1. Expense reports

Expense reports are the first step in the expense reimbursement claim process. It shows a summary of expenses employees incur during business trips or on behalf of your company (department, project, or company).

Depending on your company’s travel and expense reimbursement policy, employees file such reimbursement claims periodically, for a project, by category, department, or other factors as mentioned.

Travel expense reports serve an excellent purpose for both the employer and the employee. The employee uses the process to get a settlement while you get a clear picture of overall expenses, the economic health of the business, and a way to forecast and plan.

Typically, here’s what an employee will include in the expense reimbursement claim report:

- All details about your employment (name, employee id, department, etc.)

- Where it is a travel expense, the employee must mention the travel dates – otherwise, the expense date.

- Where the employee provides travel expense details, they must include details of the trip and proof of expenses from the trip (hotel bills, meal, and cab receipts, claimable other expenditures)

- Vendor/Payee information (this could be in the form of a receipt from the vendor)

- You must include the Customer or client information when it is incurred towards a particular customer or client.

- The total expense (if applicable, tax, fees, and other information)

2. Approvals and Verifications

According to some studies, most approvals only take about 5 minutes (per expense report). However, when you multiply it by the number of reports or manual verification for each of those, it may mean days and weeks of delay in reimbursements.

Employees submit expense reimbursement claim forms to the appropriate department. Usually, HR accepts the documents but the verifications and final approval or rejection of the reimbursement claim come from the finance department.

Once you file the expense reimbursement claim report, the finance department goes through a process to cross-check the information in the claim form. One way to make the verification process more manageable is by attaching valid proof of purchase/expense.

However, despite such proof, there are instances of intentional or unintentional fraud. Employees may pad expenses, file duplicate receipts, or claim fictitious expenses. While most companies have workflows that pick up such deviations, automated expense management software can take care of such instances of expense fraud and flag them off before you incur them.

3. Expense reimbursement claim: settlement or rejection

Once the verification process is complete and the necessary approvals are in place, the finance department will release payment against the expense reimbursement claim.

How the employee receives the reimbursement depends on the kind of T&E policies in place. Travel and expense policies are unique to companies, and based on those details, you can reimburse your employees through a check, direct transfer to the employee’s bank account, or any other means.

Generally, the finance team contacts the managers and employees if there are clarifications in the expense report. It may be time-consuming, depending on the complexity of the clarification. Managers may reject unresolved claims or where the clarification does not satisfy them.

Also, Read: Types of Expense Categories

Types of expense reimbursement claims

Commonly, expense reimbursement claims fall into three broad categories.

1. Travel expense reimbursement claims

Employee expenses incurred to carry out work that will benefit the organization falls under this category. While you may claim most of the below-mentioned expenses, companies work differently (travel expense policies are unique to organizations).

For instance, per diem allowances may be the norm in some organizations, but in others, the employees may have to produce proof of expenses for every expense incurred.

Travel expenses are expenses incurred in getting to the destination, accommodations, and other expenses to further the purpose.

For example, you can claim these items in a travel expense report.

- Airfare, tickets for the train, or other means used to travel to destination

- Cab, bus fare, or mileage information if the employee uses their vehicle.

- Meals and entertainment- food and drink bills (except alcohol)

- Hotel stay (serviced apartment or rental of any other property)

- Any allowance (subsistence, per diem, etc.)

- Wi-fi

2. Medical expenses reimbursement claims

Organizations must always consider employees’ health a priority. While health insurance takes care of most health-related expenses, health insurance claims are part of compensation packages and are HR’s responsibility.

However, any hospitalization expenses incurred during travel or while performing official duties may be reimbursed by your organization (you must study travel and expense policies for any disclaimers or wording that may exclude such expenses).

Generally, all companies have terms of healthcare coverage mentioned clearly in rules and policies (including dealing with any medical emergency). Reimbursement claims will be successful if the medical expense reimbursement claim does not fall under any of the exclusions mentioned in the policies.

Depending on the terms mentioned in the health insurance plan, employees may need to provide receipts, bills, or proof of insurance premiums.

3. Other business expenses reimbursement claims

There may be many expenses that do not fall into the categories mentioned above. For instance, expense reimbursement is possible if you purchase equipment, such as projectors, hardware, speakers, office supplies, cameras, etc., to conduct meetings on the premises.

Also, during the pandemic, many employees could claim expenses incurred on more comfortable, ergonomic chairs (so they could work from home efficiently), UPS (stay unaffected by power outages), or laptops.

Here too, the employee would need to submit an expense reimbursement claim detailing the reason for purchase and other vital information that will encourage a quick and hassle-free settlement.

Recommended Read: 10 Best Expense Reporting Software

Cashless expenses (credit cards) vs. expense reimbursement claims

Expense reimbursement Claims

There may be many occasions where the employees incur expenses on behalf of the company. Such expenses are reimbursed or settled when employees file an expense reimbursement claim.

If it is a manual process, the waiting period is long. The employee must file an expense report detailing the expense (if it is travel-related, the process will begin after the completion of the journey). Then, the reports go to appropriate departments for approval, and after passing through necessary checks, claims are settled.

Low-ticket expenses and petty cash bills are generally reserved for the end of the month. While this means a long waiting period for some employees, the other problem is ensuring that receipts are maintained well during that period.

Depending on the number and complexity of such transactions, the finance team spend hours, days or weeks reconciling the numbers. So, this means a long wait with no assurance of a settlement.

Cashless claims

An automated travel and expense management system can ensure that employees can incur expenses without worrying about spending from their pockets. Such management systems can effectively integrate corporate credit cards and pre-paid cards into your expense management system. It offers several benefits to both employees and employers.

By setting up employees with pre-paid cards, you can ensure they spend only within limits. Further, most business-related expenses can be easily authenticated.

Cashless claims mean employees do not have to wait until settlement to get their money back. Another advantage is that they do not have to carry cash for business expenses. Also, since the transactions are already mapped to the expense management system, the expense report submission is easy and quick.

Which is better? cashless claims or reimbursement claims

|

|

Cashless Claims |

Reimbursement Claims |

| Convenience | You can link prepaid or credit cards conveniently to the expense management software used by the company. | Cash advances are often given by businesses to employees for business travel expenses. |

| Security | Prepaid or credit cards are easy-to-use at POS (Point-of-sale), Online merchants, and ATMs. | You must handle cash carefully and maintain receipts/bills until the claim reimbursement process is complete. |

| Track/Verify/Approve | Prepaid or Credit Cards are linked to the expense management software, making tracking, verifying, and approving expenses easier. | You must reconcile cash Advances against receipts and bills submitted along with expense reports. |

| Reconciliation | Card reconciliations are easy as card statements (automatically uploaded) may be matched to receipts/bills. | Cash-based reconciliations are manual and time-consuming. |

| Spending limit | The spending limit may be increased easily by adding funds to the card. Similarly, you may block funds or lower spending limits quickly. | You can change the cash advance limits, but they won’t become effective until the next cash advance. |

| Finance Team | Finance teams will save time and effort by tracking and approving expenses through a dashboard. | Cash advances are a significant pain point for the finance team as they can only reconcile the accounts when the employee submits an expense report. Pre-approvals are rarely possible in manual processes. |

| Real-time Data | The availability of real-time information offers visibility into business expenses. | There is no visibility of expenses until reconciliation. |

| Reporting | The process is completely automated with the added advantage of access to insightful reports. | The workflow is time-consuming as it is manual and affects employee morale as they must wait a long time before their claim is settled. |

Challenges with expense reimbursement claims

1. Burden on employees

Employees (fresh out of college, newcomers, single parents, or so many others) may not bear business expenses from their pockets. It seems like an unfair demand to make on them as such payment lowers their own line of credit.

2. Unclear expense policies

The clarity of travel and expense policies can make a massive difference in the claim reimbursement process.

Employees must stay in hotels when they travel for work. It creates quite a few problems for those approving/rejecting these employee expense reimbursement claims. If the travel and expense policy does not mention the hotels or room rent limitations, taking approvals for the same post-travel will pose quite a challenge.

3. Employee experience

Nothing can be more frustrating than spending money in advance, filing a reimbursement claim, and hoping (all the while unsure) that the claim is accepted and settled. Depending on the organization and the complexity of the claim amount, employees may wait weeks, if not months, before you reimburse the employee expenses. Such delays affect the employee’s experience and productivity.

4. Not proactive.

The biggest challenge with the claim reimbursement process is that it happens after the expense has been incurred. So, any possibility of preventing it (if it is non-compliant or for any other reason) is already gone. So, in such cases, either the employee ends up paying from his funds, or the finance team is in an uncomfortable position to reject the claim settlement.

Suggested Read: A Guide to Expense Audit

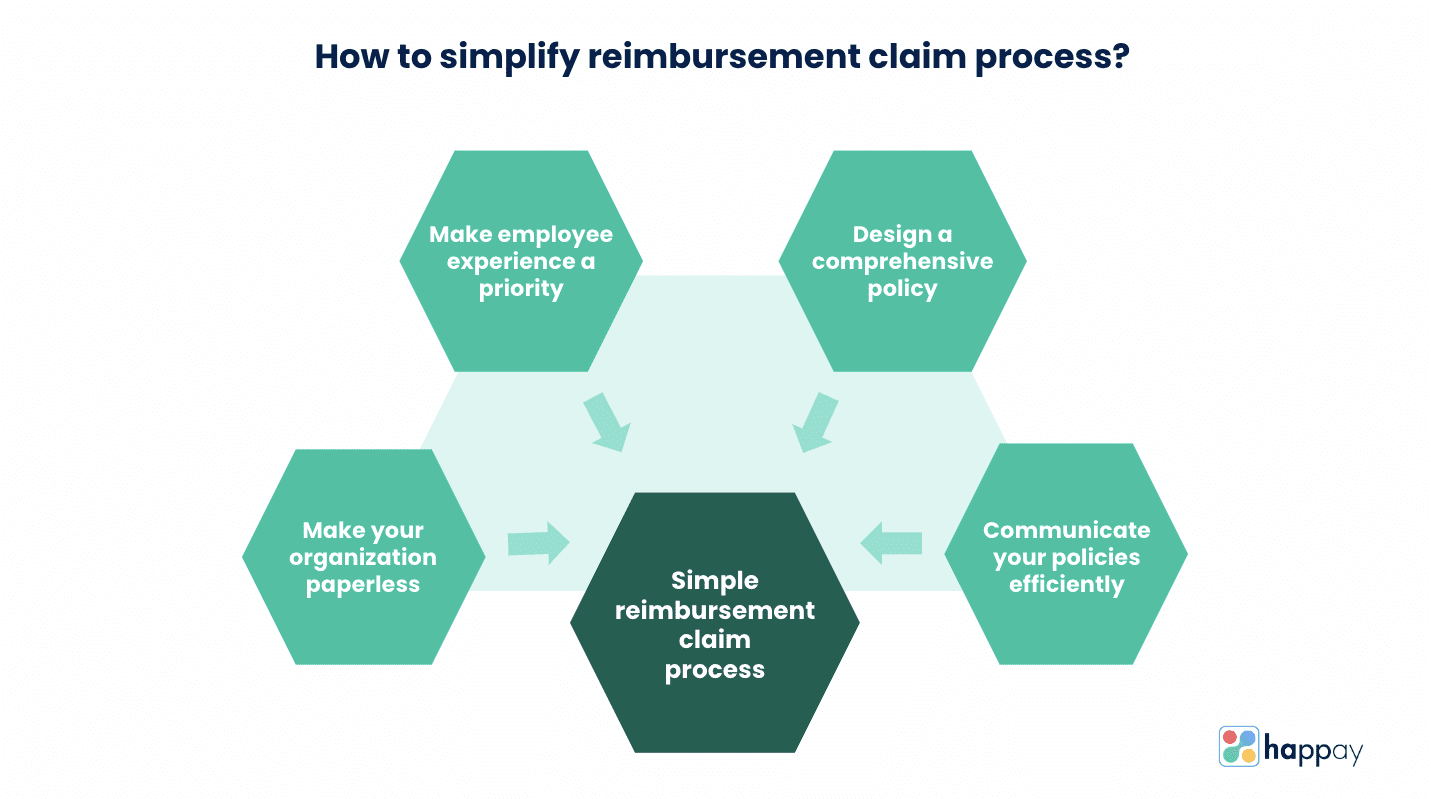

How to simplify your expense reimbursement claims system?

Simplifying a process begins by ensuring you have better visibility over your expenses. Using the right technology can be a key differentiator. Whether you are relatively new in the market or are a large enterprise, digitizing the expense management can contribute key advantages- better use of your limited resources or a bird’s eye view of the expense budget.

As Ramesh Iyer, President & CRO at Happay says, “if history has taught us anything, it is that resisting technology is a sure-shot way to lose the edge in any competitive market”.

1. Paperless and automated

You can transform and re-engineer the claim reimbursement process to manage your finances effectively and efficiently. Automated expense management software optimizes your workflows while making your organization a paperless environment.

- As and when employees incur expenses, they can capture the same through the mobile app. So, no need to save receipts and no waiting time for claim settlements.

- Expense reports are automatically forwarded to the right managers, approved, and processed without delays.

- With a complete, accessible online audit trail available, finance teams won’t have to deal with lengthy email threads and do not need to stress about compliance or reconciliations.

- You can benefit from better spend visibility and analytical capabilities as a finance leader.

2. Comprehensive policy

A comprehensive expense reimbursement policy provides guidelines for employees to follow on everything related to business and travel expenses. Make sure you cover all aspects of T&E while clearly stating the objectives and importance of following them.

Besides making it easy for your employees to understand and follow the rules, finance teams can rely on these simple regulations to prevent fraud and other errors in processing these expenses.

A simple way to ensure employees follow your policies (whether simple or not) is to automate T&E. You can erase any policy ambiguity when you incorporate the rules into the expense management system. The automation, thus, eases the expense reimbursement claim process reducing time and effort for everyone.

3. Communicate well

A comprehensive policy is only worthwhile if the employees in your organization are aware of the guidelines. Communication is important in devising a simple yet effective employee expense claim process.

As much as you must create a comprehensive yet simple policy, it is probably much more critical to make it accessible. Such an approach enables employees to learn about the rules quickly.

Pay attention to the language, as it goes a long way in ensuring that your employees understand and use it appropriately.

4. Focus on employee experience

Focusing on a better employee experience is a perfect way to create a simple and effective claim reimbursement process. Look at it from an employee’s perspective to design a process where the reimbursement turnaround time is short.

A clear policy ensures that employees do not waste time clarifying claims or replying to finance teams as they get the expense reports approved.

Automating the process also helps to simplify the process for both you and the employee. It also eliminates the need to save and maintain physical receipts. You can capture expenses, record, and submit everything online. It speeds up the process giving access to their reimbursement money swiftly. It has a direct impact on employee productivity and morale.

Quick Read: 4 Ways to Simplify Your Expense Approval System

Reasons why you must automate the expense reimbursement claims process

To begin with, organizations can quickly scale the challenges mentioned above with well-designed travel and expense management software. You can customize the software to suit your specifications. So, you can incorporate expense policies individual to your company into the architecture to ensure that expenses are 100% compliant.

Did you know that 45% of employees experience personal cash flow issues due to delays in their company’s reimbursement process? What is your turnaround time to reimburse expenses? What do your employees think of it?

Automation can genuinely transform the reimbursement process, which is part of travel and expense management. For instance, you can reduce the reimbursement turnaround time to about five days by automating.

Let us look at some significant reasons to automate the expense reimbursement claim process.

1. Overall experience improves

One of the most significant advantages of an automated process is that the employee experience improves dramatically. Employees can scan the proof of expenses through mobile apps and simultaneously compile expense reports. They need not save receipts anymore, nor must they worry about couriering the hard copies to their head office.

Since finance teams, managers, and approvers get real-time data, they can track and approve expenses instantaneously. This also lowers the time to settle claims, improving employee satisfaction.

2. Automatic T&E Compliance

Automation improves compliance dramatically. Policy violations are flagged off at the time expenses are raised as a claim. You can customize these built-in policy checks to suit your business needs.

For instance, you can design the software to disallow the employee from proceeding with an expense claim when it exceeds a specific limit. On the other hand, you can also manipulate the software to allow the expense reimbursement claim only if it goes through an additional set of approvals from other managers.

3. Better and complete visibility

The availability of real-time data gives the business visibility into employee expenses. Finance leaders can make better decisions based on accurate and relevant information churned out by the system.

You can compile and access valuable data available in visually appealing graphs, charts, or other reports so decision-makers can see the larger picture easily. Finally, these systems can adapt and scale up with your business, ensuring you do not lose stride as you grow.

Another aspect that finds appreciation in automation is the accurate tracking and calculation of expenses for your “feet on the street”.

Your employees in the field can use the mobile apps to add their start and start locations. For instance, Happay’s GPS-powered mileage tracker (Happay’s fleet management) is exceptionally designed to auto-calculate mileage rates depending on your requirements. The Happay app can also add mileage logs as expenses as soon as the employee completes a trip.

Automate with Happay

Do you want to overcome the challenges of manual reimbursement claim processes? Would you like better visibility into employee spend?

Look no further, as Happay brings you an all-in-one, well-integrated suite for corporate spend management. Offering the best mobile-first experience for both travel and expense, we improve your

- Pre-spend controls,

- Real-time reporting,

- Policy and compliance checks

You can customize a business expense management suite that matches your requirements with our mix-and-match solutions.

Some of the challenges you can scale with our products:

- Arrest cash leakages with our pre-paid cards. Consider using Happay Prepaid Cards for cash advances. On the other hand, eliminate the long approval chains and wait times as you empower your employees with Happay’s EPIC Cards. These cards are convenient to use, do not have markups for any payments made to international businesses, and can be tracked in real time.

- Employ the complete travel and expense management software solution for greater visibility into your expenses, fast-track expense reports, gain sharp insights, and automate compliance.

- Reduce employee expense fraud with Happay’s Smart Audit feature. The AI-powered expense auditing helps auto-flag spend anomalies such as duplicate bills, amount and other mismatches, and prohibited claims.

- Consider a digital petty cash management solution as you employ innovative pre-paid cards and petty cash management software (specifically designed for businesses with multiple branches, outlets, and stores).

This is just a snapshot of what we can do; if you want to know more, schedule a demo with us.

Conclusion

Expense reimbursement claims are just one of the many things that your accounting department does. However, managing it effectively (or not) has significant repercussions on everyone in the organization.

With automation, you can accelerate the process completely by expediting reimbursements, improving visibility, and reducing costs digitally.

Let Happay help you eliminate cost leakages, improve visibility and reduce errors as you sprint toward better financial health.

FAQs

When employees submit expense reimbursement claims for business expenses, they submit expense reports, also known as claims. It is a request to refund the money spent. On the other hand, reimbursement refers to the act of transferring money into the account of the employees.

A reimbursement could take any number of days, weeks, or months, depending on the complexity of the workflow. A manual process takes longer, but an automated process could be completed within a few days.

If the organization has automated travel and expense management software, you may begin the claim reimbursement process on your mobile phone/desktop and attach all relevant documents for a settlement. However, if the process is manual, you must fill out a form and attach physical documents (proof of expense).

Depending on limits set by the employer, you may claim medical reimbursements by attaching original medical bills of such medical expenses. You must also attach details of your health insurance policy or general insurance. Most organizations will have a checklist with documents you may need to present to the insurance company too.

Reimbursement claims may be rejected for many reasons, such as exceeding the limit set for the employee, amount mismatch (between original bill and claim amount), not being approved by the manager, and so on.