Expense Reimbursement:

Finance teams consume hours, days, and weeks in managing, tracking, and reconciling expense reimbursements. Meanwhile, your employees are racing against time to submit all the paperwork. Plus, the wait time for reimbursements is excruciatingly long. So, it is your hassle and their hustle!

Expense reimbursements do not have to be time-consuming or frustrating. Expense management can help you overcome these challenges and more. Stay with us as we dive deep into the subject.

What is expense reimbursement?

Expense reimbursement is when employees spend on behalf of the company during business travel and claim those travel costs back from the organization. Such repayments to employees may vary based on limitations provided by the organization in the expense policies.

Examples of expense reimbursement

A simple example of expense reimbursement is when an employee buys office supplies for the business, and then claims the expense. Once the employee purchases the product, they save the receipt and file an expense report. It becomes a valid employee expense reimbursement when employees receive approval.

Also, employees can claim travel, accommodations, and general subsistence expenses using an expense report at the end of the trip. Another example of travel reimbursement may be when employees claim travel expenses to a client site. The travel cost is calculated based on the standard mileage rate provided by your organization.

If your company processes expenses through a travel and expense management tool, you can pull the reports even as you incur the costs. Another excellent example of expense reimbursement is when employees claim expenses incurred on business travel.

Also, Read: Types of Expense Categories

What counts as employee business expenses?

You can categorize business expenses in several ways. However, the only thing that matters is that any expense paid personally by employees must comply with the travel and expense policies stated by the organization.

If the expense falls in any of the categories below, the business expense reimbursement is valid.

- Is the business expense necessary? Would any employee in your position incur the same expense?

- Travel expense is essential and unavoidable for the completion of the job.

- When employees use their own money for on-the-job expenses.

- The employee has filed a reimbursement claim for an expense paid for personally by the employee.

- Employees incurred the expenses exclusively in the performance of the job.

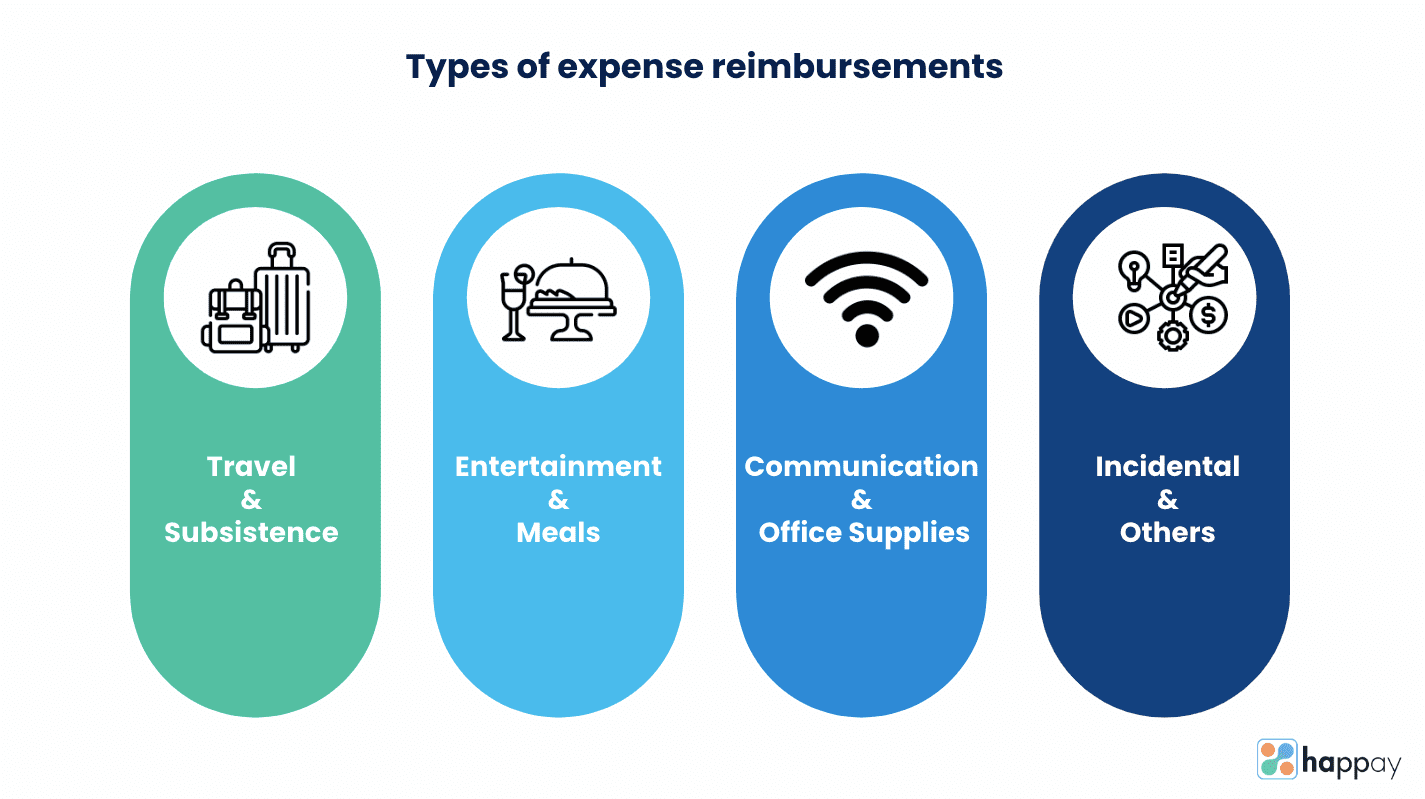

Types of expense reimbursements

There are several types of expense reimbursements, and expense reimbursements have several sub-categories. Here’s a look at the major types of reimbursements.

1. Subsistence and travel expenses

A majority of expense reimbursements consist of expenses claimed under this head. There are many expenses that an employee incurs during business trips. You can file business travel expenses into a single expense report, including transportation (airfare, train, and bus), hotel stays, and other expenses during the visit.

You can send the expense report for a settlement. The finance teams verify the accuracy and authenticity of the claim to settle or reject the same. So, all expenses arising around the logistics of a business trip will qualify as valid employee expense reimbursement claims.

Generally, the travel and expense policy must define and provide limits for such expenses.

2. Client entertainment and meals

To nurture a business relationship, employees may network or sit down for meals with clients or customers (existing or prospective ). Apart from this, there are cases where employees pay for meals during their business travel.

Since such meals and entertainment expenses are incurred in the company’s best interests, such expense reimbursement will be valid.

3. Communication, office supplies, and incidental expenses

With globalization, there is an excellent chance that your employees are working out of different locations. Making sure there is connectivity between your employees means you may have to consider reimbursing connectivity expenses.

Many companies cover cellular phone charges, internet connectivity, laptops, tablets, etc. So, employees traveling for business purposes may claim such expenses. Depending on individual policies, such business expenses may be refunded (with a limitation).

4. Other expenses

As long as these are work-related expenses, they are valid employee expenses. Defining these expenses and providing an exhaustive list that covers all those categories is the organization’s responsibility.

For instance, organizations encourage employees to sign up for health insurance and pay premiums toward medical expenses. Employees may claim some healthcare expenses (based on individual policies).

Similarly, employees may use their personal vehicles for client or customer visits. In such cases, organizations accept reimbursement requests for out-of-pocket expenses incurred for fuel.

Organizations often reimburse subscriptions (magazines related to the profession), gym memberships, etc.

Suggested Read: Remote Work Expenses

How should employees report expenses?

An ideal way for employees to report their business travel costs would be through an expense report. An expense report is an organized view of the list of travel or other expenses employees incur on behalf of the organization.

Some of the details mentioned in expense reports are:

- Employee information

- Current date

- Columns representing the expense categories

- Date when such expenses were incurred

- Approving manager details

Generally, travel and expense reports are exhaustive, so the finance teams and other departments can gather all relevant information without much back and forth. Also, original expense receipts accompany these expense reports so finance teams can validate them easily.

Managing expense reimbursements

It may be time to replace images of chaotic and frustrated employees with automatic and easy expense reimbursement processing.

Reimbursements are a critical aspect of expense management as it plays an important role in the efficiency of your process and how quickly you pay your employees. You can optimize the expense reimbursement claim cycle by managing and tracking expenses. It lowers stress for both you and your employees.

While some choose to manage the process manually, the easiest and most efficient way is to automate. Let us look at each of the aspects of managing the expense reimbursement process closely.

1. Tracking employee expenses

For finance teams tracking employee expenses manually, lack of spend visibility is one of the biggest problems. If you have a high volume of reimbursement claims, it makes sense to centralize them. Better spend visibility enables better business decisions.

A single source of truth is possible when you use an automation tool. It creates a seamless and easy user experience for employees while giving you access to valuable reimbursement data in a single place.

Dashboards allow you to view, track and manage requests while giving you the ability to pull reports on several aspects that affect your workflows.

2. Accounting expense reimbursements

It does not matter how good your expense policy is; manually accounting for expenses and reimbursements can be quite a hassle.

Capturing proof of expenses, verifying the authenticity of the claims, checking the approvals, and settling the claims can be time-consuming and frustrating for employees and finance teams.

However, you can overcome this challenge by automating the travel and expense management process.

The software can

- Capture proof of expenses on the go

- Help file claims quickly through a mobile app

- Approvals are instantaneous

- 100% compliance with expense policies

- Real-time access to and visibility of the information

3. Reconciliation

Several hundred man-hours are lost as your finance team spends days authenticating expense reimbursement claims. Automation can solve the problem while offering critical advantages in the expense reimbursement process.

- Since expenses are cross-checked for policy compliance as you incur them, you can save the time needed to authenticate each and every transaction.

- Since there is no data entry, errors are completely eliminated.

- Whether linear or deviational, approval workflows are automated, eliminating approval delays.

- Finally, since your finance team can track expenses in real-time, reconciliation is automatic, quick, and easy.

You may want to also read 6 steps to better travel policy compliance

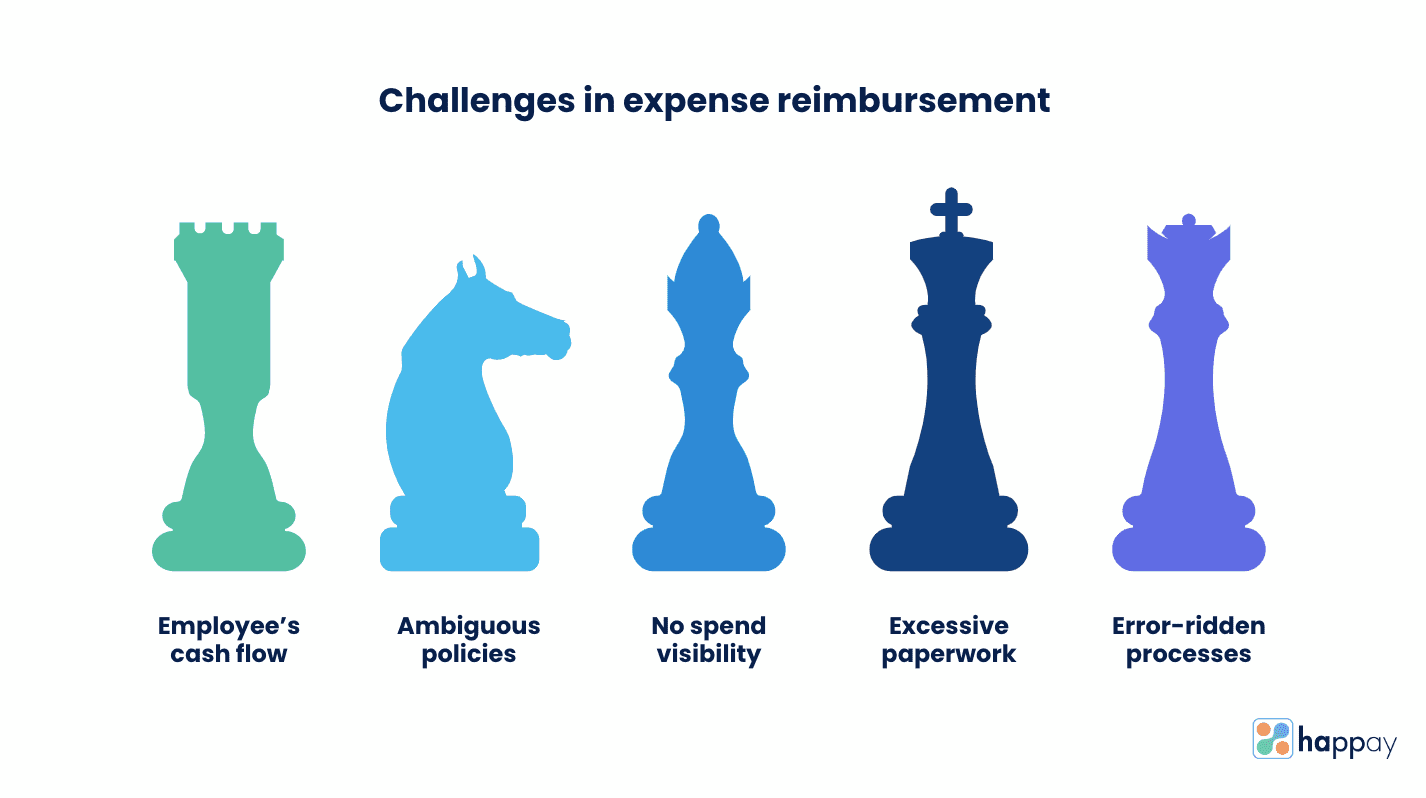

Challenges in expense reimbursement

There are numerous challenges that organizations face when they tackle employee reimbursements. The idea is to find a tool to overcome these while making the process efficient.

1. Restricting your employee’s personal cash flow

The biggest issue most employees have with the traditional process is that employees must spend their own money before they are reimbursed. Plus, it does not help that it takes quite a while for the expense reimbursement to come in.

Further, many organizations hand over cheques as settlements when a direct deposit would ease the cash flow problem immediately. While some may use their personal credit cards to pay for business expenses, it still leaves them short of funds.

2. Unclear expense policies

When travel and expense policies are complex or ambiguous, employees are confused about spending. It results in non-compliant claims or overspending. Policy adherence is important as it causes lesser challenges in reconciliation and streamlines the process.

Further, employee experience nosedives with lengthy expense claim processes and even longer wait for reimbursements. Clearly, in this case, expense policies become more of a roadblock than a guide to better workflows.

3. Lack of spend visibility

Employees are constantly spending on behalf of the business, but what if you disagree about how much and where they are spending? Can you do anything about it and in time?

If your processes do not allow you to access data in real time, you are probably stuck trying to approve and manage expenses after they have been incurred.

What makes this even more challenging is that these expense claims add up toward the end of the month. It bleeds into the month-end processes, adversely affecting the effort going into account closing.

4. Excessive paperwork

Expense receipt management is a huge challenge for both the employees and the organization. Employees feel the pain as they save receipts for expense reports. The problem grows when they travel a lot or must send those receipts to their head office at a different location.

Finance teams feel equally frustrated as these receipts must be matched with items in the expense reports, saved for audit purposes, and reconciled. Add to this the issue of clarifications where they must track emails sent to employees and their managers.

Fortunately, this has an easy solution as automation gets rid of receipt deposits, manual entries, and time-consuming reconciliations.

5. Error-ridden processes

Manual entries of expenses, tracking them, and recording the entries in the books or spreadsheets are a nightmare compared to the ease of doing everything digitally.

Apart from the time it takes, there is the challenge of errors caused due to the number of entries or the stress of deadlines.

Also, Read: 10 Best Receipt Scanner Apps

How to simplify your expense reimbursement process?

Expense management is essential to your business, especially. A tedious process frustrates employees and slows down the expense management process. It would help if you considered creating a clear-cut strategy to handle employee expense reimbursements.

Not only do the costs add up for your company, but they can frustrate your employees as they may end up waiting too long for the reimbursement.

The first and most important step to simplifying the expense reimbursement process is to design a crisp yet comprehensive expense reimbursement policy. This gives employees (managers and employers) clarity on the business-related expenses that qualify for reimbursement.

Crystal-clear guidelines will prevent wasted time and effort in tackling disputes, clarifications, and other arguments over settlements.

Also read: Everything you need to know about business travel spending

1. Technology for better expense reimbursement processes

Manual expense management processes can be a severe drain on your resources. It may be time to switch to an easier way to manage your expenses. While saving time and costs, you will see a sharp improvement in employee experiences.

For instance, Happay’s Travel and Expense Management Software will help you boost efficiency and productivity by automating the expense report submission process end-to-end. Firstly, the software allows employees to plan their business travel trips (choosing travel and hotel options that suit them).

Employees can quickly scan their travel expense receipts (OCR and AI technology) during business-related travel and collate information under an expense report. Once ready, you may send the expense report to the appropriate departments or people on the go.

You can automatically take care of approvals, policy compliances, and everything that matters in expense reimbursements. It saves time, effort, and money for your organization. Further, human errors, a common feature of manual processing, are eliminated.

2. Corporate Cards

Corporate credit cards are a perfect solution when considering revamping employee expense reimbursement. Depending on the regularity and size of expense reimbursement claims, consider offering this convenience to some of your employees (who travel often).

It will eliminate the problem of employees spending out of their pockets and later filing reimbursement claims.

Corporate cards are easy-to-use as they are accepted everywhere and provide an intelligent alternative for cash dealing. For instance, Happay cards are linked to their expense management software, making reconciliations a breeze.

Further, you can access it through the web or any mobile device. As your employees travel, you can fund their cards, track their expenses, set spending limits, or even block a card.

Quick Read: 10 Best Expense Management Software for your organization

3. Revaluate the existing expense reimbursement process

Sometimes, it may be as simple as evaluating the existing process to fix flaws as you see them. For instance, if your employees are traveling for a conference, it is most likely that you already know the dates, tickets for the conference, the possible hotel expense, per diem expenses, and so on.

Consider setting up pre-approval limits, so you can budget for the same while your employees need not worry about the reimbursement claim.

Reconsider your existing approval system. How long does it take for approvals to go through? Can you change the manager approvals number so the employee expense reimbursement is settled sooner?

Finally, consider changing the number of times employees submit their reimbursement claims. Instead of approving them at the end of the month,

- Can you consider approving them every fifteen days?

- Is it possible to approve expense claims as soon as they are submitted?

Small changes in your expense policies may lead to significant transformations in the time taken to process employee expense reimbursement claims.

Suggested Read: 10 Best Expense Reimbursement Software and Systems

Employee expense reimbursement template

Generally, companies have a unique format that employees can use for expense reimbursement. In such circumstances, it is best to use the same to submit an employee expense reimbursement claim.

Where there is no pre-set form for such a reimbursement claim, here are a few things that must be part of your reimbursement claim form.

1. Personal information

Any claim form must include personal information for your employee. So, if you are designing an employee expense reimbursement form, include the below:

- Name of the employee

- Employee Identification Number

- Department

- Details of the customer when you must allocate the expense to them.

- Details of reimbursements transferred to bank accounts directly.

- Description of expense

This part of the form must be simple so employees can easily list out the expenses, details of the expenses, date of expenses, and total of the expense. The details in this section must give all the information the finance team needs to authenticate and cross-check the expense before you send it for approval.

2. Proof of expense

Receipts, bills, and handwritten notes can qualify as proof of expense. Therefore, employees must attach any evidence they have supporting reimbursement claims. Ideally, the total amount claimed in the expense description must match the amount in the bills that the employee attaches to the document.

3. Signature

Any document, such as the expense reimbursement claim form, is only valid if it has the employee’s consent that the information is accurate and true. So, all expense claim forms must be signed by the employee submitting the claim.

4. Submission

You must submit the employee expense reimbursement form to the correct department. In most cases, Human Resources takes responsibility for verifying the claim’s authenticity before the finance team takes over to secure the approvals required to settle the claim.

Also, Read: Expense vs Expenditure

Conclusion

Expense reimbursement is a necessary workflow in all organizations. Whether it is a small setup or a large corporation, you can easily simplify and streamline the process.

Happay offers exceptional solutions to make these workflows efficient and effective. Happay expense is a feature that promises to help quicken the expense submission process while reducing the reimbursement turnaround time to 5 days.

If you would like to know more about Happay can help you do it; schedule a demo with us today.

FAQs

Business expenses are, by their very nature, unavoidable. However, employers can limit them by ensuring employees understand the difference between essential and avoidable business expenses.

No. Expense reimbursement is necessary when employees spend on behalf of the business. This may be incurred during business trips or when they claim reimbursement for an approved expense (per travel and expense policy).

No. The employee has already spent the money on a business expense previously. They are now claiming the same as a settlement, such as a previous expense.

Ultimately, it is the employer who will reimburse the business expense. However, the finance team ensures the process is completed without delays.

The reimbursement may take anywhere between a day and 15 days (or more), depending on whether the process is manual, the expense policy, and the claim’s authenticity.

There are two ways in which an unverified expense claim may be handled. First, the employee will be asked to provide clarifications. If the clarifications are not satisfactory, the claim may be rejected