Introduction to P2P Cycle

Efficient procurement and seamless payment processes are essential for sustained growth and success in today’s competitive business world. This is where the procure-to-pay (P2P) cycle steps in, serving as a comprehensive framework that encompasses everything from sourcing and procurement to invoice management and final payment.

In this article, we will delve into the intricacies of the P2P cycle, exploring its various stages, common challenges faced, and the significant benefits it offers for organizations. So, let’s get started.

What is the P2P cycle?

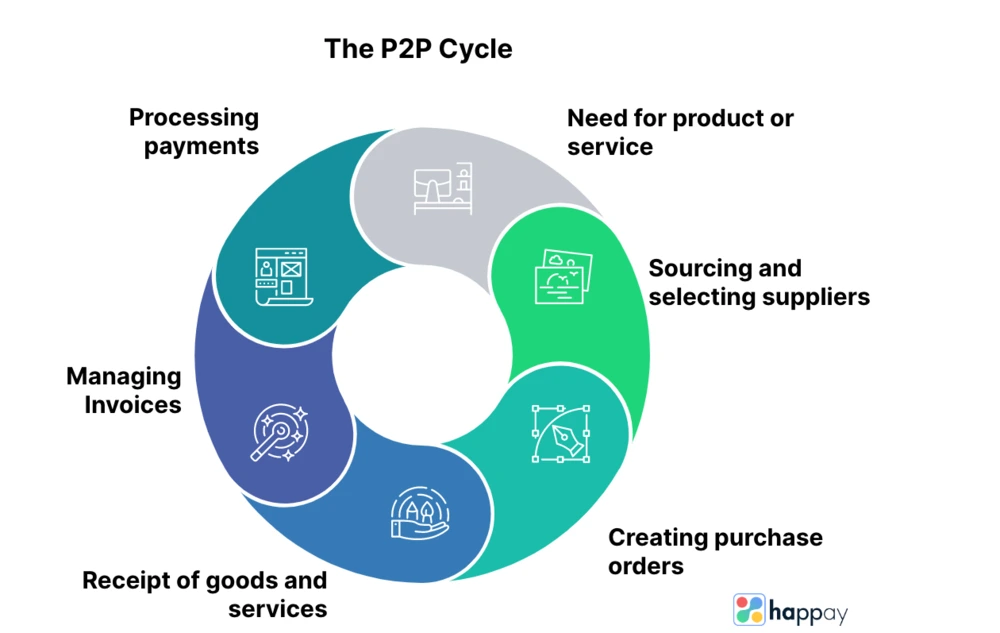

The P2P cycle is a vital business process encompassing the end-to-end journey of acquiring goods and services from suppliers. It goes all the way through to making the final payment. The process involves the following stages.

- Identifying the need for a product or service

- Sourcing and selecting suppliers

- Creating purchase orders

- Receiving goods or services

- Managing invoices

- Processing payments.

For example, consider a manufacturing company that needs raw materials for production. The process would look something like this:

- Initiating the procure-to-pay cycle by identifying the required materials

- Carrying out intermediate processes

- Paying the supplier for their services.

The procure-to-pay cycle streamlines the procurement and payment processes, ensuring transparency, control, and efficiency throughout the journey.

Importance of the P2P cycle in business operations

The procure to pay cycle offers a range of benefits for seamless business operations. It promotes transparency and control by providing a structured framework for managing procurement activities, from requisition to payment. Doing so helps organizations ensure compliance with internal policies and external regulations.

Additionally, the procure-to-pay cycle improves operational efficiency by streamlining accounts payable processes, reducing human errors, and automating workflows. Furthermore, the procure-to-pay system enables better supplier relationship management, fosters collaboration, and improves negotiation power. Organizations can ultimately expect cost savings and improved supplier performance.

Quick Read: 10 Best Accounts Payable (AP) Software

Benefits of implementing an efficient P2P cycle

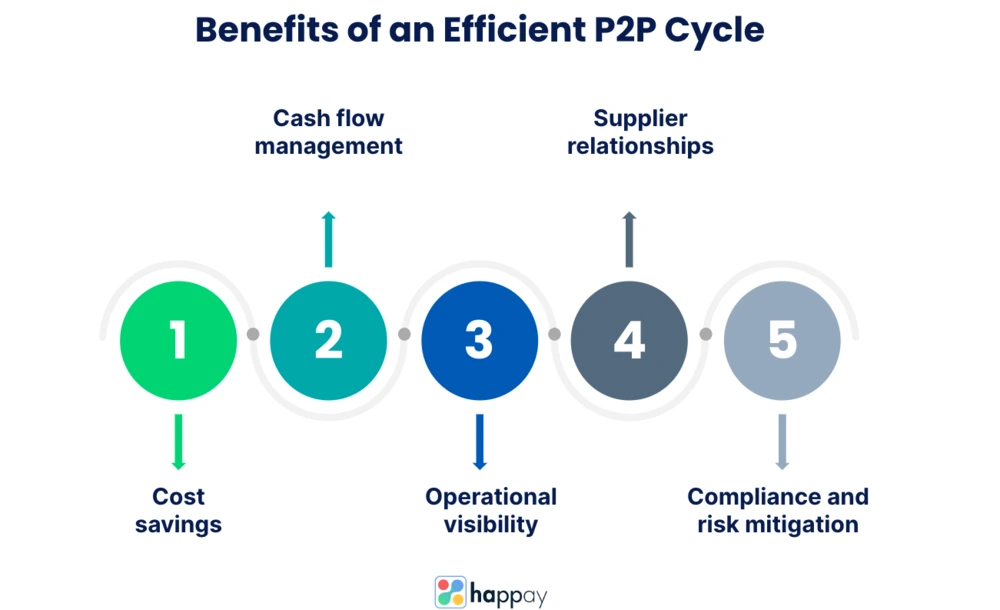

Here are the five benefits of the P2P cycle for your organization.

- Costs: An efficient P2P cycle brings substantial cost savings to organizations by streamlining procurement processes. It eliminates manual processes and automates workflows. These efficiencies help businesses reduce processing costs and improve overall operational efficiency.

- Cash flow: Implementing procure to pay cycle enables organizations to manage their cash flow better by automating vendor invoice processing and payment approvals. They can ensure timely payments to suppliers, which improves supplier relationships and potentially unlocks favorable payment terms. It can further help optimize working capital and enhance overall financial stability.

- Operational visibility: A well-implemented procure-to-pay cycle provides enhanced visibility into everything from requisition to payment. This visibility allows companies to track and monitor each step, enabling better control over spending. There is also improved budget adherence and compliance with regulations. Organizations can also leverage real-time data and analytics to make informed decisions and optimize procurement strategies.

- Supplier relationships: Efficient P2P processes allow organizations to foster collaboration and build trust with their suppliers. They can streamline communication, automate order management, and ensure prompt vendor payments. These factors also help promote better negotiation power, favorable pricing, and improved supplier performance.

- Compliance and risk mitigation: Companies can mitigate the risk of fraud, unauthorized spending, and non-compliance with a well-designed procure-to-pay cycle. They can automate approval workflows and ensure proper documentation to promote transparency and accountability. It thus reduces potential legal and financial risks.

Quick Read: 9 Best Vendor Payment Management Software

Components of the P2P process cycle

The procure to pay cycle consists of the following components that work together to ensure a seamless and efficient procurement and payment process:

- Requisition

- Vendor selection

- Purchase order (PO)

- Goods receipt

- Invoice management

- Payment processing

- Vendor management

What are the steps in the P2P cycle process?

The P2P process encompasses the following steps that facilitate the seamless acquisition of goods or services and the subsequent payment to suppliers. Let’s consider the example of a furniture manufacturing company.

1. Requisition

For example, the relevant employees in the company identify the need for a specific type of wood as raw material and submit a requisition form to the procurement department.

2. Supplier identification and selection

The procurement team evaluates wood suppliers based on price, quality, and delivery capabilities. They select a reliable supplier that meets the company’s requirements.

3. Purchase order (PO) creation

The procurement team creates a purchase order detailing the quantity of wood, specifications, and agreed-upon terms. They send the PO to the chosen supplier.

4. Order fulfillment

Once the purchase order goes to the supplier, they fulfill the order by delivering the requested wood within the specified timeframe. The organization closely monitors the order to ensure timely and accurate fulfillment.

5. Goods receipt

Upon receiving the ordered wood, the organization verifies and acknowledges the receipt. This step involves physically inspecting the wood, checking for any discrepancies, and recording the details in the system.

6. Invoice processing

Following the receipt of the wood, the supplier sends an invoice for the services offered. The organization matches the invoice with the corresponding purchase order and goods receipt, verifies the accuracy of the invoice, resolves any discrepancies, and prepares for payment.

7. Payment authorization

Once the invoice is validated, the organization authorizes the payment. This step involves reviewing and approving the invoice, ensuring compliance with internal policies and payment terms, and initiating the payment process.

8. Payment execution

Finally, the organization proceeds with executing the payment to the supplier. This can be done through cheques, electronic funds transfer (EFT), or online payment platforms. The payment happens within the agreed-upon payment terms.

Here’s a quick read on: What Is Purchase Order Automation and How to Do the PO Process?

How does the procure to pay cycle work?

The P2P cycle seamlessly integrates the procurement and payment processes within an organization. It begins with identifying the need for goods or services through a requisition, followed by supplier selection and purchase order creation. Once the supplier fulfills the order, the organization acknowledges the receipt of goods or services.

The invoice generated by the supplier undergoes validation and matching with the purchase order and goods receipt. After verifying the invoice’s accuracy, the organization proceeds with payment authorization and execution. Effective vendor management and adherence to internal policies and regulations are crucial throughout the cycle.

The procure-to-pay cycle ensures transparency, control, and efficiency in managing procurement and payment operations. It ultimately contributes to the smooth functioning of an organization’s supply chain.

Quick Read: Purchase Requisition vs Purchase Order: A Comparative Guide

Best practices for optimizing the P2P cycle

To maximize the efficiency of the P2P cycle, organizations can implement the following best practices:

- Standardize and automate processes: Establish standardized procedures and workflows for each step of the P2P cycle. Automate repetitive tasks such as purchase order creation, invoice processing, and payment execution to reduce manual errors, save time, and increase efficiency.

- Implement purchase order (PO) compliance: Enforce adherence to purchase orders by ensuring all purchases are against approved POs. The practice helps control spending, prevents unauthorized purchases, and reduces the risk of duplicate or incorrect orders.

- Enhance supplier management: Maintain accurate and up-to-date supplier information, including contact details, performance metrics, and contract terms. Regularly assess supplier performance and nurture strong relationships to improve collaboration and mitigate supply chain management risks.

- Embrace electronic invoicing: Encourage suppliers to adopt electronic invoicing methods, like electronic data interchange (EDI) or electronic invoicing platforms. It helps eliminate manual data entry, reduces processing time, minimizes errors, and enhances invoice traceability.

- Implement three-way matching: Utilize a three-way invoice matching process. It involves invoice matching against the corresponding purchase order and goods receipt. There will be enhanced accuracy, reduced risk of overpayments or duplicate payments, and improved control over the payment process.

- Leverage analytics and reporting: Use data analytics and reporting tools to gain insights into the purchase-to-pay cycle’s performance. Monitor cycle time, processing costs, and payment accuracy. It will help identify bottlenecks, measure performance, and identify areas for improvement.

- Implement segregation of duties: Separate responsibilities within the P2P process to prevent conflicts of interest and fraud. Assign different individuals or teams for requisition approval, purchase order creation, goods receipt, invoice verification, and payment authorization.

- Foster collaboration: Encourage cross-functional collaboration between the procurement department and the finance team. Open communication and collaboration improve efficiency, ensure alignment, and enhance decision-making.

- Improve and evolve: Seek feedback from stakeholders, benchmark against industry standards, and stay updated with emerging technologies and best practices to drive continuous improvement.

Read More: 6 Best E Invoicing Software

Common challenges in the P2P cycle

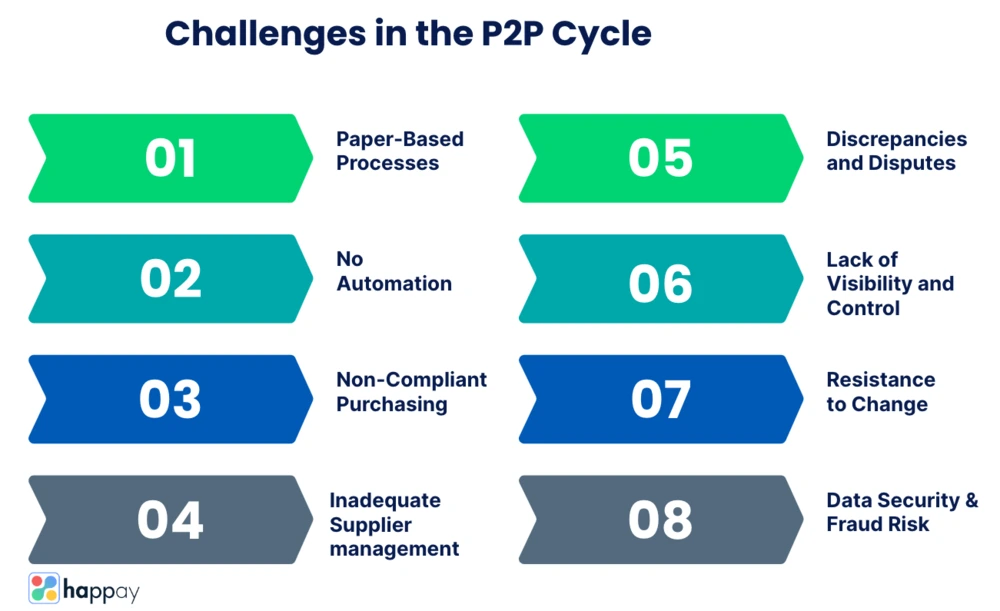

While the P2P cycle offers numerous benefits, it also presents the following challenges that organizations must prepare for.

- Manual and paper-based processes: Relying on manual and paper-based processes can lead to inefficiencies, errors, and delays. Manually handling purchase orders, invoices, and payments increases the risk of data entry errors, misplaced documents, and processing bottlenecks.

- Lack of automation and integration: Insufficient automation and integration among systems can hinder the smooth information flow between departments. It can result in data discrepancies, delays in approvals, and difficulties in tracking and reporting.

- Non-compliant purchasing: Organizations may face challenges in ensuring compliance with internal policies and external regulations. Non-compliant purchasing practices, such as maverick spending or bypassing established procurement procedures, can lead to increased costs, limited control, and increased risk of fraud.

- Inadequate supplier management: Poor supplier management can hamper the efficiency of the P2P cycle. Challenges may include unreliable suppliers, inconsistent quality, difficulties in supplier onboarding, and ineffective communication. It can impact the timely fulfillment of orders and lead to supply chain disruptions.

- Discrepancies and disputes: Discrepancies and disputes like incorrect pricing, quantity mismatches, or missing documentation can cause delays in payment processing and strained supplier relationships. Resolving these discrepancies can be time-consuming and require additional communication and collaboration between stakeholders.

- Lack of visibility and control: Limited visibility into the P2P process can hinder organizations’ ability to track and monitor activities. It can lead to reduced control over spending, increased risk of errors, and challenges in identifying areas for improvement.

- Resistance to change: When implementing process improvements and adopting new technologies, organizations often face resistance from employees accustomed to existing manual or legacy systems. Overcoming resistance to change and ensuring user adoption of new P2P processes and tools can be a challenge.

- Data security and fraud risks: The P2P cycle involves sensitive financial and supplier data, making it susceptible to security breaches and fraudulent activities. Inadequate data security measures, such as weak access controls or insufficient encryption, can expose organizations to financial losses and reputational damage.

Quick Read: Invoice Discrepancy: How to Avoid and Resolve Invoice Disputes?

Key performance indicators (KPIs) for monitoring the P2P cycle

Monitoring the following KPIs is essential for assessing the effectiveness and efficiency of the P2P cycle:

1. Purchase order cycle time

It measures the time taken from the creation of a purchase order to its final approval. The metric reflects the efficiency of the procurement process and helps identify bottlenecks.

2. Invoice processing time

Invoice processing time measures the duration from the receipt of an invoice to its final verification and approval. Monitoring this KPI enables organizations to identify inefficiencies and streamline invoice processing.

3. Payment cycle time

The payment cycle time measures the time from invoice approval to payment execution. It provides insights into the efficiency of the payment process, helping organizations ensure timely payments to suppliers.

4. First-time match rate

The first-time match rate indicates the percentage of invoices matched correctly against the corresponding purchase orders and goods receipts without requiring additional adjustments or manual intervention. A high first-time match rate shows better control and accuracy in the P2P process.

5. Vendor performance scorecards

Vendor performance scorecards evaluate and measure the performance of suppliers based on on-time delivery, quality, responsiveness, and adherence to contract terms. Monitoring vendor performance enables organizations to assess supplier relationships and optimize the supply chain.

Quick read: Procurement KPIs Guide: Top 10 Metrics to Measure Your Success

Emerging trends and technologies in P2P

The procure-to-pay process is witnessing the integration of various emerging trends and technologies, transforming how organizations manage their procurement and payment operations. Let’s explore some of the notable trends and technologies shaping the P2P landscape:

1. Artificial intelligence and machine learning

AI and machine learning technologies are revolutionizing P2P by automating manual tasks, improving data accuracy, and enabling intelligent decision-making. AI-powered systems can automate invoice processing, perform spend analytics, detect anomalies, and provide predictive insights for better procurement planning and supplier management.

2. Blockchain in procurement

Blockchain technology is gaining traction in procurement due to its ability to provide transparency, security, and traceability in transactions. Blockchain-based systems enable tamper-proof record-keeping, smart contracts, and real-time visibility into the supply chain. It reduces fraud risks, ensures compliance, and enhances trust between buyers and suppliers.

3. Robotic process automation (RPA)

RPA streamlines P2P processes by automating repetitive and rule-based tasks. The software can handle purchase order creation, invoice processing, and payment reconciliation. It reduces errors, improves speed, and frees human resources to focus on more strategic activities.

4. E-procurement and digital transformation

E-procurement solutions drive digital transformation in P2P, enabling organizations to digitize and streamline their procurement activities. These solutions provide centralized platforms for requisitioning, supplier management, purchase order creation, and collaboration.

Quick Read: 10 Best Purchasing Software for Organizations

Best P2P software

Selecting the right procure-to-pay (P2P) software is crucial for organizations to streamline their procurement and payment processes. A good P2P software solution should offer robust functionality, user-friendly interfaces, integration capabilities, and scalability. While the choice of procurement software depends on specific business needs, here are the five top procure-to-pay solutions in the market:

- SAP Ariba

- Coupa

- PRM360

- Basware

- Precoro

Read More: TOP 10 Procure-to-Pay Software Solutions in 2023

Bottomline

The P2P cycle plays a critical role in managing the procurement and payment processes within organizations. Seamless integration of these functions helps ensure transparency, control, and efficiency. It ultimately contributes to the smooth functioning of the supply chain.

Despite the challenges, implementing best practices and leveraging emerging technologies can optimize the P2P cycle. As organizations continue to embrace digital transformation, it is essential to prioritize the optimization of the P2P cycle to drive success in procurement and payment operations.

FAQs

Procure-to-pay (P2P) is a process that encompasses the entire procurement and payment cycle within an organization. It involves requisitioning, sourcing, purchasing, receiving goods or services, verifying invoices, and paying suppliers.

The P2P (Procure-to-pay) cycle focuses on the procurement and payment functions, while the O2C (Order-to-cash) cycle revolves around sales and revenue generation. P2P involves activities from procurement to payment, whereas O2C covers everything from order placement to cash receipt.

An example of a P2P process is when an organization identifies a need for a product or service, creates a purchase requisition, obtains approvals, issues a purchase order, receives the goods or services, verifies the invoice against the purchase order and receipt, and proceeds to make the payment to the supplier.

The P2P payment process involves verifying invoices, matching them against purchase orders and receipts, reconciling discrepancies, and initiating payments. It includes invoice verification, approval, and payment execution.

The main difference between P2P and O2C is the focus of the cycle. P2P centers around procurement and payment processes, while O2C revolves around the sales and revenue generation processes.

P2P refers to the end-to-end process that includes procurement, receipt of goods or services, verification of invoices, and payment to suppliers. Procurement, on the other hand, refers to acquiring goods or services from suppliers.

A P2P marketplace, also known as a peer-to-peer marketplace, is an online platform that connects individuals or businesses directly to facilitate buying and selling of goods or services. It eliminates the need for intermediaries, allowing users to transact with each other.

The advantages of a P2P system include streamlined procurement processes, improved supplier management, increased efficiency, reduced manual errors, and enhanced control and compliance.

P2P payment offers advantages such as faster payment processing, reduced dependency on paper-based transactions, improved transparency in payment status, simplified payment reconciliation, and lower transaction costs compared to traditional O2C payment methods.

In the purchasing process, P2P stands for procure-to-pay, which refers to the process starting from identifying the need for a product or service to making payments to suppliers. It encompasses the purchasing cycle from initiation to payment.

Discussion about this post