Introduction

We live in a world where you can access multiple services anytime, anywhere, with a single click on our phones. You can now order food, book a hotel, rent a car, and perform other tasks successfully with just a smartphone and the internet.

Business travel should be no different! You should be able to plan business trips with ease and receive travel expense reimbursements with equal ease.

Travel expense reimbursement meaning

Surely, if you have friends, you know what reimbursement means. You pay on their behalf and they pay you back later! We know that in the “friend” scenario, it almost never comes back, but in travel expense reimbursement, your money comes back to you within a specific time limit.

Today, in most organizations, reimbursement requests are entertained and processed manually or semi-automatically. Whether it is for employees or employers, this is nothing short of a nightmare. These manual processes are cumbersome and error-ridden, leading to long waiting periods.

Does your organization suffer from the same travel reimbursement inefficiencies? How long do employees in your organization wait before their expense claims are settled?

It’s high time you switched to an agile system that can make your firm’s travel reimbursement hassle-free. Do you know that you can bring down the travel expense reimbursement cycle to 5 days or less? Read on as we deep dive into expense reimbursement.

Also, Read: A Guide to Travel and Expense Management

How does travel expense reimbursement work?

Travel expense reimbursement is the process of paying your employees back for the out-of-pocket expenses incurred during a business trip. The firm must reimburse the employee fully if the employee, during the business trip, had paid from his wallet for expenses such as travel, food, etc.

Organizations globally verify the legitimacy of the expenses before reimbursing the employee. To do that, employees must submit a travel expense report with details of the actual cost. The line managers and finance teams then verify the report to ensure its legitimacy and compliance.

This entire process – if not automated – can take days or, worse, even months. Also, it can affect the employee’s productivity and negatively impact his morale – which will be reflected in his work!

Is travel expense reimbursement mandatory for employers?

As per existing labor laws in any country, travel reimbursement is not mandatory. However, if employees of an organization travel for the company and spend out of their personal pocket during such travel, then the organization is obligated to reimburse such business travel expenses.

To accommodate such expenses, organizations may consider providing a travel allowance for employees. On the other hand, on the provision of original receipts of expenses incurred, the amount may be reimbursed within a specific period (as decided by the organization).

How travel reimbursement benefits everyone?

Here are some of the advantages of reimbursement:

- Faster reimbursements will boost employee morale.

- Travel expense reimbursement is considered business expenses that can be used for tax deductions.

- It can also positively impact employee efficiency and productivity

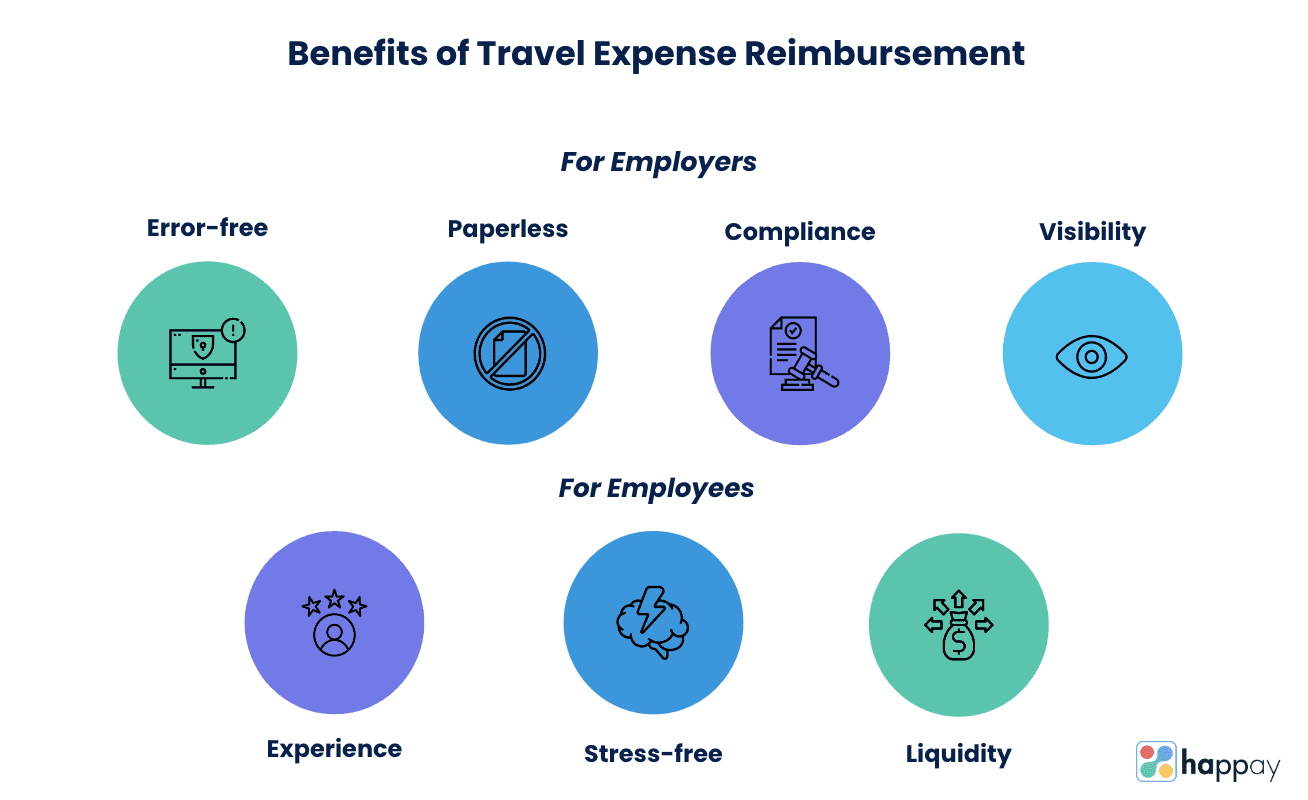

Let us look at this in more detail as we analyze the benefits for both employers and employees.

Benefits for employers

There are multiple benefits to automating travel reimbursement in your firm. Here are some of them:

1. Reduce errors

In traditional expense reporting and travel reimbursement processes, there’s a high chance of committing errors. The employee could make this error while submitting the expense report, the manager while verifying, or the finance department. Worry no more. Automation can help eliminate errors in these processes.

2. Eliminate paperwork

You can eliminate your firm’s mind-boggling amount of paperwork by automating the entire travel reimbursement process. Your supervisors and finance teams no longer have to go through a ton of paperwork and then approve or reject the report.

Instead, by automating the process, they can now view the reports on a single screen and approve or reject them with a single click. Thus, making the entire process quick and efficient.

Quick Read: 5 Easy Steps to Paperless Expense Filing

3. Greater policy compliance

Automation is your best bet if you aim for greater policy compliance rates in your firm. By automating the reimbursement process, you can prevent reports that violate your company’s travel policy from getting reimbursed. Furthermore, in most expense management software, if there are any policy violations in the report, the system will flag it and notify both the user and approver.

4. Increased visibility

Using automated software for travel expense reimbursement, you can get better visibility of where your funds are being spent. Additionally, using the system, you can accurately find the categories you’re overspending or under-spending. Centralized spend visibility gives you better control over your funds and helps forecast future expenses.

Benefits for employees

Now, let us look at how a good travel reimbursement process helps employees too.

1. Lowers the personal burden

When you have a good travel expense reimbursement process in place, your employees feel assured that personal money spent on business expenses will be reimbursed.

Any delays in the process may force them to be conscious of their spending habits. This may affect their liquidity when it comes to other essential personal expenses.

2. Stress-free travel

Structured travel expense reimbursement processes ensure that employees’ business travel trips are stress-free. They do not have to worry about reimbursement.

Timely settlements ensure that despite some lag in claim settlements, employees feel assured that if they provide original documents in support of their expenses, expenses will be reimbursed.

3. Makes expense claims easy

A simple yet complete workflow for travel expense reimbursement ensures that employees stick to procedures and expense policies. Employees prefer clear-cut rules and easy-to-follow procedures as this benefits them too.

Also, Read: Corporate Travel Management

What are reimbursable travel expenses?

Certainly, not all expenses will be reimbursed by your company. So, how do you know what’s acceptable and what’s not?

In this case, a comprehensive travel and expense policy works like a guide!

a) What is travel expense reimbursement policy?

A travel reimbursement policy of a company is an official document that specifies the rules and procedures for travel expense reimbursement. Here are some of the aspects a travel reimbursement policy typically covers:

- Travel expenses your firm will cover

- Travel expenses your firm will not cover

- How employees should report expenses

- How and when will employees be reimbursed

b) What to include in a travel expense reimbursement policy?

Since the travel and expense policy covers all aspects of travel expense reimbursement. It must be your “go-to” document for any clarifications in this regard.

Let us look at the types of expenses that are included in the policy.

1. Travel expenses

The travel expense policy must detail the expenses that your firm will cover. Here are some of the travel-related expenses that most organizations cover:

- Airfare

- Hotel accommodation

- Cab

- Meals

- Fuel

- Parking

- Toll

Make sure you mention the spending limits clearly, so the employees don’t overspend and end up not receiving reimbursement.

2. Level of the employee

In some organizations, the level of the employee plays a significant role in the reimbursement process. In your travel policy, mention the business travel expenses you will reimburse at the employee level.

3. Non-employees

In some organizations, the travel policy states that employees can take their family and spouses along for the business trip. Some organizations also reimburse the expenses for the employee’s family members; if your firm is ready to do that, then state it in the policy.

4. Exclusions

In your expense policy, make sure you include the travel costs that will not be covered. This way, your employees will know where to spend their money. Here are some of the items that most companies do not reimburse:

- Alcohol

- Flight and hotel room upgrades

- expenses incurred on family members

- Non-policy compliant expenses

5. Responsibility of employees

State all the steps your employees need to follow for reimbursement. In some companies, employees need to submit all the receipts along with their travel expense reports manually. On the other hand, in some companies, employees are required to submit it digitally. Make sure you add the reimbursement approval workflow into the policy. This way, your employees know whom to contact when reimbursement takes time.

6. Time

Mention the estimated time for the reimbursement to be reflected. This way, your employees will know when to expect the reimbursement.

7.Per diem

Employees’ daily allowance to cover business-related expenses is called per diem. Ensure you include per diem rates and other related information in the policy.

So, that brings us to the question of what expenses are allowed and what are not.

c) Allowable expenses

Here’s a list of all allowable travel and other incidental expenses that can be reimbursed:

- Transportation

- Meals

- Lodging

- Cab

- Car rental

- Baggage fees

- Gifts

- Internet

- Laundry costs

- Visa charges

- Fuel cost

d) Non-allowable expenses

All expenses that do not comply with your firm’s travel policies are non-allowable expenses. Also, personal expenses that employees incur are non-reimbursable. Here’s a list of non-allowable expenses:

- Personal mobile bills

- Parking tickets and violations

- Upgrades

Also, Read: A Guide to Creating Corporate Travel Policy

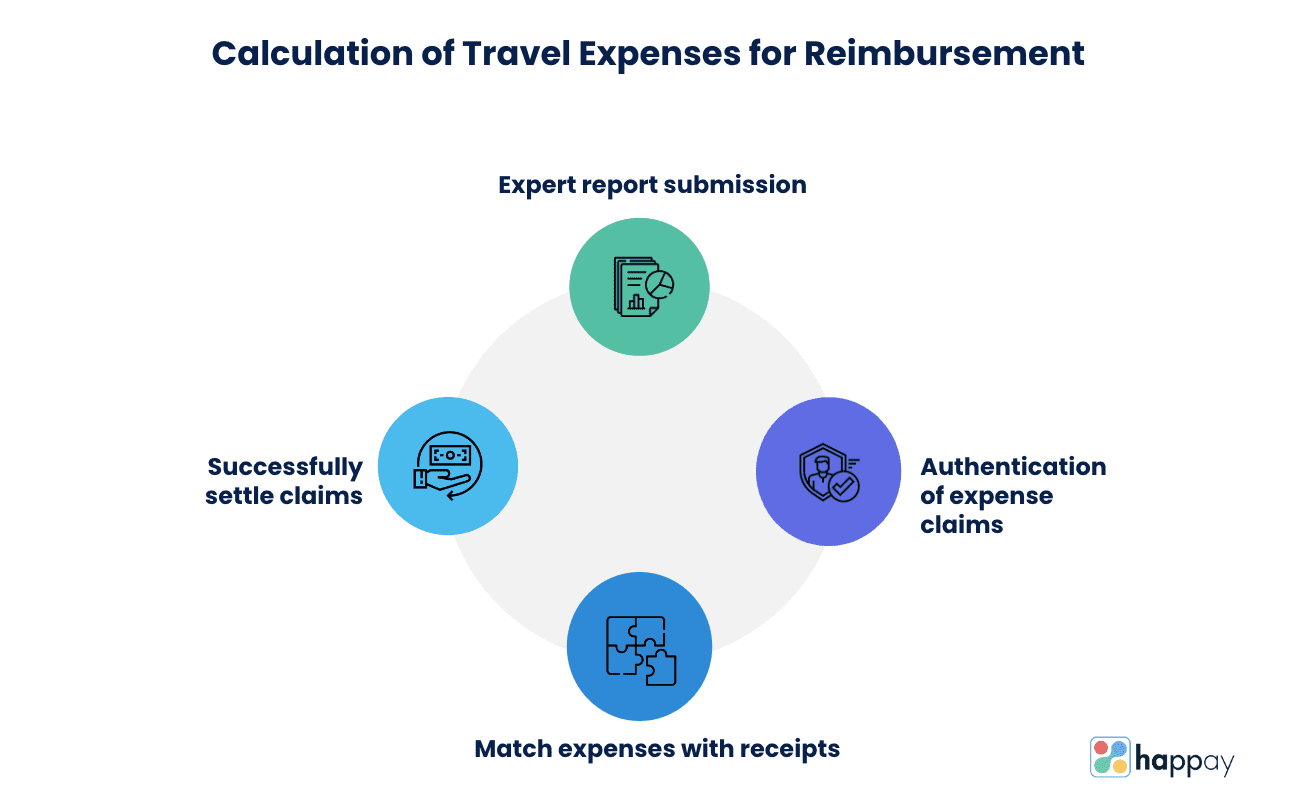

Calculation of travel expenses for reimbursement

Calculation of travel expenses is an important aspect of expense management. Even if there are just a few expense claims, wrong calculations can have an impact. To avoid this, clarity on the process of calculation of travel expenses is essential.

Let us look at how to calculate travel expenses for reimbursement.

1. Calculate reimbursements using an expense report

A travel expense report is a document that contains a list of all expenses that the employee incurs during the trip. The sum of all those expenses is what constitutes the travel expense reimbursement amount.

Travel expense reports may be submitted through manual or digital methods. Manual methods are time-consuming and prone to errors. Digital methods are quick and easy to use. So, both employees and employers benefit from such a process.

Want to know more? Check out our blog on travel and expense report

2. Authenticate claims

One of the most important stages is to authenticate the claims made for expenses incurred during travel for business purposes. Travel and expense policies clearly mention claimable expenses. The finance team must validate these claims by ensuring that they are compliant.

For instance, they may cross-verify that amounts are within the permissible limits or that the mileage rate used is the right one for the employee (based on grade and other parameters).

3. Match expense amounts against original receipts

The next stage involves confirming that the expenses claimed were actually incurred by the employee, matching the actual expense (no fraud or padding), and proof of such expenses is attached to the expense report.

For instance, an employee may have claimed an amount and attached the original receipt for dry cleaning. A quick look at the policies may confirm that dry cleaning charges are not reimbursed by your company.

4. Settle claims

Once the above parameters are met and the claim is valid, you can settle the employee’s claim. For instance, for transportation costs, your finance team must verify that the employee has only claimed fuel costs (within permissible limits for their employment grade) where he has used a personal vehicle.

Then, you can either directly credit the employee’s bank account or use any other process that is followed in your organization.

Also, Read: A Guide to Business Travel Management

Challenges in travel expense reimbursement

1. Manual processes

Manual processes are a big hurdle for quick and efficient travel expense reimbursements. From the time that an expense report is filed to when the claim is eventually settled, it crosses too many hands. It not only increases the time takes to settle the claim but increases the chances of errors or fraud.

2. Unclear travel and expense policies

Unless your travel and expense policy is comprehensive and clear, you are looking at problems and endless delays in expense reimbursements. You must simplify your travel and expense policy so employees understand it better and stick to the rules. Similarly, when the approval workflows are clearly defined and straightforward, the process is smoother and quicker.

3. Complicated workflows

Complicated workflows can seriously hamper your travel expense reimbursement process. Whether you have linear or multi-layered workflows, it is important to keep them simple and straightforward. The clarity in the approval process goes a long way in ensuring that employees get approval quickly and the claims move to the next stage as quickly as possible.

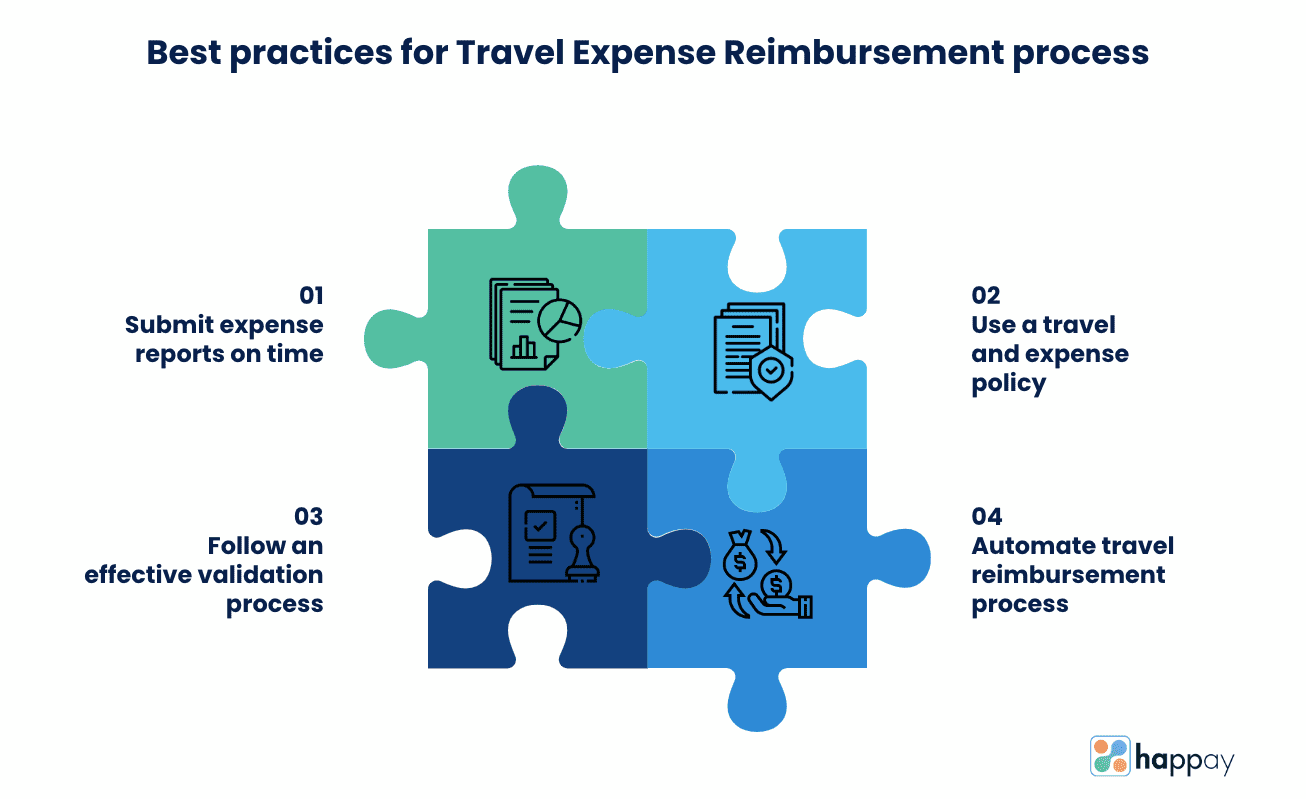

Best practices to streamline your travel expense reimbursement process

Looking to speed up the travel reimbursement process in your firm? Here are our best practices to make your company’s reimbursement process hassle-free.

1. Submitting expense reports on time

Delays in submitting expense reports are one of the important reasons for a slow employee travel expenses reimbursement process. To tackle this issue, set a deadline for submitting expense reports to which your employees must adhere.

2. Follow an expense policy

A clear and well-defined expense policy has multiple advantages. From reducing fraudulent claims to increasing the policy compliance rate to eliminating out-of-policy spending, expense policy can positively impact your reimbursement process. If you do not have an expense policy for your firm, we recommend formulating one to make the reimbursement process smooth.

3. Implement an effective validation process

For the finance team, it’s arduous to go through each report and check for compliance. Due to this strenuous task, the chances of approving reports violating your policy are also very high. That’s why it’s always best to automate validation to speed up the process.

4. Automate travel expense reimbursement

By automating the travel expense reimbursement process, you can save both money and time for your organization. Additionally, automation can make the entire process quick and error-free.

Also, Read: Expense Management Automation

Impact of automation on travel expense reimbursement

Do you know that organizations that have moved to an automated expense management system have quoted “Reimbursing employees faster” as the second biggest reason for digitizing T&E

When every other part of your business is being digitized, why ignore employee travel expenses?

Manual processes hinder productivity and are time-consuming. It is time to move to a simpler travel expense reimbursement process – for employers and employees. Now, reimbursing employees can be quick and easy. With an automated and efficient travel expense reimbursement system, you can

- Save on several hundred man-hours dedicated to authenticating and reconciling corporate travel expenditures.

- Digitally access travel expense data in real-time allowing your finance team to spend time on other critical parts of your business.

- Perform expense tracking digitally and access data instantly for better reporting and analysis.

Essential features in an ideal travel expense reimbursement system

According to a 2020 Forrester study, 30% of finance leaders in top firms are unhappy with their T&E solution. Therefore, before zeroing in on a travel reimbursement system, here are the things you should look for:

1. It has an advanced OCR technology

Manually filling expense forms with data from invoices and receipts is a thing of the past now. Thanks to optical character recognition in most expense software, your employees now just have to click the receipt picture. OCR will then automatically capture the invoice data and create an expense.

2. It should auto-capture expenses from all sources

Let’s accept it, manually filling out expense forms requires a special kind of superpower. Pick an expense software that auto-captures expenses from multiple sources like emails, SMS, credit, and debit card statements, TMCs, etc.

3. It can detect non-policy-compliant expenses

An efficient travel reimbursement system must automatically detect expenditures that do not comply with your company’s T&E policy and notify you. Thus helping you in maintaining a higher compliance rate.

4. It has the best UI

Spare your employees from using automated systems with an old, cluttered user interface. Instead, pick software that has the best and easy-to-use UI.

5. GST compliance

Pick a T&E system that makes your firm GST compliant and allows you to claim ITC for all booking and expenses.

Also, Read: 10 Best Travel Management Software

Simplify your travel expense reimbursement with Happay

If you’re looking for the best automated T&E management system to make your firm’s expense reporting and reimbursement process robust, your search ends with Happay. Known as Asia’s #1 T&E management solution for India’s conglomerates, we offer a complete paperless expense management solution with incredible cost savings.

Here are some of the key features of Happay:

- You can offer a superior employee experience for your traveling employees and become a tech-savvy employer to attract the best talent in the industry.

- We offer 100% visibility as you enjoy better predictability and control over your T&E budget.

- Whether it is international or domestic, employees can self-book flights and hotels in one user-friendly app on mobile or the web. Pre-spend violations, real-time reporting, and policy configurations can be customized and are included in the system’s architecture.

- File travel expenses on the go using the in-built OCR technology in Happay

- Happay auto-captures expenses from email, text messages, credit card statements, and other sources.

- Automate per diem based on expense data

- Happay’s GST return module can help gather all your GST data in one place. Save more on your travel spending with accurate ITC claims

And the benefits do not end here. Want to know more about Happay? Schedule a demo with us today.

Conclusion

Travel expense reimbursements are always a sore point for employees as it is associated with emails back and forth along with long wait times. However, it does not have to be so.

Apart from numerous other benefits, automated expense management solutions ensure that the turnaround time for travel expense reimbursements is short. As employees enjoy the quick settlements, finance teams can stay stress-free as reconciliations and other reporting are insightful and automatic.

FAQs

In most companies, for travel expense reimbursement, employees must submit expense reports along with proof of expenses.

As long as the reimbursement is for expenditures incurred for the organization, such expenses are not taxable income. Whether it is an allowance included in the income is a question that can be answered by looking at the employee’s individual salary details.

Here are a few expenses that businesses reimburse:

a) Air ticket/ train fare

b) Cab fare

c) Meals during the travel

Since travel expense reimbursement is not an income for the employee, it need not be reported as income by the organization too.