Introduction

In 2020, India’s travel market value was estimated at 74 billion USD. This number is expected to grow to approximately 127 billion USD by 2027.

A travel policy for employees in India is crucial as it clarifies the organization’s position on travel within and across India. Many times, employees may transit through the country. Procedures and rules that cover expense reimbursement in all these scenarios are helpful for employees and

What is travel policy for employees?

Corporate travel comes with a whole set of challenges. If you do not plan well, you and your employees will spend more time planning business trips and reconciling the resultant expenses.

Imagine you have just purchased a product that comes with its manual. This manual gives you a clear picture of the features, dos, and don’ts. Following these instructions will allow you to enjoy and use the product for as long as possible.

A travel and expense policy is precisely like the manual. It tells you everything your employees need to know about your organization’s expense culture, what’s reimbursable and what’s not. The ideal scenario is when such a policy covers all aspects and leaves no room for ambiguity.

So, a travel policy for employees is a perfect guide to understanding how the business tracks, records, and reimburses all categories of expenses.

Read More: A Guide to Corporate Travel Management

Why should organizations have a travel policy for employees?

Employees traveling for business purposes must know what business expenses the organization will reimburse. Broad guidelines about eligibilities, travel advances, expense claims, and reimbursement processes will help offer clarity to traveling employees.

A travel policy for employees in India will ensure that

- Employers can put down guidelines for everyone in the organization.

- Employees can adhere to rules and regulations without worrying about expense claim rejections.

- There is no ambiguity about expense claims and approvals

Read More: 5 Steps to Automate Expense Approval Process

Writing guidelines for expense payment modes in travel policies for employees in India

1. Online payment policy of employees

It is hard to imagine payments in physical cash or cheques. Employees who often incur business expenses use online payment methods for business travel expenses. It is essential to add guidelines for such payments in the company travel policy.

You can restrict expenses by allowing certain websites or excluding certain others. For instance, you can give your employees Happay travel cards with pre-set limits. You can load these cards with an amount and limit employee travel expenses to that value alone.

2. POS payment policy of employees

In an attempt to make it easy for employees to spend during their travels, organizations also make POS payments possible. Company travel policies for employees must clearly mention rules for using corporate cards or money at POS counters. You can put together a list of approved merchants using MCC (Merchant Category Codes).

For instance, employees may use corporate credit cards at numerous POS or retail outlet counters. They can pay for products and draw cash according to pre-set limitations. When an employee tries to swipe a corporate credit card at any store, they may only be able to do so if the store is on the approved list.

3. ATM payment policy of employees

Employees can also pay for business travel expenses by allowing cash withdrawals through ATMs.

For instance, you can give employees corporate credit cards with a pre-set limit. Also, they can use them in specific ATMs (locations, cities, and so on).

What are (MCC) merchant category codes?

Credit card issuers use 4-digit codes to classify businesses based on the goods and services they offer. You can use such merchant category codes to discourage transactions of a specific type.

For instance, all organizations discourage the use of corporate credit cards for the purchase of alcoholic beverages. So, you can add the appropriate MCC or merchant category codes for those products to the restricted categories. Another example is if you restrict the usage of corporate cards to only certain hotels or restaurants.

Also, Read: 7 Top Online Travel Booking Trends and Statistics

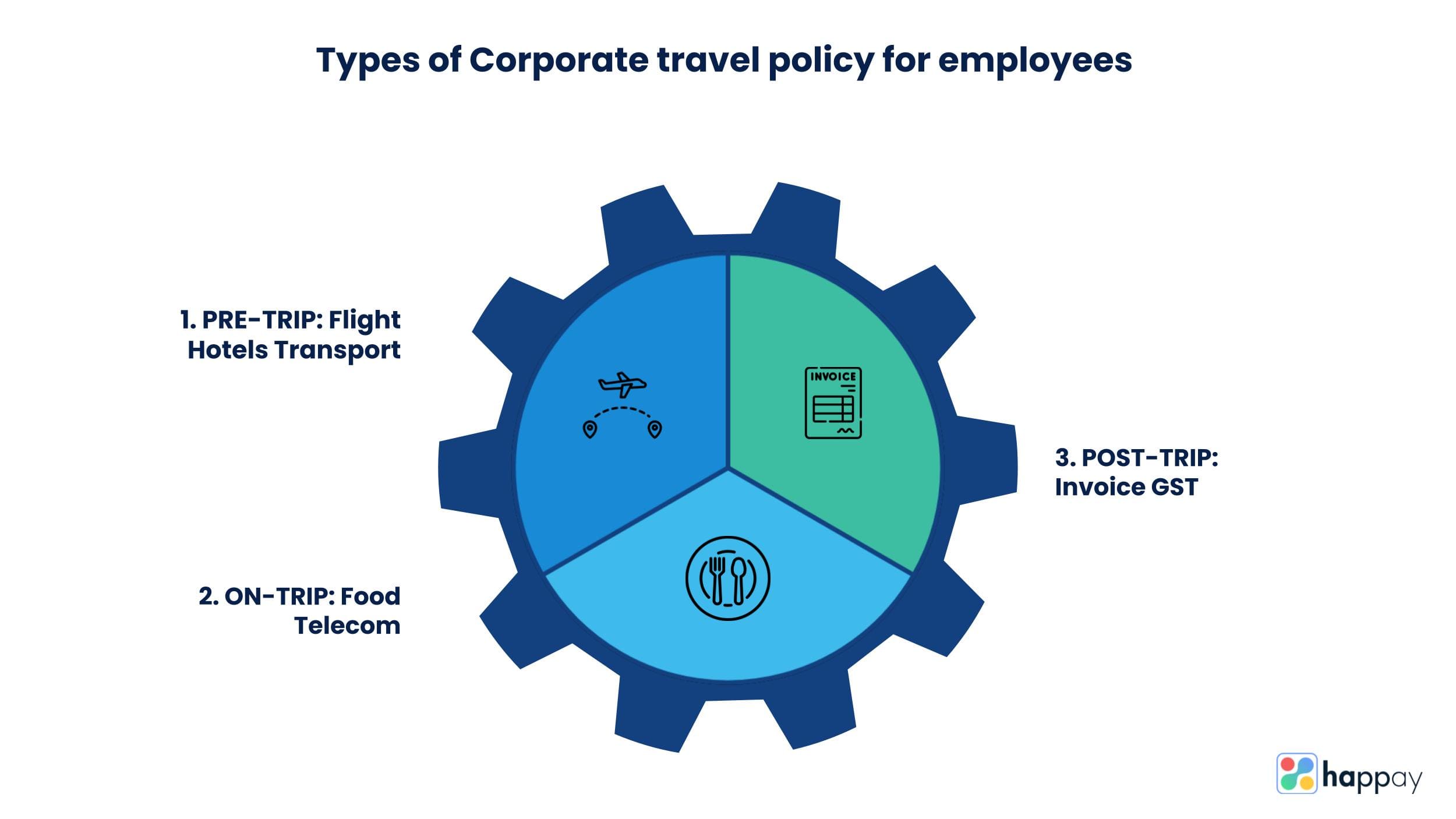

Types of corporate travel policy for employees in India

Travel policy for employees in India must include a set of general and specific rules for travel-related expenses that your employees may undertake. It should be comprehensive yet concise, so employees get the appropriate information without confusion.

Read on as we give you an idea of how you can go about writing a good travel policy for employees.

Here’s how you may approach it.

1. Pre-trip business travel policy for employees

The pre-travel policy must clarify everything your employees need to know during the business travel planning stage. Whether you work through a travel agency, have a dedicated travel desk, or allow employees to plan their own travel, a travel policy can make your workflows more efficient.

A centralized and automatic system that allows employees to plan and book their travel is the perfect way to simplify the process and make it error-free.

For instance, Happay’s travel and expense management system offers a self-booking tool that not only allows employees to view numerous travel options but also allows you to customize the platform to include your policies. So, whether it is domestic or international travel, it will ensure employees plan their travel only within permissible limits.

1.1 Flight

At this point, you must cover domestic and international travel rules by providing specific information about employees and their entitlement regarding

- Flights

- Flight ticket class (business class or economy class)

- Routes or sectors (acceptable and to be avoided)

- Cancellations, delayed, missed, or flight bookings

- The upper limit that any employee can spend on a flight or airfare.

- Anything that you still need to cover in the previous list.

1.2 Hotel

A travel policy for employees in India must clarify the position on hotel accommodations. Apart from mentioning permissible limits for employees (could be based on seniority or other factors), the policy must clarify:

- Hotel names, a chain of hotels, the number of stars, and other distinguishing qualities allow employees to pick the right option quickly.

- If your organization has a list of preferred hotels (you may have negotiated special fares for your employees), you must include the list here.

- Clarify the organization’s position on booking various room categories such as single, suites, or others.

- Your position on room service, food, and other services, such as laundry and spa facilities, must be stated.

1.3 Transportation policy

Transport guidelines deal with employees’ transportation choices within or outside the city. It clarifies your position on how much the employee can spend on transportation. So, whether it is cabs, trains, buses, autos, or any other means, here are a few ideas on how to approach it.

- Include a list of approved transportation methods

- Mention the kind of acceptable receipts (physical or digital)

- If you plan to reimburse fuel charges for personal vehicles, mention the rate, tracking methodologies, and the receipt submission for reimbursement.

The mentioned rules are just an idea of how comprehensively you can design your travel policy for employees.

Quick Read: 10 Best Travel Management Software

2. On-trip business travel policy for employees

2.1 Food

As regards meals during business travel, you can include the following in your policy

- Per diem rates

- Breakfast, lunch, and dinner reimbursable expenses

- Team outings or customer entertainment meals where you must mention upper limits clearly.

- Clarify your position on tips or random other expenditures in this category.

2.2 Transport

Transport guidelines have been covered extensively in the previous section. If there are specific rules about transport in another city or state that you may have missed, you should do so here.

2.3 Telecom

Suppose your organization reimburses telephone bills, internet connectivity charges, or other fees that may be necessary for the employee to stay connected on behalf of the company. In that case, you must clarify the position here.

- Do you redeem the bills for telephone and internet? If so, then the maximum limit.

- Consider offering options for reimbursement when your employee misplaces or is a victim of theft.

3. Post-trip business travel policy for employees

3.1 Invoice

Employees must understand the importance of asking for an invoice. Employees must back even the most minor or insignificant amounts spent on official travel with an invoice.

Depending on whether your expense management is automated, employees scan those invoices or save the physical receipts to file an expense reimbursement claim.

3.2 GST

It is preferable to ask for GST invoices as this helps your organization claim the correct amount from the government. It would be best to communicate the importance of such GST-compliant invoices and bills. Also, mention if the absence of such GST invoices will be a reason for the rejection of expense claims.

Quick Read: Travel Expense Reimbursement

Employee travel policy violations guidelines

Let us assume an employee is traveling to Ahmedabad for official purposes. While your organization takes care of travel insurance, there is no clarity on modes of travel. So, the employee uses the most expensive cab service. The reporting manager rejects the expense, saying that this counts as a personal expense!

What would you do?

In this section, the travel policy for employees must emphasize the responsibilities of the employee to ensure that they collect sufficient proof of any business expenses they incur.

- Employees must plan their trip knowing the company’s resources are not theirs. So, as best as possible, they must plan their travel arrangements reasonably. (So, in the example above, since the employee was not acting reasonably, the reporting manager was right in rejecting the claim)

- Employees must collect all bills and receipts against expenses, save them, and submit them within a reasonable time, as mentioned in the policy.

- You must mention the minimum and the maximum number of days it will take for employees to receive a reimbursement.

- A critical part of the travel policy for employees is the travel policy violation. It would help if you clarified the consequences of violating the rules or guidelines.

Also, Read: How to Create an Expense Reimbursement Policy?

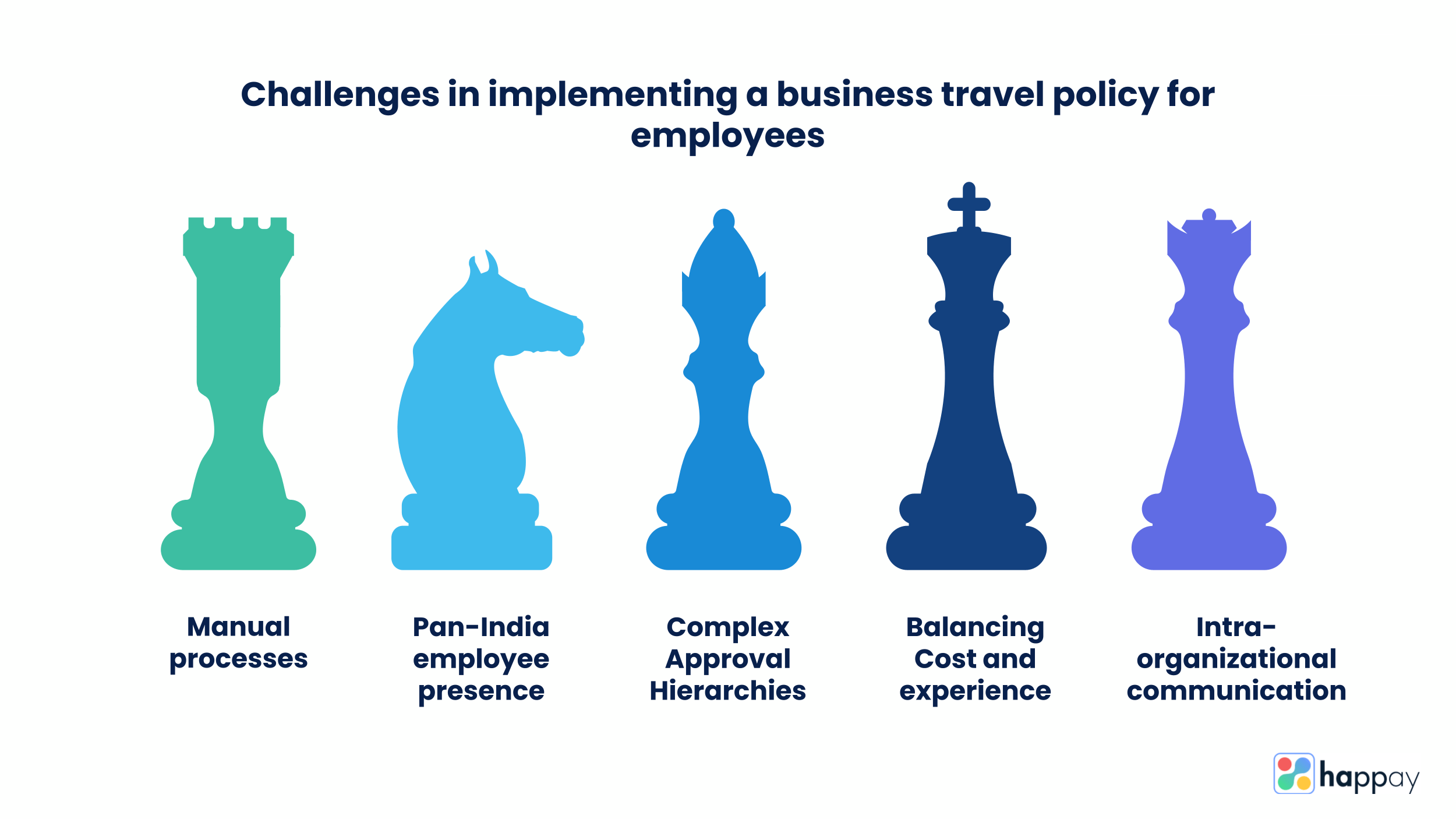

Challenges in implementing a travel policy for employees in India

1. Manual processes

Do your employees send physical receipts from different parts of India to the head office? Does your finance team take weeks to compile and reconcile these expenses? How long does it take to post relevant data entries?

Traditional workflows may be cumbersome, but they are often a monotonous routine that most finance teams indulge in as part of their month-end processes. They may complain but consider it a part of the job description.

A business travel policy that automates or proposes new guidelines or workflows may face resistance from employees. Whether it is from finance teams that must learn new ways or from employees who must abide by new policies or rules.

Quick Read: How To Streamline Travel Request Approval Workflow?

2. Too many employees across the country

What if you have as many employees in Pune and Bangalore as you have in Idukki, Kerala and Durgapur, Kolkata? As these employees travel across states on official work, the nature of their business expenses vary greatly. So, your policies must give equal importance to guest house stays and local conveyance along with hotel room rates and car rentals.

A challenge that many organizations face is employees working in different parts of the country. The travel policy must cover scenarios that are equally relevant to all employees. Any errors or omissions may lead to ambiguity. Unclear policies can majorly cause erroneous or false travel and expense claims, draining your time and resources.

3. Complex approval hierarchies

What is your reimbursement turnaround time? Do the complex approvals have anything to do with it?

An expense claim submission may go through a single approval or multiple levels of approval depending on the kind of claim, amount, and seniority of the employee. The greater the complexity or level of approvals, the more time it takes to reimburse your employees.

Designing and creating a travel policy incorporating such complex approval hierarchies is hard. One of the chief complaints with such policies is that there is a delay in reimbursements, affecting employee experience. Secondly, employees may need help understanding the policy.

4. Intra-organizational communication

Ask your employees about the latest travel policy change. How many of them would know about the company travel policy or any updates on the same?

You may have a comprehensive and well-defined travel policy, but it is only worthwhile if you communicate it well across your organization. What methods of communication does your organization use to educate or inform your employees?

It may be utterly pointless if you have an excellent travel policy but do not have a medium to communicate it amongst your employees.

5. Cost-effective and employee-centric

Would you allow higher airfares for your employees (not cost-effective for your organization) or restrict it to low airfares (employees may only get a few travel options affecting their travel experience)?

Let us assume an employee must reach Mumbai urgently to address the concerns of your client. Per your travel policy, employees must book only the lowest available fares on any route.

In this case, air travel from Chennai to Mumbai at the lowest fare is only possible after a stop in Hyderabad. what do you do in this scenario? Save travel time and book an expensive flight? Or only approve the low-cost option?

The biggest challenge in implementing a company travel policy for employees in India is ensuring you have a policy that incorporates the needs of your employees while being cost-effective for your organization.

Quick Read: The Transformation of Travel and Expense (T&E) Automation

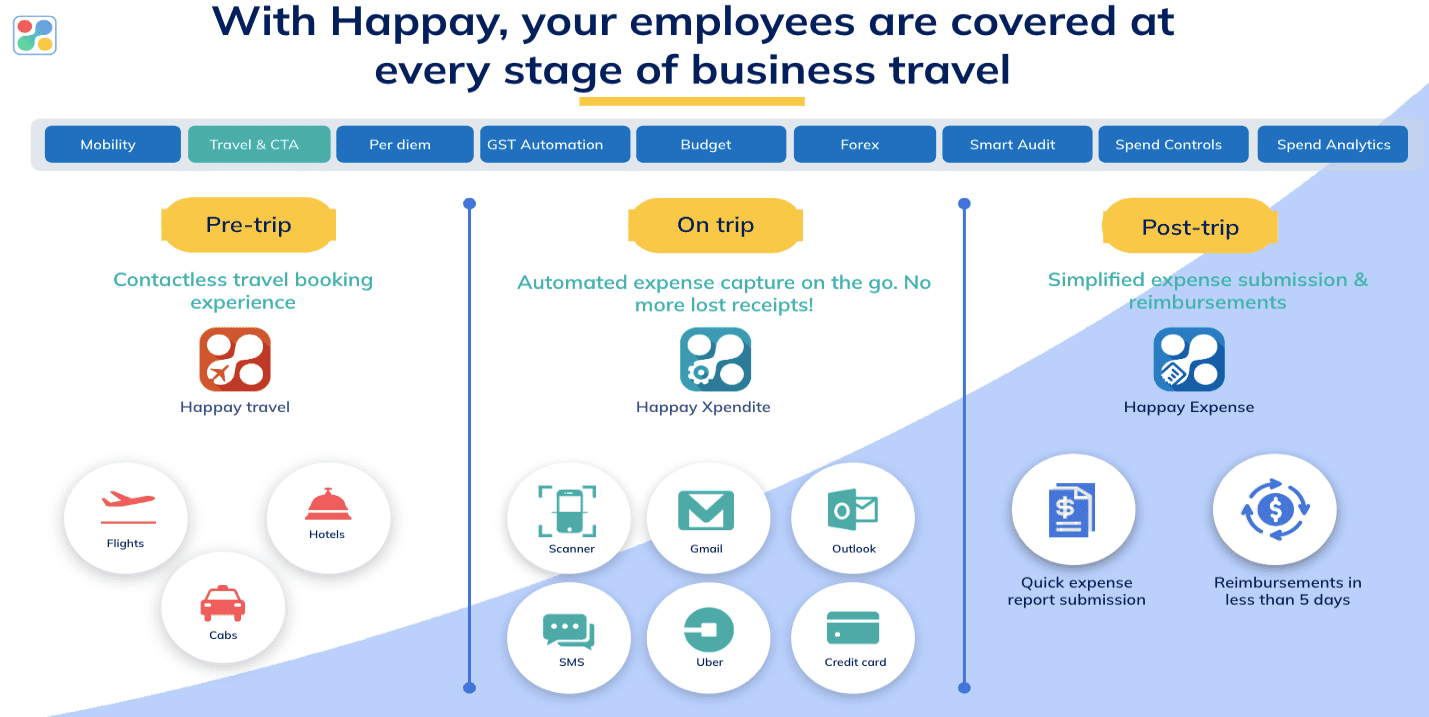

How can Happay improve travel policy for your organization?

Happay’s three pillars of success for a modern T&E policy can help you improve your travel policy compliance.

The three pillars are

- Better employee experience,

- Financial efficiency and accuracy, and

- T&E spend visibility and control

While designing the right travel policy for your employees in India is a critical step to conquering your travel and expense challenges, what is more, important is finding the right software to support your travel policy requirements.

Happay’s travel and expense management software offers support in multiple ways to ensure that you improve your travel compliance. For instance,

- It offers a self-booking tool with a millennial-friendly UI for both a quick and contactless travel booking experience. The tool integrates with Happay Expense for automated expense capture, simplifying your expense management experience.

- Pre-spend violation alerts are available for flights and hotels, ensuring employees are alerted about the violation. Based on the information, they can choose other options. It leads to 100% policy compliance.

- Happay’s expense tracking app offers a route tracker to eliminate fraudulent claims and cost leakages.

- Our customized software captures accurate GST breakups right before expense report creation. It can capture vendor GST details (using OCR) and auto-calculate GST breakups during report submission.

FAQ’s

A typical corporate travel policy includes rules for expenses on airfares, accommodations, or meals. Such guidelines often include rules on submitting expense reports, proof of expenses, approvals, and reimbursements.

Corporate travel or T&E policy defines the organization’s view on various aspects of business trips. So, airfare, train fare, lodging, meals, and other subsistence expenses are all covered by the corporate travel policy.