What is invoice management?

Invoice management is a business function that facilitates the procurement process. It involves the process of managing supplier invoices. Along with facilitating prompt payments, invoice management helps businesses determine the legitimacy of an invoice.

The steps involved in invoice management are as follows.

- Getting the invoice

- Analyzing the details

- Validating the invoice information

- Approving the invoice payment

- Extracting invoices and transactions and saving them on a database

Also, Read: What is an Invoice: A Comprehensive Guide

Why is invoice management important?

Invoice management streamlines all purchase and procurement-related information. It helps create a comprehensive database of all purchase orders, payables, transactions, etc.

Here are a few reasons why invoice management is essential.

- Accurate and streamlined processing of spend data

- Fewer cost leakages

- Compliance with expense policies

- Increased spend visibility for finance officials

- Better vendor relationships

- Complete overview of purchase patterns and behavior

Also, Read: What is Spend Management?

What are the different types of invoices?

Companies procure different kinds of products and services from different vendors. Consequently, the types of invoices the companies get are also of different types. The type of invoice can also differ depending on the client industry, vendor industry, or previously agreed upon terms.

Here are a few types of invoices businesses commonly receive.

- Interim invoice

- Proforma invoice

- Final invoice

- Recurring invoice

- Debit invoice

- Credit invoice

- Collective invoice

- Overdue invoice

Let’s see what these invoice types entail.

Interim Invoice

When projects or orders stretch for a period of time, vendors can send you the invoice intermittently. That is, when the work has started but not yet done.

Proforma Invoice

You will receive this from vendors before any service has been rendered. It doesn’t necessarily mean that you have to make the payment right away. It is rather a notice of the due date or the expected payment timeline.

Final Invoice

This is the final invoice you will receive by the service provider. It will have the details of all the purchases made, services rendered, and good sent. It also contains the final balance due after all the transactions have been made.

Recurring Invoice

You will receive these invoices at specific intervals for long-drawn projects.

Debit Invoice

These invoices are memos used to make minor adjustments to existing bills. If a vendor has underbilled you, they will send you a debit invoice detailing the balance due.

Credit Invoice

Much like debit invoice, a credit invoice makes adjustments to a previous payment. They include the amount that is owed back to you and means that you should expect a refund. It happens if you were charged extra by mistake or accidentally made duplicate payments.

Collective Invoice

If a vendor is taking care of multiple orders or projects for you, they can issue a collective invoice consisting of all the individual invoices for particular services. Collective invoices have the sum of all the smaller invoice amounts.

Overdue Invoice

You will receive an overdue invoice if you default on your payment. Defaulting on a payment means that you didn’t send the vendor money before the agreed upon due date.

Also, Read: What is Invoice Financing?

What are the biggest challenges in invoice management?

While small businesses get only a few invoices every month, large enterprises receive hundreds of purchase invoices. Managing invoices in bulk is not an option, as every invoice has to be validated and vetted individually.

Hence, a lot of invoice management challenges arise.

- Invoice process is highly time-consuming

- Delay in payments can result in penalties

- Irregular payments can make you lose credibility

- Disrupted cash flow management

- Data extraction complexities can result in data contamination

Invoice processing takes a lot of time

Manual invoice processing is a long and time-consuming process. Every invoice must be reviewed, validated, and reconciled against bills before approval. This process can take weeks for large enterprises to process a single invoice.

Delay in payments can result in penalties

Manually processing invoices can lead to invoice errors and result in payment delays. Depending on the vendors, this can result in heavy penalties. Late payments can also cause vendor dissatisfaction. They may lower the service or quality standards. This can result in reduced quality for your own end products.

Irregular payments can make you lose credibility

Credibility and goodwill are two important factors in supplier relationships. Multiple missed deadlines and irregular payment habits can make you lose credibility as a customer and result in poor reputation. This may result in loss of good deals with established vendors.

Disrupted cash flow management

Managing multiple invoices from multiple different vendors is confusing. Even if you are up to date with all the payments, certain vendors may send the invoices late. Another problem that may arise is receiving invoices twice for the same purchase. You may end up paying double for a purchase. This brings in the hassle of recovering extra money.

These unprecedented cash outflows can cause disrupt the company’s cash flow. Additionally, an unclear overview of purchases and exact expenses can cause issues in the cash flow management process.

Data extraction complexities can result in data contamination

Companies process hundreds of invoices per month. Many data points in the invoices are large numbers across a range of data points. Manual data extraction can result in data contamination. A few simple errors can result in continued confusion, overspending, delayed and missed payments, etc.

Also, Read: 11 Best Billing Software for Small Business

How to manage your invoices?

Before discussing the best ways to manage invoices, let’s take a look at the two main ways you can perform a task.

- Manual invoice management

- Automated invoice management

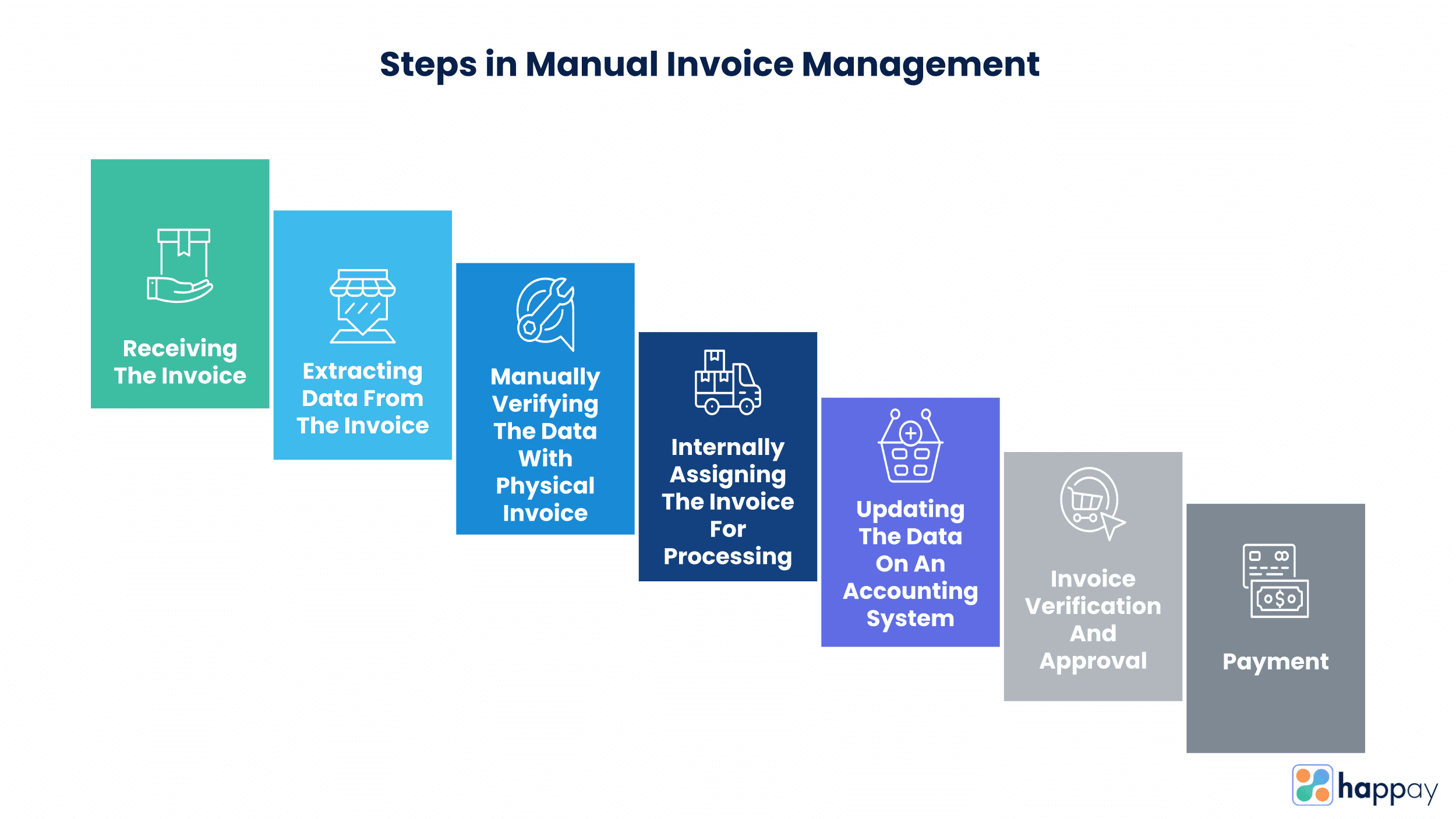

Manual invoice management process

A manual invoice management system relies on human expertise and skill to process invoices. This method is outdated and not recommended for large businesses that handle hundreds of invoices at a time.

How does manual invoice management work?

Manual invoice management involves the following steps.

- Receiving the invoice

- Extracting the data from the invoice

- Manually verifying the extracted data with the physical invoice

- Internally assigning invoices for processing

- Entering the invoice data into accounting software/accounting spreadsheet/erp

- Invoice verification and approval

- Payment

What are the bottlenecks in the manual invoice management system?

Manual invoice management relies on physical bills and receipts for invoice processing. It is a slow and outdated method of processing invoices.

Let’s look at a few common bottlenecks of the manual invoice management system.

- Simple human error can cause data contamination, delay payments, disrupt cash flow, sour reputation, and weaken vendor relationships.

- The records are not maintained digitally and are hence vulnerable to sudden loss, corruption, or breach.

- Validating invoices physically also restricts search functionality and, in turn, increases the per-invoice processing time.

- Delayed payments can result in heavy fines which can add up to a huge monetary loss for the company.

Quick Read: Difference Between Invoice and Bill

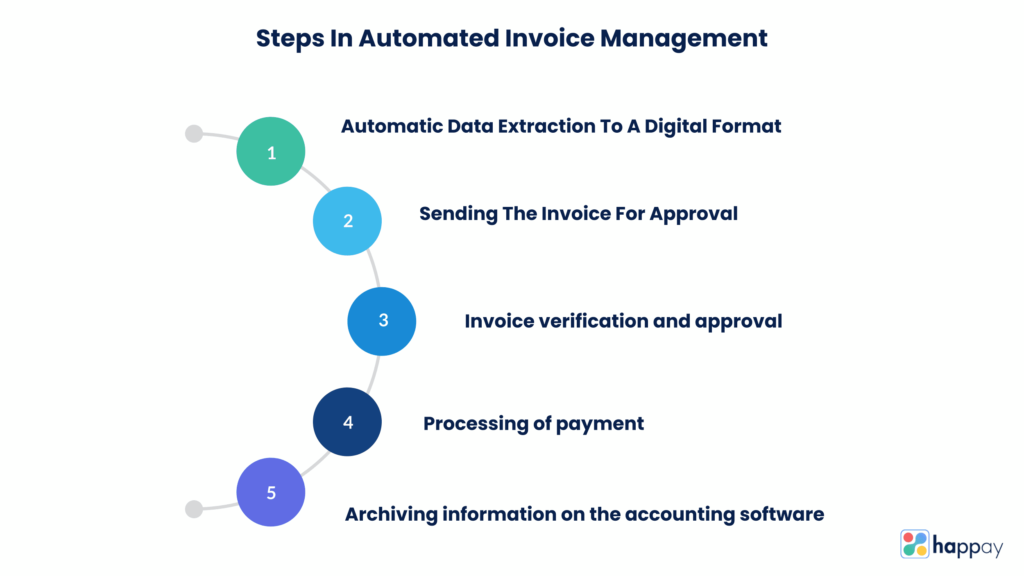

Automated invoice management process

Automated invoice management, as the name suggests, is the automation of the invoice processing function. It is a software that helps extract, process, store, and manage invoice data.

It helps accurately extract and verify payment details and facilitate timely and prompt payments. An automated invoice management system efficiently eliminates the time-consuming and repetitive steps involved in manual invoice management.

How does automated invoice management work?

Here are the steps in automated invoice management.

- Automatic data extraction to a digital format

- Sending the invoice for approval along with notification to the approver

- Verification and approval (or rejection) of invoice

- Processing of payment

- Archiving invoice and payment information on the accounting system

Benefits of automated invoice management system

Automated invoice management facilitates end-to-end processing of invoices. From data entry to data storage, every step of the process is programmed into a linear automated workflow.

Let’s look at a few benefits of automated invoice management.

- On-time payments

- Better vendor relationships

- Increased credibility

- Saving processing costs

- Increased compliance

- Time saved on manual invoice processing

- Accounts payable or ap automation

Cons of automated invoice management

- Integrations with accounting software may take time

- The returns might not justify the cost in the case of very small businesses

Also, Read: A Guide to Vendor Payments

Difference between manual and automated invoice management: which is best?

After assessing the bottlenecks, challenges, and benefits of both methods, we can safely conclude that automated invoice management is better for large organizations.

Manual Invoice Management |

Automated Invoice management |

| Data extraction from paper invoices takes a long time | E-invoicing makes data capture easier |

| The data captured may have errors and inaccuracies | The data captured will be accurate |

| No digital database will make the invoice records vulnerable to loss | All data will be stored on a cloud-ready architecture |

| Slow approval process | Fast and robust approval process |

| Manually making every payment | Streamlined payment process- automatic transfer of funds is possible |

| No tool to efficiently track invoices | Easy invoice tracking in real-time |

| No rewards | Possible rewards on payments and early payment discounts by vendors |

Quick read: Invoice Vs Receipt: Importance, Differences, and Components

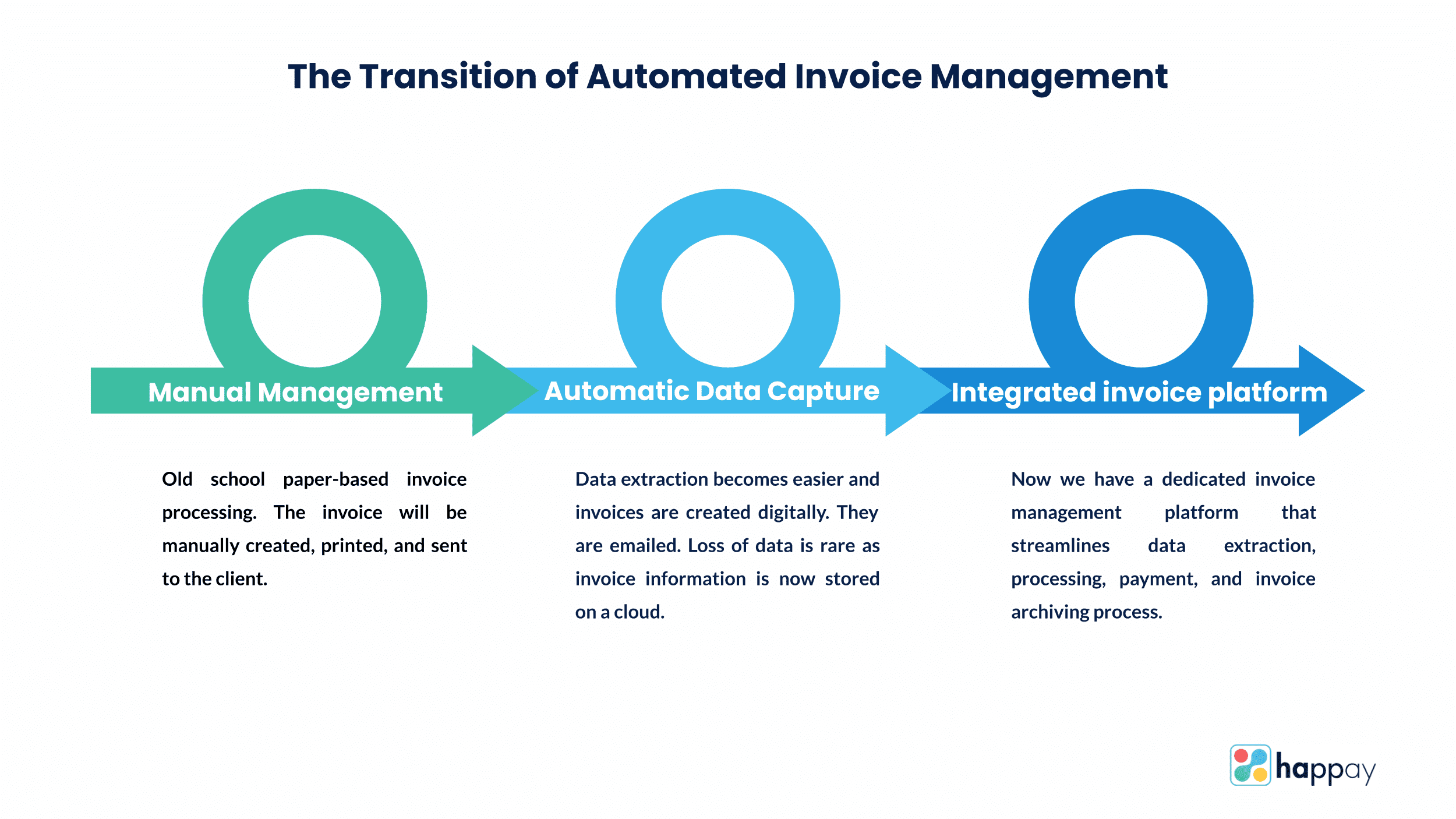

The transition of automated invoice management systems

Automated invoice management was not an intelligent process until very recently. The use of artificial intelligence and machine learning in workflow automation are fairly new concepts.

And while OCR technology dates back to 1974, the modern use of OCR to extract selective data to enable complex workflow automation didn’t happen until the late 90s.

Let’s see how invoice management has evolved.

Top 5 automated invoice management systems and platforms

1. Happay Invoice

Happay, a company best known for its end-to-end integrated travel and expense management software and corporate credit cards has launched its new product – Happay Invoice.

Happay invoice fully automates invoice processing. Tailored specifically for medium and large businesses, Happay is a platform that has a very easy vendor registration process. It effectively facilitates direct bank transfers, better liquidity management, quick turnaround, and has a robust approval process.

2. FreshBooks

FreshBooks is an invoice management software that comes with comprehensive templates, easy payment solutions, app integrations and a robust reporting module. FreshBooks is an exhaustive invoice processing tool. However, its mobile application functionality is limited.

3. Stampli

Stampli is a fully automated accounting payable automation software. It unifies payable communication, documentation, payments, and credit cards in one single platform. It gives the accounts payable department complete spend visibility over business expenses.

4. Bill.com

Bill is a financial and accounting automation software made for small to medium-sized businesses. It facilitates easy automation of financial workflows, including expense management, receivables management, and payables management.

5. AvidXchange

AvidXchange is an automated accounts payable platform for mid-sized businesses. It offers complete automation of the invoice and payments processing workflows. AvidXchange allows you to readily access invoice information from a dashboard. It also gives you a cloud-ready solution for archiving your invoices.

Suggested Read: 12 Best Invoicing Software for Your Business

Happay automated invoice management software

Happay Invoice is an end-to-end invoice management solution. It automates 100% of the invoice management process and has the following unique features.

- Direct funds transfer

- Easy vendor integration

- Smart dashboard

- A robust invoice approval process

- Better liquidity management, etc.

Schedule a demo with the Happay team to know more about the product that can transform the way you handle payments.

Conclusion

While using manual processes can work on a small scale, invoice automation is crucial for medium and large businesses. Manual invoice processing can lead to a number of problems arising from delayed payments. These problems can be easily solved by adopting automated invoice management software with basic invoice processing features.

FAQ’s

An invoice management system is a set of workflows that facilitates the processing, verification, management, and payment of invoices.

The invoice management system is used by organizations that want to optimize their invoice processing and payable process. The following departments can find an invoice management system useful.

a) Accounts payable team

b) Finance department

c) Internal auditors

Happay Invoice is an invoice management platform that automates the complete invoice management workflow seamlessly. It is the best software in the market for invoice processing at the moment.

An e-invoice is an electronic invoice that can get automatic electronic authentication by GSTN on the GST portal.

Invoice management reporting is the process of accounting invoice data. It is the system of recording invoices received, paid, and sent.

Companies usually have two ways of managing invoices- manual and automatic.

An invoice management platform is a software that facilitates end-to-end invoice processing.