Invoice processing

Manager: So, the word invoice is not working. Our vendors need to pay up.

A perplexed Akash: OK. So, do you want us to change the word?

Manager: Yes! The term is too soft and friendly.

A further perplexed Akash: What do you mean?

Manager: We need a word that says “pay up or die!!”

Are invoices constantly on your mind? Do you record, track and pay your invoices manually? How many invoices does your finance team process in a day?

In manual processes, a person can process approximately about 1000 invoices a month (if we assume about 5 in an hour). However, this number assumes that invoices follow a standard format and are all error-free!

What is invoice processing?

Invoice processing refers to the entire cycle of receiving an invoice from the supplier, verifying its authenticity, approving it, remitting the payment, and documenting the same in the accounting books.

Also, Read: Types of Invoices

Why you must automate your invoice processing?

You can put technology to use and streamline manual and error-ridden invoice processing workflows. Invoice process automation saves you costs and can free up your employees’ time to be more productive elsewhere.

While ap automation benefits the payable department, invoice processing automation can ease your everyday challenges. Whether it is a standardized generation of invoices, capture, tracking, or storage, you will see improvements all around the organization.

You can manage supplier invoices more efficiently, reduce human errors, and increase your organization’s bottom lines.

An automated invoice processing system can

- Issue invoices

- Collect payments

- Update accounting systems with relevant data entries.

The data from such systems can be easily read and analyzed by other systems, so you get relevant information in real-time.

Apart from speeding up invoice processing, the most significant challenges include cost-savings and a better understanding and control over your payables.

Suggested Read: E-Invoicing Under GST

How does invoice processing work?

Invoice management is a critical element of the accounts payable process. Traditionally; manual invoice processing involves receiving bills or invoices through email, PDF, or an e-invoice. You must manually enter the information into the business’s accounting system. After that, the process continues, where the invoice is verified and paid.

A tight, quick, and effective invoice processing workflow is crucial to ensure that you pay the vendors/suppliers on time. It further ensures that the business functions smoothly as product or service supply is not interrupted.

Manual invoice processing methods may be effective, but it is filled with errors and cost you time and resources. For instance, it is said that it costs companies between $8-$10 to process invoices manually. Imagine these numbers as your business grows!

As businesses automate the process, these statistics change rapidly. While this is just one way to make invoice processing more efficient, let us look at five other ways to improve invoice processing.

Also, Read: 12 Best Invoicing Software for Your Company

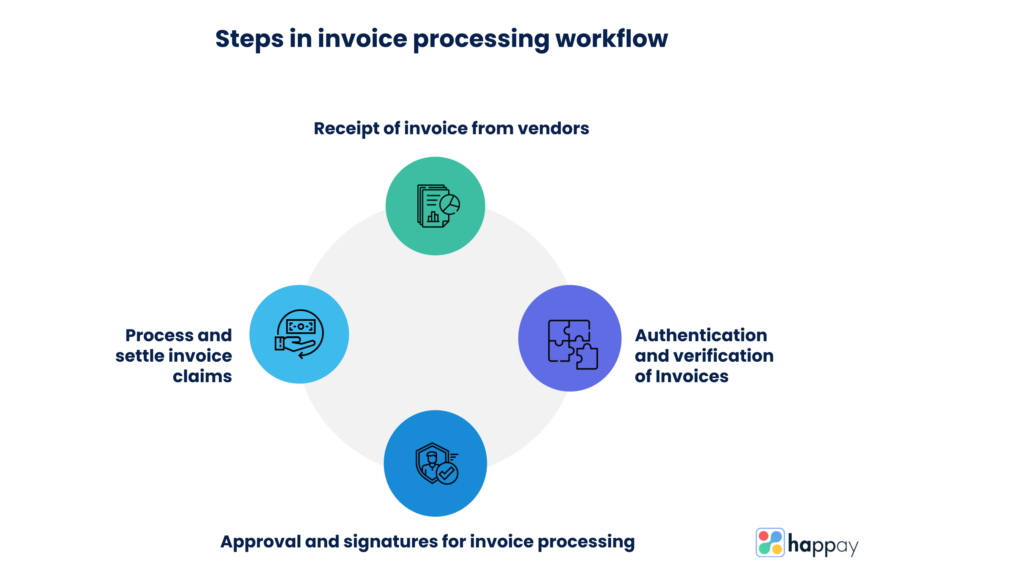

Invoice processing workflow

Step 1 – Receipt of invoice

Did you know: It costs an organization about $14 to $20 to process a single invoice?

The first stage in the invoice processing workflow is when you receive the invoice. Suppliers or vendors send the invoices to your finance department (accounts payable). These invoices may be in several formats-paper, PDFs, or even emails.

The accounts payable then standardize invoice data through manual data entry or an intelligent scan (OCR or optical character recognition-based). The team records it in the organization’s accounting system or general ledgers.

Future Read: 10 Best Receipt Scanner Apps

Step 2 – Authentication and confirmation

60%-70% of invoices are in the “easy-to-pay” category as they require minimal verification before processing (even in these cases, you must match invoice amounts and approvals before processing). In others, errors or wrong claims may require back and forth, making it time-consuming and costly.

In this stage, the invoices go through an extensive process of matching, where invoices are matched against the correct purchase order and the approvals from the respective departments. Invoice approval is an important stage as this determines the amount of time before payment is processed.

While this may seem like little, consider the size of your organization and the number of invoices you process, and it can quickly become a challenge. It is especially true if you are managing these invoices manually.

Step 3 – Approval

The finance or the accounts payable team receives the invoice details; it is time to act on it. So, the next stage is ensuring necessary approvals are in place so they can release the payment.

Another element that complicates and delays this process is the approval hierarchies. In manual processes, the challenge arises in ensuring that managers or department heads approve these invoices on time. If the approval matrix rests on a select few, things are bound to back up.

Also, Read: 5 Steps to Automate your Expense Approval Process

Step 4 – Payment processing

According to late invoice payment statistics, invoices are generally paid six days late, and 20% of the invoices are late by more than two weeks. Further, another 33% of the late invoices are late by more than a month.

Once the invoice receipts pass through the previous stages, it is time to pay the vendor. Primarily, you can process such payments through a bank wire transfer, cheque payment, or cash.

The part of the process that causes a delay in this stage is the non-availability of the approving manager, financial issues, or manual processes.

Challenges in manual invoice processing

1. Slows down productivity

When you involve humans in any process, delays are almost a certainty. There could be multiple reasons for the same. It could be for several reasons, such as

- The number of steps involved

- The verification for each of these steps,

- The documentation involved

Whatever the reason, the time it takes to complete the process delays the cycle leading to slower productivity.

2. Error-ridden workflows

Manual processes involve too many steps and people. It automatically contributes to a higher chance of errors. Unfortunately, this leads to longer and more costly reconciliations. Further, identifying and correcting these errors can be time-consuming.

3. Heavily manual processes

One of the biggest challenges in manual processing invoices is the involvement of people from the beginning to the end of the process. So, for instance, during data entry, if an employee enters the date of payment as 7/6/23 instead of 6/7/23, payment may be late. The organization may end up bearing late charges too.

4. Time-intensive

You may design workflows to be straightforward and tight. However, there is a lot of uncertainty and chances for errors when humans are involved. The reasons for delays may be valid, but the fact remains that your organization must bear the cost of such delays.

5. Increases cost

Manual processes are associated with excessive use of paper and the costs of hiring extra hands when the pressure is more significant. So, for instance, as your organization grows, the number of paper invoices you deal with increases. You may need to hire more people to tackle this pressure.

6. The process is not transparent

One of the other challenges with manual processes is that departments or other employees often need to be privy to what is happening in another part of the organization. For instance, a vital invoice may already be physically present in another department (which you are unaware of). It may be stuck because some information you may have is yet to be verified.

7. Fraud

Lost or duplicate invoices and fake invoices are issues that are common to manual processes. A physical invoice’s long and tedious journey is often exposed to different people. Therefore, there is a bigger chance of fraud in the process. The chances of losing money through such frauds are quite high unless you have very tight checks and balances.

Suggested Read: 10 Common Types of Financial Frauds

8. Recording and tracking

You may have a perfectly well-structured process that records and monitors the invoice’s progress from the time you receive it. However, are all relevant parties able to view the details and progress? While one section or department records the receipt, the actual department that must release payment is unaware of the same.

9. Reconciliation

One of the most significant challenges in manual invoice processing is the reconciliation of discrepancies. Some may be small enough to ignore or write off. Others may have major repercussions, including tax implications. Therefore, eliminate manual processes and opt for automation.

Must Read: How to Avoid and Resolve Invoice Discrepancy?

5 ways to simplify your invoice processing

1. Invoice processing- policies Must Be Clear

Clear business policies and payment terms are critical for smooth and effective accounts payable and invoice processing workflows. As you finalize the deals, the suppliers, vendors, clients, or other dealers must know the contract terms, the services to be rendered, payment cycles, penalties for default, and so on.

Apart from mentioning the policies regarding bills payable, cash payment, and invoice processing, formal communication is vital. A contract that details everything from the billing period (or on completion of a project), amount, method of payment, rate of interest (if there is a delay in payment), and consequences of failure to pay must be signed by both parties.

Some of the terms your contract must have

- Details of vendor

- Payment terms (amount, project completion time, etc.)

- Invoice templates (e-invoice, email, or other formats)

- Penalties for non-payment (a time when an interest will kick in)

2. Standard invoice formats- clear and precise

Cash flow management is a significant concern whether it is a small or large business. Precise and accurate invoice processing is essential in ensuring that cash flows through the company.

Make sure you have a standard format for all vendors or suppliers. While a clear invoice format may not guarantee payment, it prevents delays due to inconsistencies or missing information. The standardized invoice form must contain all relevant information, so there is no delay in payment.

For example, label the invoice clearly and boldly “Invoice.” Contact information along with tracking numbers (or allocate specific identification numbers) must accompany details such as

- Product/service

- Due date (last date of payment)

- Pricing

- Total amount (along with tax calculations)

- Discounts, if any

- Total (if this is a part payment, make sure you mention the same along with any other relevant details)

- Payment method (cash, cheque, direct transfer, and so on)

Ensuring the invoice format contains all the necessary details is more than half the job accomplished.

Quick Read: Purchase Order and Invoices: Definition and Differences

3. For efficient invoice processing, timing is everything

To simplify invoice processing management, you must ensure there are no delays in billing or invoicing. So, whether it is billing at your end or receiving bills, ensure you have a strict timeline of when the process begins. You can establish this based on the time taken to verify the invoice, receive approval, issue a cheque or transfer the money.

Consistency is always important, so devise a schedule that gives you enough time to follow the process before releasing payments. If the project is long-drawn, you may set up payment milestones. As and when milestones are achieved, you may begin invoicing the client.

Some tips to consider for better invoice management

For periodic invoices such as those sent out weekly, you may want to consider sending them on the weekend.

Similarly, for those monthly invoices, consider sending them out at the beginning of the month.

The ideal time to begin invoice processing is right after receiving a service or immediately after the product or service is delivered to the client. Timely invoice processing assures swift payment. Quick or early payments may also result in early payment discounts giving you the advantage.

4. Efficient invoice processing- follow-up

Follow-ups and reminders are professional and effective ways to ensure you or your clients do not end up paying late fees. If payment has not been processed, you can send a reminder a week before the due date.

Reminder notes may also be standardized with information relevant to the sales or purchase invoice. These reminders could be sent to the offices as a physical document or, just like e-invoices, as an email or an SMS. It is essential to keep the language in such reminders courteous and professional.

5. Automated invoice processing

Automated invoice processing saves businesses time and money. Post-procurement, printing invoices, following up with departments or people for approvals, and eventually processing the payments are tedious and error-prone.

All the above tips are relevant as it is essential to have a standard workflow in place before you automate. However, with an ap automation solution, the accounts payable teams will spend lesser time reconciling and following up to ensure that invoices are managed well and processed on time.

Here’s how your invoice processing system will improve with automation.

- The first significant advantage of automating the business’s invoice processing is decreasing data entry errors and time spent verifying and correcting invoices as you receive them.

- Secondly, automating the invoice process gives you visibility over the process. Since you have access to real-time data, you can tell the number of outstanding invoices and calculate the bills that have been paid and those that are partially paid. Further, you can create reports that give you an idea of frequent defaulters or those that always pay on time (allowing you to consider a discount or better terms).

- Thanks to quicker approval workflows, the ap department can process more invoices in a shorter time frame.

- Since automation systems give everyone access to updated information in real-time, any inquiries are handled swiftly. For instance, if a vendor wants to know the status of a specific invoice, a quick look at the file will reveal its current status.

Also, Read: Invoice Financing: Definition, Types, Process

5 Best practices for invoice processing

1. A well-structured process is critical

Whether you automate invoice processing or not, it is important to have an organized and well-structured process. You must invest in good training processes for employees part of this process. Further, CFOs must conduct regular checks for compliance.

2. Automation is a game changer

It’s simple; automation saves you both time and money. The entire process can be efficiently and effectively managed, from confirming the invoices to recording the entries after payment. Further, as compared to manual workflows, automated processes help you to scale up easily.

3. Identify relevant categories for your organization

When you face challenges with physical invoices, categorizing or organizing them is the best way to tackle them. You must determine the most relevant categories for your organization. Once the information is categorized appropriately, you can easily access the data.

4. Foolproof verification methods

Ensure you have a method that checks the validity of every invoice without compromising the time it takes to release payments. Whatever the value of the invoice, it is critical that you have pre-set verification methods. These methods must be foolproof and must be randomly checked for accuracy.

5. Stick to timely payments

Timely payments are bound to strengthen your vendor relationships. So, it does not matter whether your processes are automated or not. It would help if you focused on designing a complete process that ensures your vendors get paid on time.

Also, Read: 10 Best Accounts Payable (AP) Software

Features of automated invoice processing software

1. Dashboards

The most important feature of automated invoice processing software is a central dashboard. It gives you access to all the relevant information in one place. So, your dashboard will provide it all if you need invoice numbers, details of vendors, outstanding payments, buyers, sellers, or any other financial data.

2. IDC or smart data capture features

Several advanced technologies offer Intelligent Data Capture (IDC) as an important feature. This feature uses OCR and other powerful machine learning algorithms to delve deeper into documents and give you access to relevant and categorized information. Further, digitalizing the documents helps to retrieve, process, and classify data at a high level and from the invoices directly.

The technology captures, organizes, and saves information appropriately using multiple sources such as contracts, invoices, receipts, claims, scanned images, or shipment notes.

The processed information is also useful for AI-driven analytics for better and more actionable insights.

3. Real-time analytics

The most significant advantage of using an automated invoice processing system is that your business processes become more transparent. This transparency leads to better control, allowing you to understand invoice processing workflows better. So, knowing when an invoice is generated, its current status, and the due date will allow you to make more informed decisions.

Further, imagine having access to better reports! For example,

- Vendor invoice lists

- Overdue payable reports

- Productivity numbers

- Exception analyses

- Supplier/vendor reports

- Cash discount analyses

4. Automated data storage

Archival is a crucial function in any organization. While some of it is required by law, other organizations maintain documents for their own reasons. Accounts payable automation makes archival easy and lowers costs for you too.

For instance, electronic document management relieves the need to store them in a unit somewhere physically. Keeping the information on the cloud eliminates paying for physical space and gives you quick access to the data. Further, you can use the expertise of the accounts payable team in other more important tasks or activities.

5. Customization

Customization in automation is always a big plus point for any organization. In this case, customized workflows that allow you to tailor invoice management to suit your organization’s needs are invaluable.

The advantages that arise from such customizations could be

- An improvement in exception handling as the information reaches the relevant parties instantly.

- Timely processing of invoices as the approval hierarchies are built into the system’s architecture.

- Compliance is better as the controls are also incorporated into the system.

- Pre-designed templates for invoices and other official documents ensure standardization.

- Including the company logo in the documentation adds value to your brand.

6. Better invoice management

The biggest challenge for everyone is not the number of invoices but the varied formats in which you receive these invoices. The absence of a single standardized format makes it challenging to sort, read, categorize, and manage them. When you manage it manually, this challenge quadruples.

One area in which most organizations immediately see a difference is document classification and management. The technology intelligently tags the documents, reads the invoice information, and categorizes them.

It assures timely payments for your vendors and ensures that employees have instant access to real-time invoice-related information.

7. Improves efficiencies all over

Automated invoice processing systems simply eliminate the need for additional or external systems to manage the entire process. A well-designed intelligent system that is customized to suit your business needs strengthens your accounting department.

It enhances the accounts payable function while improving efficiencies throughout the organization.

Also, Read: 11 Best Billing Software in India

Invoice processing with Happay

Happay offers an AI-powered automated invoice processing solution that captures invoices, automates the approval process, and accelerates vendor payments. Happay Invoice is a smart yet simple invoice processing solution that speeds up the invoice-to-pay cycle and make it up to three times faster. It lowers the invoice processing cost by 70% and provides 100% protection from fraud.

The benefits of using Happay Invoice.

- Smart automation – You can enjoy OCR-based invoice processing, ERP systems integration, and advanced analytics.

- Simplified vendor payments – you can add invoices, digitize the complete process and accelerate the vendor payments.

- Seamless invoice processing – you can easily improve cash flows, boost efficiencies and increase compliance.

- Smart dashboards – you can use a user-friendly interface to gain end-to-end cash flow visibility.

- Improve liquidity – you can process payments using a credit line facilitated by Happay to improve your cash flows. You can also extend the days available for payable outstanding.

- Same-day invoice reconciliation – Happay’s features allow you to pay your vendors on the same day.

- Advanced scheduling – allows you to schedule invoices, so you never miss a payment.

- Invoice payments – Happay makes it easy for you to pay your vendors. Whether through direct wire transfers (bank), unsecured credit lines, or pool accounts.

Conclusion

Invoice processing and management involve capturing, recording, and managing invoices and payments to suppliers or vendors. While manual business processes may still work, a growing organization must consider invoice automation software as a perfect solution to scale up and become more efficient.

FAQ’s

Invoice processing is an essential aspect of the Accounts Payable function in any business. It is the process of receiving an invoice from a supplier or vendor, verifying its authenticity, approving it, and settling the payment.

As soon as you receive the invoice, the first step is to verify details such as the purchase order/receipt against which the invoice is received, capturing details in your books, GL codes, and any other reference numbers of relevance. The invoice is then sent to the relevant department for further verification and approval. Once approval is received, the details will be sent to the finance team, which will issue a cheque or transfer the payment into the vendor’s account.

Many invoices depend on the business, due date, industry type, region, compliance requirements, etc. For instance, you may send a proforma invoice to give the buyer an idea of the estimated cost for a product or service. Then, you could send a sales invoice, a simple request to pay for a product or service rendered. Similarly, there are retainer invoices, overdue invoices, timesheet invoices, and total invoices.

a) First, it is essential to understand your client and set clear terms for doing business together. So, the most important thing to do at this stage is to b) enter into a contract that covers all vital aspects.

c) Create tight workflows and insist on managing the invoices promptly.

d) Automate the invoice processing process, as it can save your business time, money, and resources.

Invoice processing is part of the accounts payable process. Invoice processing deals with receiving invoices from suppliers, verifying, approving, and settling the same.