Business expenses

“Look everywhere you can to cut a little bit from your expenses. It will all add up to a meaningful sum.”

– Suze Orman

Business expenses are all the funds that facilitate any and all business operations. They include all capital expenditures, operating expenses, non-operating expenses, cost of goods sold, incidental expenses, etc. Tracking business expenses is the process of recording, monitoring, and managing business expenses to ensure that the expense process is cost-optimal.

Tracking business expenses is crucial to a sustainable business. Not monitoring costs and optimizing the process can lead to several cash flow issues. This can be detrimental to business health, as a US Bank study states that 82% of businesses fail because of cash flow problems.

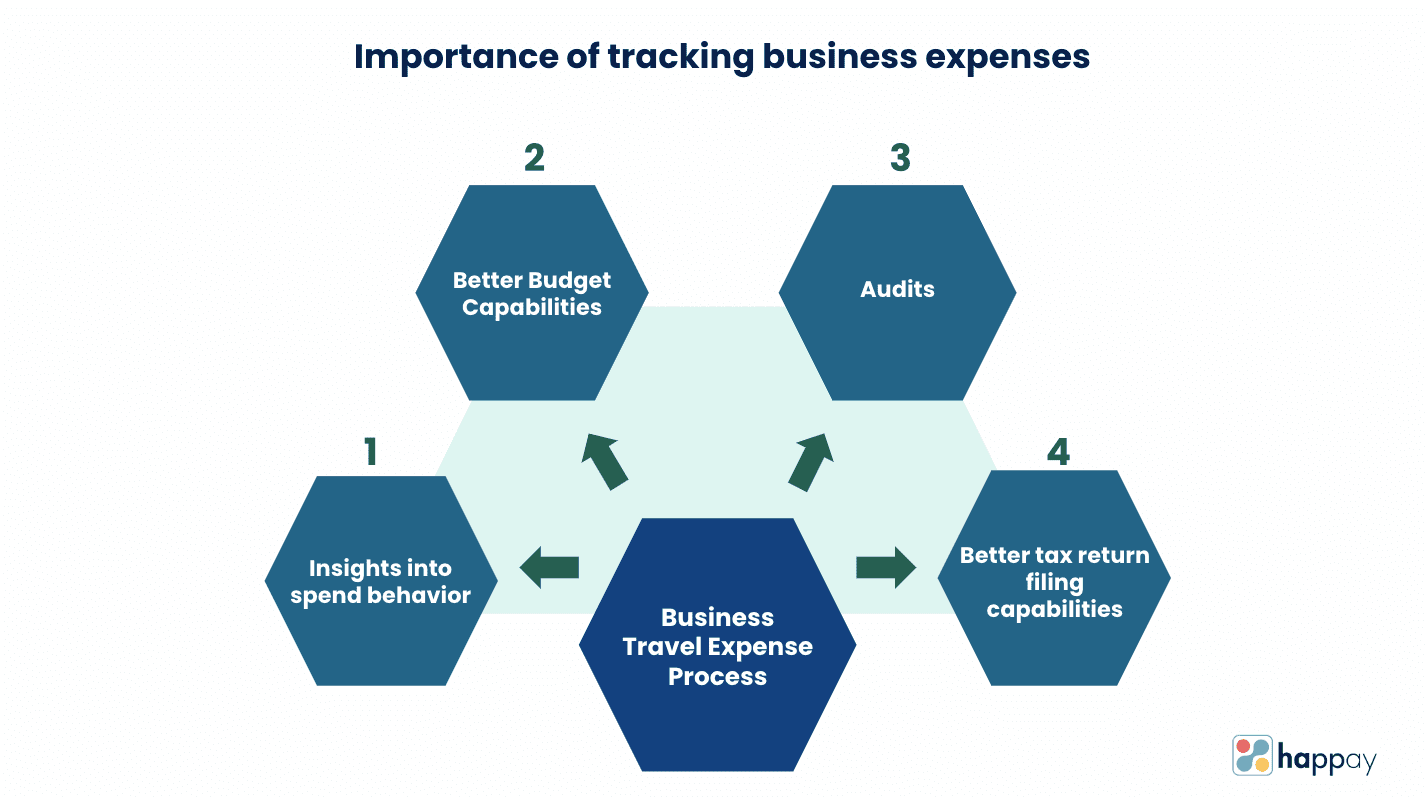

Why is tracking business expenses important?

1. Insights into spend behavior

Tracking business expenses can help you record spend data over various months. Monitoring this data can help you get insights into employee spend behavior over the months. Analyzing employee expense behavior can help you understand which departments suffer the highest cost leakages.

2. Better budgeting capabilities

Getting insights into employee spend behavior can equip you to make necessary changes in the department budgets. It can help you establish rules that will secure the organization against overspending. Tracking expenses also helps you stay updated on the financial health of your organization.

3. Audits

Business expense audits help ensure that your company’s information representation is accurate and fair. They help prevent expense fraud and ensure that your expense practices comply with the expense reimbursement policy.

Tracking business expenses and maintaining a digitally accessible record of them helps you remain throughout the year. Tracking business expenses makes data extraction easier during expense audits, and the entire process becomes more transparent and efficient.

4. Better tax return filing capabilities

Tax write-offs exist to support your organization against heavy expenses. However, filing tax returns is more complex than it sounds. You need to have extensive and accurate knowledge of your costs if you want to get the most out of your tax returns.

Regular and timely tracking of your expenses ensures that you have instant access to all your transactions. This can help you categorize, segregate, and eventually file returns for eligible expenses and claim returns on every rupee spent.

Also, Read: What are Business Travel Expenses?

Which business expenses should you track?

While tracking all business expenses is crucial, you must closely track the following business expenses to safeguard yourself against loss.

1. Operating expenses

Operating expenses are all the funds that facilitate the everyday running of a business. Operating expenses include rent, legal fees, insurance, taxes, depreciation of fixed assets, etc. While mostly recurring and fixed, these expenses have a lot of room for cutbacks.

Since operating expenses are primarily static, any variation can point toward expense anomalies or issues. Regular tracking of operating expenses can alert you to these issues early, and you can tackle them.

2. Cost of goods sold

Cost of goods sold, or COGS, is all the costs directly paying for the manufacturing and production. They include the cost of raw materials, the labor involved in the show, machinery, inventory acquisition, etc.

Efficient tracking of the cost of goods sold can help you calculate the net income. It can help you determine the level of storage capacity you need. It can also keep you updated on vendor prices and decide when it’s time to switch vendors.

3. Incidental expenses and petty cash

Incidental expenses are minor everyday expenses that usually do not have a receipt trail. This makes incidental expense reserves and petty cash funds vulnerable to misuse.

Hence, developing a strategy to track and record incidental expenses is essential. Tracking unexpected expenses gives you more visibility over petty cash spending and deters employees from misusing them.

Suggested Read: Types of Expenses and Accounting

What is the best method for tracking business expenses?

There are many ways to track business expenses. However, if you want to streamline expense tracking and simplify the process, you should opt for automated expense tracking platforms or corporate credit cards.

Let’s discuss the various ways to track business expenses.

1. Manually tracking expenses on excel sheets or spreadsheets

The traditional way of tracking business expenses was using manual methods like excel sheets or physical spreadsheets. However, as digital technology came into the equation and business grew bigger, this method became outdated.

However, some businesses still use manual methods to track expenses. This is counterintuitive, as manual tracking can result in data contamination, false analyses, and misinformed decisions.

2. Expense tracking software

An expense tracking software automates the expense capture process. It helps businesses reduce their expense report processing costs. Expense tracking software directly captures information from receipts using auto-capture technology. This prevents data contamination, inaccuracies, misreporting, and expense fraud.

3. Accounting software

Accounting software is a tool that helps accountants and finance officials record, manage, present, and report a company’s financial transactions. Using it with expense tracking software can help you maintain your books efficiently and accurately.

4. Corporate credit cards

Some organizations issue corporate credit cards to employees for business transactions. Corporate credit cards automatically record every transaction made through them. They minimize the need for the expense filing and reimbursement process and simplify business travel spending.

If your employees spend on behalf of the business, you can issue corporate credit cards to shorten the expense reporting process. Using traditional tracking methods may result in inaccuracies. Choose a combination of expense tracking and accounting software.

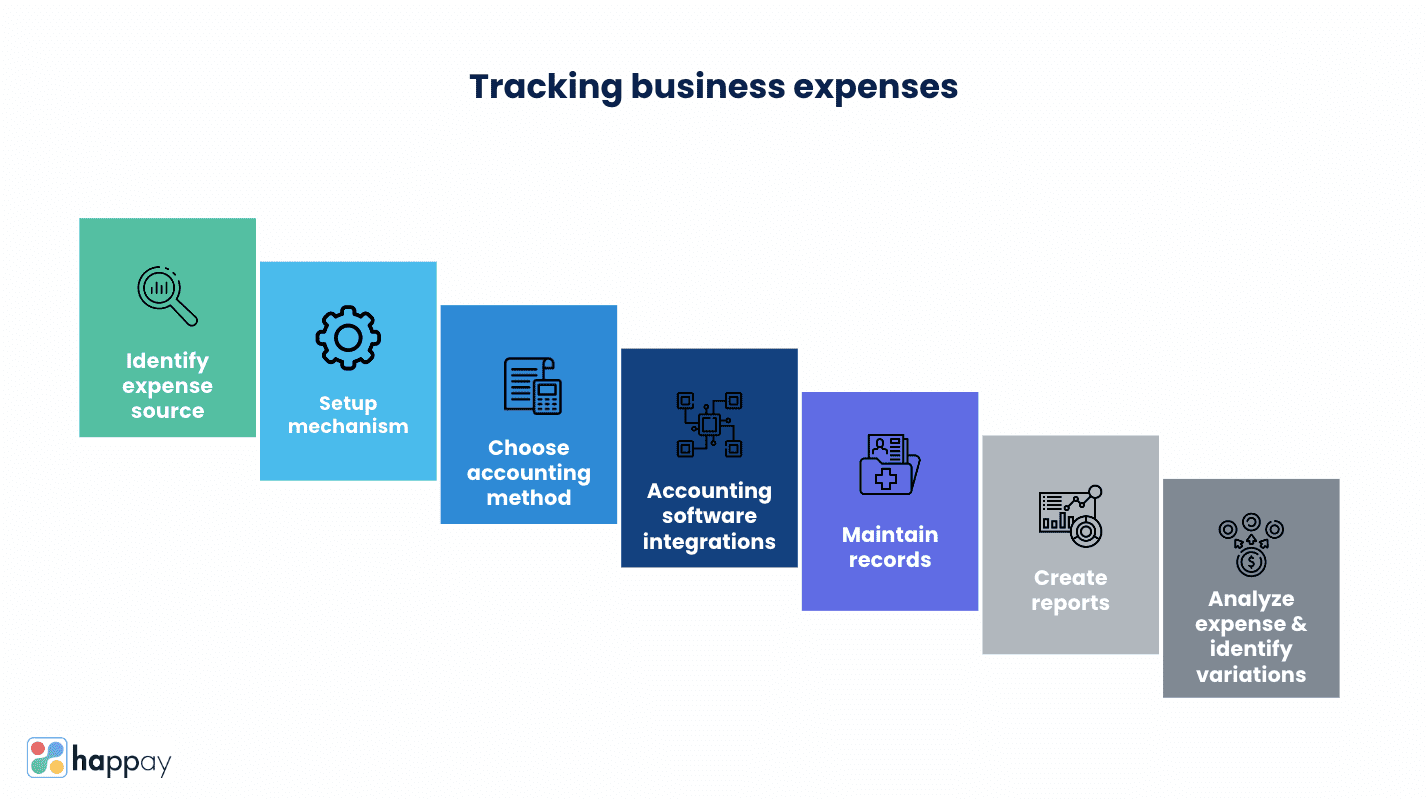

7 Steps to tracking business expenses

1. Identify expense sources

List down all the cash outflows from the organization. These include all expense outlets. Categorize expense sources as fixed, variable, recurring, non-recurring, etc. Different expense sources can include rent, machinery, cost of goods sold, cost of property, plant, legal fees, etc.

You can identify your expense sources by looking at your business bank account or credit card transactions. All cash outflow channels are expense sources.

The next step is to categorize these expenses. Categorizing expenses allows easier management and monitoring.

2. Develop expense recording mechanisms

Set up tracking and monitoring mechanisms for all cash outflow channels. You can do this by creating an exhaustive expense policy. All business transactions should happen through authorized channels like a company bank account, credit cards, etc.

If employees often pay for business expenses, ensure that there are robust measures in place to ensure that expense reporting is accurate. An expense tracking software is the easiest way to do it as they auto-captures spend data from multiple sources.

Corporate credit cards are also a great way to identify and record expense sources. You can automatically track all the transactions in real-time if your employees are using credit cards.

3. Choose the right accounting method

Businesses should pick a standard for accounting when reporting expenses. A consistent accounting style is crucial for tax filings. You can choose either cash or accrual accounting. Cash accounting is a simple accounting approach as it records transactions once the payment is complete. It means that expenses are deducted in the same year that they are paid.

In accrual accounting, you can record transactions based on the completion of a sale. It means that you can deduct expenses in the tax year when the sale happened, no matter when the payment was done.

4. Link your bank account to your accounting software

There are different types of accounting integrations with your bank account. It can help you import all expense and income data into your system. You can also download bank statements and upload them as an Excel file to your system.

You can use a connectivity plug-in in your accounting system as well. This will allow you to access a bank feed that will update after a specific period.

5. Maintain records

Once you collect the expense data, ensure it is stored on a digital database. This storage space should be secure, and specific data sets should be easily searchable. An expense tracking platform can help with this step as it automatically stores all data in a comprehensive format.

When using manual storage methods, conduct frequent audits and checks to secure against data contamination. Use a cloud-enabled program and multiple data backups when storing data on a digital platform to safeguard against data loss.

6. Create reports

Data is not useful until it gets converted into knowledge. Use your expense records to create comprehensive reports for your expenses. An expense management platform automatically creates insightful reports on expense data.

Create reports that showcase spending for all departments and projects in the organization. These reports help consolidate the insights you will need to make crucial business decisions

7. Analyze expenses and identify variations

Once you have compiled data in a report, do systematic analyses of the reports for various categories. Identify any unprecedented variations in the transaction patterns.

If you find anomalies in the spend behavior, you must conduct a thorough analysis of the past spending practices to confirm the reason for the variation. This will help you take prompt action in case of an employee mistake or deliberate expense fraud.

5 Best apps for tracking business expenses

1. Happay

Happay is an end-to-end expense management solution with a cloud-ready architecture and complex expense capture features. Happay can extract data from multiple transaction data points to produce comprehensive reports, allowing seamless expense tracking and analysis.

2. Rydoo

Rydoo’s expense management software allows users to capture receipts through the Rydoo mobile app. Employees can simply send the receipts through e-mail, and the AI-powered platforms automatically create an expense.

3. Expensify

Expensify is an expense management platform built to streamline business travel spending and management. It has various expense tracking features like one-click receipt capture, credit card import, accounting integrations, etc.

4. Zoho expense

Zoho expense is an expense tracking app that simplifies expense tracking for employees. It allows organizations to go paperless and be audit-ready. Zoho can also auto-scan receipts and track your business mileage, further simplifying expense tracking.

5. Concur expense

Concur expense is an expense management tool purpose-built to make reimbursements easy for employees. It automatically populates expense reports with electronic receipts from hotels, taxis, restaurants, etc.

Also, Read: How to Choose Expense Tracking Software?

Benefits of tracking business expenses

1. Fewer cost leakages

Tracking business expenses helps you keep a close watch on employee spending. You can use expense data to identify cost leakages, locate the source of these leakages, and minimize their effect.

2. Better deals

Tracking business expenses can help you get better deals with vendors. You can recognize vendor transaction patterns and plan your purchases better. You can also identify your most frequent vendors and negotiate better deals with them.

3. Better vendor relationships

Tracking business expenses can help you understand your payable frequency more effectively. This lets you promptly clear your payables on time and ensures healthy vendor relationships.

4. Protection against expense fraud

Preventing expense fraud is a challenge for all CFOs and finance officials. Crafty employees always come up with ways to circumvent fraud prevention measures. However, tracking and analyzing business expenses regularly can alert you to overspending and direct you toward expense fraud.

FAQs

Yes, you can track expenses in an excel sheet. However, tracking expenses in an excel sheet is tedious for large businesses and can lead to confusion.

To track business expenses, populate the top row with categories. The left-hand column should be the date section. Enter the outgoing cash amount for each transaction.

To ensure better management, make separate sheets for each month or specified period.

Track business expenses using accounting software or an expense-tracking platform. Categorize every expense carefully and record them on a digital database. This will make the database accessible during tax filing and easy to claim returns on every rupee spent.