Expense tracker

It’s hard to keep track of expenses in a fast-paced small business environment. Over time, however, with advancements in expense management automation and related technology, it is now possible to simplify the whole process.

Expense trackers are solutions that help companies and employees log expenses, categorize them and keep an eye on spends. An expense tracker helps companies break down spends and create a budget to help them stay on track. These solutions are available on desktop and mobile, meaning users can track spends wherever they are.

Expense trackers help small businesses get a firm grip on their finances, save time on manual tracking, stick to a budget, stay tax compliant, and work from anywhere.

In this article, you’ll learn about how these solutions work, the best expense trackers for small business, benefits, and more.

How does an expense tracker app work?

A small business expense tracker app works in two ways-

- Letting users feed information into the solution &

- Automatic capture data, such as bills and payments

All records are categorized and tagged with critical information such as vendor details, date, and payment mode.

The tool then generates expense reports and income statements to help users understand spending patterns.

Some of the best business expense trackers offer functionalities such as:

- Pre-trip missed savings alerts

- Budget setting

- Bank account and credit card integrations

An expense tracker app also allows users to take and attach photos of receipts and bills to transactions to ensure every little detail is in one place to avoid confusion while processing.

Suggested Read: 10 Best Expense Management Software

Top 10 expense tracker apps

A quick glance at the 10 best expense trackers for small business

|

Product |

Highest-rated feature |

Pricing |

Free trial |

|

Automated data capture, policy compliance, and integrations |

Contact for pricing |

No |

|

|

Expense reports, compliance, fraud detection |

Free to $8 per user |

Yes |

|

|

Ease of use, support, and reporting |

Contact for pricing |

Yes |

|

|

Reporting and dashboards, performance, and ease of use |

$15 to $50 per month |

Yes |

|

|

Easy to set up, unlimited receipt scanning |

$5 to $9 per month |

Yes |

|

|

Automatic receipt matching, integrations |

Contact for pricing |

Yes |

|

|

Expense automation, integration and mobile app |

Contact for pricing |

Yes |

|

|

Rewards, reporting, and accounting integrations |

Contact for pricing |

Yes |

|

|

Workflows, reporting and automation |

Contact for pricing |

Yes |

|

|

Revenue recognition, reminders and performance |

Contact for pricing |

Yes |

10 Best expense trackers for small businesses

Here are some of our top picks for the best expense tracking solutions in the market today in 2023.

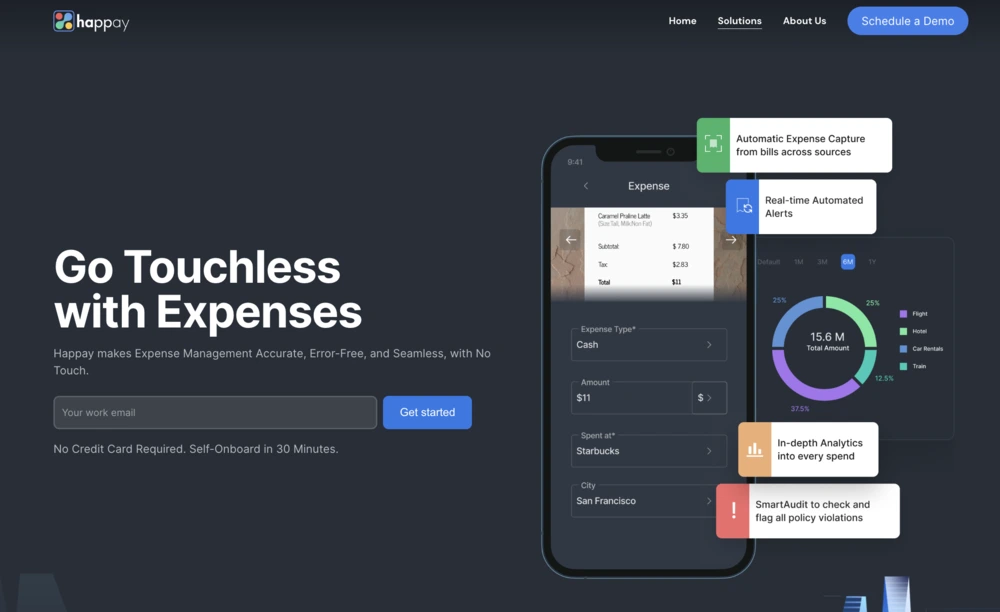

1. Happay

Happay is an all-in-one, cloud-based solution provider for travel, expense, and payments.

The best part is that users can track expenses of any kind such as travel expenses, personal expenses, and more from anywhere, mobile devices or desktop. This means you don’t have to deal with manual data entry and paper receipts anymore.

Its cloud-ready architecture, seamless integration, and data-driven analytics make it one of the best expense tracker apps for small businesses.

From seamless integration with crucial systems to ease of use and taking care of spending from end to end, you have your entire travel and expense (T&E) ecosystem in one place.

With Happay’s expense management solution, reimbursements are fast, and the expense process is simple. There’s no need for email follow-ups, and cash leakages are eliminated. In addition, the platform ensures auto-compliance with company policies and is entirely digital.

Moreover, with access to end-to-end analytics and audit trails, data-driven decisions are made quickly.

Features

- Single sign-on (SSO) prevents users from having to remember multiple passwords

- Strong security that helps ensure all the integrity of all sensitive information

- Workflows with multiple levels and steps

- Mileage tracking

- Audit trails to ensure all evidence remains intact in case of ambiguities

- Compliance to ensure that all GST data gets captured

- Mobile app available on Android and iOS

Pros

- Simplify your business trip and expense planning with automatic request routing to managers for expense approval

- Ensure all stakeholders have access to bookings and advance processing

- Automatically capture trip expenses from anywhere with Happay’s Xpendite: an AI-powered engine that gets data from any source, such as SMS, business bank accounts, or email

- Automated travel policy enforcement with Happay’s policy engine that helps you bring all your expense policies into a centralized location

- The solution also auto-checks all expenses with your policies and alerts you if there is any violation

- Get complete visibility into all the data you need to make informed decisions

- Helps finance teams process reimbursements with real-time trip data and summary reports

Cons

- Happay does not natively support a few languages such as Mandarin and Japanese

Who is it suitable for?

Happay is suitable for all business needs, ranging in size from small to mid-market and enterprises.

Pricing

You can contact Happay’s team to learn more about their pricing and get a product demo.

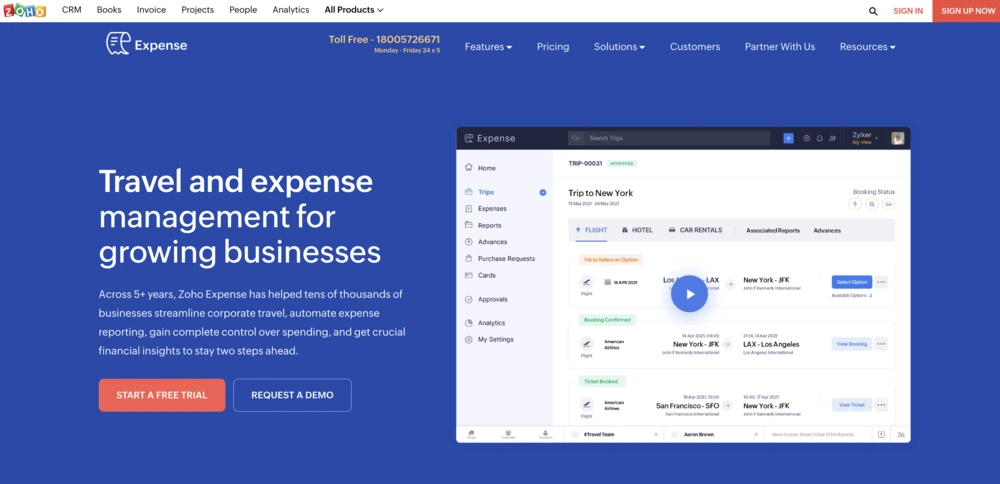

2. Zoho Expense

Zoho Expense is another expense tracker solution that helps companies simplify travel and business finances. The solution helps track business expenses, and gives them total control over spending.

Zoho Expense also ensures compliance, detects fraud, reconciles card transactions, and accounts for expenses. With its web and mobile options, the solution easily adapts to workflows by integrating smoothly with other software.

Plus, its high level of customization ensures that organizations can set it up quickly and efficiently without changing their current processes.

Features

- Expense report creation

- Bank and credit card integration

- Smart expense categorization

- Digital receipts handling and management

- Employee reimbursement handling and processing

- Receipt capture

- Track mileage

Pros

- User-friendly

- Quick and smooth receipt capture

- The expense tracker works well with Zoho’s suite of products

- Easy to use and set up

Cons

- Falls short in bank and credit card integration

- High cost

Who is it suitable for?

Zoho Expense is primarily suited for small to mid-sized businesses.

Pricing

Zoho Expense plans start from “Free Forever” and go up to $8 per user per month when billed annually.

Future Read: 7 Best Zoho Expense Alternatives and Competitors

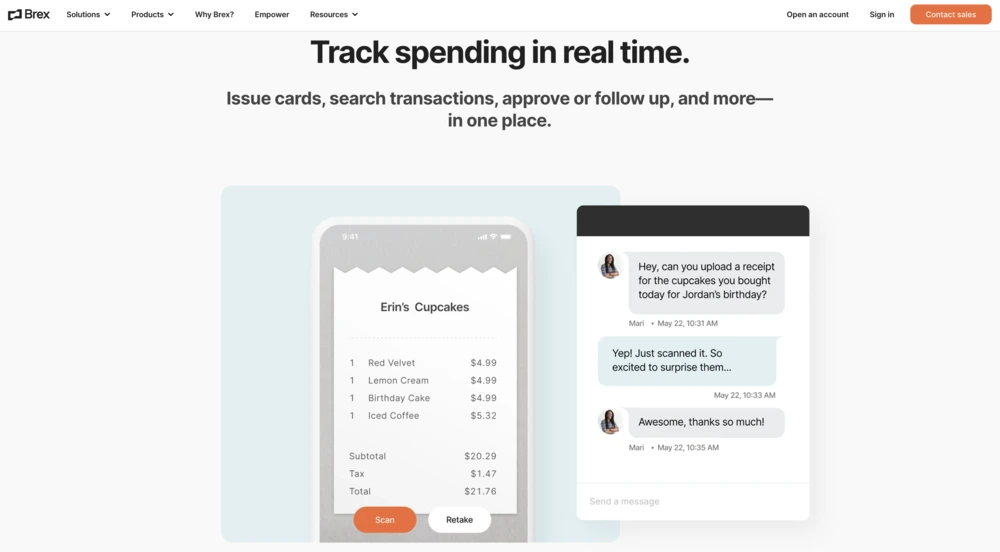

3. Brex

Brex is an expense tracking tool that helps manage payments, capital, and expenses in one place. Brex makes it easy for finance teams and employees to spend wisely.

Brex helps employees track every single transaction and facilitates instant expense reporting by auto-generating expense claims, and managers focus on what’s important. Overall, it helps improve the speed of work by letting them review spending that is out of policy.

Features

- Expense reports

- Bank accounts and card integration

- Receipts management

- Employee reimbursement

- Automated reminders

Pros

- Great customer support

- Seamless and easy expense tracking

- Quick report generation

Cons

- The approval workflow is complex

- It does not provide real-time email notifications

- Physical card and digital card numbers are different

- The mobile app lacks features

Who is it suitable for?

Brex can be used individually by people such as entrepreneurs, self-employed personnel, and small to medium-sized businesses.

Pricing

Brex offers a free trial to start with. Get in touch with them to know more.

Suggested Read: 10 Best Receipt Scanner Apps

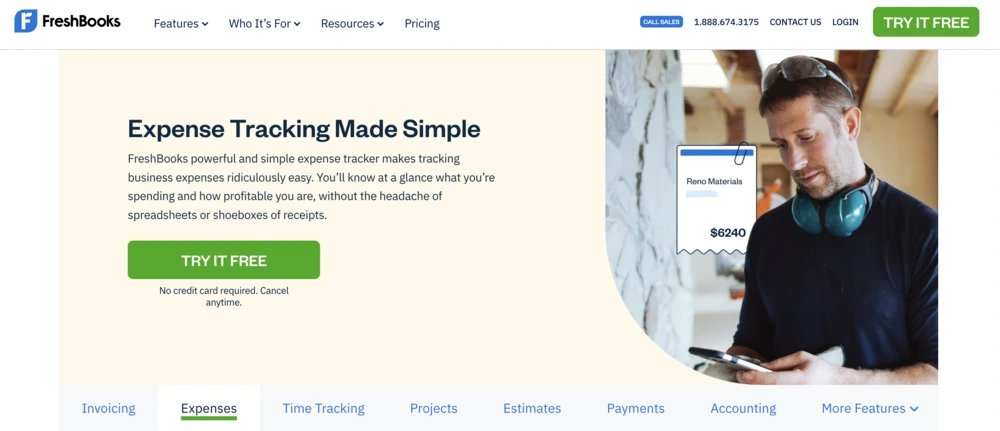

4. FreshBooks

FreshBooks is an expense management software that makes it super easy to keep track of all your business expenses. You can use it to upload receipts, categorize your expenses, and even generate reports to see where your money is going. It’s good tool for small business owners, freelancers, or anyone who wants to get a better handle on their finances.

Features

- Access management based on users and roles

- Accounts receivable and payable

- Custom invoices

- AP automation

- Payment processing

Pros

- Easy to setup and use

- Good customer support

Cons

Who is it suitable for?

Lots of small businesses use Freshbooks for expense tracking.

Pricing

Freshbooks offers a free trial, and their plans start from $15 to $50 per month. You can get in touch with them to know more.

Quick Read: What is Capital Expenditure?

5. Expensify

Expensify is a solution for managing money, used by many businesses worldwide. It offers features, such as corporate cards, expense tracking, reimbursement, time tracking, and more. In addition, Expensify allows users to import expenses easily from a credit card and create expense reports.

Features

- Quick receipt-scanning

- Credit card importing

- Multi-app integration

- Delegated access and multiple approvers

- PCI-compliant

- Custom reporting

Pros

- Quick reimbursement

- Easy to set up

- No extra cost to implement

- Unlimited receipt scans

Cons

Who is it suitable for?

Expensify suits small to mid-sized businesses, and many popular companies use it.

Pricing

Expensify offers a free trial, and their plans start from a basic and go up to $9 per user per month.

Also, Read: 11 Best Billing Software for Small Business

6. Ramp

Ramp is a spend management platform that helps businesses control expenses, save time, and automate tasks. The platform has features such as corporate cards, expense management, bill payments, and accounting integrations. In addition, the solution helps with expense tracking, employee follow-ups, and book closing.

Features

- Quick receipt-scanning

- Credit card importing

- Multi-app integration

- Delegated access and multiple approvers

- PCI-compliant

- Custom reporting

Pros

- Pay bills faster

- It helps close books faster

- Integrates with crucial tools

- It helps cut down on unnecessary spends

Cons

- Confusing to use for new users

- Forecasting is not accurate

Who is it suitable for?

Small businesses primarily use Ramp.

Pricing

Ramp offers a free trial. You can contact their team to know more about the final costs.

Also, Read: 10 Best Accounting Software and Systems

7. Navan (TripActions)

TripActions helps establish and manage a high-performance travel and expense program that can adapt to any business size. The platform offers functionalities such as receipt scanning, policy setups, custom reporting, along with implementation and onboarding.

Features

- Expense automation

- Integration

- Mobile application

- Compliance

- Automation rules and workflows

Pros

- Easy to set up and use

- A single solution to manage all expenses

- Booking is easy

Cons

Who is it suitable for?

TripActions can be used by companies in the small to the mid-size range.

Pricing

TripActions lets you sign up for free, but you’ll have to get in touch with their team to learn more about their paid plans.

Future Read: 8 Best TripActions Alternatives and Competitors

8. Divvy

Divvy is a spend and expense management solution that eliminates the need for expense report processing. With Divvy, users can set enforceable budgets and real-time access visibility of all spending with one platform. Additionally, users earn rewards that can be customized to fit any business, any size.

Features

- Reimbursements

- Rewards

- Mobile application

- Reporting and insights

- Accounting integrations

Pros

- No annual or initiation fees

- Flexible rewards

- Free-to-use

- Automated expense management

- Integrations with daily-use apps

Cons

Who is it suitable for?

Businesses can use Divvy in the small to medium-sized segment.

Pricing

Divvy is free for all business segments. You can get in touch with them to know more.

Suggested Read: 10 Best Accounts Payable Software for Your Business

9. Airbase

Airbase is an expense tracking platform that adapts to companies of all sizes, from startups to IPO. It offers a consistent platform experience for all non-payroll spends. Automated accounting and approval workflows provide visibility and control, allowing for faster close and real-time reporting.

Features

- Bill payments

- Reimbursements

- Approval workflows

- Accounting automation

- Real-time reporting

- Multi-subsidiary support

Pros

- Automatic request routing for approvers

- Better budget management

- Real-time data

- Expense management

Cons

- Updating does not happen uniformly

- Purchase order functionality is not responsive

- Categorizing is inaccurate

Who is it suitable for?

Airbase is primarily used by mid-market companies but can be used by small businesses as well.

Pricing

Airbase offers a free trial. You can get in touch with their team to know more about their pricing.

Quick Read: What is Cloud ERP Software and How does it Work?

10. myBiz by MakeMyTrip

myBiz by MakeMyTrip is a travel management solution for small to large enterprises. Their mobile-first, self-booking tool is also available on desktop. myBiz’s AI and ML-driven platform helps with booking, and their HRMS integration and instant policy go-live ensure compliance with travel policies.

Features

- Revenue recognition

- Automated reminders

- Role and access management

- Performance and reliability

- Mobile support

Pros

- Free

- Provides complete visibility on expenses

- Real-time expense claim reports

Cons

Who is it suitable for?

myBiz by MakeMyTrip can be used by small businesses.

Pricing

myBiz by MakeMyTrip is free to use. You can get in touch with them to know more.

How do small businesses keep track of expenses?

Small businesses can keep track of expenses in the following ways:

- Manual records: This method is a tedious, time-consuming process that involves keeping a physical or digital record of all financial transactions, such as receipts, invoices, and bills. Although error-prone, it is a simple way to track expenses.

- Spreadsheets: Small businesses can create sheets using solutions like Microsoft Excel or Google Sheets to record and keep track of expenses. Unlike manual record-keeping, it can sort all data and provides templates to start quickly.

- Expense tracking software: Possibly the most efficient mode of keeping track of expenses, expense tracking software automates recording and categorizing expenses.

- Expense tracking app for mobile: Mobile apps are a convenient solution for small business owners who are on the go.

Best way to track expenses for small business

An expense tracking software is the best way to track expenses for a small business.

This allows small business owners handle all expenses entirely and use generated reports to analyze their spending patterns.

Expense tracking software like Happay automates the process of recording and categorizing expenses and offers features such as budget setting, alerts, and bank account and credit integration to make it more convenient.

How does an expense tracker app help small businesses?

While an expense tracker is a sure-fire way to be on top of spends, small business owners face some challenges such as:

- Not having the required financial resources to invest in software

- Not prioritizing expense tracking among many other tasks

- Struggling to categorize expenses

However, expense tracker apps help save time and money in the long run, among many others.

Here are six specific ways in which an expense tracker app helps small businesses:

1. Real-time data and tracking

Since an expense tracker app lets owners record financial transactions as they occur, it makes it easy to keep track of all expenses in real time. This helps ensure they are always in the loop about spending and can make tweaks as needed.

2. Automatic categorization

The app automatically categorizes expenses according to the purchase type, vendor, or project, making it easy to track expenses by category. This is useful for businesses with different types of expenses or various departmental spending.

3. Reports

An expense tracker app generates various reports, such as income statements and expense and budget reports, and provides analytics. This helps owners make more informed decisions. For example, an expense report helps small business owners see which expense categories are the most expensive and take steps to reduce them.

4. Receipt scanning

Many expense tracker apps allow users to take photos of receipts or bills and attach them to the transactions, making it easy to keep all the necessary information in one place and also submit expense reports with all the needed information.

5. Budget setting

Budget setting functionalities help small businesses set a budget for each category of expenses and get alerts when the budget is about to exceed. Small businesses can reduce expenses before they become a problem by setting budgets and getting alerts when they are about to be exceeded.

6. Integration with other tools

Some expense tracker apps can integrate with other tools, such as bank accounts, credit cards, and accounting software, allowing small business owners to see all their financial information in one place.

Suggested Read: Expense vs Expenditure

How to choose the best expense tracker for your business?

Elements to consider while choosing the expense tracker

When picking an expense tracker for your small business, it’s essential to consider a few key things-

- First, ensure that the expense tracker is easy to use and navigate. You need to spend less time figuring out how to input transactions or categorize expenses.

- Consider reporting and analytics. First, you should be able to see where your money is going, so look for an expense tracker that can generate different reports, like expense reports and income statements.

- Check whether the expense tracker can connect with other financial tools like bank accounts or accounting software.

- Another essential feature is budget setting and alerts. It’s helpful to set a budget for different categories of expenses and get alerts when you’re about to exceed it.

- Some expense trackers also allow you to scan and manage receipts. This can be useful for small businesses that need to keep records of expenses for tax or accounting purposes.

- Consider if the expense tracker is mobile-friendly and can be used on the go. If you’re always on the move, it’s essential to be able to input expenses and check reports from your phone.

Why is Happay the best expense tracker for small businesses?

Happay is a solution that helps companies control costs, automate compliance, generate expense reports and make more informed decisions through real-time insights.

With over 6000 customers, Happay provides everything you need to manage expenses in a single platform.

Happay simplifies travel planning and approvals, automatically capture expense data into the system, ensure expense reports are policy-compliant, speed up approvals, and ensure reimbursements are sent to employees on time.

Additionally, the analytics engine provides useful expense data that helps higher-ups drive cost savings, improve policy compliance, simplify complexity and optimize internal processes.

Conclusion

In summary, an expense tracker for small businesses is a crucial tool that helps managers keep track of all expenses without visibility loss and employees record expenses and get reimbursements on time. In addition, the overall process is stress-free for companies and helps save costs.

FAQ’s

Happay is the best solution for tracking expenses from end to end. It provides seamless integration with popular applications, expense capture, automated policy checks, and violation intimation.

Various free expense tracker apps for small businesses help you automate T&E entirely. However, in terms of usability, customer trust, and simplicity, Happay stands out from other solutions in the market.

A simple way to create your expense tracker is through a spreadsheet. You can manually record all expenses based on categories and vendors and use the reporting functionality to understand patterns and optimize clearly.

Many expense tracking apps are available for small businesses, such as Happay, Zoho Expense, Brex, and Expensify. You can choose one based on your needs and requirements, but the one solution that stands out is Happay.

Discussion about this post