Looking for billing software?

Billing software is a critical asset that helps finance teams automate mundane tasks related to payment accounting and billing. The lack of it can make invoicing a long-drawn process, costing you precious hours and money.

It’s crucial to find the best billing software to enhance efficiency and boost productivity. This article looks at the top 11 billing software in 2023 to make it easier for you to decide. We will outline their features and how they can benefit your business. Keep reading to learn more.

Read More: What is Billing and their Types, Process, How it Works & Format

What is billing software?

Billing software is a computer program that helps businesses manage their financial transactions, including invoicing customers and tracking payments. Your business can use the billing software to automate billing processes and make them efficient and accurate. Reports and templates help you keep track of spending, budgeting, and forecasting. Some billing software also come with analytical capabilities that drive informed decision-making.

Billing software come as a standalone application or even as a part of a larger enterprise resource planning (ERP) system. When choosing billing software, it is important to consider the specific needs of your business and select a solution that offers the features and functionality you require.

Ensure to consider reports, templates, and integrations with other business systems, such as accounting software, customer relationship management (CRM), and inventory management software.

Quick Read: Billing Cycle: What is it, Types, Duration and How Does it Work?

TOP 11 billing software for businesses in 2024

Here are our picks of some of the best billing software in 2023.

- Happay Invoice

- Scoro

- QuickBooks

- FreshBooks

- Wave

- Tally Solutions

- ClearTax

- Square Invoices

- Zoho

- Vyapar

- XERO

A quick glimpse at the TOP 11 billing software – comparative table

| Billing Software | Market Segment | Top Features | Pros | Cons | Starting Price | Trial Period | Mobile Apps | Bill Pay Tools |

| Happay Invoice | Medium to large business |

|

|

|

Contact for quote | – | – | – |

| Scoro | Business Management |

|

|

|

$28 Per Month | 14 Days Free Trial | Yes | Yes |

| Quickbooks | Small Business |

|

|

|

$15 Per Month | 30 Days Free Trial | Yes | Yes |

| Freshbooks | Invoicing |

|

|

|

$4.50 Per Month | 30 Days Free Trial | Yes | Yes |

| Wave | Small Business |

|

|

|

Free plan | NA | Yes | Yes |

| Tally Solutions | Small & Medium Business |

|

|

|

$7.50 Per Month | 7 Days Free Trial | Yes | Yes |

| ClearTax | Tax and Business |

|

|

|

$12.49 Per Month | NA | No | Yes |

| Square Invoices | Business Management |

|

|

|

$20 Per Month | NA | Yes | Yes |

| Zoho | Micro Business |

|

|

|

$9.50 Per Month | 14 Days Free Trial | Yes | Yes |

| Vyapar | Small Business |

|

|

|

$24.99 Per Month | 15 Days Free Trial | Yes | Yes |

| Xero | Grow Business |

|

|

|

$12 Per Month | 30 Days Free Trial | Yes | Yes |

11 Best billing software in India

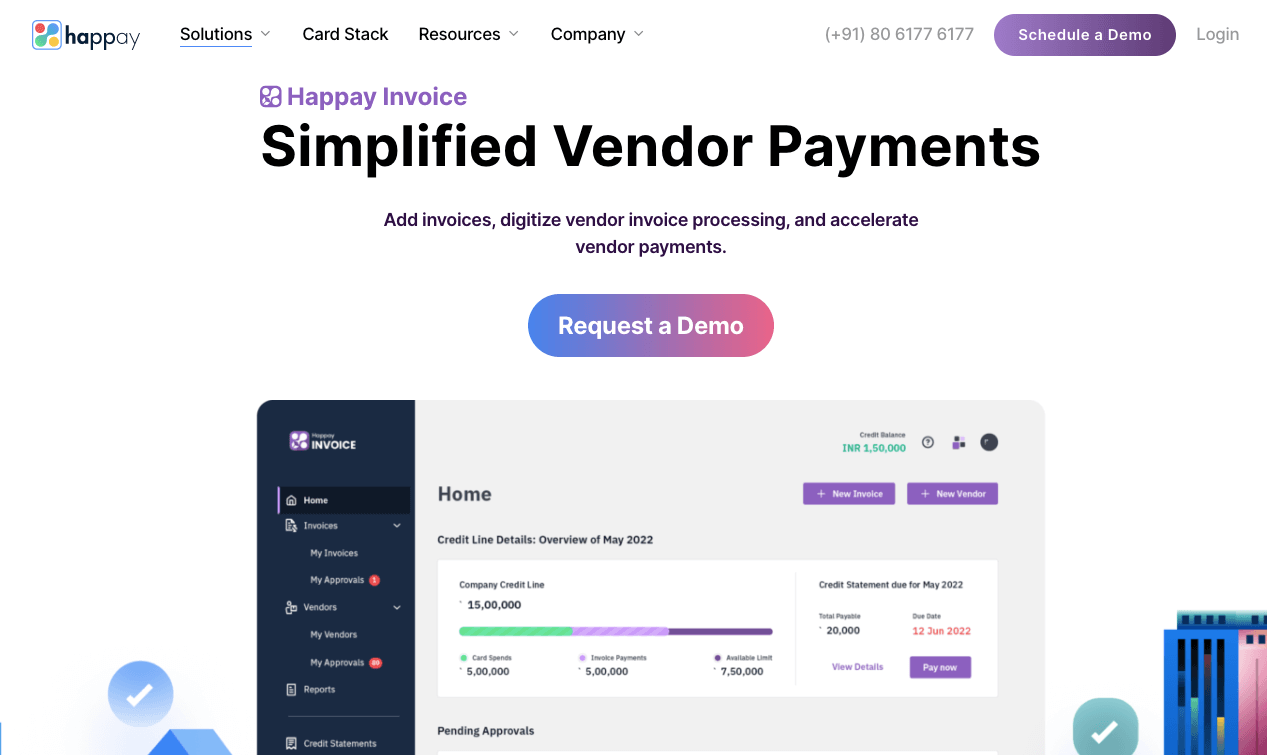

1. Happay Invoice

Happay Invoice is your ideal solutions if you are looking to simplify the process of making payments to your vendors. It is one of the best invoicing software and comes with advanced capabilities that allow you to add invoices and digitize the entire process. You can expect an accelerated vendor payments process that saves precious time and resources.

Furthermore, your accounts team can experience seamless invoice processing with inbuilt tools. Besides improving process efficiency, it will also allow your team to experience enhanced productivity. You can also be on the right side of the law with business-compliant processes.

Features of Happay Invoice

Happay Invoice comes with a range of features that will redefine the way your finance teams processes invoices.

Let’s take a look at them.

- Get end-to-end visibility for invoices and vendor payments.

- Get improved liquidity management and cash flow visibility with Happay’s credit line.

- Finish pending tasks timely through regular prompts and notifications.

- Register vendors seamlessly by adding the necessary details.

- Create a robust approval workflow to process invoices.

Why choose Happay Invoice?

Happay Invoice is a seamless invoice processing solution that allows you to do more in less time. The invoice templates offered by Happay are ideal for burdened finance teams looking to enhance process efficiencies and boost productivity.

Besides the operational benefits, there are financial benefits as well. You can improve the cash flow of your business by availing of the credit line feature of Happay Invoice.

Pros & Cons

Pros |

Cons |

| Reduces cost per invoice | Still a work in progress |

| Reduces compliance-related costs | – |

| Reduces late payment and related costs | – |

Pricing: Contact for quote.

Read More: What is Invoice Management: Types, Process, Systems, Challenges

2. Scoro

Scoro is an end-to-end work management software that helps businesses and professional service firms streamline their operations and boost productivity. It is an all-in-one solution that covers all aspects of work, from project management and task management to time tracking, invoicing, automated billing, and reporting.

It is suitable for businesses of all sizes and industries. With Scoro, you can plan and manage your projects in one place, get a real-time overview of your team’s work progress, track billable and non-billable time, and generate accurate reports on your project’s financials.

Features of Scoro

Scoro is an end-to-end work management software that helps teams better organise and manage their work.

Here are some of its top features.

- Its customisable dashboard gives you a clear overview of your team’s work.

- Stay on track with real-time progress tracking.

- Improve teamwork with built-in tools for communication and file sharing.

- Scoro’s project management features can streamline and improve workflows.

- Get insightful reports on your team’s performance and progress.

Why choose Scoro?

Scoro is the all-in-one work management software that helps you get more done in less time. From project and task management to CRM and invoicing, Scoro gives you everything you need to run your business efficiently.

It helps you to streamline and optimise your workflows, saving you time and money. The software includes project management, task management, time tracking, invoicing, and more.

Scoro can help you boost your productivity and efficiency while giving you complete visibility and control over your work. It is an ideal solution for businesses of all sizes.

Pros & Cons

Pros |

Cons |

| It is an all-in-one solution for work management | The software is not always intuitive |

| Flexible and customisable to the needs of your business | Limited integration capabilities with other software |

| Easy to use for all members of your team | Limited customer support |

Scoro is a powerful, comprehensive project management software solution that offers flexibility and customisation.

Pricing: $28 Per Month

Quick Read: 10 Best Expense Management Software

3. QuickBooks

QuickBooks is a popular accounting software used by small and medium businesses. It is a good option for businesses that need to track income and expenses, manage inventory, and generate invoices and GST reports. QuickBooks can track customers, vendors, employees, and other important data points.

The software includes several features that make it easy to use, including creating custom reports and exporting data to Excel or other spreadsheet programs. QuickBooks online also offers integration with many third-party applications, making it possible to extend its functionality beyond basic accounting.

Features of QuickBooks

QuickBooks is accounting software that helps small businesses manage their finances. Some QuickBooks features include:

- The ability to track sales and expenses

- A user-friendly interface

- The ability to generate reports

- The ability to create invoices and track payments

- Integration with other software programs

Why choose QuickBooks?

There are many reasons to choose QuickBooks accounting software for your business. It is a powerful and versatile tool that saves time and money. Furthermore, it can help you track income and expenses, manage inventory, and create financial reports.

As a leading accounting software for small businesses, it is used by millions of firms worldwide. QuickBooks is easy to use and you can customise it to meet your needs. It is also affordable and offers a free trial, so you can try before you buy it.

Pros & Cons

Pros |

Cons |

| It is user-friendly and easy to learn | QuickBooks can be expensive to buy and maintain, especially if you upgrade |

| It can handle everything from invoicing to expense tracking | The software can be complex for some users and may require training or help from an accountant or bookkeeper |

| You can integrate with other business software to keep your business data in one place | QuickBooks requires a stable internet connection |

| QuickBooks offers different pricing plans to meet business needs and budgets | – |

Overall, QuickBooks is a powerful and helpful accounting software program that can be a great asset for small businesses.

Pricing: $15 Per Month

Quick Read: 10 Best Expense Reporting Software Systems

4. FreshBooks

FreshBooks is accounting software designed specifically for small businesses. It is easy to use and can help you save time and money by keeping track of your finances in one place.

This software provides detailed reports on your income, expenses, and profitability. The information can help you decide where to focus your efforts going forward. FreshBooks also makes it easy to send professional-looking invoices.

Features of FreshBooks

FreshBooks saves you time and helps you keep track of your money. Here are some features that make FreshBooks the best accounting software for business owners and accountants.

- It is easy to use so that you can track your finances immediately.

- The FreshBooks mobile invoicing tool lets you track your finances on the go.

- It automatically backs up your data, so you never lose your financial information.

- It uses industry-leading security measures to keep your data safe.

- Project management is easy with FreshBooks. You can add projects, view their progress, and track time.

Why choose FreshBooks?

FreshBooks is cloud-based accounting software that makes tracking your expenses and income easy. You can also send invoices, get paid, and keep tabs on your business finances. And because it’s cloud-based, you can access your account from anywhere, anytime.

FreshBooks has many features designed to save time and streamline your accounting. For example, you can automatically import data from your bank account, track mileage and expenses, and create custom invoices.

One of the biggest benefits of FreshBooks is that it is extremely easy to use, even if you have no prior accounting experience. The software is intuitive and user-friendly, so you can get started managing your finances right away.

Pros & Cons

Pros |

Cons |

| It is easy to use and great for small businesses and startups | It is more expensive than some other accounting software options |

| It has many features, including invoicing, time tracking, expense management, and project management | FreshBooks is hard to scale |

| It integrates with popular business applications like PayPal and Stripe | – |

| It has a strong customer support team that can help with any issues | – |

Pricing: $4.5 Per Month

Quick Read: Differences Between Bookkeeping and Accounting

5. Wave

Wave is an easy-to-use money management software that helps you keep track of your finances and make smart decisions with your money. The software helps you stay on top of your bills, budget better, and save money.

With Wave, you can see your financial information in one place and get insights into your spending and saving habits. It also offers tools to help you pay off debt, plan for your future, and make the most of your money. Besides small and large businesses, it is also ideal for freelancers.

Features of Wave

- Wave automatically categorises expenses so you can track spending.

- Wave’s accounting reports give you the insights you need to make informed business decisions.

- It integrates with several popular business applications so that you can manage all your business needs in one place.

- It allows you to pay bills online.

- It also offers a variety of financial tools to help you manage your money.

Why choose Wave?

Wave money management software saves you time and hassle by providing a simple, streamlined way to manage finances for everyone from freelancers to businesses.

Wave offers a variety of features and options that allow you to customise the software to meet your specific needs. The platform integrates with many popular accounting and financial software packages, making it easy to get started.

It’s free to use, easy to use, and offers a variety of features and benefits that other programs simply don’t provide.

Pros & Cons

Pros |

Cons |

| Simple, intuitive design makes it easy to use | Limited customisation options compared to other programs |

| The affordable price point makes it a good value for small businesses | Some users have reported stability issues |

| Includes features like invoicing and expense tracking | – |

| Offers free call and email support | – |

Pricing: Free

Also, Read: A Guide to Spend Management

6. Tally Solutions

Tally offers a comprehensive product suite that includes accounting, inventory, point of sale, and tax solutions. Its products meet the specific needs of businesses in different industries.

Known for their ease of use and flexibility, they have been adopted by companies of all sizes worldwide.

Features of Tally Solutions

- Its integrated accounting and inventory management system saves time and effort in managing finances.

- It provides comprehensive sales and purchase management features to track customers and suppliers.

- Tally’s billing and invoicing features can save you time and money

- Tally Solutions offers a complete customer relationship management (CRM) system to help you manage your customers.

- Tally Solutions’ project management features can help you manage projects.

Why choose Tally Solutions?

Tally Solutions is one of the leading providers of business management software. With over two decades of experience, Tally Solutions has helped businesses of all sizes streamline their operations and improve their bottom line.

It is easy to use, even for businesses with no experience with business management software. You’ll be up and running quickly, with minimal training required.

Tally Solutions includes all the features you need to run your business effectively, including accounting, inventory management, customer relationship management, and more.

Pros & Cons

Pros |

Cons |

| It is user-friendly and easy to use, even for businesses with little accounting experience | Tally Solutions software can be expensive, especially for multiple licenses |

| Tally Solutions offers products that can be customised for your business | The products are only available online, which can be inconvenient for some businesses |

| The platform has a team of experts who are always available to help | Tally Solutions software isn’t compatible with all operating systems, so check compatibility before buying |

| You can avail of a free trial of their software | – |

Pricing: $7.5 Per Month

Quick Read: Difference Between Invoice and Bill

7. ClearTax

ClearTax software is one of the most popular tax preparation and e-filing software programs. It offers a wide range of products and services to help individuals and businesses prepare and file their taxes.

ClearTax has a simple and easy-to-use interface, making it an excellent choice for those unfamiliar with the tax preparation process. The company also offers a variety of features and tools to help users maximise their tax deductions and get the most out of their returns.

ClearTax is a trusted name in the tax preparation industry, and its products are used by millions of taxpayers every year.

Features of ClearTax

- ClearTax allows businesses to file their taxes online without any hassles.

- It provides businesses with the ability to generate e-invoices that are compliant with the latest GST guidelines.

- ClearTax is intuitive and user-friendly so that businesses can use it easily.

- ClearTax makes tax filing easy with features like Excel import, auto-calculation of taxes, and more.

Why choose ClearTax?

There are many reasons to choose Cleartax software for your tax filing needs. Cleartax is the most user-friendly tax software on the market. It’s simple, so anyone can file taxes, and its valuable features make it the best choice for tax filers.

In addition to being the easiest way to file taxes, ClearTax software is also the most accurate. They have a team of tax experts who are available to help you with any questions you may have. Cleartax also offers a free mobile android app with an iOS alternative that allows you to file your taxes on the go.

Pros & Cons

Pros |

Cons |

| It is user-friendly and easy to use, even for businesses with little accounting experience | Tally Solutions software can be expensive, especially for multiple licenses |

| Tally Solutions offers products that can be customised for your business | The products are only available online, which can be inconvenient for some businesses |

| The platform has a team of experts who are always available to help | Tally Solutions software isn’t compatible with all operating systems, so check compatibility before buying |

| You can avail of a free trial of their software | – |

Pricing: $12.49 Per Month

Suggested Read: How to Avoid and Resolve Invoice Disputes?

8. Square Invoices

Square invoices software is an excellent way to keep track of your finances. This software can help you manage and monitor your income and expenses, create invoices and estimate future payments.

Square invoices software is available for both Windows and Mac computers. The software is easy to install and can be used by anyone, regardless of their experience level. The interface is straightforward to navigate, and the software comes with various features that make it a great choice for small businesses and individuals.

Features of Square Invoices

- It lets you create and send invoices quickly.

- Square Invoices allows you to brand and customise invoices.

- You can track payments and display invoice history.

- You can set up automated payment reminders.

- You can see paid and unpaid invoices on your dashboard.

- Square Invoices integrates with leading accounting software to help you manage your finances in one place.

Why choose Square Invoices?

There are many reasons to choose Square Invoices as your online invoicing software. The software is simple to use, efficient, and designed to help businesses save time and money.

Square Invoices also offers a variety of features that can benefit any business, including the ability to create and send invoices in seconds, track payments, and manage customers. Square Go for Invoice you’re looking for a great invoicing solution for your business.

Pros & Cons

Pros |

Cons |

| Square Invoices Software is cloud-based accounting software | Some users have reported that the software is difficult to use and navigate |

| It helps businesses send professional invoices, track payments, and manage finances | The monthly and annual subscription plans can be expensive for some businesses |

| It saves time and money by automating accounting tasks | There have been some reports of glitches and bugs within the software |

| The software integrates with Square Point of Sale to provide a complete solution for businesses | – |

Pricing: $20 Per Month

Overall, Square Invoices Software is a great accounting solution for businesses of all sizes. The software is easy to use and provides a comprehensive solution for businesses.

Must Read: What is Expense Management?

9. Zoho

Zoho software is a comprehensive suite of productivity and collaboration tools. It includes everything you need to get work done, from word processing and spreadsheets to project and customer relationship management.

Zoho invoice is available in both on-premises and cloud-based versions, so you can choose the deployment option that best fits your needs. And because it’s a complete suite of tools, you can ensure you have everything you need to work effectively and efficiently.

Features of Zoho

- Zoho invoice includes a wide range of tools that can be used for various purposes.

- It is affordable for businesses of all sizes.

- It can be used on multiple platforms, including Windows, Mac, Linux, and mobile devices.

- Zoho invoice has an online office suite that includes everything you need to get work done.

- Its collaboration tools include real-time editing, chat, and video conferencing.

- You can track your business projects and tasks more efficiently.

Why choose Zoho?

There are many reasons to choose Zoho software for your business. Zoho offers a wide range of products and services that can cater to the needs of businesses of all sizes. The software is known for its reliability and security, making it a safe choice for companies that handle sensitive data.

Zoho software is easy to use and you can customise it to fit the specific needs of your business. Finally, Zoho software is affordable and offers a variety of pricing options to suit your budget.

Pros & Cons

Pros |

Cons |

| It is very user-friendly and easy to learn | Some users say the software is glitchy |

| It can manage customers, create invoices, and track inventory | Some features and integrations are only in the paid version |

| Zoho offers a free trial so businesses can try the software before purchasing | There have been some reports of glitches and bugs within the software |

| Zoho software is relatively affordable when compared to other similar programs | – |

Pricing: $9.5 Per Month

Must Read: 7 Best Zoho Expense Alternatives and Competitors

10. Vyapar

Vyapar is one of the most popular GST billing software in India. It offers a wide range of features and benefits that make it an ideal choice for businesses of all sizes.

One of the key features of Vyapar GST Billing Software is its ability to generate e-invoices. Businesses can save time and money by not having to print and mail invoices to their customers. Additionally, businesses can track payments and receive real-time updates on their GST filing status.

Another great feature of Vyapar is its built-in CRM. This feature allows businesses to manage their customer relationships more effectively. With Vyapar, businesses can add and update customer contact information, track customer interactions, and create custom reports.

Features of Vyapar

- Vyapar is a comprehensive GST billing, accounting, and inventory management software.

- It is simple to use yet powerful and feature-rich.

- Vyapar helps businesses keep track of their GST invoices, inventory, and accounting.

- It is available in both desktop and cloud versions.

- Vyapar is compliant with all the latest GST regulations.

- It offers a free trial period of 15 days.

- It comes with round-the-clock support from a team of experts.

Why choose Vyapar?

You should choose Vyapar GST Billing Software for many reasons for your business. First and foremost, it is a comprehensive and all-inclusive software that helps you with GST billing, inventory management, accounting, and other financial tasks.

It is also very user-friendly, so you can easily get started. Moreover, it offers a free GST Billing Software trial, so you can try it out before deciding whether or not to purchase it. Finally, the customer support is excellent, so you can always get help if you need it.

Pros & Cons

Pros |

Cons |

| It will help your business comply with the Goods and Services Tax (GST) laws | The initial cost of investing in a Vyapar solution can be high |

| It can prevent GST penalties and interest charges | Additional hardware and infrastructure may be needed to run the software |

| It helps you track GST credits and input tax credits, which can be claimed as a refund | The learning curve for the software can be steep, so you may need to train your staff |

| Vyapar streamlines invoicing and accounting, making financial management more manageable | Incorrect software use can lead to GST filing errors and penalties |

| Some software solutions offer inventory management, CRM, and analytics, which can improve business operations | – |

Pricing: $24.99 Per Month

Also, Read: How Does Invoice Automation Work?

11. XERO

Xero is affordable and easy-to-use accounting software perfect for small businesses and startups. It offers real-time financial visibility, which helps businesses make informed decisions and stay on top of their cash flow.

In addition, Xero provides businesses access to a wide range of financial services and products, including invoicing, bank reconciliation, inventory management, and reporting. Xero also offers a mobile app, which allows businesses to manage their finances on the go.

Features of Xero

- Xero’s interface is intuitive and easy to use, even for beginners.

- It automatically reconciles bank transactions, saving you time.

- Xero makes it easy to create and send invoices and offers payments options online.

- Its expense tracking features help you track and categorise business expenses for taxes.

- Xero’s real-time reporting features give you up-to-the-minute financial information so you can monitor cash flow.

Why choose Xero?

There are many reasons to choose Xero accounting software for your business. Xero is a cloud-based accounting solution that offers users several features and benefits. Perhaps most importantly, Xero is easy to use and gives users real-time visibility into their financial data. This means that users can make informed decisions about their finances and avoid surprises down the line.

Another reason to choose Xero is that it is highly scalable. This means that as your business grows, Xero can grow with you. Additionally, Xero integrates with several popular applications and has a wide range of support options, so you can be sure that you’ll always have the help you need.

Pros & cons

Pros |

Cons |

| Xero is easy-to-use accounting software that is perfect for small businesses | Xero isn’t as feature-rich as other accounting software |

| The software is cloud-based, so you can access it from anywhere | There have been some security concerns with Xero in the past |

| Xero is very affordable, starting at just $12 per month | Because it is cloud-based, you need a good internet connection to use it |

| The software has many features, including invoicing, bank reconciliation, and tracking expenses | – |

| Xero integrates with other software to make accounting easier | – |

Pricing: $12 Per Month

Future Read: Invoice Financing: Types, Process, Pros and Cons

Different types of billing software

Businesses can use many different types of billing software to manage their finances. Invoicing is the most popular billing software, which can track customer payments and manage invoices.

Other types of billing software include time tracking software, project management software, and accounting software. Each type of software has unique features and benefits, so it’s important to choose the right one for your business.

Quick Read: 10 Best Restaurant Billing Software

Need for billing software

Billing software can be useful for businesses of all sizes because it helps streamline and automate the billing process, saving time and reducing the risk of errors. With billing software, you can create invoices and send them to customers electronically, track payments and overdue balances, and generate reports to get an overview of your billing and financial performance.

Some billing software also integrates with other business tools, such as accounting software and customer relationship management (CRM) systems, to provide a more comprehensive view of your business operations. If you are a small business owner or an independent contractor, billing software can be especially helpful in managing your finances and getting paid on time.

Features to look for in billing software

When choosing small business billing software for your business, there are a few key features to look for:

- It should be compatible with your existing accounting software. It will save you time and hassle in the long run, as you won’t have to enter data into two separate systems.

- It should automate maximum processes. That includes automatic invoice generation, recurring invoices, and payment processing. The more automated the software is, the less time you’ll spend on monthly bills.

- It should offer excellent customer support. This is important if you run into software problems or have questions. Look for a company that offers 24/7 support so you can always get help when you need it.

Quick Read: 10 Best POS Billing Software

Benefits of billing software for your company

There are many benefits of billing solutions for businesses.

1. Save time and money

Perhaps the most obvious benefit is that it can save time and money with accurate and up-to-date records of your billings and help you avoid the costly mistakes that come with billing inconsistency.

2. Track inventory

Another benefit of billing software is that it can keep track of your inventory. With easy billing software, you can automatically track inventory levels and reorder products when necessary. This can save time and money, as you won’t need to track inventory levels manually.

3. Manage customer database

Billing software can also help businesses manage their customer database. This is important to keep track of your customers’ contact information and purchase history. With billing software, you can easily add and update customer information and save time and money.

Quick Read: 10 Best Medical Billing Software

Challenges of billing software

As your business grows, you’ll need to consider implementing a billing software solution. But before you do, be aware of your potential challenges.

1. Error tracking

One of the most common problems with billing software is that it can be difficult to track errors. If you’re not careful, you could end up billing your customers for the wrong amount or even double-billing them.

2. Set up and use

Another challenge is that billing software can be complicated to set up and use. Getting the system up and running may be difficult if you’re not tech-savvy. And even if you are, you may still find the learning curve to be a bit steep.

3. Fraud

You need to be aware of the potential for fraud. If you’re not careful, it’s easy to accidentally give someone who shouldn’t have access to your billing system. This could lead to them making unauthorised charges or stealing your customer’s credit card information.

If you’re aware of these challenges and take steps to avoid them, you’ll be well on your way to choosing the right billing software for your business.

Also, Read: What is e-Billing? A Comprehensive Guide for Electronic Billing

How much does billing software cost?

The cost of billing software can vary depending on the features and capabilities you need. Some are free invoicing software, while others can cost several hundred dollars per month. It’s important to consider what features and capabilities you need in a billing software and choose a plan that meets your needs and budget.

Some software offers free billing trials or money-back guarantees, which can be a good way to try out the software and see if it works for you before committing to a subscription.

FAQs

There are many different billing software options available for small businesses. The best choice for your business depends on many factors: the size and type of your business, your budget, your specific needs, etc.

One popular billing software option for small businesses is QuickBooks. It is cloud-based accounting software that includes features such as online invoicing, bill payment, and expense tracking.

Tally is one of the most popular accounting software used in India. It is simple to use and can be easily adopted by small businesses. It is compliant with all the GST laws and can generate e-invoices as required.

The cost of billing software for small businesses can vary depending on the features and functionality required. However, there are a few general price points to consider.

Small businesses can expect to pay around $15 per month for basic invoicing and billing functionality. This price point typically includes invoicing, payments, and expense tracking.

Billing software streamlines the process of billing customers for goods and services. The software can generate invoices, track payments, and manage customer accounts. Billing software often integrates with other business applications, such as accounting software, to automate financial tasks.

The short answer is yes, billing software is secure. In terms of data security, billing software is typically very secure. This is because the software is designed to store sensitive financial information, so the developers put a lot of effort into ensuring it is secure. The software is usually encrypted, so even if a hacker were to get access to your data, they would not be able to read it.

No, billing software is not free. However, several options provide various levels of functionality and pricing. Some companies offer free software trials, so it’s worth checking out a few options to see what best fits your needs.