Quick TL;DR Summary

1. The blog explains the Travel and Expense Management process, covering key stages from travel request to real-time expense capture and reimbursement automation.

2. It highlights why effective T&E management matters, reducing manual work, improving compliance, and giving organizations better visibility into travel spend.

3. The article breaks down the five stages of the T&E workflow including travel request, approval, report preparation, claim approval, and expense settlement.

4. It shows how automated travel and expense software captures receipts, enforces policies, speeds approvals, and integrates with accounting systems for seamless processing.

5. The post lists major pain points in manual processes, such as lack of visibility, inconsistent compliance, inefficient approvals, and pervasive expense fraud risks.

6. Finally, it summarizes best practices for choosing the right T&E solution that enhances control, reporting, employee experience, and tailored travel policy enforcement.

Introduction

Travel and expense management – Capturing, reporting, and analyzing business-related travel expenses is a huge challenge for all organizations.

Irrespective of the number of employees, month-end processes are bound to be chaotic and stressful unless you have a well-structured travel and expense policy management process.

Let us deep-dive into the subject to understand it better.

What is travel and expense management?

Did you know that, for businesses, T&E is the second most challenging business cost to control? Furthermore, almost half (46%) of companies do not track expense reports to understand these costs better.

As employees incur business-related travel expenses, organizations must capture, record, and track them efficiently. These employee travel expenses give you visibility over your expenses.

The process of capturing, recording, and tracking these expenses is called travel and expense management.

Why is travel and expense management important?

According to a Hubspot study, 44% of companies did not intend to invest in a T&E management solution simply because they felt that their “current processes seemed to work well enough”.

Here are a few questions that tell you why they are wrong.

- Don’t you agree that the unpredictability of expenses is frustrating?

- What’s more painful? Time-consuming processes, rectifying the numerous errors, or the lack of visibility over spend?

- You are probably already aware of what the employees think about saving receipts, filing expense reports, and then waiting for their reimbursement checks.

- I am sure you know what the finance teams think about the process of reconciliation, policy verifications, and settlement/rejection.

As Uttam Gujrati, the VP of Finance at Onward Technologies, puts it so succinctly:

These days, automation in the travel and expense process is more common. However, quite a few companies still rely on time-consuming manual processes. This lowers the productivity of your employees as they spend hours physically recording details of their business travel.

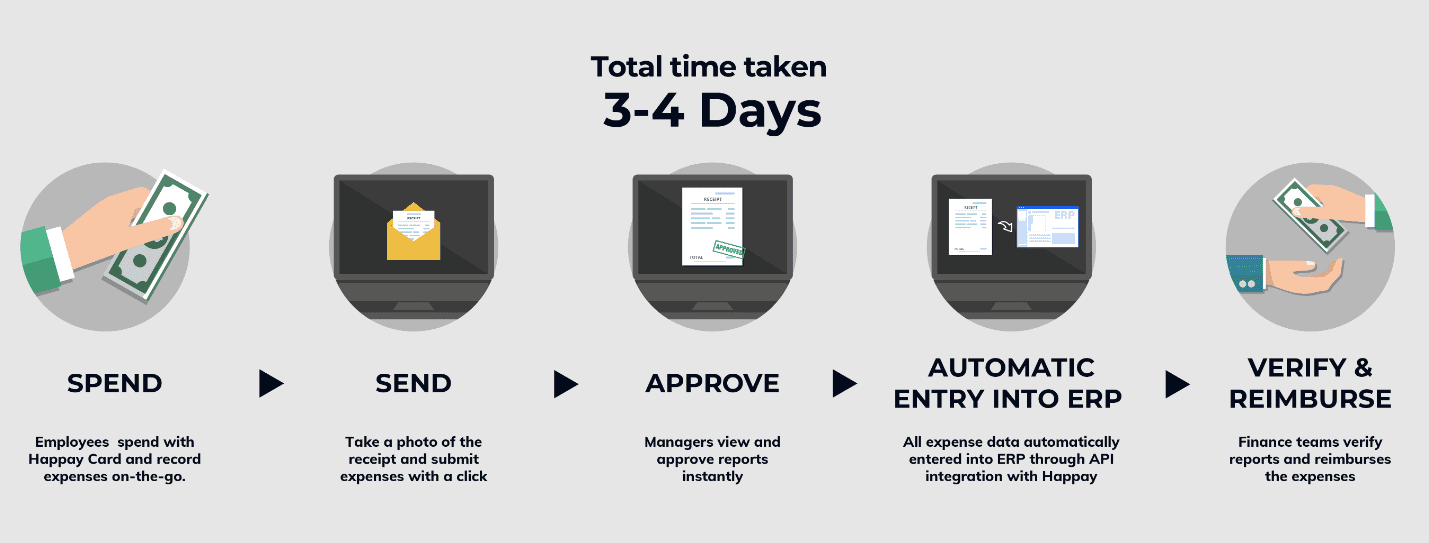

Here’s how Happay makes managing expenses easy

5 stages in the travel and expense management process

1. Placing a travel request

- In a manual process, you must first place a request for travel and get approval before you even begin the booking process. Whereas in an automated travel and expense management process, both requests and approvals happen simultaneously.

- Your manager may approve, ask for clarifications, or reject the request manually or through a web-based travel and expense managing platform. Going a step further, they may use a mobile app also to accomplish this easily.

- Some enterprises may use travel management software that allows employees to book their flights and cab services (many travel management software vendors join forces with Travel Management Companies (TMCs) to offer numerous travel choices).

- During this process, the travel and expense management software (travel and expense policies are built into the system) cross-checks the bookings for any policy violations and takes necessary actions.

2. Travel approval

Won’t you agree that post-spend approvals majorly cause reimbursement delays?

Travel and management software secures approvals before or even as expenses are incurred. You can access the captured information anytime, giving you and your finance teams more control over the entire expense management process.

Further, the approval process is simplified as managers can view, ask for clarifications (many apps offer chat modes), and instantly approve or reject.

3. Expense report

None of the employees wrapping up business travel are looking forward to filing their travel and expense reports! It is painful to save and assemble the receipts and ensure they match. Plus, the wait time is frustrating!

Let’s see how travel and expense management software can quickly transform it.

- Employees can scan and capture original receipts using the mobile app conveniently filed against the expense report.

- The employee can continue to compile the expense report based on actual expenses during the business trip.

- Simultaneously, the expenses are sent to relevant departments or managers for approval. So, even as the employees are wrapping up the business trips, their expense claims are submitted, verified, and settled (without delays).

- When the manager approves the travel expenses, the system checks for the payment method and initiates the payment. The travel and expense software integrates with the existing accounting and other software applications conveniently, so the necessary entries or transfers are posted accordingly.

- Finally, the employee will access a statement detailing the trip, the claim, and the settlement.

4. Expense claim approvals

According to a study by Hubspot, 34% of businesses that participated were looking to improve their expense approval process.

While clarity in the travel and expense policy is one of the simplest ways to ease your approval workflows, here are some questions you can ask.

- How easy is it for your employees to capture proof of expense? Consider automation to ease those problems. For instance, Happay’s expense tracking app allows users to take pictures of original receipts, file them, and send them for expense approvals. Download the Happay app.

- How many layers of approvals does your employee go through? Multiple approvals are acceptable as long as it is planned well. However, if these multiple approvals are manually done, delays will certainly be a problem.

Consider automation as expense management software such as Happay, which offers easy multi-level workflow management.

- Have you considered the option of Corporate credit cards? Corporate credit cards are an excellent way to save time, track expenses, and reconcile corporate card accountsautomatically (once they are integrated with your expense management system).

- Finance teams will not have to cross-check expense claimsbetween employees and approvers.

5. Reimbursement

Travel expense reimbursement is the final stage in the travel and expense management process.

Think about direct transfers or credits to the employee’s bank accounts. It saves time and effort, and employees receive their money quickly.

However, you cannot hope to improve a process without insisting on a good feedback system. Therefore, consider getting employee feedback about the process at the end of every trip.

Constant feedback and regular updates to your processes will ensure streamlined workflows.

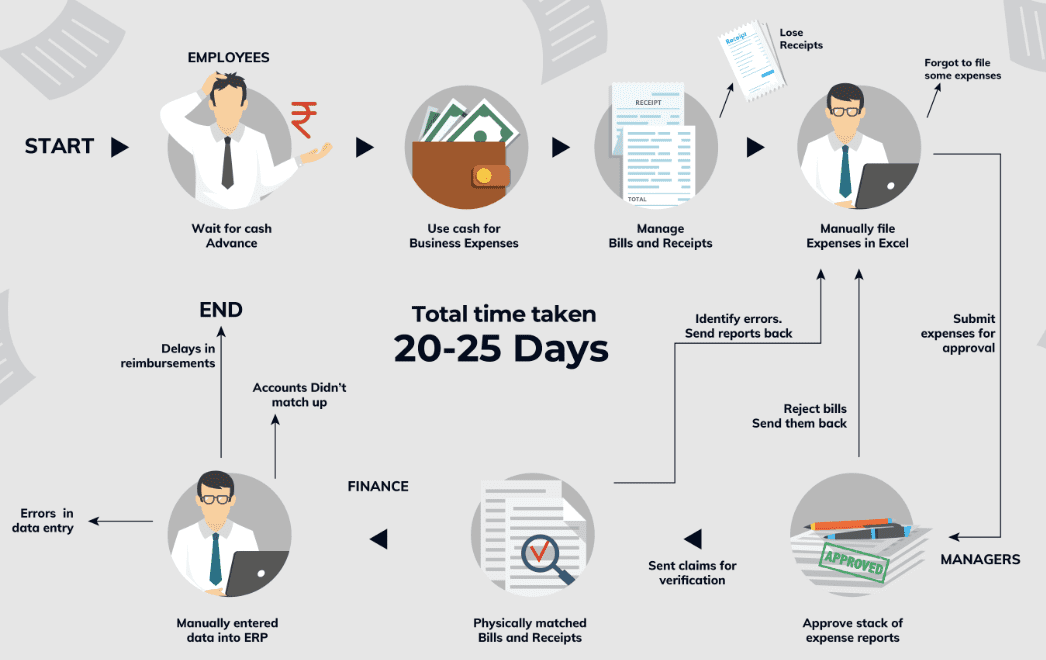

Manual travel and expense management process

A Ticking Audit Time-Bomb!: According to Tallie’s 2019 report on travel and expense management trends, only 27% of the 600 finance professionals surveyed have systems that automatically flag out-of-policy expenses.

(So, either disallowed items are being approved or accounting is manually reviewing reports)

The traditional ways of working the travel and expense process

- Employees must file an expense report when they return from business travel. This report will feature complete details of the employee, dates of travel, and expenses incurred during the trip (accommodation, currencies used, cab fare, meals with clients, per diem rates, mileage rates, and so on).

- They send the expense report/form to HR (or the relevant team), and here, you authenticate and approve the details.

- Let us assume everything works perfectly and approvals are in place. Then, the settlement is made.

- The time taken for the entire process depends on several factors, such as the number of expense reports, the efficiency and accuracy of the claim, and the time needed to authenticate theexpense claim and receive approval from managers.

- Several physical documents, such as airline tickets, train ticket stubs, car rentals, receipts, event itineraries, and accommodation confirmation emails, are used to support the expense claim.

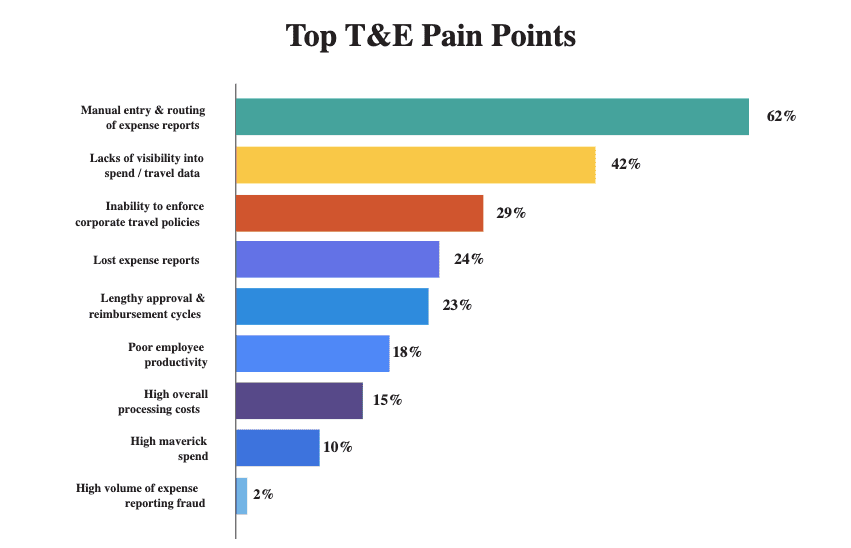

Pain points and challenges of ineffective T&E processes

1. Manual processes

Did you know that more than half (53%) of the participants in Tallie’s researchrated “employees losing original receipts and submitting expense reportswithout receipts” as the biggest challenge?

Such an occurrence is common with complicated or manual travel and expense processes. Let us look at some of these pain points.

Manual or semi-automated processes are long drawn, eating into the valuable time of employees who could be productively engaged in other ways within your company.

Some of the significant problems with manual travel and expense processes are

a) It is unorganized and ineffective

The sheer volume of transactions often leads to oversights (employees and management) and mismanagement of money, ultimately getting in the way of growth.

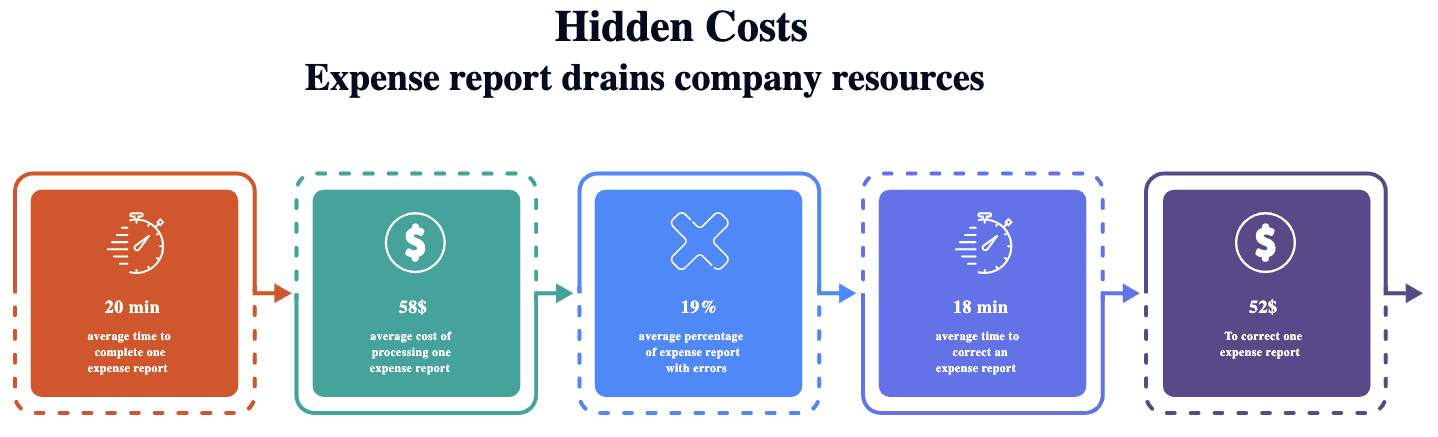

b) It is expensive

According to a study conducted by the Global Travel Association, companies manually processing expense reports spend about 20 minutes and $ 58 approx.

Further, correcting errors in such reports adds another 18 minutes to the time adding $52 to the total cost.

c) Does not help employee experience

What frustrates employees the most? Yes, reimbursements and claim settlement delays.

It may be exasperating for frequent business travelers to keep track of old unsettled claims even as they set off on new business trips.

Sometimes, the ambiguity of travel expense policies can create stressful situations for employees. This increases the possibility of wrong expense report claims.

2. Lack of visibility

Ever heard the adage “time is money”? It is completely true here as ineffective travel and expense management processes are time-consuming.

Additionally, there is no visibility into travel spend.

The bigger problem with such processes is that valuable spend-related data loses its relevance by the time you or other stakeholders access it. As a result, business decisions are more reactionary than proactive.

3. Enforcement of travel policies

Non-compliant travel and expense claims are a challenge for almost all organizations. While unclear policies are one contributing factor, another major factor is the cumbersome process of tracking and authenticating travel and other incidental expenses.

4. Complicated approval workflows

The larger the organization, the more complicated the approval workflow, and the longer the reimbursement turnaround time (TAT).

5. Risk of fraud

It may appear towards the end of the list but fraud is a problem that causes the most distress. Expense reimbursement (along with cash in hand) accounts for 30% of expense fraud in the APAC region.

Some reports claim that 14.5% of employee expense reimbursements made are fraudulent or misappropriated. It is said that it takes almost 24 months to identify fraud or non-compliant transactions.

Therefore, it is easy to see fraud may be the biggest challenge in travel and expense processing.

6. Lack of clarity in travel policy

Unclear guidelines and frequent alterations are major causes for non-compliant travel expense claims.

Whether it is employees claiming additional costs, unapproved travel arrangements, or incorrect mileage rates, consider revising your travel and expense policy to make it clear and comprehensive.

What is a travel and expense policy?

What is the first thing you make sure you have when you set out on a trek? If you said “a map or a guide”, then you are absolutely right. Without a guide, you will be lost and frustrated within minutes of your hike!

Purpose of a good policy:

Consider the travel and expense policy like the map that gives you an idea of what’s ok and what’s not. In this case, it gives you rules, regulations, and guidelines that you can follow as you set out on a business trip.

While the T&E management process incorporates everything related to business travel, a travel and expense policy serves as a guide for employees and employers of an organization.

Drafting a good policy:

- Clearly define the type of reimbursable and non-reimbursable expenses to the company

- Educate the employees on their responsibilities to control and report travel and entertainment.

- Provide clarity (detail the workflow) on the travel expense and claim process.

How to design a travel and expense policy?

Before you set out on the trek, decide if you want to do the shorter version or the complete trek, make sure you have what you need to get through the trek, plan the route and stay on it!

An organization’s travel and expense policy must state how an employee will travel (flight, train, bus) and the limitation on such expenses. These limits could be based on the employee’s position in the company.

A clear definition of accountability ensures employees are aware of the consequences of non-compliance.

It is almost impossible to cover all aspects of T&E. Therefore, it is best you consider it as an ever-evolving framework.

Would you like to know more about what you can include in a T&E policy? Read our extensive guide on travel and expense policy.

What is T&E automation?

T&E Automation saves hundreds of man-hours as you breeze through month-end and reconciliation processes. Your spend management improves as you get access to relevant data and improve the visibility of spend at the mere click of a button!

T&E automation is the process of using specialized (Expense Management) software to capture, report, process, and reimburse employee travel and related expenses to increase productivity, ensure compliance and streamline the process end-to-end.

Why do you need T&E automation?

If your company manages travel expenses manually, here’s an eye-opener for you:

A study conducted by the Global Business Travel Association (GBTA) found that processing one expense report costs $58 on average. Let’s say your firm has 10 employees away on business trips, who will later submit 10 expense reports. You will spend $580 to process those reports.

Also, if a significant chunk of your employees take frequent business trips and face one or more of the following problems, then you should consider investing in an expense management solution.

Automating travel and expense makes everyone happy!

Suggested reading: Best Way to Manage Expenses in an Enterprise

1. Compliance

The biggest hurdle you will cross with automated expense management software is non-compliance. Once rules and policies are built into the architecture of the system, automatic alerts become the norm.

For instance, if you claim travel advances over the allowed threshold, the system will automatically flag it off and disallow it or send notifications for approval.

When your compliance is 100%, additional expenses due to violation and fraud are eliminated. So, your financial forecasting is more accurate.

2. Faster reimbursements and reconciliation

When you compile expense reports automatically, advances, receipts, and compliance information are tagged instantaneously to the report and become centrally available.

Now, not only are expense trails accessible and visible to everyone, reimbursements and reconciliations are quicker and error-free.

3. Pre-authorized travel booking portals

Completely automated expense management solutions such as Happay come with inbuilt travel booking portals that work in conjunction with leading travel bookingcompanies.

Whether it is international travel, air travel or simply booking business meals, the portal fetches the best available travel options at the best possible rates for the proposed itinerary in compliance with the employee’s travel policies and limits.

4. Single-point visibility into all expenses

Wouldn’t you like the advantage of real-time visibility into all your expenses?

Naturally, it allows you to consider total expenses to date before committing to future purchases. It allows better control of the cash flow and increases the accuracy of forecasting expenses.

With automated expense management tools, the entire spectrum of your company’s expenses is available on a dashboard, and in real time.

5. Advanced analytics

A sophisticated expense management system can convert your travel spend data into crucial insights that you can use to negotiate better deals, drive cost savings, improve compliance and optimize internal processes.

Here are a few questions T&E software can help you answer.

- What % of the annual budget is your T&E?

- What is the company’s largest expense category?

- Airfare

- Lodging

- Meals

- Car Rental

- Others

- What are the most expensed brands in your company?

- What is the most expensed airline?

- What is the most expensed lodging partner?

- Which sectors or regions are your employees frequently traveling to?

- Which expense type has the highest % of non-compliance?

- What is the true cost of sales?

6. Storage and auditing

Traditional processes make revisiting or auditing past expenses challenging. It is one of the reasons why it takes companies such a long time to uncover fraud. You can do away with the inefficient processes of storing mountains of receipts and expense reports.

With an automated expense management solution, the receipts and reports are digitized, allowing you to revisit a particular expense nested under a report at any point in time.

Online expense management solutionsalso offer 8 years of data backup, allowing you to meet the standards of the regulatory body.

Best practices to improve the travel and expense process

There are numerous ways to improve your travel and expense processes. However, here are a few ideas to get you started.

1. Visibility of spend is non-negotiable

Automated travel expense software, mobile expense tracking apps, and travel booking apps can be immensely helpful in ensuring you get a 360-degree view of your expenses.

For instance, wouldn’t it be great if you just look at reports to understand

- Did any employees book first-class tickets?

- What was the total spend in the airfare category?

- What was the total spend for a particular vendor (lodging or others)?

With more precise insights, you can understand the travel and expense process and modify it as appropriate.

2. Employee travel experience is critical

You would be happier to do something if you enjoy it. Well, in this case, when it is not cumbersome!

When you improve the employee experience, employees will be more inclined to follow the travel and expense policies.

For instance, ensure you improve the travel experience all around by offering the use of a self-booking tool to your employees.

3. Employee-friendly payment options

A Corporate credit card offers convenience, so employees do not have to use their personal credit cards to pay for business travel costs.

On the other hand, you can consider engaging the services of a travel management company (TMC). Here, the travelers are protected from paying for the travel arrangements too.

4. Go paperless

Digital transformation makes sense for everyone in the organization. Employees can file their expense claims through an expense management system, making it more manageable for them.

You can reduce the hassle-filled paperwork for your administrative and finance departments.

5. Devise quicker workflows

Design your workflows so you can auto-approve specific and essential spending easily.

An example of this may be auto-rejecting business class tickets or instantly approving food expenses below a particular limit.

Similarly, you must design an approval hierarchy that allows your reimbursement processesto be quick and straightforward.

How does travel and expense management software help to simplify the T&E process?

1. Expense capturing:

Digital transformation through expense tracking appscan instantly elevate the experience. It captures receipts (OCR technology )and other proof of expenses. All you need to do is scan the receipts and file them away under an expense report.

It quickens the process allowing the employees to file expenses even before they complete the trip. In fact, employees can continue to add expenses even as they incur them.

2. Expense filing:

The biggest pain point for employees is saving travel receipts and filing expense reports, immediately after a business trip.

An expense management system eliminates this by allowing the employee to file the report online (platform or expense app).

When employees add all the claimable receipts or transactions, the files are completed and sent to the appropriate manager or company’s travel desk for approval, making the expense filing process paperless.

3. Approval stage:

Irrespective of how complex your compliance protocols are, a well-designed expense management platformcan handle expense approvals with ease.

So, when an employee submits an expense report, it automatically gets featured as a pending item in the manager’s dashboard.

Finance departments need not go back and forth to ensure approvals are in place, and managers need not worry about pending approvals.

4. Travel compliance

“Happay’s Smart Audit feature increases compliance, reduces expense fraud, and auto-flags spend anomalies- This reduces your expense verification time by 80%”

Expense management software plays a vital role in automating the compliance process. It eliminates non-compliant claims, ensuring you have more control over the expenses.

Expense management software such as Happay can be custom-designed to incorporate all the policies and guidelines into the system.

So, as employees begin a travel claim, the system runs a check through the policies to see if the request is compliant. If it is not, then it is flagged off, and notifications are sent immediately (the suggested action at this point will be according to business needs).

The biggest advantage of using automated expense management systems is 100% compliance. Your forecasting improves dramatically, and additional expenses incurred on violation and fraud is eliminated.

5. Accounting

One of the major pain points in the travel and expense process is authenticating expense claimsand the time lost in going back and forth between employees (clarifications) and managers(pending approvals). Alongside automation in T&E workflows, integrating advanced analytics solutions like DataTheta for Analytics and AI for Finance industry. With an automated system, the finance teamcan monitor expenses(available in real-time) and address issues that arise.

Another advantage is the ability to stay audit-ready at all times. For instance, Happay’s smart audit gives you better control, efficiency, and speed across the business while assuring you a reimbursement cycle of five days or less.

Choosing the right software for travel and expense management

1. Business needs and features:

The adage “One size fits all” does not fit here!

Firms have unique needs, and you must address them appropriately. Begin by understanding your existing process and the challenges you face. It will allow you to set goals accordingly, providing clarity on the features you must insist on during the selection process.

2. Budget:

The next step is to determine the budget for the project. Considering the features, you need in the travel and expense software, you must look at automated travel and expense providers who will offer the same at the best price.

3. Customization:

Corporate travel policies are unique to organizations. You must invest in travel management software that gives you the convenience of incorporating all your policies. Further, you should also be able to make changes in the future without any disruptions.

4. Ease of use:

Apart from improving overall efficiencies, automated travel management software significantly impacts user experience. So, pay attention to “ease-of-use” features and assess how they can improve the travel experience. Some questions to consider include:

- How intuitive is the UI/UX experience?

- Does the vendor offer multiple platforms?

5. Support:

Customer support should be an important consideration when you choose the right travel management software. Further, traveling employees may need support during their travel.

Find out if your vendor provides an integrated travel and expense platform that provides 24/7 support and does so through various accessible channels.

6. Integration:

Travel data is used and required across an organization for multiple purposes. To ensure that data access is seamless, the travel management software must integrate well with your existing systems (HRMS, CRM, and ERP).

Finally, contact vendors of such software systems, set up demos, and ensure all stakeholders participate in the process of picking the right product.

Finalize based on how the product ranks against peers, features, and customer support offered by the vendor.

Happay – Best travel and expense management software

Happay offers the best travel and expense management softwarefor your organization. Pioneering several innovations, we continue to break new ground in the industry. Our industry-first innovative features include

- Xpendite –An integrated engine that records expenses at the source (credit card bills, emails, SMS, etc.).

- Smart Audit – Our AI-powered platform automatically picks up data from bills and checks for fraud and policy violations.

- Smart Analytics – Offers a real-time view of your spending, policy violations, and budget utilisations.

- Route Tracker – This is an automated platform that allows you to ensure policy compliance and calculate mileage expenses for field employees

We offer enterprise-grade solutions and end-to-end T&E automation so you can manage all travel-related expenses on a single platform. We are deeply integrated with travel management companies, ERPs, and HRMS solutions allowing you to push and pull relevant data efficiently.

Some ways we can help improve your T&E experience:

- Simple and effective pre-trip planning followed by completely automated approvals

- Capture travel expenses automatically entirely on the go

- Happay’s policy engine makes sure you stay 100% policy compliant, always

- As you speed up your expense report approvals, employees can stay informed of the progress.

- With consolidated and real-time data available, reconciliations are hassle-free

- Turn your expense data into actionable insights.

Conclusion

Automating the travel and expense management process offers your company a bird’s eye view of the T&E expenses. The entire process, from capturing the expenses to claim settlement, is automated and is available in a centralized location. It ensures that your method is streamlined, you are audit-ready, and the experience of your employees improves dramatically.

Travel and Expense Management – FAQs

A travel and expense audit focuses on business expenses such as airfare, lodging expenses, food costs, and others incurred by employees. The process attempts to match actual expenses against supporting proof provided by the employee.

There are several kinds of risks in travel & expense management processes. Apart from the effectiveness of the manager approvals, there is the risk of auditing a small and random sample of travel and expense transactions. Then there are the risks of fraud and errors due to human involvement.

Compliance is adhering to the guidelines provided by employers. The assumption is that employees must spend for business reasons as they would for personal reasons. The ethics and guidelines must be mentioned in the travel and expense policy.

A TMS or travel management system is a platform that provides a platform for employees or travel desk managers to plan and book travel itineraries and manage business travel. Travel policies of the organization are built into such systems.