Introduction

GlobeNewswire states that the expense reporting software market size was estimated to be $5,487.17 million in 2020. It is expected to reach 13,349.12 million by the year 2026.

Expense reporting software simplifies business expense reporting, tracking, approvals, reimbursements, and reconciliations. The software platform automates the entire expense management process improving the employer’s and employee’s experience.

After studying 50+ market players, we give you the list of the top 10 expense reporting software. Along with a comparative table that gives you a quick look at relevant features of the best in the market, we also deep dive into each by giving you an overview, features, and pros/cons.

Here’s a short video of how Happay’s expense reporting software works.

List of 10 best expense reporting software

Best expense reporting software – Comparative table

|

Expense Reporting Software |

Market Segment |

Top Two Integrations With Budgeting Modules |

Analytics Module/Dashboard |

Audit Trail |

Time & Expense Tracking |

Pricing Details |

|

Medium & Large Enterprise |

SAP, Oracle |

Dashboard & Complete Analytics Module |

Yes |

Yes |

Contact for Pricing |

|

|

Small & Medium Enterprises |

Budgyt, Quickbooks online |

Dashboard |

Yes |

Yes |

Free trial, 12$ Per Month (flat rate, avg price) |

|

|

Small Business |

Xero & Quickbooks |

Dashboard |

No |

Yes |

Free trial, 15$ Per Month (flat rate, avg price) |

|

|

Mid-market & Large |

Zoho Books & Quickbooks online |

Dashboard & Complete Analytics Module |

Yes |

Yes |

Entry Level Price Free |

|

|

Small, medium & large enterprises |

NetSuite & Quickbooks online |

Dashboard |

Yes |

Yes |

No pricing information available |

|

|

High-growth enterprises |

Xero |

NA |

Yes |

Yes |

Entry Level Price Free |

|

|

Small & Medium Enterprises |

Xero & NetSuite |

Dashboard |

No |

Yes |

No pricing information available |

|

|

Small, medium & large enterprises |

Quickbooks Online Advanced & Quicken |

Dashboard |

No |

No |

3.99$ per month (per feature, avg price) |

|

|

Start-ups & Small Enterprises |

Sage Intacct |

Dashboard |

NA |

Yes |

Free trial, 4.99$ per month (per feature, avg price) |

|

|

Small Enterprises |

NetSuite & Sage Intacct |

Dashboard |

Yes |

No |

Entry Level Price Free |

10 Best expense reporting software systems and tools

1. Happay

Happay clearly stands out as the best-integrated expense reporting software solution. It is superior to the competition because it combines all five essential travel and expense management tools on a single platform.

- Travel management

- Expense management

- Integration and analytics modules

- GST automation

- Corporate cards

Addressing significant issues such as long reimbursement cycles, gaps in policy compliance, cash leakages, and poor employee morale, Happay’s expense reporting solution revolutionizes legacy systems to make them seamless, paperless, and completely automated.

Features that impress:

- Happay’s ReconX gives you access to over 40 data points sourced from more than ten different sources, auto-reconciled in one place.

- Xpendite automatically reads invoices physically and digitally. It captures relevant information accurately and completely error-free.

- Happay’s corporate cards offer a world of options with hassle-free processes and robust spend controls.

- Google-backed systems offer accurate expense and mileage tracking.

- Whether it is tracking, identifying, or addressing, Smart Audit assures time and effort savings for finance teams, 100% policy compliance, and 0 violations

- The superior spend and reporting analytics module allows you to track, manage, and get the most out of your financial information.

- It streamlines processes to improve workflow management.

- Happay’s DeepAnalyze offers 360o visibility in travel and expense. Your regular data becomes insightful information as you list the top spenders, Identify the top violators, or calculate the time taken for approvals, reconciliations, or reimbursements.

Happay rating

Overall Rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

According to Bittu Verghese, CFO of Sula Vineyards, Happay’s integrated travel, and expense solution has revolutionized their expense reporting process. Expense filing, approval seeking, and other processes are easily accomplished on a user-friendly mobile app. He counts the strong policy compliances through automated policy checks and real-time spend analytics as a significant win in the process transformation.

Suitable for: Medium and large enterprises

2. Xero

Xero was founded in 2006 and is well known for its accounting and bookkeeping software. It is considered one of the best organizations in cloud accounting for small businesses and other organizations. With the hope of making a difference in how enterprises manage financial data, they offer features that help companies access real-time financial data anytime and anywhere.

It also offers expense management tools that help businesses efficiently track and manage their travel expenses.

Features that impress

- The expense reporting system allows your business to submit and reimburse business expense claims digitally. You can track your business spend using Xero’s expense management tools. For instance, you can use mileage tracking (uses maps in mobile devices for accuracy) to submit expense claims.

- You can make your expense capture and claim process completely paperless. The reimbursement turnaround time is significantly reduced.

- The use of reports and analytics will improve as you take advantage of Xero’s customized pictorial and other category-wise reports.

Xero rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel

Users appreciate the fact that Xero seems to integrate quite easily with their existing system and are impressed with the support system. On the other hand, they are a little disappointed with the UI experience as they feel it is outdated.

Good for: Small and mid-sized businesses

Read also – 10 Best Travel Management Software

3. Freshbooks

Freshbooks is a cloud-based accounting software. It helps small service-based businesses with their accounting and bookkeeping. The expense reporting software is one of the features of their accounting software.

The expense tracker integrates with accounting, invoicing, and other reporting features to ensure visibility over your expenses.

Features that impress:

- The system creates expense and profitability reports automatically.

- Once your bank or card accounts are linked to the software, the system will update expense transactions daily and card reconciliations become easier.

- You can capture expenses on the go with the expense tracking app.

Freshbooks rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

Users feel positively towards the software that helps in better estimation and billing. Apart from helping to process payments quicker, it helps clients choose an option that works for them.

While some users felt that the new features were a bit clunky, the plus is that users can message the client on the invoice portal itself.

Good for: Small businesses

Quick Read: 11 Best Billing Software for Businesses

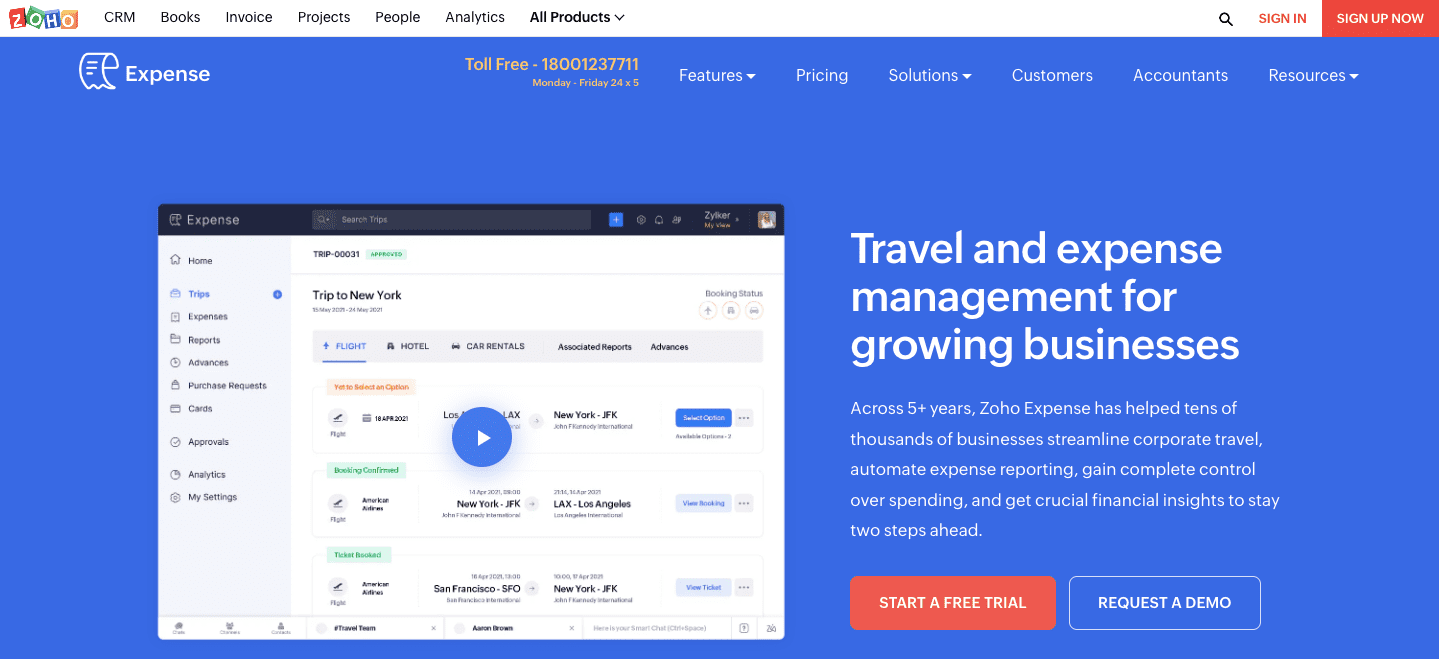

4. ZOHO

ZOHO expense offers a travel and expense software solution that completely streamlines your expense reporting process. Everything is automated, from expense capturing to approvals and reporting.

To reduce time, effort, and costs, the expense management system improves spend control by automating the approval processes, customizing the spend limits and rules, and digitizing the budgeting and analytics process.

Features that impress:

- The expense capture (receipts, corporate card transactions, and others), approvals, and reporting are easily automated.

- Budgeting, compliance, and forecasting automation reduces time and effort for finance professionals.

- A variety of charts, KPI widgets, and tables build up a customized view on your dashboard.

Zoho Expense rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

Users recommend Zoho Expense for startups and small businesses. The software’s drag-and-drop files feature is appreciated. Receipt management or the ability to pull data from receipts into reporting also seems to also impress.

What does not work is the steep learning curve that comes with the software and default information on the dashboard that cannot be customized.

Good for: Mid-market and large businesses

Future read: Zoho Expense alternatives and competitors

5. Nexonia

Nexonia is a cloud-based, configurable expense management software solution that helps you eliminate the manual element in expense reporting.

The organization is part of Emburse; the goal is to eliminate manual and time-consuming tasks so enterprises can focus on their mission. They offer expense management software and other accounts payable automation solutions too.

Nexonia is present in several countries and supports several organizations to become digitized. Their solutions streamline the expense capture, approval, and reporting processes.

Features that impress:

- Flexible workflows that can be configured to replicate your enterprise’s approval structure promise to grow as you do.

- The mobile application offers a good user experience that helps to create and manage your expenses on the go.

- Offers seamless integrations that update data into your existing platforms.

- Emburse Audit is one of the features they offer. A team of independent auditors reviews expense receipts to ensure compliance or spot possible fraud trends.

Nexonia rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

Users like the simplicity and user-friendliness of the mobile app. Further, the software’s integration capabilities seem to have impressed quite a few users.

What is counted as a con by most is the tax calculations, which can mean a bit of a learning curve. Also, most users found linking personal credit cards to Nexonia challenging.

Good for: Small, medium, and large enterprises

Read also – 10 Best Accounts Payable Software

6. Travelstop

Travel Stop offers travel and expense management software tools that assist enterprises in lowering costs and improving productivity. By managing their travel and expenses efficiently through web-based and mobile applications, organizations can digitize effectively and efficiently.

Whether it is employees, managers, finance teams, or travelers, Travelstop provides an easy and smooth way to manage expenses. As employees capture, track, manage, and report all types of expenses, managers review and approve the same instantaneously.

Similarly, finance teams enjoy the convenience of automation as relevant data flows seamlessly into your system.

Features that impress:

- Expense reporting is elevated to the next level as you streamline the capture and approval processes.

- Eliminates manual work thoroughly to make expense tracking effortless.

- You can streamline and simplify your approval workflows as expense reports are viewed and settled with a click of a button.

- Rules are automated, so policy compliances is better.

Travelstop

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel

Users appreciate the smooth travel booking process during travel planning. While the quick customer support came in for praise, some users were disappointed that travel-related warnings were not passed on to travelers.

Good for: High-growth enterprises

Also, Read: 10 Best Business Budgeting Software

7. Spendesk

Spendesk expense reporting software helps track employee expenses in real time. It leads to better reimbursement turnaround times across the organization.

Automating manual expense claim processes, Spendesk replaces them with an intuitive mobile app that tracks the claims even as employees submit them. Promising a safer and faster automated process, Spendesk hopes to make your business digitized and smarter.

Spendesk believes their differentiating factor is centralizing control by allowing decentralized employee spending. Second is their scalable solution that is designed to evolve with your business. Finally, offering real-time visibility, the software helps you to track your corporate spending efficiently.

Features that impress:

- The expense reporting software primarily helps you track your budget and approve claim requests, eliminating manual administrative efforts.

- The software eliminates the need for finance teams to send reminders, as you can collect 98% of the expense receipts on time.

- By automating the process, you can take expense reporting to the next level, as claim requests and expense reports can be addressed immediately, not at the end of the month.

- Expense reporting software ensures you are audit-ready at all times.

Spendesk rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

What users like about Spendesk is that it digitizes the old-fashioned expense management process into an efficient one. Another plus point is the design and intuitiveness of the app.

On the other hand, the lack of analytics on the mobile app was disappointing for some.

Good for: Small and medium enterprises

Read More: 10 Best Spend Management Software

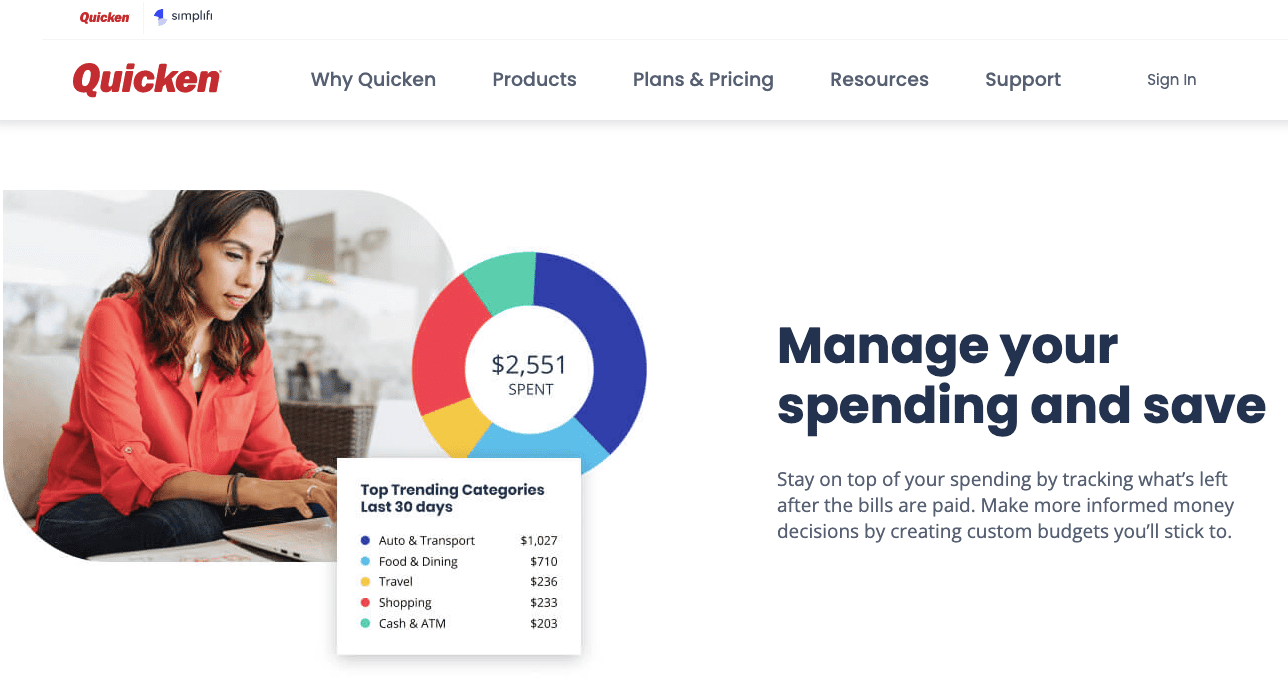

8. Quicken

Quicken, well-known as the best personal finance software in the US, offers several products and has also successfully expanded to mobile apps. It offers several software solutions with a mission to help customers stay financially strong, healthy, and confident. They now boast of over 20 million customers managing their finances confidently.

With several options, such as the Quicken Starter, Deluxe, Premier, and Home & Business, customers can choose the expense management software that suits their needs.

Features that impress:

- The expense management software lets you view transactions on web apps, mobile devices, or desktops by connecting to more than 14,000 financial institutions.

- The automation helps you to access and track expense transactions category-wise and identify problem cases, leading to better money management.

- Projection and forecasting your expenses is easier as you track your spending in real-time.

Quicken rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

Users like the straightforward and easy-to-use interface, the ability to sync all accounts in one place, and the software’s bonus real estate features.

However, as a con, most feel that their Home & Business package is only available for Windows. The investing features offered are not really relevant for businesses too.

Good for: Small, medium, and large property management companies

Read also – 12 Best Invoicing Software for Your Business

9. Expensya

Expensya hopes to make a difference in the travel and expense industry by offering software to ease the woes of those struggling with manual processes. With over 160 employees in over four countries, Expensya is currently used by over 7,00,000 users worldwide.

The expense reporting software automates the expense capturing, recording, and tracking processes, streamlines workflows. It also offers an efficient way to manage your spend.

Automatic tracking and generating expense reports coupled with several features such as ERP integrations, multi-level verifications, and approvals make this a good way to optimize the expense reporting process.

Features that impress:

- Real-time management of your business expenses is now possible with expense reporting software.

- The use of OCR technology helps eliminate the need for manual entries. Employees need only to capture the receipt through the mobile app.

- You can manage validation workflows quickly and efficiently as the approval rules are incorporated into the system.

- Whether it is spending policy automation, tax calculations, per diems, or mere integrations, Expensya promises to take care of it for you.

Expensya rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

Users find the Expensya tool easy to configure and use. Using the tool over various platforms and accessible customer support are some of the plus points.

As a con, users find the long response time of the receipt capture feature frustrating and rate the status of expense reports as confusing. Some others complain that finding claims later is challenging.

Good for: Startups and small businesses

Suggested Read: 6 Best Cash Flow Management Software

10. Brex

Formerly called Veyond, Brex is a fintech company offering app-based credit cards and a spend management platform for startups and enterprises. Offering a modern solution to a traditional challenge, their integrated cards and expense reporting software drives compliance while promising minimal manual effort.

The Brex expense reporting platform reduces the overall time spent on expense reporting and management, accounting and bookkeeping, and, eventually, budgeting.

Features that impress:

- As a CFO, you can count on the accountability it brings as you use budgets and other custom expense policies to manage spending.

- Brex offers a mobile app and the convenience of auto-generated receipts and global reimbursements.

- Brex’s expense reporting software promises to break down silos typical in legacy systems.

Brex rating

Overall rating

- Ease of use

- Customer service

- Features

- Value for money

*Ratings are based on numbers as published by Capterra

What users feel:

Users highly recommend Brex’s expense reporting software for startups and small businesses. The overall customer support, account management, and intuitive app come in for praise.

On the other hand, some aspects of the receipt matching features and the lack of specific accounting integrations are cons, as suggested by users.

What is expense reporting software?

Organizations process business expenses manually or have a semi-automated process. Whether partial automation or manual, these processes are time-consuming and error-prone.

According to survey highlighting the major pain points in spend management, more than 51% feel that the time they spend reporting negatively affects the ability to accomplish their work.

Expense reporting software streamlines the workflows by removing the major pain points, such as

- Expense capture,

- Policy compliance,

- Expense approvals,

- Tracking, and

- Reconciliations

The need for expense reporting software

In a time crunch, ignoring expense automation is like turning a blind eye to a high-speed elevator and insisting on climbing several flights of stairs!

Expense management solutions help organizations streamline T&E operations, improve productivity, and boost the bottom line. How the expense reporting software helps:

1. Faster processes

By eliminating paper from the process, you can save time and the cost of processing. For instance, expense receipt management is better as you can route expense capturing and reporting to approvers (through the expense app). Also, when the settlement is approved, it is transferred online to the employee’s bank account.

2. Shorter expense reimbursement cycles

Manual processes can be time-consuming and tedious. Time delays in expense reimbursement can seriously affect the personal cash flow situation of the employees. Expense management solutions can speed up the process by reducing the time taken to settle claims. It can improve the employee experience noticeably.

Reimbursement delays are most frustrating for employees. Verification emails flowing back and forth between managers and the finance team can lead to long waits. Such waits are not only frustrating but can be hard to keep track of when you travel often.

Customized expense reporting software can transform workflows, reducing the reimbursement turnaround time dramatically. Since policies are built into the system, approvals are more accessible and quicker.

Since the system carries out all policy checks, finance teams must pay attention to only a few claims that may have been flagged off.

3. The process is timely and error-free

The biggest challenge with traditional workflows is human intervention—the higher the human intervention, the greater the risk of errors and delays. Expense automation takes care of it by ensuring automatic data entry.

Paper receipts, spreadsheets, files with transaction histories, and extra-long email threads are common indicators of traditional or manual processes. Often, the result of such workflows is excessive paper, unnecessary delays, and a high risk of errors or fraud.

Expense reporting software allows employees to capture and submit their expense reports online. Even as these expenses are raised (pre-trip), approvers can accept or reject these claims through their mobile devices. Imagine the time, effort, and expense savings due to such a change.

4. Expense policy compliance

Would you like to know

- How many employees booked tickets outside the permissible limits?

- The number of employees who booked most expensive accommodations?

- If you could have stopped them from making those choices?

Out-of-policy claims are a significant pain point for finance teams and CFOs. Well-designed and customized expense management solutions assure travel and expense policy compliance.

With expense reporting software, you can do the above and more. The best expense management software is designed to notify approvers or managers when there is a policy violation.

The first level check is when the employee is notified of a possible violation. If they choose to proceed, it is raised as a red flag and awaits approval (these can be customized to suit your organization’s rules).

This not only improves policy enforcement but encourages employees to adhere to the travel and expense policies of the organization.

5. Better operational efficiencies

When the travel and expense process time reduces, it translates into better operational efficiencies. It allows employees to spend time on more high-value jobs.

Organizations have unique approval workflows, but the best expense reporting software can be customized to suit your business needs. So, whether you have linear, simplistic, or multi-layered approval workflows, the software can take care of it for you.

6. Visibility improves

You want to be in the driver’s seat when it comes to making decisions for your organization.

Automation or expense reporting software will help you

- to look at relevant data,

- review spending

- analyze trends

This can lead to multiple benefits, whether you want quicker approvals or you want to make strategic decisions such as negotiating better terms with preferential vendors.

Expense reporting software offers features such as better spend analytics and interactive dashboards that can offer deep insights into organization-wide trends, helping you forecast better.

Challenges with manual expense reporting

You have just given your approval for an expense claim. By the time the entry navigates into the accounting books, the budget is overshot! If you are familiar with such a scenario, you are dealing with manual or partially automated processes!

The above is just one example of the many problems you face with manual expense reporting processes. Let us look at some of the most significant pain points.

1. Compliance

Can you imagine the number of policies, eligibilities, and rules your managers and approvers must know to ensure that approvals (or rejections) happen accurately and on time? As your organization grows, this challenge will undoubtedly quadruple!

If you look at it from the employee’s perspective, imagine remembering all the expense policies so your claims are not rejected. So, this stress also ensures that the business trip meets its goals.

2. Visibility

If we use the above example, what if, before approving the expense claim, you could cross-check if you have a budget for it?

The absence of spend visbility is one of the biggest challenges in the manual processing of expenses. Let us take the example of a company with a large field force.

The organization can anticipate and allocate funds for the field employees’ spending with adequate real-time visibility. On the other hand, expense reporting software can give access to real-time information that allows you to make more accurate decisions promptly.

3. Time-consuming

As an approver, the responsibility is to check the details and ensure no padding or fake claims. This is a huge demand as, most likely, you are dealing with more than a few expense reports. The time taken to accomplish all of this takes away the time you could spend making better business decisions.

Let’s talk about how many hours your finance team spends verifying claims and reconciling. What makes it additionally challenging is the fact that most of the reconciliations happen post-trip.

- Could you approve travel expenses at the click of a button because the system’s architecture incorporates your policies?

- What if you can complete several hundred hours of reconciliations within a few hours?

That is what a well-designed expense reporting software will do for you.

Read Also – Top 10 Expense Management Tips for Your Business

Features your expense reporting software must have

1. Expense capturing, categorization, and tracking

Any expense reporting software must automatically capture receipts and allow online submissions and tracking of such expenses and claims. Most vendors will offer a multitude of features that will help speed up the process while making it more efficient and error-free.

2. Automating approval workflows

One of the key features is the ability to automate travel and expense policies. Ask about how well the software can incorporate policies and spend controls into the expense reporting software.

There are many ways to work this

- You could restrict expenses to a specific limit, not allowing your employee to proceed with a transaction.

- The software can be designed to insist on approval (from the manager(s) before the employee can proceed to the next stage.

- You could insist on different policies for different departments, branches, designations, or categories.

3. Mobile compatibility

Mobile compatibility is a critical feature as it allows employees to use the features during travel. Further, managers and other heads can track data in real-time, ensuring they have visibility of funds at all times.

Last but not least, employee experience dramatically improves as employees no longer have to worry about preserving physical documents and receipts.

4. Expense reporting

You can see by studying the expense data that employees visiting clients in a place seem to prefer specific hotel accommodations. Would you have the same insights if you were processing expenses manually? Doesn’t this offer an opportunity to negotiate good terms with this vendor?

Expense automation offers a massive advantage as you can now access comprehensive intelligence and data analysis. It helps you to identify challenges before they become problems and opportunities before they are gone.

Most expense reporting software solutions offer intuitive dashboards that give employees a customized view of relevant information. Customizable reports, category-wise analyses, and pictorial views of information make it easy and convenient for employees to use.

5. Integrations

Even if the expense reporting software is smart and intelligent, you are in trouble if it does not integrate well with your existing software and apps. When the expense management software integrates with your ERP, HRMS, CRM, or other systems automatically, you save time and manual effort for your accounts processing and other teams in the organization.

6. Support

User interface and customer support are both features that must be non-negotiable when it comes to identifying the features you need in the right expense reporting software. The software’s features must be simple, intuitive, and uncomplicated. Ask your vendor for a demo so you can understand first-hand how the software works.

Another important feature would be customer support. Ensure you understand the terms, as some vendors offer a dedicated account manager, and others offer 24/7 online support. Insist on what works best for your organization.

Read also – How To Choose the Best Expense Tracking Software?

How to implement expense reporting software?

Now that you know the features your expense reporting software must have let’s look at how you can implement it across your organization.

- Study the options available

Study the options available to you based on your organization’s needs and functionality. This process may require an in-depth study of vendors, their products, features, and their suitability for your organization.

- Picking the right software

Assuming the previous stage was comprehensive, you will have everything you need to make the right choice. Make sure you pay attention to the user-friendliness, integration, and customization capabilities of the software before you pick the right software.

- Ask for demos

Certainly, ask for demos before you pick the right software, as this offers insights you may have missed when speaking to the vendors. Watching a demo may give you a better understanding of how easy the features are to use.

- Talk about customization

Once you finalize the vendor and software, it is time to discuss how to customize the software according to your specifications. While there may be features, you will rarely use, others are non-negotiable for you. These discussions should take place before you sign on the dotted line.

- Understand, test, and take feedback on the software

Do you have everything you need to work with the software? Make sure you have user guides, instructions, technical manuals, or other documentation to help the employees understand and use the software.

It may make sense to test the software by implementing it on a small pool of people for a short period to assess ease of use and the challenges that may crop up. Set up a feedback loop so users can give you the information you may use to work on before you implement it across the organization. - Communication and managing the change

Communication is an integral part of any successful implementation. Here too, make sure you prepare employees for the upcoming change. Make certain that you circulate information and discuss and people get a chance to ask questions about the change.

- Implementation

Implementation must involve training and demo sessions followed by feedback. Make sure you have guidance available for those using the software extensively. You must ensure that all your employees are on the same page.

- Measure KPIs

You must have KPIs that you can measure after a small usage period. This will give you an idea of how well the software meets your needs. It may be the perfect time to incorporate changes or adjustments that you may need to make after the initial assessment.

Conclusion

In conclusion, Happay stands out as a strong contender when looking for the best expense reporting software. Happay provides a reliable solution for companies of all sizes with its full feature set, user-friendly interface, and dedication to streamlining expense management. Its capacity to streamline approval processes, automate expense reporting, and give organisations real-time insights into spending patterns empowers them to make wise financial decisions while cutting down on administrative costs.

Additionally, Happay’s mobile compatibility guarantees that staff members can easily record and submit expenses while on the go, boosting productivity and compliance. All things considered, Happay stands out as the best option for those looking for an effective, affordable, and scalable expense reporting software solution to streamline their financial procedures and propel their organisations forward.

FAQ’s

Happay offers a complete and integrated solution to manage your expenses. With a mobile app that automates expense filing and a solution that offers real-time spend visibility for agile decision-making and tighter budget controls, you have the best software for expenses.

An easy-to-use and effective software that can track expenses while offering a solution for invoice automation is Happay. Offering a nextgen platform, Happay promises to manage all kinds of corporate expenses, employee reimbursements, petty cash, invoice management, payments, cards, business travel, and more.

There are expense management software vendors who provide complete, integrated solutions (all-in-one suites). However, you can also choose solutions that allow you to address individual challenges you may have. For instance, if petty cash payments are an issue, you could sign up for a solution that is catered to tackle the same.

Happay offers the best expense-tracking app for android. The app can auto-create expenses by using your messages and receipts, compile, report, and submit expense reports, track mileage, and so on easily and effectively. You can click on the link to download Happay Expense.