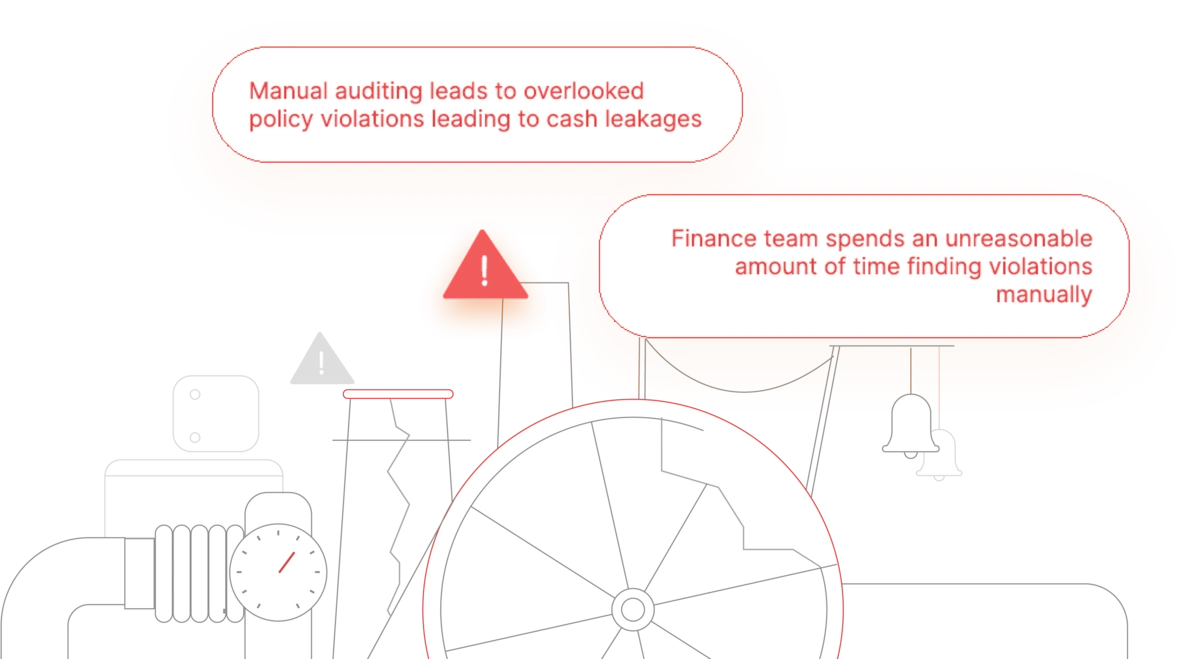

Why manual auditing does not

See what’s possible with

SmartAudit

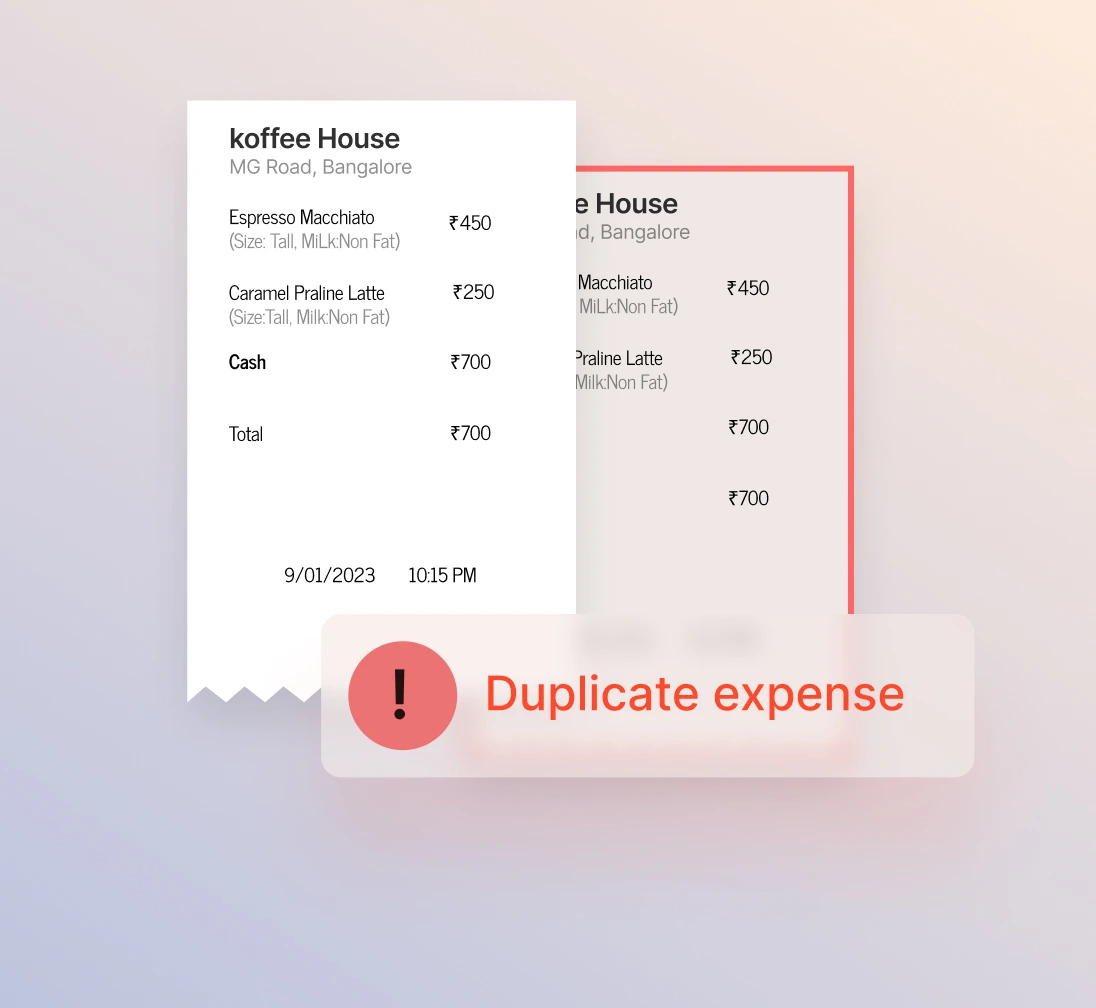

SmartAudit of

duplicate invoices

Happay stores everything.

So when a duplicate invoice is claimed in an expense,

Happay’s SmartAudit will automatically flag it and ensure

your approvers are informed.

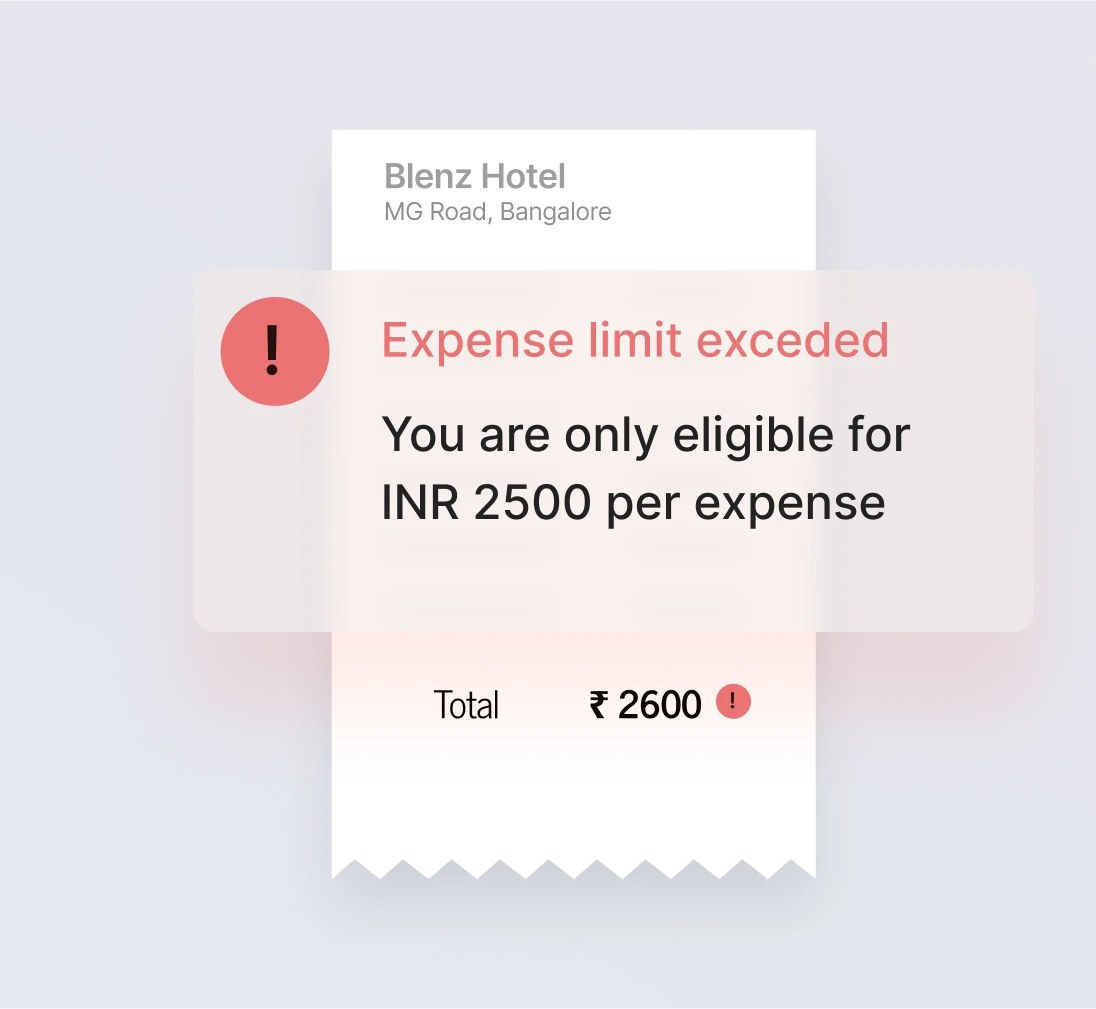

SmartAudit of over claimed

expenses

Happay’s SmartAudit will automatically flag an

expense if its amount exceeds the employee’s

authorized spend limit.

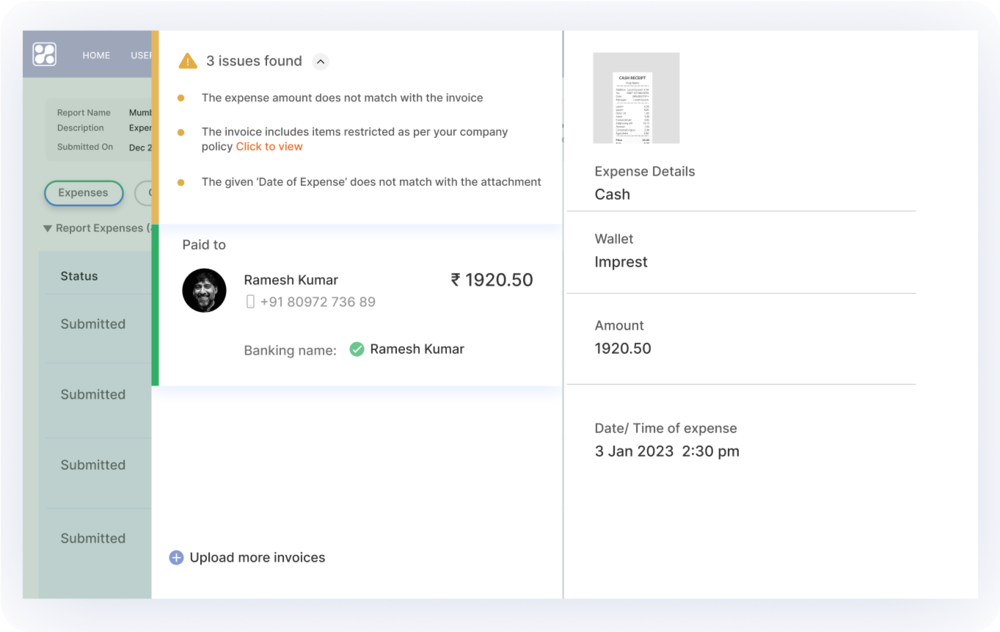

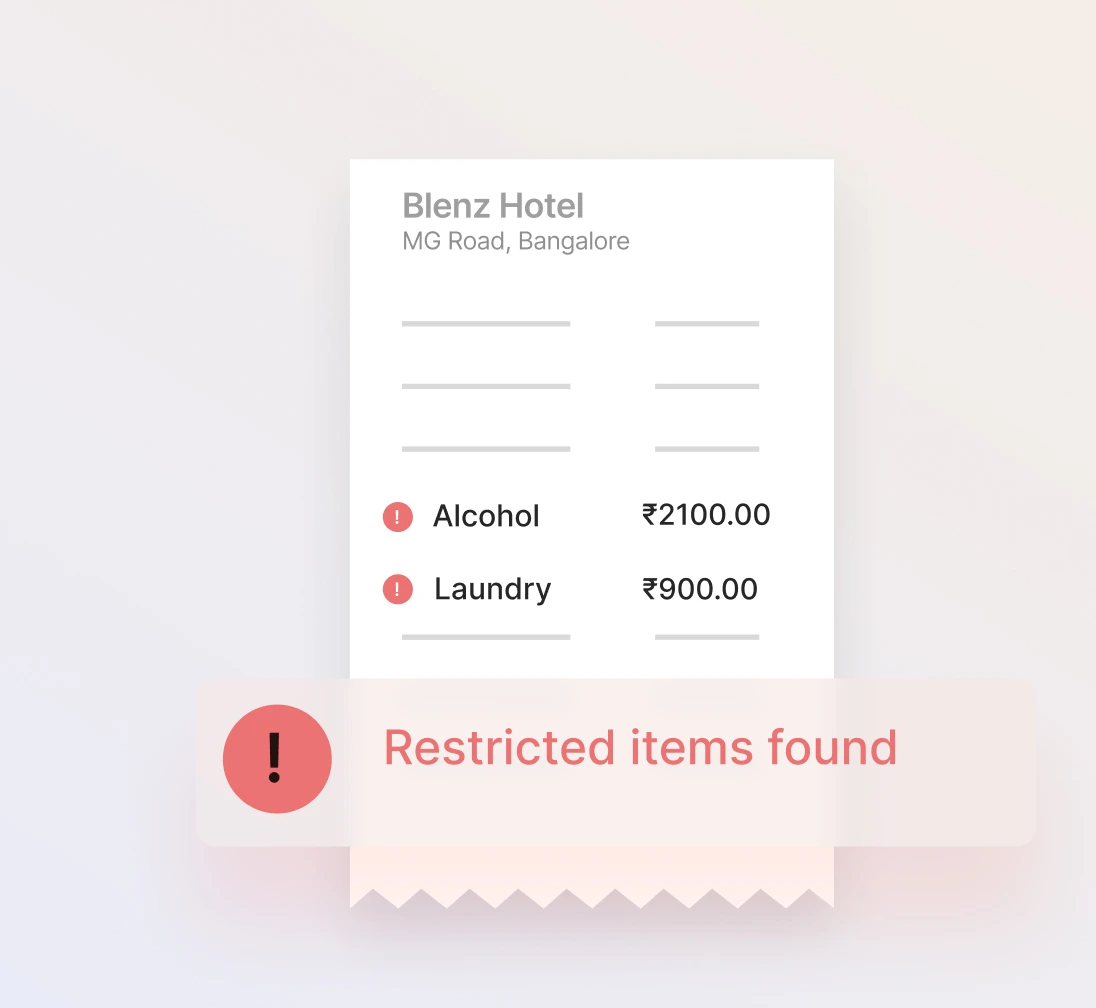

SmartAudit of

restricted items

Alcohol. Laundry. Anything out of

policy.

Happay’s SmartAudit will automatically flag it

during approval ensuring no restricted item

gets approved.

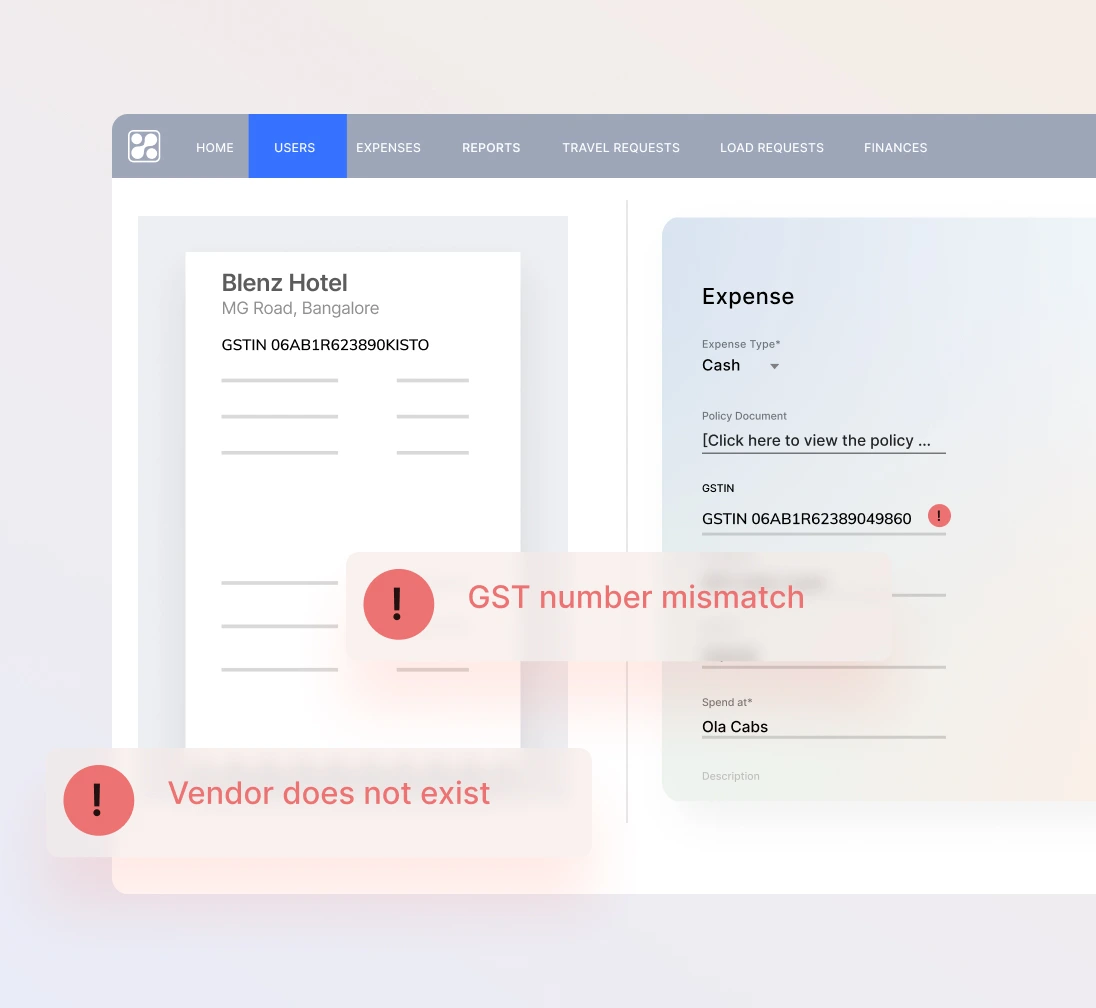

SmartAudit of GST

details

Happay’s SmartAudit automatically checks if

the manually entered GST number is matching

with the bill attached and flags any errors.

Furthermore, SmartAudit also automatically

flags if the GST number does not exist and if

the merchant is invalid.

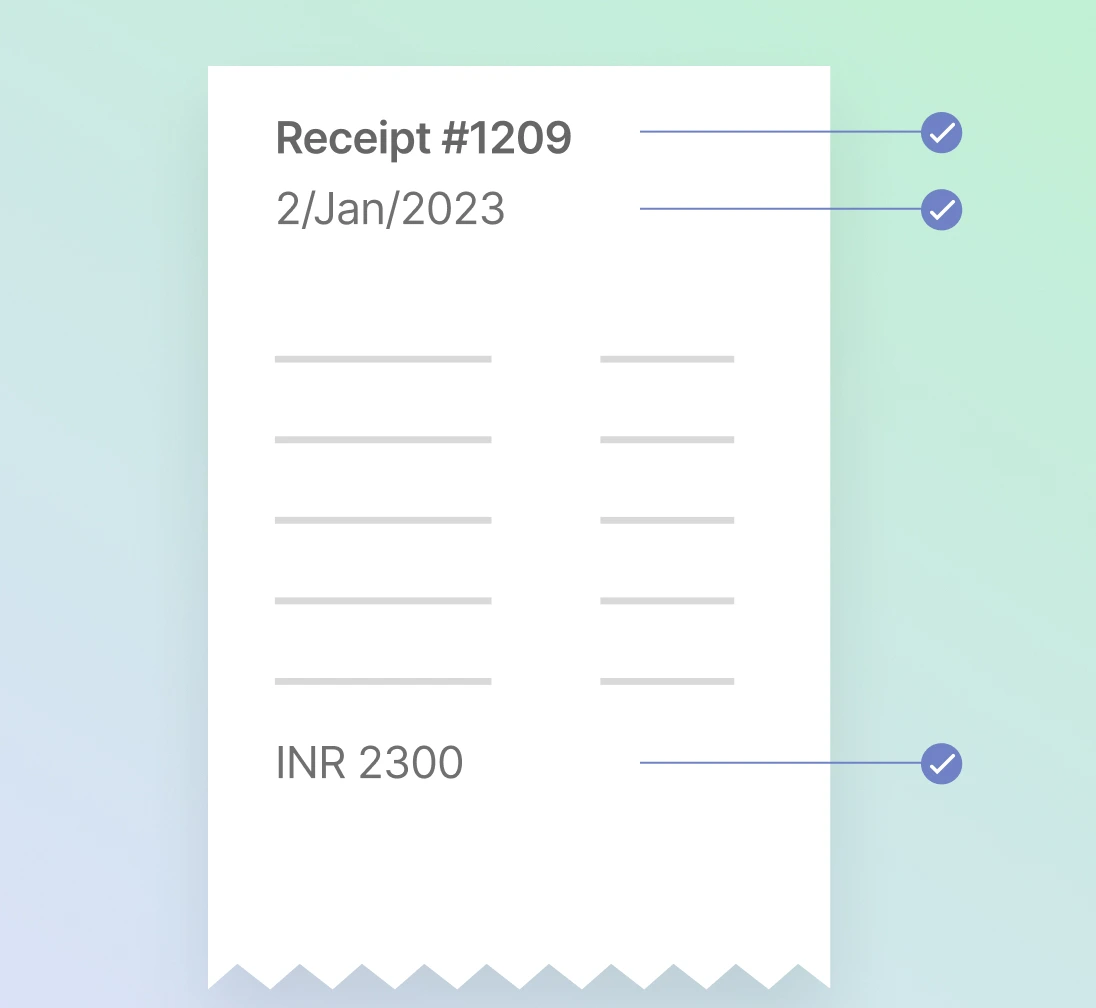

SmartAudit of invoice

information

Invoice number, invoice date, invoice bill

amount – an end-to-end audit of your invoice

is performed with Happay’s SmartAudit

ensuring 100% accuracy during auditing.