Looking for Odoo alternatives?

Odoo helps businesses streamline expense management and accounting processes. It provides a user-friendly interface with features like invoicing, expense management, bank reconciliation, financial reporting, and more. Odoo’s customers are primarily small businesses. The footfall of users from mid- and enterprise segments is relatively low.

If you’re looking for a more scalable solution for your business, compare the best Odoo alternatives to find the perfect software. Several alternatives offer similar capabilities as Odoo. Whether enterprises require a more customized system or an industry-specific solution, this article covers all the necessary information.

List of top 7 Odoo alternatives and competitors

Many competitors and alternatives of Odoo prevail in the market. Below are some of the most popular ones.

7 Best Odoo alternatives and competitors: An unbiased comparison

Whether you’re looking for a more scalable or cost-effective solution, take a deep dive into this comparison and choose the best Odoo alternatives for your business.

1. Happay

Happay is one of the strongest Odoo alternatives. It is a digital expense management platform that fixes redundancies in the manual processes of managing expenses. The complete, integrated T&E solution intelligently captures expense data from multiple sources eliminating the manual process completely.. With Happay, businesses can automate and streamline payment operations, from expense reporting to reconciliations and accounting.

Offering real-time data extraction with policy checks and approval automation, Happay helps in keeping you audit-ready all the time. With a seven-year data backup and rich business intelligence, expense management is easy and efficient with Happay.

Top features* of Happay

Happay offers a wide range of features to help businesses manage their payment processes efficiently and securely. Here are some of the top features of Happay:

- Payment processing: Happay allows businesses to make payments quickly and easily, whether through bank transfers, credit cards, or other payment methods. Users rate Happay’s payment processing 5 out of 5.

- Petty cash management: Happay provides centralized control over all expenses, including petty cash. It helps ensure the predictability of funds. Users rate it 5 out of 5.

- Invoice management: The platform offers a simple and intuitive way to manage invoices, from creating and sending them to tracking their status and payments. Users rate Happay’s invoice management 5 out of 5.

- Payment tracking and reporting: Happay enables businesses to track their payments in real-time and generate detailed reports on their payment activity, giving them better visibility into their cash flow. Users rate payment tracking and reporting 4.5 out of 5.

- Expense management: Happay allows businesses to manage their expenses, from tracking receipts to approving and reimbursing expenses. Users rate expense management 5 out of 5.

- Integration with accounting systems: The platform seamlessly integrates with accounting systems like QuickBooks and Xero to streamline accounting processes. Users rate integrations 4.5 out of 5.

- Mobile app: Happay offers a mobile app (iOS and Android) that allows businesses to manage their payments and expenses on the go, from anywhere, and at any time. Users rate Happay’s mobile application 5 out of 5.

- Customizable workflows: The platform enables businesses to customize their payment workflows to match their unique business model and needs. Users rate customizable workflows 5 out of 5.

In addition, Happay offers AI-powered expense reports, filing, and features to input and capture GST (in India).

The highest-rated features of Happay based on G2 reviews are digital receipt management, mileage tracking, and employee reimbursements. The software solution also performs an admirable job in petty cash management for multi-chain retailers.

*These features are picked from G2 and Happay’s official websites.

What do users highlight while reviewing Happay over Odoo?

Reviewers compared the two solutions and reported Happay as more user-friendly and convenient to set up and administer. In general, reviewers preferred working with Happay. Additionally, Happay was deemed more suitable for fulfilling business requirements than Odoo.

In terms of ongoing product support, Happay was found to be the preferred option. Happay’s direction of feature updates and roadmaps was also favored by reviewers over Odoo.

Happay vs. Odoo

Features |

Happay |

Odoo |

|

G2 ranking |

Ranked by G2 as the top choice for expense management. |

Ranked by G2 in top 50 finance software in 2021. |

|

Support quality |

High |

Moderate |

|

Cost effective |

Yes |

No |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Businesses in the mid-market and enterprise segment have a higher affinity for Happay compared to Odoo. On the other hand, small businesses prefer Odoo’s accounting software for their needs.

Pricing

Happay offers custom pricing for users based on their requirements and business needs. You can contact Happay’s team directly to book a free demo and discuss. Schedule a free demo with Happay experts and learn more about the product.

Also, Read: 7 Best Zoho Expense Alternatives and Competitors

2. SAP Concur

As one. of the Odoo alternatives, SAP Concur provides an integrated online and mobile business travel and expense management solution that automates expense management. On-premise or cloud-based, it helps you manage employee reimbursements, perform auditing, and other activities crucial to business finance.

Top features* of SAP Concur

Below are some notable features of SAP Concur.

- Expense management helps users submit, review, and approve budgets on the go. Users rate it 4.5 out of 5.

- ExpenseIt populates expense reports with e-receipts. Users rate it 5 out of 5.

- Reporting improves budgeting, forecasting, and financing. Users rate it 4.5 out of 5.

- Connectors help integrate with ERP systems (enterprise resource planning) to obtain a full view of a company’s financials. Users rate it 4.5 out of 5.

- Security certifications enable you to track data securely. Users rate it 5 out of 5.

*These features are picked from G2 and SAP Concur’s official websites.

What do users highlight while reviewing SAP Concur over Odoo?

After assessing both solutions, reviewers found SAP Concur is better equipped to meet business needs and provide reliable ongoing support. However, users prefer the direction of Odoo over SAP Concur for feature updates and product roadmap.

SAP Concur vs. Odoo

Features |

SAP Concur |

Odoo |

|

Quality of support |

High |

Moderate |

|

Ease of use |

Less |

More |

|

Cost-effectiveness |

Moderate |

High |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Businesses in the mid-market and enterprise segment businesses with a higher affinity for SAP Concur compared to Odoo. On the other hand, Odoo caters to small businesses and startups with little footfall in the mid-market and enterprise segments.

Pricing

SAP Concur offers custom pricing based on software buyers’ requirements, needs, and preferences. You can contact their team to learn more about pricing options.

Related Read: 5 Best SAP Concur Alternatives and Competitors

3. Expensify

Expensify is one of Odoo alternatives that offers web-based software that automates pre-accounting processes like bills, invoices, mileage tracking, etc. Teams utilize Expensify’s capabilities to scan receipts and track business and personal expenses.

Top features* of Expensify

Below are some notable features of Expensify.

- One-click receipt capture takes a snapshot of the receipt, and “SmartScan” captures all data into a report. Users rate it 4.3 out of 5.

- Automatic receipts import personal and business transactions for merging and coding. Users rate it 4.7 out of 5.

- Workflows allow users to enforce a company’s expense policy and customize the approval process. Users rate it 4.8 out of 5.

- Corporate card reconciliation lets you confirm statement amounts and manage corporate spending. Users rate it 4 out of 5.

*These features are picked from G2 and Expensify’s official websites.

What do users highlight while reviewing Expensify over Odoo?

Users preferred to do business with Expensify over Odoo. They liked Expensify’s ease of use and ongoing support. When it comes to administration, both Expensify and Odoo perform at a similar level.

Expensify vs. Odoo

Features |

Expensify |

Odoo |

|

Ease of use |

High |

Moderate |

|

Quality of support |

More |

Less |

|

Feature updates |

Less frequent |

More frequent |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Businesses in the mid-market segment prefer to use Expensify over Odoo. Whereas, Odoo has been a unanimous choice for small businesses. The majority of Expensify users come from the IT services sector. In Odoo’s case, several users come from the computer software industry.

Pricing

Expensify offers three plans for businesses: Free, Collect, and Control.

- The Free plan helps users with corporate cards, reimbursements, sending invoices, and paying bills free of cost.

- Collect comes with all features of the free plan while including Smart limits, Accounting Sync, Expense reporting, and Payroll. It costs $5 per user per month.

- Control plan has all features of Collect. In addition, it supports multiple approvers, expense policies, custom reporting, and access control. The company prices it at $9 per user per month.

Suggested Read: 10 Best Expensify Alternative and Competitors

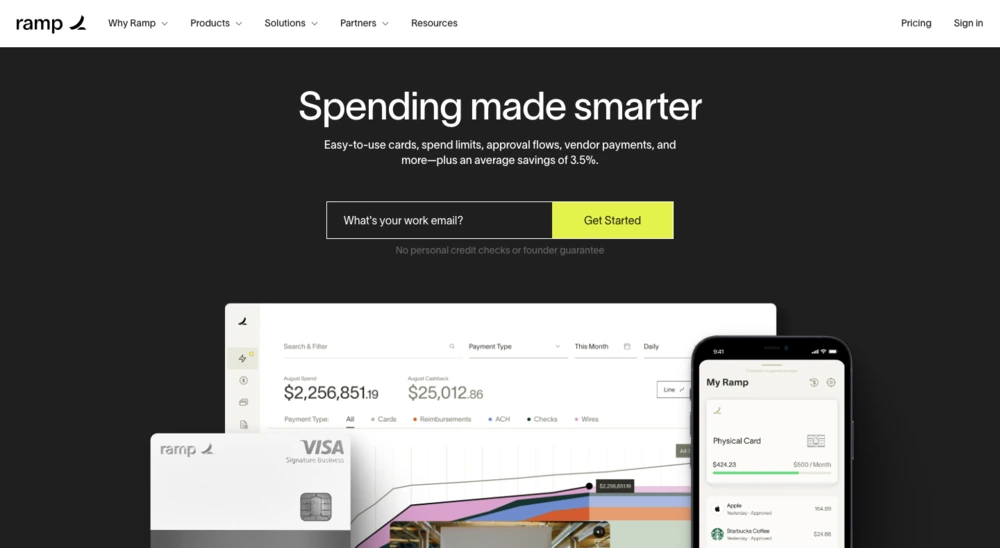

4. Ramp

Ramp is a cloud-based accounting software that helps finance teams automate tedious manual processes in day-to-day financial operations. It creates expense reports, and manages vendor payments and other payouts while empowering you to scale globally.

Top features* of Ramp

Below are some of the most popular features of Ramp.

- Real-time reporting provide dashboards to help you monitor transactions as they happen in real time. Users rate it 4 out of 5.

- Integrations with Uber, Lyft, Amazon Businesses, and various other platforms empowers you to capture receipts automatically. Users rate it 4.4 out of 5.

- AI-powered matching allows you to match blurry, crumbled receipts in foreign currencies. Users rate it 4.5 out of 5.

- Expense categorization automates expense accounting with smart rules for any field from category to the department. Users rate it 4 out of 5.

*These features are picked from G2 and Ramp’s official websites.

What do users highlight while reviewing Ramp over Odoo?

Be the ability to meet requirements, ongoing support, feature updates, or product roadmap, users seem to rate Ramp better than Odoo. In reviews, users mention that Ramp is easier to use, set up, and administer.

Ramp vs. Odoo

Features |

Ramp |

Odoo |

|

Ease of use |

High |

Moderate |

|

Mileage tracking |

No |

Yes |

|

Currency conversions |

Effective |

Less effective |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Users of Ramp and Odoo belong to small business or mid-market segments (SMEs). As one of Odoo alternatives, Ramp has a small base in the enterprise segment. However, Odoo isn’t a preferred option for large companies or enterprises.

Pricing

Ramp offers a free plan with unlimited corporate cards, zero-touch expenses, superfast bill payments, and reporting. For a custom plan for more users and your unique requirements, you can contact the Ramp’s team to get a demo and a custom quote.

Also, Read: 7 Best Finly Alternatives and Competitors

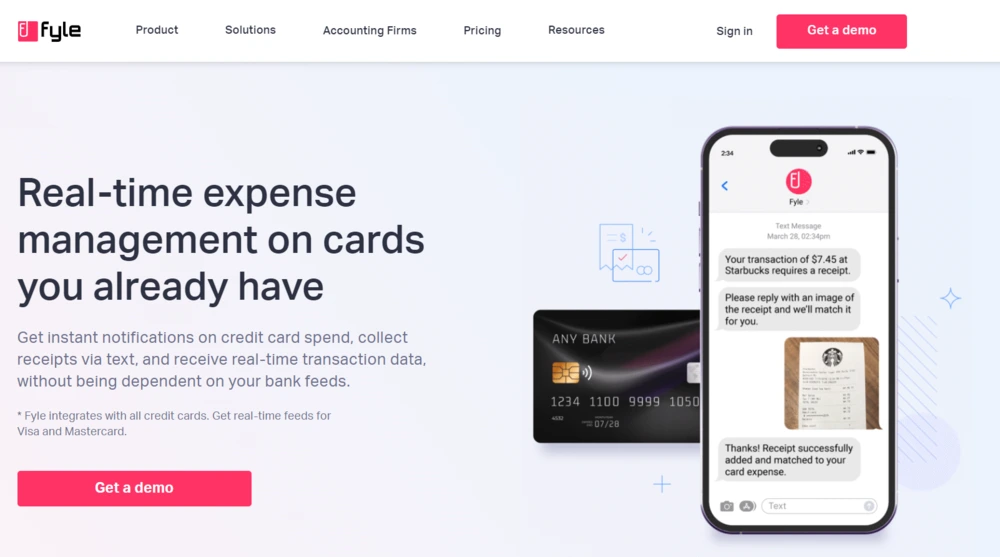

5. Fyle

Fyle empowers teams with real-time expense management on cards, presenting themselves as one of Odoo’s alternatives. It provides instant notifications and real-time transaction data and collects receipts via text message templates.

Top features* of Fyle

Below are some of the most popular features of Fyle.

- Mobile app helps you capture and store information on paper receipts. Users rate it 5 out of 5.

- Chrome extension and Office 365 plugin capture receipt information in your inbox. Users rate it 4.5 out of 5.

- Expense form collects all expense details with capabilities to assign the expense to respective cost centers and split it with other users. Users rate it 4.2 out of 5.

- Real-time compliance monitors and flags expenses outside your company’s expense policy or guidelines.

What do users highlight while reviewing Fyle over Odoo?

Overall, users found Fyle easy to use and do business with. However, setting up an account is more straightforward in Odoo. In terms of ongoing support, Fyle outperforms Odoo. On the other hand, reviewers feel Odoo is a better option when it comes to feature updates and product roadmap.

*These features are picked from G2 and Fyle’s official websites.

Fyle vs. Odoo

Features |

Fyle |

Odoo |

|

Performance and reliability |

High |

Moderate |

|

Mobile user support |

Low |

High |

|

Mileage tracking |

Highly-effective |

Effective |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Users of Fyle come from small businesses, mid-market, and enterprises, indicating that it’s a scalable solution for businesses. Odoo users mainly belong to small businesses, as per G2.

Pricing

Fyle offers three pricing options, Standard, Premium, and Enterprise, at $6.99, $11.99, and custom pricing. Check their pricing page for more details on features available in the plan of your choice.

Quick Read: 8 Best ITILITE Alternatives and Competitors

6. Divvy

Divvy offers a SaaS-based all-in-one expense management platform with credit lines up to $15 Million. This Odoo alternative provides a seamless experience of spending, tracking, and requesting business finance.

Top features* of Divvy

Below are some of the most popular features of Divvy.

- Automation removes the challenges of manually managing spending and closing books. Users rate it 4.5 out of 5.

- Real-time categorization helps manage spending easily with customizable budget controls. Users rate it 4.5 out of 5.

- Integrations sync transactions to accounting software, customer relationship management software (CRM) like Salesforce, collaboration tools, and other task management applications, helping you avoid back and forth for cards and expense management. Users rate it 3.8 out of 5.

- Real-time visibility helps you track expenses in real time. Users rate it 4 out of 5.

*These features are picked from G2 and Divvy’s official websites.

What do users highlight while reviewing Divvy over Odoo?

Users felt Divvy is easier to use compared to Odoo. However, Odoo offers more flexibility during account setup. When it comes to ongoing support, feature updates, and the ability to meet business needs, users preferred Divvy over Odoo.

Divvy vs. Odoo

Features |

Divvy |

Odoo |

|

Ease of setup |

Less |

More |

|

Smart categorization |

Effective |

Less effective |

|

Electronic payments |

Highly-effective |

Moderate |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Both Divvy and Odoos’ users belong to small business and mid-market segments. The majority of Odoo users represent Food and Beverage industries and the Ecommerce sector. On the other hand, Divvy’s user base is mainly from the construction industry.

Pricing

Divvy is free to all. Divvy doesn’t make money by selling software. Instead, whenever you make a purchase through a card, the merchant pays a Visa or Mastercard. Divvy takes a share of the same fees merchants pay, allowing it to provide the software for free.

Also, Read: 6 Best Zaggle Alternatives and Competitors

7. Navan (Formerly TripActions)

Navan, previously known as TripActions, streamlines expense management processes by automating redundant business operations and bringing more clarity to business finance. It helps companies control spending, drive efficiency at scale, and monitor real-time transactions.

Top features* of Navan

Below are some of the most popular features of Navan.

- Automatic expense capture takes expense details from a receipt’s photo. Users rate it 4.2 out of 5.

- Real-time reporting helps you get a multi-dimensional view of global spending and reimbursements. Users rate it 4.0 out of 5.

- Integrations sync transactions to accounting software, helping you avoid back and forth for cards and expense management. Users rate it 4 out of 5.

- VAT-compliant invoices allow businesses to report on VAT transactions and claim up to 25% on expenses. Users rate it 4.5 out of 5.

*These features are picked from G2 and Navan’s official websites.

What do users highlight while reviewing Navan over Odoo?

Users felt the administration of both Navan and Odoo was equally easy. However, some users rated Navan over Odoo for its ease of use, ongoing product support, and feature updates. They also felt Navan met business needs better than Odoo.

Divvy vs. Odoo

Features |

Navan |

Odoo |

|

Bank/credit card integration |

Highly effective |

Effective |

|

Employee reimbursements |

Decent |

Reasonable |

|

Receipt capture |

Highly effective |

Moderate |

*The above data has been collected from software review websites like G2, Capterra, TrustRadius, and others.

Suitable for

Navan’s users primarily belong to mid-market or enterprise segments. On the other hand, Odoo’s user base comes from the small business segment with a negligible footprint in the enterprise segment.

Pricing

Navan offers custom pricing for its users. You can contact Navan’s team for a pricing option suitable to your unique requirements.

Suggested Read: Top 8 Dice (Eka) Alternatives and Competitors

About Odoo

Odoo expense is a cloud ERP software that allows organizations to save time on expense reports and better manage expenses by sharing the workload between different departments.

With Odoo, businesses can easily integrate with other Odoo applications like invoicing, project, and other accounting or project management systems. It simplifies the approval process by bringing all stakeholders together, helping organizations to make faster and better decisions.

Features of Odoo

Odoo offers a wide range of features to help businesses manage their financial transactions and gain greater insight into their expenses. Some key features of the Odoo Expense module include:

- User-friendly interface makes it easy for employees to submit expenses and seek manager approvals.

- Mobile app allows employees to submit expenses through mobile devices.

- Automatic expense tracking tracks expenses by connecting to credit cards, bank accounts, or other financial accounts, reducing the manual work.

- Receipt scanning makes it easy for employees to upload receipts and for managers to review them.

- Approval Workflow allows managers to review, approve or reject expenses based on company policies.

Pros and cons of Odoo

Pros |

Cons |

|

Leave no room for errors |

User interface needs improvement (G2) |

|

Easy to manage payroll and expenses |

Data transfer from Excel to Odoo can be challenging (G2) |

|

Easy to install and have specialist’s support |

Optical character recognition can be improved (G2) |

|

Effective training modules |

Needs the option to pay expenses without setting up a report (G2) |

Odoo Pricing

Odoo is open-source software. It offers three pricing plans. The Free plan provides access to one Odoo application. The Standard plan provides access to all Odoo applications at $9.42 per user per month.

The custom plan is priced at $14.35 per user per month and includes access to Odoo Studio and various other functionalities, including features of the Oddo Standard plan.

How to choose the best Odoo alternatives for expense management?

Business needs, budget, features, and functionalities play a significant role in selecting the best Odoo alternative. Below are a few things you should consider to compare software alternatives suitable for your business better.

1. Identify business needs

Determine the specific needs and features essential for your operations. List all business needs and feature requirements, such as mobile accessibility, receipt scanning, multi-currency support, and reporting.

It’s best to research and look for reviews, ratings, and customer feedback to gain insights into how other businesses use the top Odoo alternatives.

2. Consider costs and integration capabilities

Fix a budget for expense management software and compare it with the costs of each option you consider. Their pricing would vary based on the number of users, features, integration capabilities, and other factors.

Determine whether the software can integrate with your accounting software and other business apps. It helps streamline business processes and reduce manual work.

3. Check for ongoing support

The level of support a company provides is evident from its user reviews and feedback. Go to websites like G2, Capterra, TrustRadius, and other software marketplaces to collect ulterior information about the vendor’s support processes.

Look for software vendors that offer customer support through multiple channels, including phone, email, and chat, and are available 24/7 to help you get past any hurdle that might randomly pop up.

How Happay helps your business grow

Happay helps companies to automate and streamline their expense management process, resulting in increased efficiency, cost savings, and improved financial control. It improves expense tracking, categorization, and reporting, empowering businesses to manage expenses consciously.

The software automates manual data entry and reduces the time spent creating expense reports, enabling your team to focus on more strategic and critical tasks.

With real-time visibility, Happay helps you control spending and make informed decisions. It allows you to have better control, avoid overspending, and improve profitability in the long run.

The software enforces your company’s expense policy and flags any act that violates policy guidelines. This empowers you to be within allocated budgets, with a better forecast of where to spend and where not to.

Happay comes with robust petty cash management capabilities. It eliminates challenges in petty cash management, like accountability issues with the custodian and heavy reliance on paperwork for incidental expenses. Happay offers petty cash cards to prevent cash leakages and provide more visibility over spending.

Overall, Happy streamlines the expense management process into a structured, standardized, and automated workflow, enabling finance teams to save hours of tedious manual work. When expense management is taken care of, your teams can focus on improving cash flow and other aspects of business that lead it toward growth.

Odoo FAQs

There is no definitive answer to what is better than Odoo, as the best alternative to Odoo depends on the specific needs and requirements of your business. That being said, there are several popular alternatives to Odoo that businesses often consider. Here are some alternatives: Happay, SAP Concur, Expensify, Fyle, Ramp, Divvy, and Navan.

While Odoo is a powerful and versatile cloud ERP system, some potential drawbacks include complexity, limited support, upgrades, and limited availability of features.

Choosing between SAP and Odoo depends on your business needs and requirements. SAP and Odoo are powerful ERP systems and inventory management tools, but they differ in their capabilities, cost, and complexity.

Many companies, from small businesses to large enterprises, use Odoo. Some well-known companies that use Odoo are Toyota, Trident, Hyundai, and GSC Group.

Odoo is an open-source ERP system, and the community edition of Odoo is still available for free. This means that anyone can download, use, and modify the software without paying any licensing fees.

Choosing the best Odoo alternative depends on your business’ needs and requirements. Happay, Expensify, Fyle, SAP Concur, Divvy, Navan, NetSuite, SAP Business One, and ERPNext are popular alternatives.

Happay offers a complete and integrated expense management solution with 7000+ customers worldwide. On the other hand, Odoo offers an ERP solution catering to business management with expense management for its module. Happay, provides solutions for travel and expense management along with other solutions such as petty cash management, cards, and invoice management.

Discussion about this post