See what’s possible with

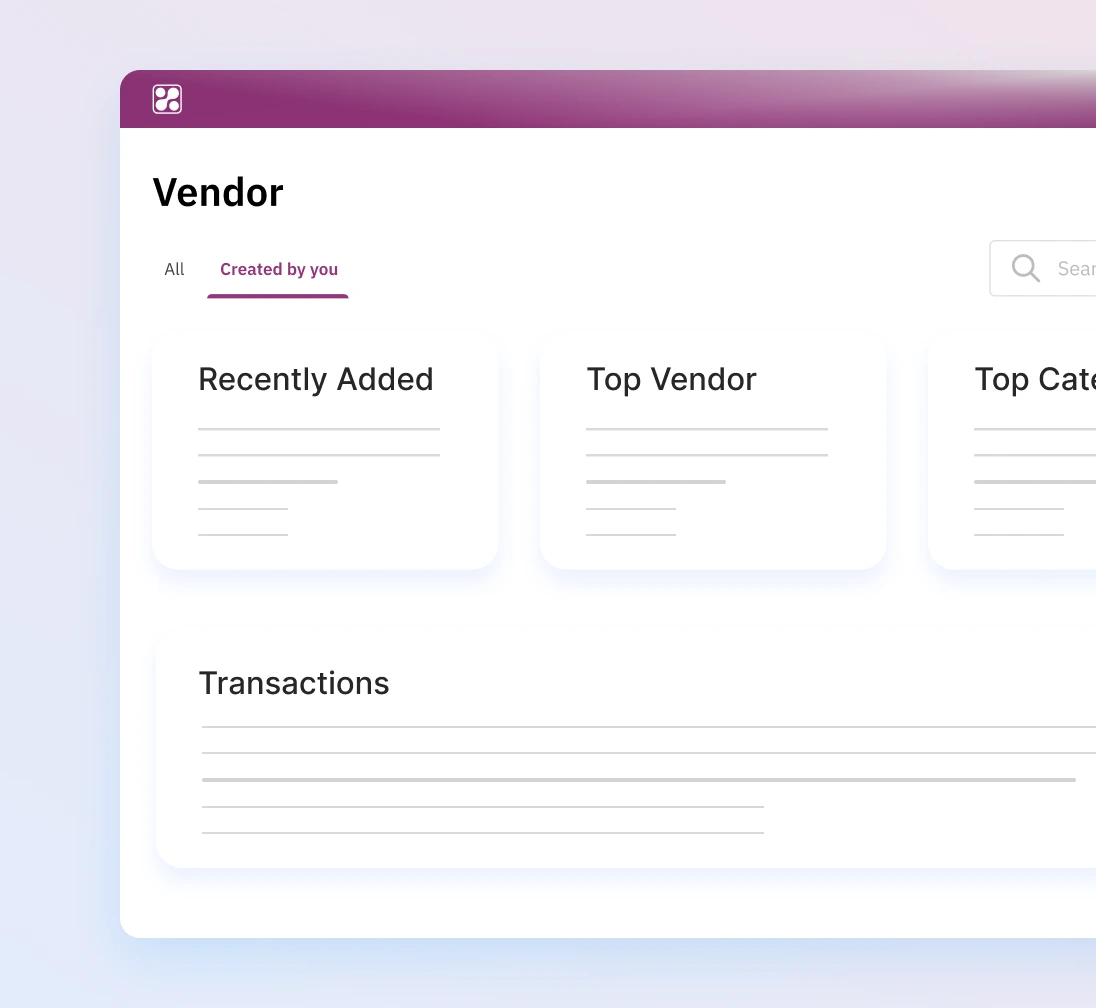

Simplified Vendor Management

Swift & 100% accurate and compliant vendor registration. Enter the GST or PAN no., and Happay will automatically retrieve all other essential details.

- Store all your vendor details in one convenient location.

- Automatically validate a vendor’s bank account using penny-drop test to prevent funds from going into an incorrect account.

- Additionally, Happay allows you to retrieve all your past vendor data using your company’s GSTIN. This ensures that you don’t have to add past vendors manually.

- Register a vendor with complete details within 60 seconds.

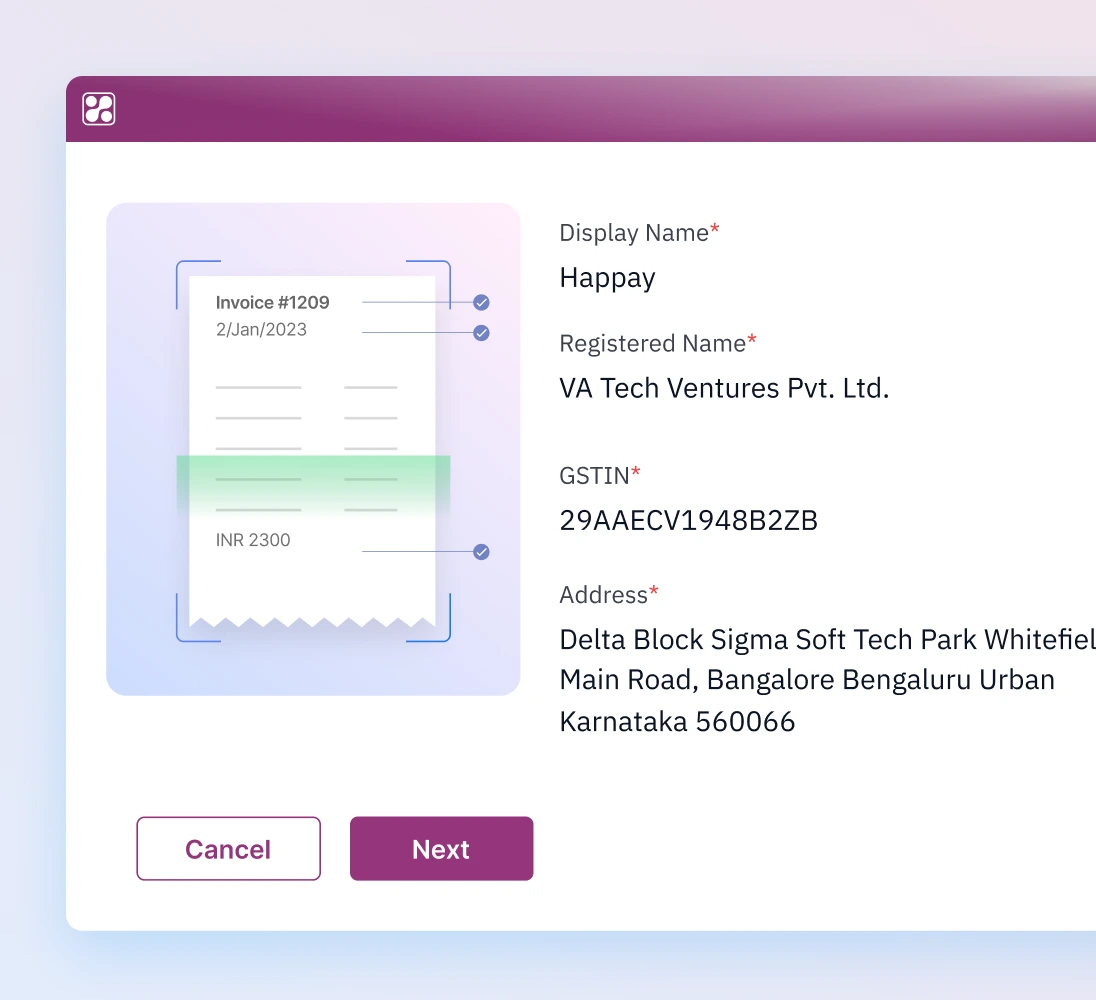

Automated Invoice Capture

with OCR

Upload your invoice, and Happay OCR will automatically capture invoice and vendor details. This eliminates the need for manual & error-prone data entry process.

- Happay can automatically capture invoice amount, GST breakup, invoice no., invoice due date, vendor name from the uploaded invoice.

- If any invoice of an unregistered vendor is uploaded, Happay automatically triggers vendor onboarding flow.

- Happay’s OCR technology has the highest accuracy rate of 81% in the industry with our latest image capture and processing techniques.

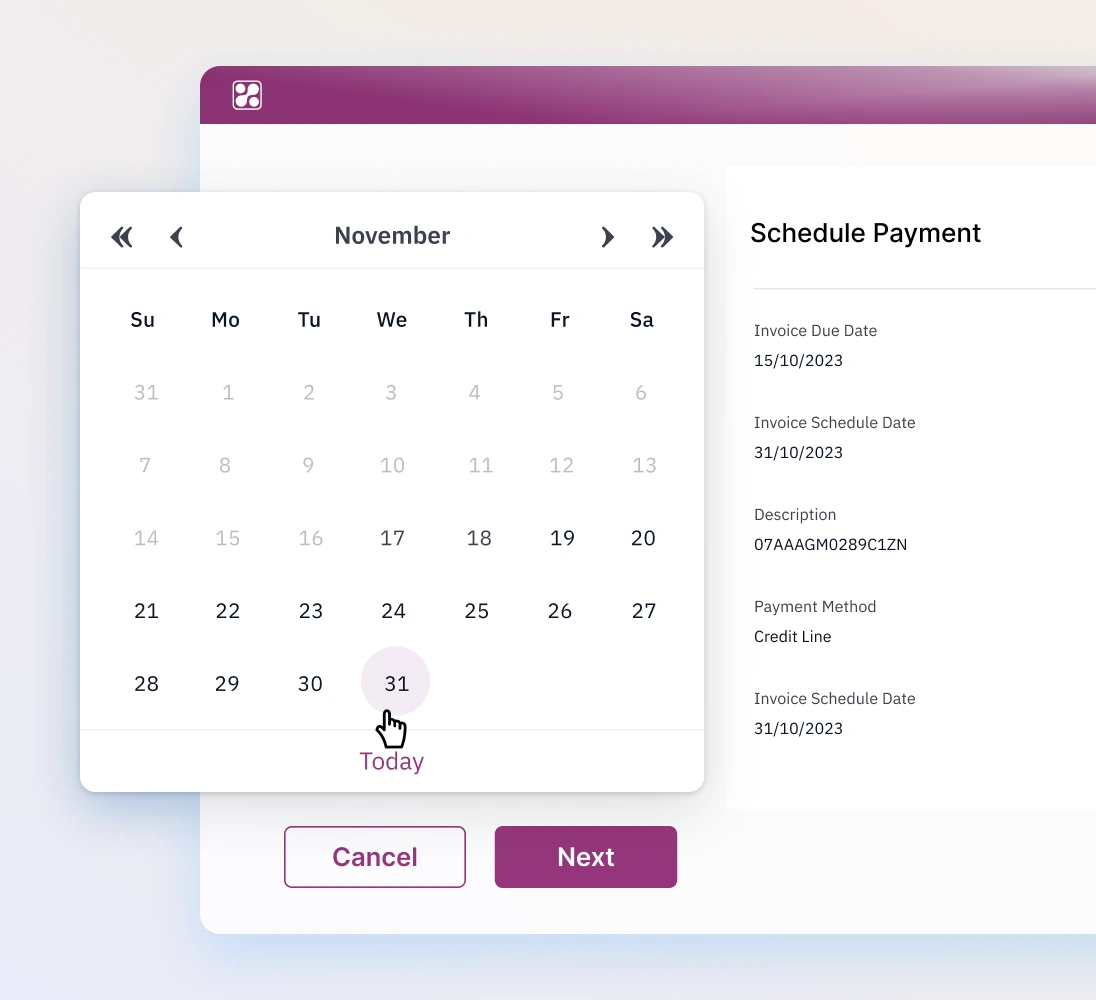

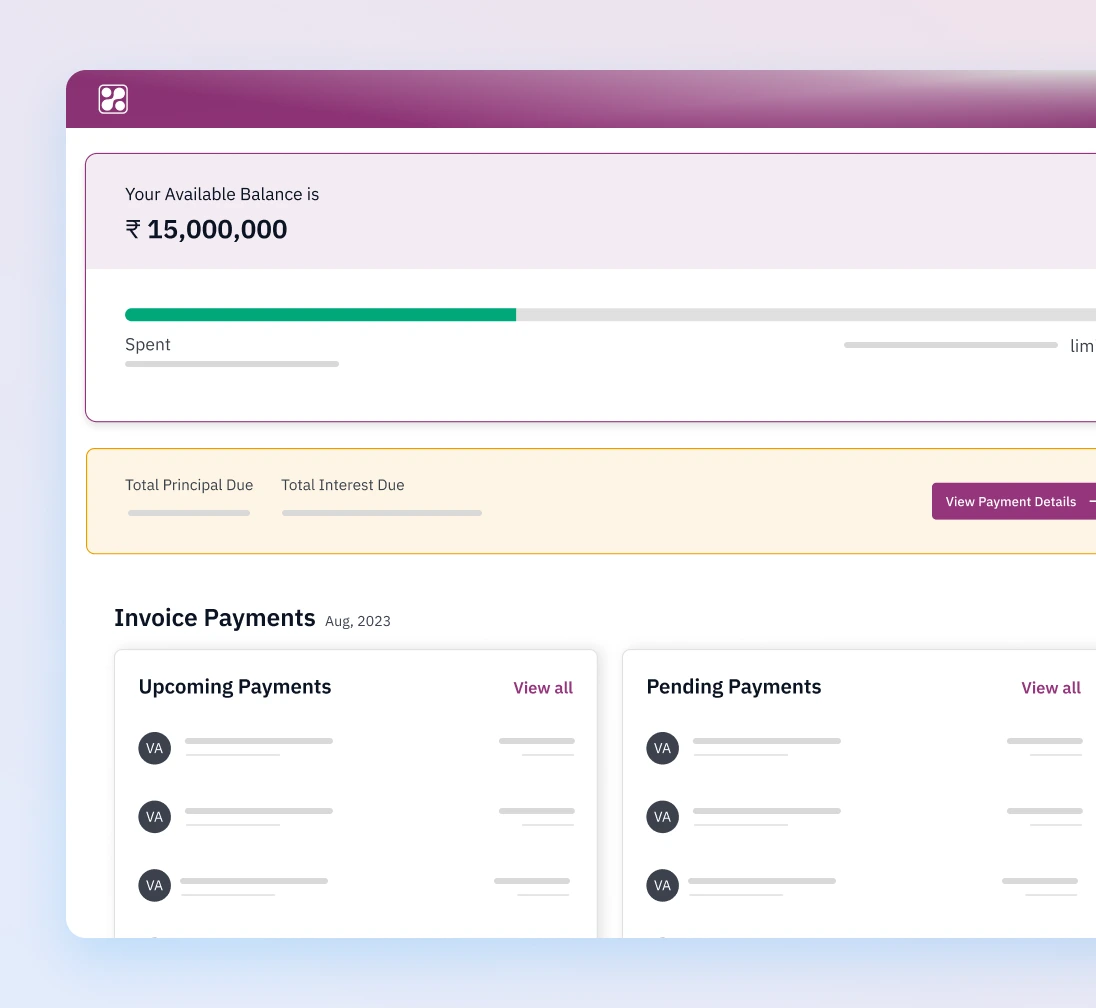

Scheduled Payments for On-Time

Settlement

Schedule payments to be executed automatically as per their due dates, eliminating the hassles of repetitive payment actions & ad-hoc approvals.

- Vendor can be notified of upcoming payment when you schedule a payment, to ensure minimal vendor follow-ups or post-payment escalations.

- Prevent the business risk of service disruption and penalties caused due to missed payments.

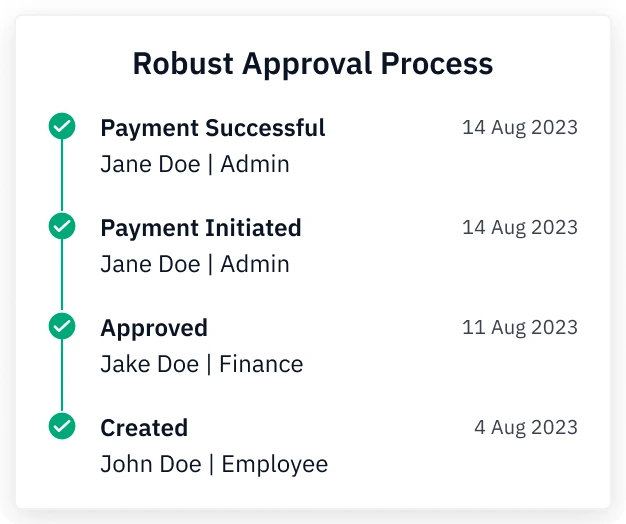

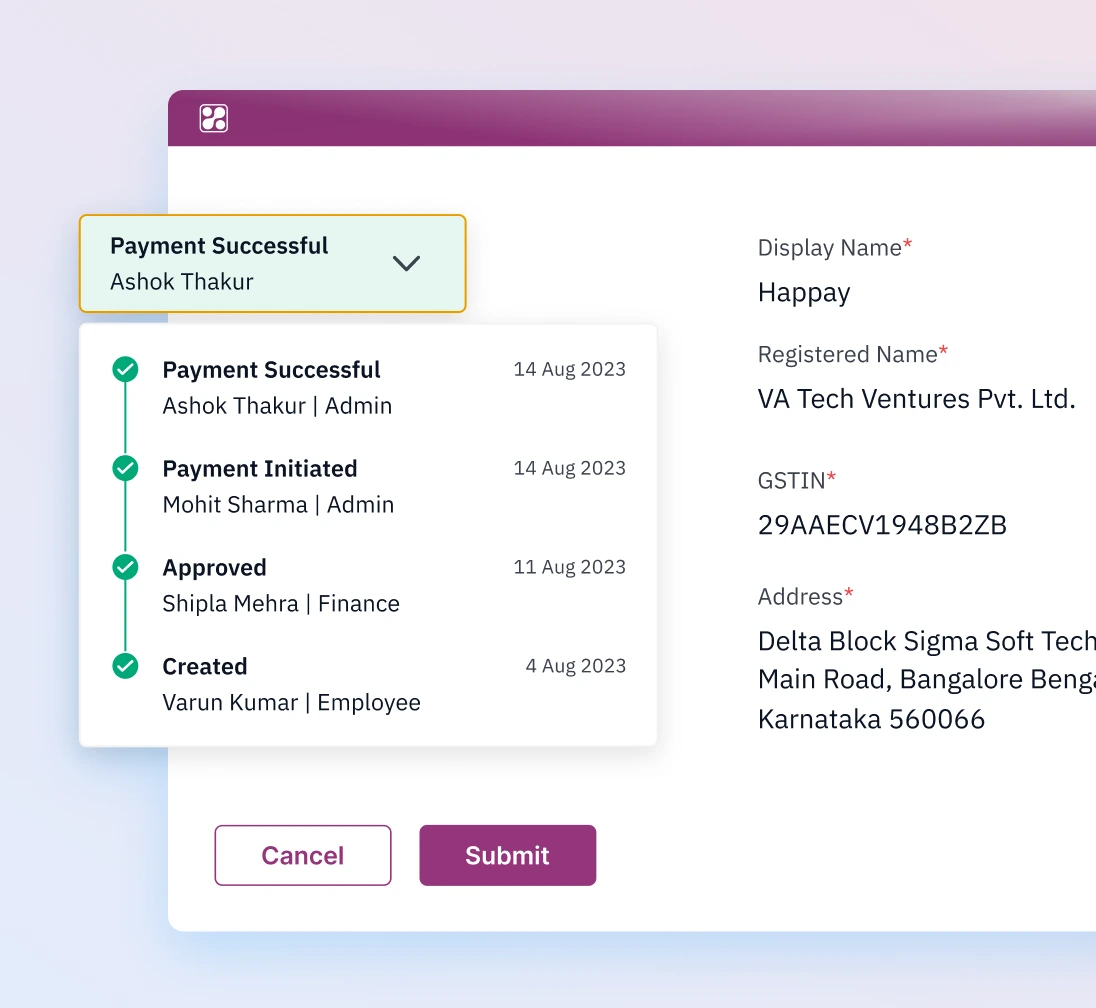

Robust Approval Workflow

Create workflows for both vendor and payment approvals in a single platform, eliminating the risk of unauthorized payments.

- Vendor Approvals: Create an approval workflow to prevent payments to unauthorized vendors.

- Payment Approvals: Create amount-based approval hierarchies.

- Track the complete audit trail of all approvals and payments from one platform.

- Ensure zero escalations arising from unauthorized payment approvals or email/paper-based approvals during audits.

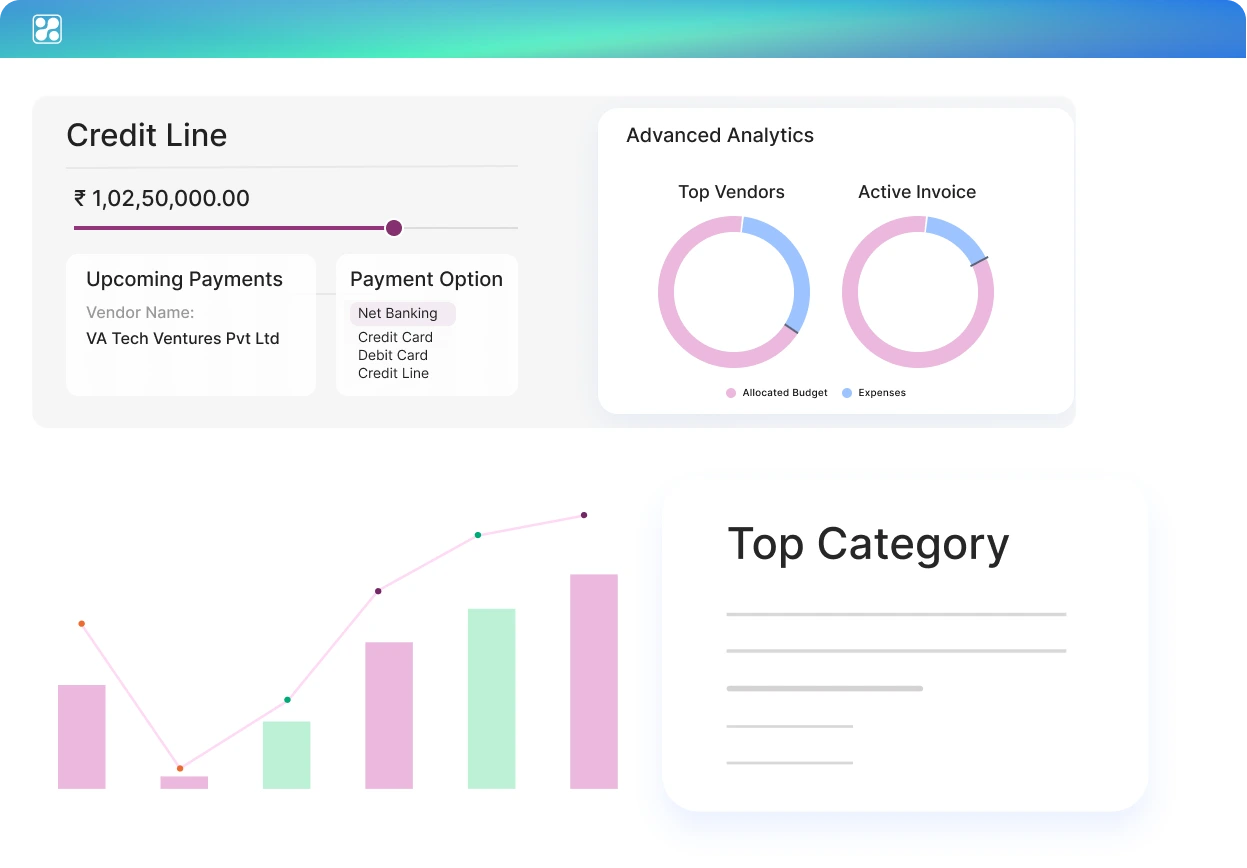

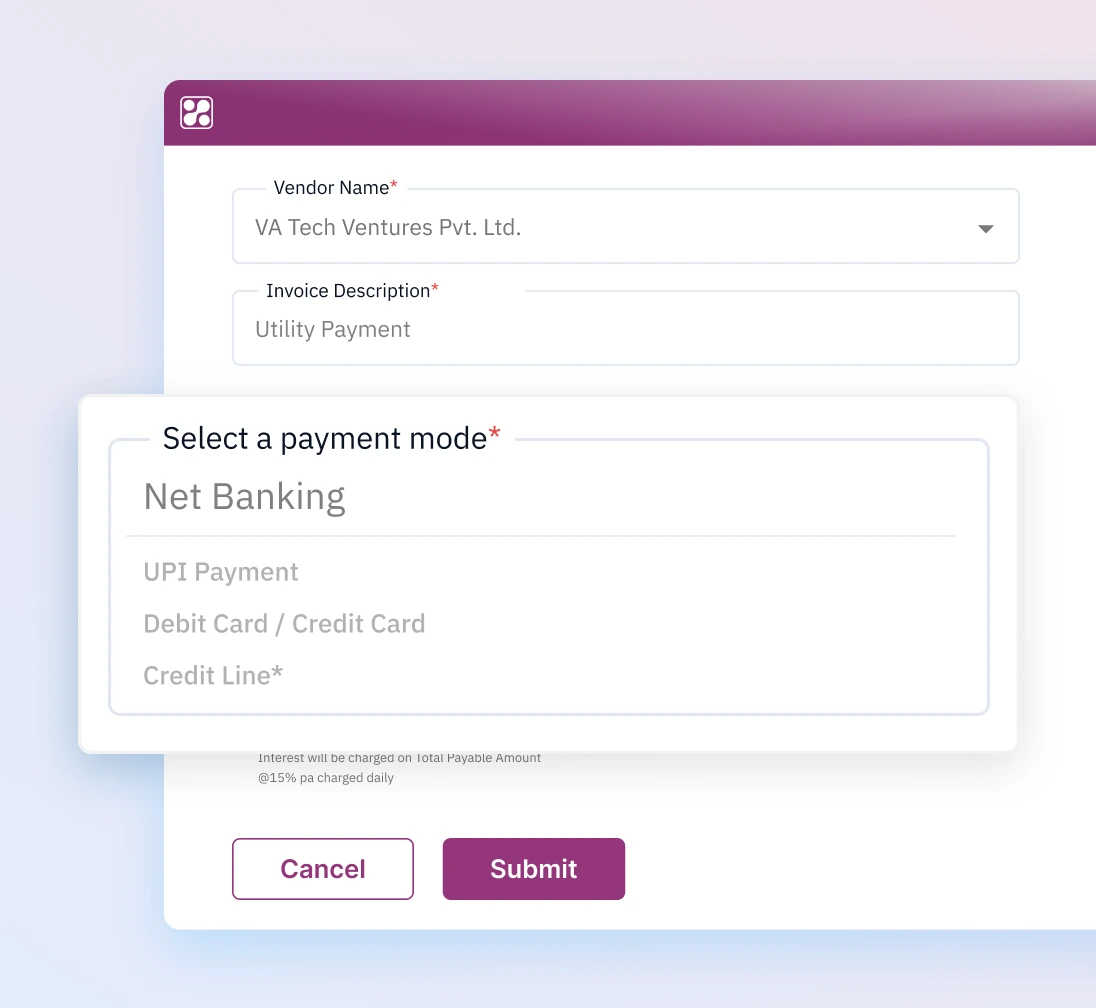

Multiple Payment Options

Choose from a wide range of options while making any payment – debit cards, credit cards, bank-transfer, and UPI.

- Make any type of business payments (vendor invoices, utility bills etc.) using any payment method (credit/debit card, net banking, UPI, etc.)

- Drive complete utilization of all payment options available to your company, ensuring availability of funds to fuel business growth.

Access to Credit Line

Get access to unsecured credit line to pay for your business needs, and improve your working capital.

- Access a credit line of up to 90 days without any collateral.

- Enjoy the flexibility of prepayment without incurring additional fees.

- Negotiate 2-3% invoice-discounts from vendor for making advance payments.

- Extend your days-payables by getting access to credit for your payables.

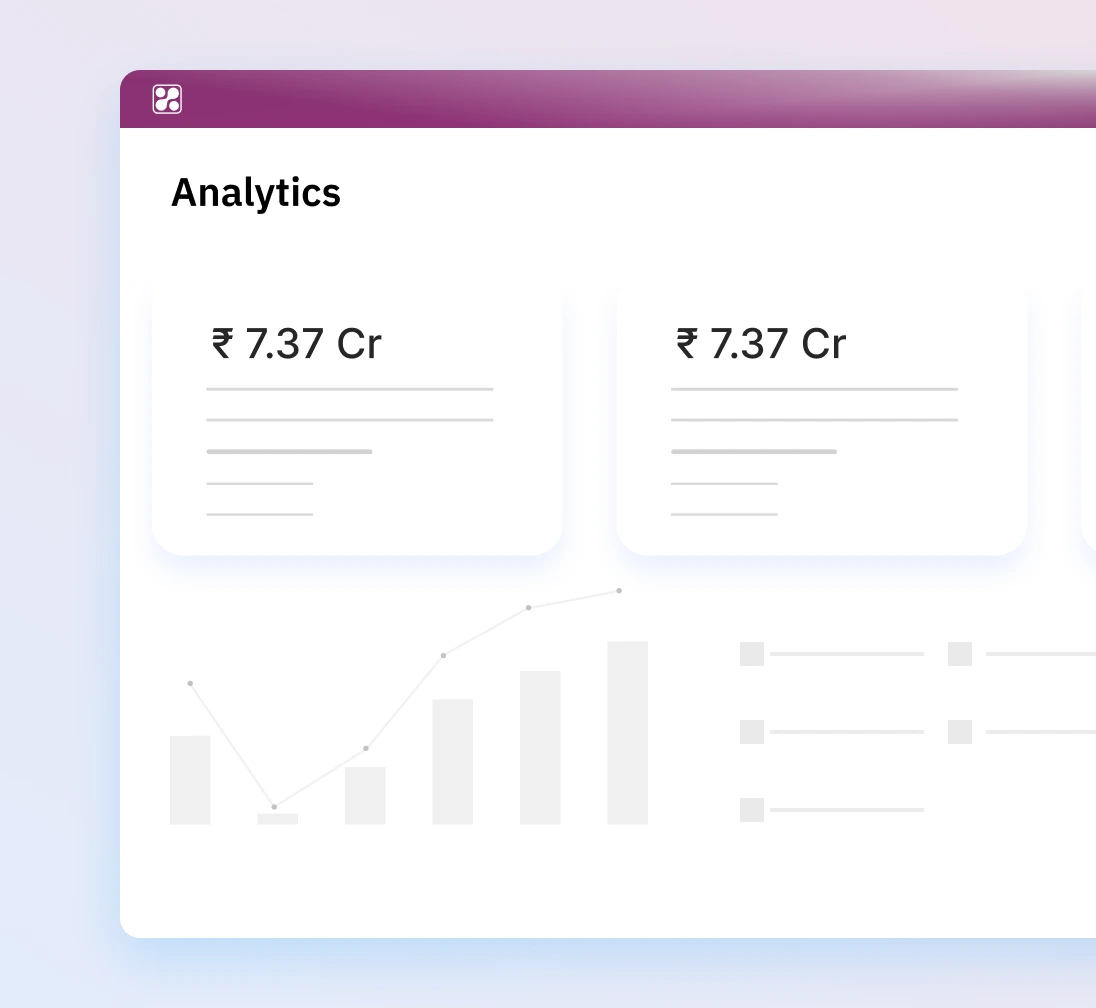

Advanced Analytics

Gain a deeper understanding of all your payments and vendors to make better business decisions.

- Eliminate the need for manual data analysis. Get all insights on a single dashboard.