Invoicing trends

- The 2019 Billentis Market Report suggests that by 2025, the volume of invoices businesses send and receive is projected to reach USD 20.5 billion.

- About 70% of the invoices that are processed globally are paper-based.

The sheer volume of paper invoices makes manually managing and reconciling paper invoices a time-consuming and error-prone task. Based on their specific business needs, startups and enterprises are now moving from managing invoice data on excel sheets to adopting either an invoicing tool for digitized invoice processing or an automated invoicing software for end-to-end invoice management.

What is invoicing software?

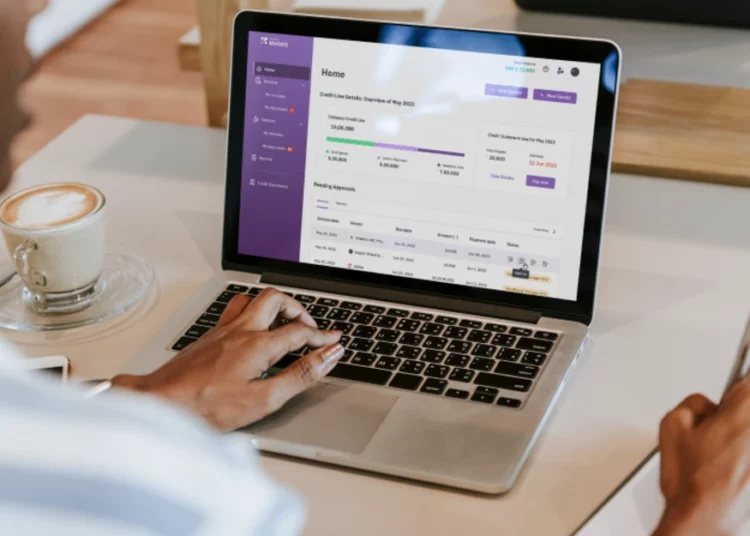

Invoicing software solutions help small businesses and enterprises automate the process of creating, sending, and tracking unlimited invoices. The billing software can create customized invoices for outgoing vendor payments while also enabling customizable one-time invoices or recurring invoices for recurring payments.

With a streamlined invoicing process, the best invoicing software can save businesses time and money, aiding in effective project and business management.

Cloud-based invoicing software can help track billable hours, create and send professional invoices, send payment reminders, and export invoice data to CRM or accounting software, such as QuickBooks Online. For incoming invoices, the billing software automates the approval workflow and expedites payment processing.

Suggested Read: What is an Invoice: The Ultimate Guide

List of top 12 invoicing software

- Happay Invoice

- Zoho Invoice

- Freshbooks

- RazorpayX

- Spendesk

- Enkash

- Xero

- PayPal Invoicing

- Paymate

- Karbon Business

- Square Invoices

- Innominds

Different types of invoicing software

Invoicing software can be broadly divided into two categories: offline and online. Businesses of different sizes can choose the invoicing tool most suitable to their business needs.

Offline Invoicing Software |

Online Invoicing Software |

|

Needs to be installed on individual devices |

Can be accessed from anywhere |

|

Data saved on devices; vulnerable to data loss |

Better data security with cloud backup |

|

Invoices created and stored on a device |

Invoices created and accessed on the go |

|

Device compatibility required |

Device independent |

|

Manual downloading and emailing of invoices |

Automated processes and advanced functionality |

|

Ideal for freelancers or self-employed people dealing with a handful of invoices |

Cost-efficient invoicing solution for businesses with multiple functions |

1. Desktop invoicing software

This predominantly offline invoicing software is downloaded to desktop computers. Small businesses with low invoice volumes, self-employed professionals, and freelancers commonly use free invoice software for PCs, such as Microsoft Excel.

2. Multi-device invoicing software

This online invoicing software offers flexibility and ease of use by allowing easy access to invoice data via any device. Professional invoices, such as debit notes or point-of-sale (POS) invoices, can be created using a variety of invoice templates and stored on the cloud.

3. Invoice processing software

Invoice processing software digitizes physical vendor invoices using optical character recognition (OCR) technology. The online invoice software streamlines invoice processing, minimizing invoice processing time and costs while eliminating data-entry mistakes.

4. Invoice management software

Invoice management software streamlines the entire invoicing process, saving time and money and aiding in effective project management. Automation eliminates the hassles of manually creating customized invoices, sending payment reminders, and managing recurring billing.

Suggested Read: 8 Best OCR Software and Tools

Top invoice processing software: A comparative analysis

Criteria |

Happay |

RazorpayX |

Enkash |

Karbon |

Paymate |

Innominds |

|

Vendor Addition |

Bulk |

Individual user |

Bulk |

Individual user |

Bulk |

Individual user |

|

OCR |

Yes | Yes | Yes | No | No | Yes |

|

Scheduling Payments |

Yes | Yes | No | No | Yes | No |

|

Payment Method |

NEFT/ Credit line |

Payment suite |

Online payment |

SmartPay |

NEFT/ Cards |

Online payment |

|

Deduplication Algorithm |

Yes | Yes | No | No | No | Yes |

|

Auto- Reconciliation |

Yes | Yes | No | No | Yes | No |

|

Invoice Reports |

Real-time |

Real-time |

Real-time |

Available |

Real-time |

Available |

|

Setting Budget Limits |

Yes | No | Yes | No | No | No |

|

NLP for data recognition |

Yes | No | No | No | No | Yes |

|

Integrations |

ERP |

Current account |

ERP/ Accounting |

Bookkeeping (Upcoming) |

ERP |

Third-party solutions |

|

Exporting Invoices |

Yes | Yes | No | No | No | Yes |

|

Market Segment |

Mid, large enterprises |

Small, mid, large size |

Small, mid, large size |

Startups |

Small, mid, large size |

Enterprises |

Top invoice management software: A comparative analysis

Criteria |

Zoho Invoice |

Freshbooks |

Spendesk |

Paypal |

Xero |

Square Invoices |

|

Trial Period |

14 days |

30 days |

30 days |

No |

30 days |

No |

|

OCR |

Yes | Yes | Yes | No | Yes | No |

|

Invoice Discounting |

Yes | No | No | No | No | Yes |

|

Bulk/Batch Invoicing |

Batch |

Bulk |

Bulk |

Batch |

Bulk |

Batch |

|

Integrations |

Accounting/ Payments |

Import/ Export tools |

Accounting software |

Accounting/ Payments |

Third-party apps |

Accounting/ Payments |

|

Auto- Reconciliation |

Yes | Yes | Yes | Yes | Yes | No |

|

Three-way matching |

Yes | No | Yes | No | No | No |

|

Turnaround Time |

2–4 days |

2–4 days |

2–4 days |

1 day |

2–4 days |

1 day |

|

Payment Method |

Payment gateways |

Card/Online payment |

Card/ACH transfer |

Multiple modes |

Online payment |

Card/ACH transfer |

|

Real-Time Tracking |

Yes | Yes | Yes | No | No | Yes |

|

Invoice Reports |

Real-time |

Generated |

Real-time |

Available |

Real-time |

Live overview |

|

Customizable Templates |

Yes | Yes | No | Yes |

Limited |

Yes |

|

Market Segment |

Small, mid size |

Small, mid size |

Mid-market, enterprises |

Small, mid size |

Startups |

Small, mid size |

Best invoice processing software in India

1. Happay Invoice

Happay Invoice effectively digitizes and simplifies vendor payments, saving time and ruling out inaccuracies. Data can be extracted faster, the approval workflow can be streamlined, and invoices can be scheduled for payment. Happay enables improved process efficiency, better productivity, and faster invoice processing.

Happay’s intuitive invoice processing tool offers easy payment options including direct fund transfers to vendor bank accounts using a line of credit. No payment gateways or ACH fees are involved in this process. Using a line of credit enables faster online payments and improves cash flow by extending supplier payment terms.

Top features

- OCR technology with natural language processing (NLP) for data recognition

- Invoice scheduling for on-time payments

- Detecting duplicate invoices or inconsistencies

- Bulk vendor or supplier addition

- Quick invoice turnaround time

- ERP integrations

- GST calculation

- Customizable invoices and templates

- Customized approval workflow

- Robust customer support

Happay Invoice pros

- A smart deduplication algorithm

- The line of credit payment option

- Auto-reconciliation of invoice data

- Real-time invoice reports

- Setting limits for budget control

- Exporting invoices for bookkeeping

- Invoice tracking

Happay Invoice cons

- No provision for bulk invoicing yet

- No bulk payments using commercial credit cards

Product USP

- Bank account transfer using a credit line

- Same-day bank reconciliation

Happay Invoice pricing

Happay Invoice does not involve any joining or annual fees, but businesses incur nominal transaction charges.

Suggested Read: EPIC Corporate Credit Card: Everything You Need To Know

2. RazorpayX

RazorpayX Vendor Payments offers businesses ease of use by simplifying vendor payments and automating key processes. Once invoices are uploaded and the data is auto-captured, the software sends timely payment reminders and facilitates instant fund transfers via IMPS, NEFT, RTGS, or UPI.

With end-to-end visibility, businesses can track all invoices from a single dashboard and can benefit from better expense tracking and cash flow management.

Top features

- Invoice data auto-capture with OCR technology

- Scheduling invoice payments

- Setting up approval workflows

- Forwarding invoices via email

- Accounting software and current account integrations

- Invoice tracking

- Invoice reports

- Payment reminders

- GST calculation and payment

- Customer support based on chosen paid plans

RazorpayX pros

- A deduplication algorithm

- Importing invoices from accounting software

- Exporting invoices for bookkeeping

- TDS auto-calculation

- Auto-reconciliation of invoices

RazorpayX cons

- No provision to set budget limits

- No bulk vendor addition or bulk invoicing

- No same-day bank reconciliation

Product USP

- Vendors directly adding invoices through a vendor portal

- Vendor-level TDS calculation and monthly aggregate TDS payment

RazorpayX pricing

Standard plan with nominal charges and enterprise plan with custom pricing

Also Read: 5 Best RazorpayX Alternatives & Competitors for Corporate Card

3. Enkash

Enkash’s invoicing software replaces manual invoicing efforts, improving efficiency and productivity. For recurring payments, the invoicing process can be automated. The software optimizes invoicing costs and offers complete visibility.

Top features

- Bulk addition of vendors

- Invoice tracking

- OCR technology to extract invoice data

- Integrations with ERP and accounting software

- Virtual accounts

- Setting up approval workflows

- Invoice reports

- GST compliance

- Utility bill payments

Enkash pros

- Automated payment reminders

- Multiple payment methods for better convenience

- Budgetary controls

- Invoice tracking

- Making tax payments, including sales tax

Enkash cons

- No scheduling options available

- No duplicate invoice detection

- Auto-reconciliation not available

Product USP

- Bulk payouts

- Embedded payment links in invoices

Enkash pricing

For pricing details, contact the customer support.

Also Read: What is Payroll Accounting?

4. Karbon Business

Karbon Payout tracks and manages all vendor payments from one dashboard, improving cost and cash flow visibility. Karbon’s user-friendly interface provides ease of use, and smart bulk payouts ensure the payment gateway opts for the most convenient payment method.

Top features

- Effective beneficiary management

- Vendor payouts anytime, irrespective of banking hours

- Invoice tracking

- GST calculation

- Auto-selection of the fastest payment method

- Customized invoice templates

- Forwarding invoices via email

Karbon pros

- Bulk invoicing or payouts

- The SmartPay feature

- TDS calculation

- Receiving verified beneficiary payment details via links

Karbon cons

- No OCR technology for data auto-capture

- No software integrations yet

- Auto-reconciliation not available

Product USP

- 24X7 payment processing

- Sending beneficiaries payout links

Karbon pricing

For pricing details, contact the customer support.

Also Read: 5 Best Karbon Alternatives & Competitors for Corporate Cards

5. Paymate

With Paymate’s supply chain payments platform, digitized vendor payments using commercial credit cards are faster and more optimized, extending days payable outstanding and improving cash flow. Late payments and human error can be eliminated with digitized processes.

Top features

- Bulk addition of suppliers

- ERP and accounting integrations

- Scheduling invoice payments

- GST calculation and payment

- Machine learning analytics to maximize returns

- Real-time invoice reports

- Automated e-KYC

- Utility bill payments

- Bulk payouts using corporate credit cards

- Approval workflow setup

Paymate pros

- Transferring funds from commercial credit cards to bank accounts

- Paying GST via commercial credit cards

- Same-day payment processing

- Automated credit engine

- Three-way invoice matching

- Auto-reconciliation of invoices

Paymate cons

- No provision to set limits for budget control

- OCR technology not available

- No deduplication algorithm

Product USP

- Early payment discounts

- Payment via intuitive mobile apps (both Android and iOS)

Paymate pricing

The basic free plan as well as premium API and custom paid plans

Also Read: What is a Tax Invoice: A Complete Guide

6. Innominds

Innominds offers an AI-first, invoice processing solution that is specifically designed for large enterprises. Digitally capturing all invoices ensures all incoming invoices are correctly mapped. Manual processes and human error can be effectively reduced while minimizing the invoice processing time.

Top features

- OCR technology for extracting invoice data

- NLP for recognizing and classifying data

- Multiple data sources and invoice formats

- Integrations with third-party accounting software

- Customized invoices

- Strict invoice validation before processing

- Forwarding invoices via email

Innominds pros

- Advanced analytics for metrics on invoices

- An admin portal for configuring and mapping invoices

- Detecting errors and inconsistencies in invoices

- Exporting invoices to API software

Innominds cons

- No scheduling feature available

- Auto-reconciliation not available

- No addition of vendors in bulk

Product USP

- Pre-OCR and OCR to extract data

- Batch invoice processing

Innominds pricing

For pricing details, contact the customer support.

For businesses looking for end-to-end invoice management, here’s a list of the best invoice management software.

Suggested Read: Difference Between Invoice and Bill

Best invoice management software in India

1. Zoho Invoice

The cloud-based invoice management solution automates end-to-end invoice processing, time tracking, payment collection, invoice reports, and expense tracking. The intuitive interface facilitates easy creation and sending of invoices.

The Zoho invoicing app helps businesses record and manage customer data and tax information, such as sales tax and GST. Users can track invoice history from the Zoho Invoice dashboard.

Top features

- Creating invoices, credit notes, and retainers

- Multi-currency and multi-lingual invoices

- Automated payment reminders

- Customer self-service portal

- Real-time invoice tracking

- Tracking billable hours and project management

- Digital and recurring billing

- Integrations with accounting and payments software

Zoho Invoice pros

- Easy accessibility with Android and iOS mobile apps

- Integrations with multiple payment gateways

- Over 30 built-in invoice reports

- Batch invoicing

- Auto-reconciliation of invoices

- A 14-day free trial

Zoho Invoice cons

- One-day invoice turnaround time not available

- Not designed for large enterprises

Product USP

- Three-way invoice matching

- Invoice discounting

Zoho Invoice pricing

Free plans for small businesses and freelancers

Also Read: Zoho Expense vs Expensify: A Detailed Comparison 2023

2. Freshbooks

Designed primarily for small businesses and freelancers, Freshbooks invoicing app automates and simplifies the invoicing and billing process. The Freshbooks invoice generator software helps create customizable invoices.

Top features

- Credit card payments and ACH

- Automated payment reminders and notifications

- Unlimited invoices to clients based on the chosen plan

- A self-service portal for clients

- Tracking sales tax and reports

- Payment via checkout links with some plans

- Auto-reconciliation of invoices

- Tracking billable time and expenses

Freshbooks pros

- Easy accessibility with iOS and Android mobile apps

- Invoice data import and export

- OCR technology for data extraction

- Real-time tracking of invoices

- A 30-day trial period

Freshbooks cons

- No real-time invoice reports

- No three-way matching

Product USP

- Bulk invoicing

- Requesting a deposit on the invoice value

Freshbooks pricing

Four Freshbooks pricing editions, with the Lite plan starting at $8.50 per month

Also Read: What is Billing: The Ultimate Guide

3. Spendesk

The Spendesk invoicing app tracks and monitors the invoice management process, from procure to pay. The software streamlines approval workflows and budgets while keeping invoicing errors and inconsistencies at bay.

Top features

- An automated AP system

- Built-in approval workflows and controls

- OCR technology to extract data

- Accounting integrations

- Auto-reconciliation of invoices

- Submitting invoices via email or file upload

- Complete visibility for project management

Spendesk pros

- Bulk invoicing

- Updating budgets in real time

- Smart card payments

- Real-time invoice reports

- A deduplication algorithm

Spendesk cons

- No invoice discounting option

- One-day invoice turnaround time not available

Product USP

- Three-way matching

- Scheduling payments

Spendesk pricing

Starter, Essentials, and Scale plans

Quick Read: What is a Commercial Invoice?

4. PayPal Invoicing

The PayPal Invoicing app enables businesses to create and send invoices, track unpaid invoices, and send payment reminders. This online invoicing software offers the flexibility to create professional invoices, send estimates, and access invoice data from any device.

Top features

- Auto-reconciliation of invoice data

- Customizable invoice templates

- Integrations with accounting and payments software

- Invoice reports

- Easy conversion of estimates to invoices

- Multiple payment modes, including PayPal payments and cards

PayPal Invoicing pros

- Scheduling recurring invoices

- Automatic sending of past-due notices

- Sending invoice estimates to clients

- Payment links embedded in the invoices

PayPal Invoicing cons

- No trial period

- No three-way matching

Product USP

- One-day invoice turnaround time

- Batch invoicing

PayPal pricing

For pricing details, contact the customer support.

Also, Read: What is e-Billing? A Comprehensive Guide for Electronic Billing

5. Xero

Xero invoicing software helps eliminate data-entry errors by extracting expense and sales records from banks, POS systems, invoicing apps, and e-commerce websites. Businesses can create and send online invoices via the desktop or mobile app.

Top features

- OCR technology for data auto-capture

- Real-time invoice reports

- Automated financial reporting

- Easy bank reconciliation

- Customized invoices

- Integrations with third-party apps, including CRM, inventory management, and e-commerce

Xero pros

- Automatic payment reminders

- Invoice data import and export

- Easy compliance with cloud-based accounting

- A 30-day trial period

- Online customer support

Xero cons

- No invoice discounting

- No three-way matching

Product USP

- Bulk invoicing

- Audit trail

Xero pricing

Three Xero pricing editions, starting at $13 per month

Recommended Read: What is a billing cycle?

6. Square Invoices

With Square Invoices, businesses can track and monitor paid and unpaid invoices in real time, send payment reminders and notifications, and make payments via multiple payment modes. Users can create and access digital invoices from anywhere.

Top features

- Sending digital invoices and estimates

- Unlimited invoices and estimates

- Paying online via credit cards or ACH bank transfer

- Integrations with accounting and payments software

- Auto-converting estimates to invoices

- Custom invoice templates

- Sharing invoices via an SMS, email, or link

Square Invoices pros

- Batch invoicing

- Invoice discounting

- Real-time tracking

- Easy accessibility with Android and iOS mobile apps

Square Invoices cons

- No trial period

- No OCR technology

Product USP

- One-day invoice turnaround time

- Invoice discounting

Square Invoices pricing

Two pricing editions, between $0 and $20

Also, Read: 6 Best Cash Flow Management Software

Why do businesses need invoicing software?

Storing and managing large volumes of paper invoices is cumbersome and prone to damage or loss. Managing invoice data on Excel is both tedious and fallible. Paper invoice processing errors and late payments lead to ballooning costs and poor vendor relationships.

Manual invoicing requires manual data entry, payment processing, and reconciliation, resulting in delays and oversights. With OCR technology, digital invoice data is auto-captured and data-entry errors are prevented.

Exporting invoice and payment data to CRM, ERP, or accounting software ensures seamless integration of invoice data. End-to-end visibility means there is no duplication, oversight, overpayment, late payment, or fraud. Recurring payments can be automated, thus streamlining recurring billing. Digital invoice processing enables faster reconciliation and enhanced accuracy.

Online invoice software that has integrations with bookkeeping and accounting software, such as Freshbooks and QuickBooks Online, automates the invoicing process while providing real-time expense tracking and time tracking. The invoicing and billing software tracks and manages all one-time and recurring invoices, aiding in project and business management.

Also Read: 10 Best Business Management Software

Important features to look out for in invoicing software

The best invoicing software in India, whether catering to large or small business owners, must meet certain parameters and must have certain essential functionality.

1. OCR technology and NLP: OCR technology helps extract data from invoices, and natural language processing (NLP) recognizes and understands the data.

2. Payment reminders or advanced scheduling: Invoicing software can create and send recurring invoices automatically and also send payment reminders or notifications to customers. Some invoicing solutions come with scheduling options.

3. Auto-reconciliation of invoice data: Some invoicing software solutions simplify and automate the invoice reconciliation process, saving the time, costs, and efforts associated with manual reconciliation.

4. Bulk vendor addition and bulk invoicing: The best invoicing software allows businesses to add vendors or suppliers in bulk. Batch or bulk invoicing option, which allows invoices to be processed in bulk, is another feature to look out for.

5. Quick invoice turnaround time: Digital invoices can be processed faster, are easier to store, and are easier to track and access. Invoicing software enables faster reconciliation and enhanced accuracy.

6. Customizable invoices and invoice templates: Invoicing software provides a range of templates, together with different types of customizable invoices, including sales invoices, debit memos, and point-of-sale (POS) invoices.

7. Real-time invoice tracking: The best invoicing software options come with real-time invoice tracking and reporting features. The software provides end-to-end invoice monitoring.

8. Convenient payment options: Businesses can choose the invoicing software that offers different online payment methods. For example, direct fund transfers using a line of credit, debit or credit card payments, and so on.

9. Importing and exporting invoices: The best invoicing software solutions allow invoices to be imported from and exported to accounting software, simplifying invoice processing.

10. Deduplication algorithm: Duplicate invoices contribute to ballooning invoice processing costs, so a deduplication algorithm to detect duplicate invoices and minimize fraud is a key feature in an invoicing solution.

11. Suitable limits for budgetary control: A few invoicing software solutions offer businesses the added benefit of setting limits on invoice spend for budget control.

12. Integrations with accounting software: Businesses must opt for an invoicing software solution that allows seamless ERP or accounting integrations to eliminate the additional man hours spent on reconciling data.

Related Read: 10 Best ERP Software in 2023: A Complete Review of ERP System

Benefits of using invoicing software

Invoicing software minimizes invoice processing time, costs, and errors. Digitized invoice processing offers end-to-end visibility and improved liquidity management.

1. Minimized cost per invoice: An EY survey reveals that 52% of organizations feel cost reduction is the primary benefit of digital invoicing. Elimination of duplicate invoices and late payment minimizes costs greatly.

2. Reduced data-entry errors: Manual data entry and processing are time-consuming and error-prone tasks. Digital invoicing effectively simplifies and accelerates invoice processing, saving time and ruling out inaccuracies.

3. Duplicate invoices and discrepancies flagged: Digital invoicing equips businesses with advanced technology and analytics that help them identify and prevent overpayments, duplicate payments, and fraudulent payments.

4. Improved process efficiency and cash flow visibility: According to an International Data Corporation survey, 41% of businesses report cash flow problems due to invoicing delays. Faster invoice processing improves cash flow and visibility.

5. Reduced invoice processing time: Paper-based invoices call for manual data entry and processing, leading to inordinate delays in processing invoices and late payments. Digitization and automation eliminate these delays.

6. Streamlined audits and compliance: As per the IOFM 2021 Survey, 11% of businesses consider audit compliance as the topmost invoicing challenge. With invoicing software, automatic reconciliation reduces compliance costs.

7. Optimized invoicing process and productivity: Sometimes, the billing and invoicing tasks are delegated to employees who are already overworked. Online invoicing software reduces employee workload and improves productivity.

8. Early payment discounts: Due to longer processing times and late payments, businesses fail to avail of early payment discounts. Invoicing software enables them to make the most of any cost-saving opportunity.

9. No late payment penalties or damaged relations: Manual approvals delay payments, leading to late penalty costs and damaged vendor relations. With invoice scheduling, invoice payment delays can be easily avoided.

Also, read: 10 Best Accounts Payable (AP) Software

Critical challenges in invoicing software

With the myriad benefits they offer, invoicing software solutions also come with their own set of challenges.

1. Gaps in understanding the invoicing software

In the absence of standardization, using invoicing software is a bit of a trial-and-error process. Understanding invoice management software and its functionality may become singularly challenging without proper training.

2. Lack of process clarity

A clear understanding of the billing process is a prerequisite to successfully implementing the billing software. If a business doesn’t understand its invoicing process clearly, setting up the invoicing software to meet its needs will be challenging.

3. High costs of invoice management software

While there are some free invoice software options on the market, invoice generator software that offers end-to-end invoice management often has a range of paid plans. The cost of the best billing software can be a barrier for some business entities.

4. Paying for unutilized invoicing features

Some businesses may not need all of the automation features the software offers. The remaining functionality will remain unused or underutilized. Businesses that do not require end-to-end invoice management may get by with a less expensive billing software.

5. Difficulty amending e-invoices generated

Once generated, e-invoices cannot be modified; they can only be canceled on the Invoice Registration Portal (IRP) within 24 hours. Once canceled, the invoice number becomes invalid and a new invoice needs to be generated.

Despite these limitations, invoicing software can be a valuable tool for businesses of all sizes. The key is to find the right invoice maker software for a business and get acquainted with the functionality of the invoicing and billing software.

How to choose the right invoicing software for your business needs

What is the best invoice software for a business? Well, there is no one-size-fits-all invoicing and billing software. There are a few considerations for finding the right fit from among the best invoicing software available on the market.

- For freelancers, self-employed professionals, and small businesses dealing with low invoice volumes, a simple offline invoicing software or invoice software for PCs may suffice.

- For small and mid-level businesses as well as enterprises with moderate invoice volumes, online invoice processing software with partial automation features offering ease of use could be the most cost-effective option.

- For large enterprises with high volumes of invoices, online invoice management software that offers real-time tracking and end-to-end invoice management will be the ideal choice.

Businesses of all sizes may avail of any intuitive invoicing and billing software with free plans or nominal pricing to help optimize the invoicing process. Some levels of automation with features such as customizable invoice templates, payment reminders, scheduling, and software integrations can come in handy for different individual and business needs.

Also, Read: 10 Best Asset Management Software Systems

How much does the best invoicing software in India cost?

The Indian fintech market is flooded with myriad invoicing software options for all business sizes. Some of the best invoicing software options come at a nominal fee, such as Happay Invoice and Freshbooks, while others have paid plans that businesses can choose from. Some invoicing software solutions also come with free plans.

List of free invoice software

Here’s a list of free invoicing software for small businesses:

The bottomline

Streamlining vendor payments is a huge challenge for about 95% of businesses. Slow approval processes and lack of digitization lead to payment inefficiency. Besides paying penalties, businesses lose out on cost-saving opportunities.

Digital invoicing creates a robust payments workflow, streamlining vendor payments and offering real-time spend visibility. Payment reminders and scheduling prevent payment delays. Faster invoice processing and reconciliation improve cash flow visibility and forecasting.

End-to-end invoice management software offers effective time tracking and expense tracking with respect to services, streamlining project invoicing and project management.

Suggested Read: Top 10 Procurement Software Solutions

Invoicing software – FAQs

Small businesses have their specific business needs, and some of the best billing software on the market are designed for small businesses, startups, and freelancers. Some free invoicing software for small businesses include Zoho Invoice and Square Invoices.

Here’s a list of some other small business invoice software options:

1. Freshbooks

2. Wave

3. PayPal Invoicing

4. Xero

5. Stripe Billing

With cloud-based billing software, business owners can generate, send, and manage unlimited invoices that are GST-compliant. This modern billing software offers ease of use, with the flexibility to install the software on any device, and robust security. The best billing software provides integrations with accounting software and CRM systems.

Zoho Invoice Generator is free invoicing software that involves no hidden fees, ads, or contracts. According to G2, the invoice generator software can generate unlimited invoices for free.

Invoicing software solutions, such as Stripe, integrate with the bookkeeping and accounting software QuickBooks Online Accounting. QuickBooks Time, the employee time-tracking software, can also be integrated with QuickBooks Online.

Excel offers invoice templates that are customizable, which can be used to create various types of professional invoices for startups and small businesses at nominal costs. However, software options designed for small business owners, such as Xero, might be more efficient and profitable. Businesses dealing with moderate to large volumes of invoices may leverage advanced software options, such as Happay Invoice, Zoho Invoice, Freshbooks, QuickBooks Online, and Stripe Invoicing.