Introduction

Expense frauds, lost savings, angry employees banging on your office door and asking for reimbursements- shudders!

Can something make it all disappear?

An expense claim software is a platform that optimizes the multi-step expense claim and reimbursement process. It automates the report filing, submitting and approval, and refund disbursement workflows and makes the tedious process simple for employees.

The right expense claim software can solve numerous problems. However, choosing the right one is a mammoth task. You might as well be a finance Hercules to pick the perfect software without assistance.

That’s where we come in. Our team studied about 50 market-leading expense claim software and curated a list of the 10 best ones.

List of 10 best expense claim software

- Happay

- Zoho Expense

- Fyle HQ

- Xero

- Brex

- Concur Expense

- Coupa

- Finly

- Volopay

- Emburse Chrome River Expense

10 Best expense claim software and tools in 2023

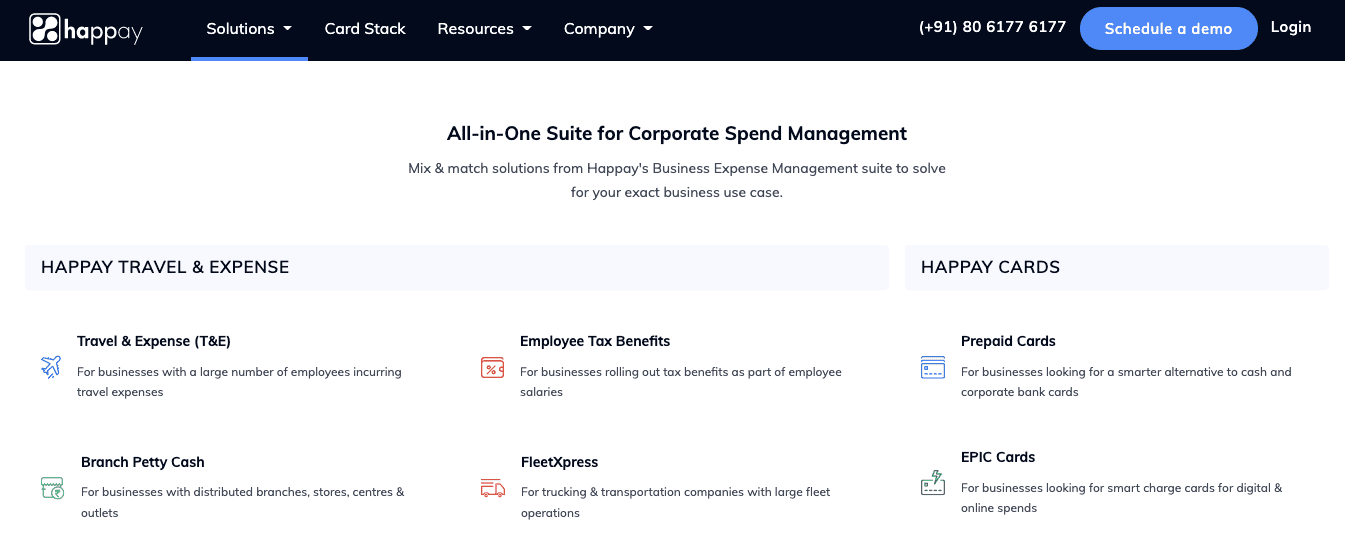

1. Happay

Happay is an exhaustive, versatile, and fully integrated expense claim software. It offers all the best expense management features including auto-expense capture, digital audit trails, AI-empowered fraud detection, automatic reconciliation, etc.

Happay has noticeably helped several clients across various industries significantly reduce their T&E spending and increase their policy compliance to up to 95%. Their dedicated team works with you to formulate a robust expense policy and then helps you customize the Happay software to fit your needs exactly.

Key Features

- Auto-capture expenses at the source

- Detailed expense audit trails

- AI-driven fraud detection

- Condition-based workflows

- Automated reconciliations

- Effortless filing & reimbursement

- Real-time spend analytics

Benefits

- Significant reduction in expense fraud

- Maximum policy compliance

- Shortened reimbursement times

- Easier audits

- Better financial decision-making because of accurate insights and analytics.

- Multi-level workflow automation

Reported disadvantages

- The mobile app does not currently support an offline feature

Best suited for

Medium to large enterprises

Happay Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

2. Zoho expense

Zoho expense is an expense management platform streamlining expense claim reporting and automating key parts of corporate travel. It enables controls that help increase budgetary compliance.

Zoho expense tackles multiple expense components like travel, purchase requests, payments, analytics, and cards. It enables high spend-visibility and increases travel and expense savings for companies.

Key Features

- Receipt management

- Expense management

- Mileage tracking

- Expense report automation

Benefits

- Simplifies the tedious approval process

- Helps you stay on top of business travel spending

- Helps you stay compliant with tax laws

- Increases reimbursement speed

Reported disadvantages

- According to a G2 review, the Zoho dashboard and layout feel outdated.

- Another G2 reviewer says that correctly filtering reports and analytics are challenging. You cannot see expenses category-wise per project.

Pricing

Zoho expense has a free version that allows up to 3 users, 5 GB storage, and 20 receipt auto-scans amongst other features.

The other plans are priced at $8- $12 per month for each active user depending on the number of active users. All the plans come with all free plan features and additional benefits get added at every payment level.

Best suited for

Small and medium businesses, and startups.

Zoho Expense Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Quick Read: 7 Best Zoho Expense Alternatives and Competitors

3. Fyle HQ

Fyle is an expense management tool that leverages the power of AI and business cards to rid businesses of their expense management issues. It enables real-time expense tracking by using regular-use apps like outlook, slack, and the G-Suite.

FyleHQ gives you a higher level of control over expenses and minimizes the need for manual reconciliation processes. You can also integrate it with your accounting software, ERPs, and HRMs to ensure efficient data movement.

Key Features

- Receipt scanning helps you extract information from paper receipts accurately

- You can split expenses based on projects, categories, or cost centers

- Tracks and submits expenses directly from everyday use apps

- Google Maps-powered mileage tracking

- Automated approvals

Benefits

- Faster reimbursements

- Happier employees

- Reduced expense reporting costs

- Limited employee spending

Reported disadvantages

- According to a G2 review, Fyle does not let you edit reports once you submit them

- Another user review said that the backend usability of the application needs significant improvement

Pricing

Fyle has two plans priced at 6.99 USD and 11.99 USD per active user per year. The two plans differ in a few features as the pricier plan offers additional tools like real-time Visa card notifications, corporate card management, bank feed setup, multiple card management, multi-stage policy approvals, etc.

It also has a custom pricing plan whose final price depends on the volume of active users and usage of the software.

Best suited for

Small, medium, and large businesses, depending on the plan.

Fyle HQ Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Future Read: 5 Best Corporate Credit Cards in India

4. Xero

Xero is an expense claim software that lets you capture and upload expense claims as you incur them. Their mobile connectivity even allows your employees to directly claim mileage and other small expenses from their phones.

Features

- Bank transaction reconciliation

- Capture bill and receipt information automatically

- In-depth analytics

- Invoice customization

Benefits

- Quick reimbursements and happier employees

- Reports and analytics facilitate smarter decision-making that yields savings

- Spend visibility and fewer expense frauds

- Digitization of the process ensures security against loss of data

Reported disadvantages

- According to a G2 review, Xero does not have an easily accessible phone support system

- Another review says that it is not easy to use if you are not an accountant

Pricing

Xero’s product plans start from $12 per month. Their most popular pricing plan is $34 per month which comes with the additional feature of bulk expense reconciliation. A higher plan which has their most sought-after features is priced at $65 per month.

Best suited for

Their cheapest plan is best for new businesses and sole traders. Their most popular plan suits small firms that are growing and their priciest plan is best for enterprises.

Xero Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Read About: 10 Best Expense Reporting Software Systems and Tools

5. Brex

Brex is an expense management solution that enables the scalability of employee purchasing power. It helps you close your books on time and increases spend visibility across the organization. Brex lets you increase your savings and compliance by setting up custom limits on spending based on categories and functions.

Key Features

- Automatically matches receipts

- Custom spend reports

- Unlimited virtual cards and spending limits.

- Full expense-related communication on the platform.

- Intelligent spend alerts.

Benefits

- Custom spend reports help identify cost-saving opportunities and execute cost-control strategies

- Virtual cards and spend visibility help avoid unpredicted large employee spends

- Accelerated expense reviews

- Smart alerts help save time and money and increase compliance

Reported disadvantages

- According to a G2 review, the app’s functionality has some bugs and dashboards do not load well

- The same review states that the inefficiencies in the two-factor authentication feature feel like a security risk

Pricing

The expense tracking platform has a free trial. Contact the Brex team to get the post-trial quote.

Best suited for

startups, and medium to large businesses.

Brex Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

6. Concur expense

Concur expense is SAP Concur’s expense management solution. It digitizes your spend information and helps you derive accurate insights from your data. Concur allows you to take control of business spending and pulls expense information from multiple sources.

Key Features

- Automatic expense reports

- Expense tracking

- Financial reporting

Benefits

- Concur automates many aspects of expense reporting, making it faster and more efficient for employees to submit their expenses. It reduces the time spent on manual data entry and paperwork.

- It ensures that expenses adhere to company guidelines, reducing the risk of non-compliant spending.

- Concur provides real-time visibility into expenses, allowing managers and finance teams to monitor spending as it happens. This can be invaluable for cost control and budgeting.

- It ensures more accurate financial records and reduces the likelihood of costly mistakes.

Reported disadvantages

- According to a G2 review, SAP Concur has poor customer support.

Pricing

The expense tracking platform has a 15-day free trial. Contact the Concur team to get the post-trial quote.

Best suited for

startups, and medium to large businesses.

Concur Expense Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Must Read: 5 Best SAP Concur Alternatives and Competitors

7. Coupa T&E

Coupa BSM platform has a cloud-native solution that empowers scalable business spend management. The platform is mobile-friendly and hence it is easier for employees to adapt to it. Coupa helps increase transaction visibility and improves compliance and control.

Key Features

- Automated expense reporting

- Real-time expense report monitoring

- Intelligent audit algorithms that score expense reports automatically

- Automatically generated virtual payment cards

Benefits

- Travel expense spend control

- Help you digitize all the receipts

- Helps you comply with complex global tax requirements

- Fewer expense frauds

Reported disadvantages

- According to a G2 reviewer, the onboarding process of Coupa T&E is difficult

- Another review says that the platform UI lacks usability

Pricing

Contact the Coupa team to get a custom quote on the pricing structure.

Best suited for

Small, medium, and large businesses depending on the plan.

Coupa Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Read Also: 10 Best Spend Management Software

8. Finly expense management

Finly’s expense management software simplifies the spend management process for businesses with its OCR technology that makes receipt filing easier for employees. The software empowers companies by streamlining their finance operations.

Key Features

- Travel desk automation

- OCR technology

- Comprehensive analytics and reports

- Card integration

Benefits

- Faster travel booking reimbursements

- Insights on expense data increase savings

- Integration with accounting software makes pulling data easier

- Prepaid cards increase spend visibility

Reported disadvantages

- Processing payments in international currency is not possible according to this G2 review.

Pricing

Contact the Finly team to get pricing details of the software.

Best suited for – Small, fast-growth, and enterprise-level firms.

Finly Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Suggested Read: 7 Best Finly Alternatives, Competitors, Reviews and Pricing

9. Volopay

Volopay is an expense management software that offers smart corporate cards to simplify expense management practices for you. Employees can submit claims for non-card incidental expenses and receive reimbursement directly into their accounts.

Features

- Instant virtual cards

- Advanced multi-level approval workflow automation

- Real-time spend tracking

- Spend controls

Benefits

- Spend controls increase policy compliance and ensure cost efficiency

- Real-time spend tracking through cards significantly reduces the risk of expense fraud

- Digital receipt management ensures an audit trail

- Mobile user support makes the platform easily accessible to everyone

Reported disadvantages

- According to a user on G2, the platform is prone to freezing.

- Another G2 review claims that the software’s interface is a bit challenging to understand.

Pricing

You have to contact the Volopay team to get a custom pricing quote on the software.

Best suited for

Small and medium-sized businesses

Volopay Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Must Read: 5 Best Volopay Alternatives & Competitors for Corporate Credit Cards

10. Emburse chrome river expense

Emburse chrome river brings modern travel and expense management technology to companies. They have a mobile application that works on smartphones, laptops, tablets, etc. which ensures easy accessibility for all users.

The main feature of their software is optimizing accounts payable management and simplifying expense claims.

Features

- Complete integration with your online booking software

- Receipt capture and expense report creations and submission from any device

- Streamlined invoice processing

- Payment process automation

Benefits

- Invoice processing gives deep insights into spending practices and empowers future decision-making

- Payment process automation helps lower operating expenses

- Increased compliance with expense policy and better administration

- Mobile receipt capture and mileage tracking make claiming expenses easier for employees

Reported disadvantages

- According to a G2 review, admins cannot update the rules in the software on their own

- Another review said that getting a hold of the customer support team is challenging

Pricing

Emburse Chrome River has not made the pricing information available. You will need to contact their team to get a custom quote on the price.

Best suited for

Medium to enterprise-level businesses.

Emburse Chrome River Ratings

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Read About: 12 Best Invoicing Software [Paid+Free]

How do companies manage expense claims?

Companies have varied expense claim management systems depending on their budget and size. While some opt for a manual reimbursement process, others prefer expense claim software that can streamline their processes. Here are a few popular methods businesses use to manage expenses and employee reimbursements.

1. Traditional travel management methods

1.1. Spreadsheets or paper-based tracking

Many companies still use the traditional expense claims and reimbursement process. If it is travel-related expenses, the planning is done over emails or meetings. Then there is a paper trail-based expense filing and reimbursement process. The spending is tracked manually on a spreadsheet.

1.2. Travel Admins

Organizations that invest heavily in travel may employ an individual specifically for travel bookings and management.

2. Modern travel management methods

2.1. Expense claim software

Enterprises and many established small and medium businesses use expense claim software. An automated expense solution is one of the most favored choices for expense claims management for those who can afford it as it maximizes savings and efficiency.

2.2. Corporate Credit Cards

Company cards function as regular credit cards but can only be used to pay for business expenses. Companies issue credit cards to employees to frequently spend on the behalf of the company.

In corporate liability cards, the company directly pays the card fee, interest charges, and expenses, hence removing the expense claim process altogether. Whereas in individual liability cards, the employee pays the fees and then files for reimbursement.

Since corporate credit cards eliminate the tedious reimbursement process, a lot of large enterprises prefer them over other methods. Cards also enable real-time tracking of all transactions and offer higher control over spend limits.

2.3. Self-booking tools for travel

Companies that invest heavily in travel opt for self-booking tools. Employees can use these tools to book their trips in a policy-controlled environment. It ensures that there are no policy violations or overspending during the booking process and makes the expense claim and reimbursement process easier.

Must Read: 10 Best Travel Management Software and Systems

Importance of expense claim software

An expense claim software helps businesses save time and money. Here are a few benefits that every effective expense claim software has.

1. Boosted policy compliance

No more policy violations and cost leakages. An automated expense claim software can let you activate pre-spend controls and violation alerts while employees book their trips or make purchases.

2. Fewer expense frauds

Modern expense management software come with OCR technology that helps them automatically capture spend data from invoices. This helps employees avoid mistakes, misreporting and overreporting, and receipt manipulation.

3. Higher spend visibility

Expense claim software can automatically track spending data and create comprehensive expense reports. Some expense management solutions can integrate with your ERP and HRMS software and pull data directly from these platforms.

This integrability leads to higher purchase visibility. It gives you a detailed insight into the spending behavior of various branches, teams, and employees and empowers you to make better budget and expense decisions.

4. Saves time

An automated expense reporting software can help you create and execute optimized workflows. It accelerates the approval process and helps you disburse reimbursement amounts faster. This saves time for all stakeholders including the employees, approvers, and finance teams.

5. Saves money

The end-to-end spend visibility gives you all the insights and information you need to take timely budget decisions and perform accurate cashflow forecasts.

Expense claim software also give direct insights into vendor payments which shows you how frequently your company uses specific vendors. This information gives you more negotiating power while executing new contracts and deals.

Read About: 6 Best Cash Flow Management Software

How to choose the best expense claim software?

Choosing the best expense reporting software for your business is half the battle won.

To choose the right expense claim software for your business, take the following steps.

- Audit current expense management processes – Scrutinise every detail, workflow, and bottleneck of your current expense management process. Access previous spending history and list the pros and cons of the current system.

- Identify gaps – Identify the challenges that your current process has and make a list of tools and features you need to fill in those gaps.

- Set a budget – Before you start researching options, ensure how much you can afford to spend on the expense management system.

- Weigh your options – Go through guides and lists that detail the most significant features, pros, and cons of each option. Look for the tools and features that you shortlisted in step 2. Pick the software that has the maximum needed features in your budget.

TOP 5 features to look for in your expense management software

1. Automated expense filing

Get rid of those tedious manual processes and spreadsheets by adopting a platform that enables automated expense filing. This feature saves time for all parties involved and significantly reduces expense fraud.

2. Mobile and cloud capabilities

Today, most communication takes place over mobile devices. Ensuring that your expense management platform is accessible by smartphones and other mobile devices boosts the flexibility of the expense reporting process.

A cloud-based platform is also no more a luxury in the expense management domain. It’s a necessity that not only ensures security but also helps employees upload receipts and create expense reports on the go.

3. Automated reconciliation

Expense claim software that offers automatic reconciliation from multiple data points (airline details, PNR, payments, GST, etc.) can help you save numerous manhours spent doing manual receipt comparisons against purchase histories and expense reports.

4. Automated policy compliance checks and controls

Expense management software that allows you to spend hard policy controls and limit employee spending behavior helps increase expense policy compliance. You can also program these platforms to set violation alerts that prompt the employees to check their bookings.

5. Smart analytics

Having instant access to spend data supplements various forecasts and budget analyses and, in turn, increases your decision-making power regarding the company’s expense behavior.

Hence, you must choose a platform that gives you an exhaustive overview of your spend data. Software that can be integrated with other management platforms and can pull information from other platforms and produce more nuanced, exhaustive reports.

Read More: 15 Best Expense Management Software in India

How much does an expense claim software cost?

The cost of expense claim software installation and deployment depends on the size and needs of your organization. The average starting price for expense claim software is as low as 5 USD per month for each user.

Contact your service provider and give a list of all the necessary specifications and features you need in your expense claim software to receive the final price.

How to adopt an expense claim software in your business

Adopting a new expense claim software is an easy process. Follow these steps to make the installation and deployment easy for you and your team.

1. Formulate an expense policy

Creating an exhaustive expense policy is the first step to implementing expense automation adoption. You need to have a set of rules at hand because you need to program your software to implement these rules.

Try to make a policy that is as specific as possible. If you already have an expense management policy, audit it and see if you can fill in any gaps.

2. Program your software and educate all the stakeholders

Modern expense claim platforms are very easy to use. Once you have programmed the software to execute the necessary functions, educate the platform users on both ends.

In essence, give a demo and an overview of the main features to employees, managers, finance teams and anyone who will be using the software.

3. Test it out

Before fully implementing the new software, test it out with a few of your team members and get their feedback. This will help you detect the shortcomings of the system and make early changes.

4. Deploy

The final deployment stage can last from a few days to weeks to months. During this stage, ensure that your employees and vendors receive assistance every step of the way. If there are any bottlenecks, work with your team to remove them and reorganize the expense management structure to fit your current needs.

Happay – the expense claim software that unifies all the best features

Happay’s expense management software brings the best features of all other expense solutions together. Happay offers end-to-end spend management solutions across various industries to more than 7000 clients across 40 verticals.

Here are a few Happay features that deliver the highest ROI.

- Automated expense filing increases the efficiency of the reimbursement process, and shortens the reimbursement processing duration to about 5 days

- Automated policy compliance checks reduce policy violations from about 25% to 2%

- Workflow automation and real-time status updates can increase approval turnaround time by about 40-60%

- Expense reconciliation through multiple data point capture (PNR, GST, purchases, airlines) reduces expense reconciliation time by up to 80%

- Total spend visibility reduces expense frauds and smart analytics increase the accuracy of cash forecasts

Frequently asked questions

When employees pay for a business expense out of pocket, they can claim the amount they spent for reimbursement. This practice is known as expense claim.

Once employees file an expense claim, the approver (managers) has to approve that expense. Sometimes the finance department also has to greenlight an expense claim. Once all validations have been completed, the employee receives a reimbursement amount. If the necessary approvals don’t come, the employee is denied reimbursement.

An expense reporting software helps employees capture, report, and process expenses. Managers and finance officials can then use the same software to review these reports and approve expenses.

Expense Claim Software helps businesses automate and simplify the expense management process, reducing errors, saving time, and improving compliance with expense policies.

It typically allows employees to submit expense claims online, which are then routed to approvers for review. Once approved, the software can integrate with accounting systems for reimbursement.

Common features include receipt scanning, mobile access, multi-currency support, policy enforcement, reporting, and integration with accounting software.

Yes, many Expense Claim Software solutions cater to businesses of all sizes. Small businesses can benefit from cost-effective options tailored to their needs.

Expense Claim Software often allows users to capture receipts using mobile apps or upload digital copies. Some even use OCR technology to extract data automatically.

Yes, most Expense Claim Software solutions allow businesses to define and enforce custom expense policies, ensuring compliance and cost control.

Reputable Expense Claim Software providers prioritize data security, with features like encryption, access controls, and regular security audits.