Introduction

Card usage has been consistently on the rise in recent years. In 2021, nearly 62 million credit cards were in use in India. In fact, according to a report published in WSJ, one of every five finance departments is looking at corporate credit cards for their employees.

There are several options in the market for the best corporate credit cards. However, you must find what works for your organization. Kodo offers virtual and physical corporate cards to help with your spend management. However, before you settle on Kodo, it makes perfect sense to consider Kodo alternatives and competitors.

We decided to do the grunt work for you as we have gone through the list of Kodo competitors to bring you an in-depth analysis of the segment. With a complete overview of Kodo corporate card alternatives and their features, you can pick the best option for your organization.

Why look for alternatives to Kodo?

At the bare minimum, any corporate card solution must satisfy the following criteria:

- Does it help you track your business or travel expenses easily?

- Tracking your travel and business expenses is easier with corporate cards. The ensuing reports can give you a better idea of your most used hotels or vendors. This knowledge gives you better leverage to negotiate terms suitable for you.

- Does your existing corporate card/expense management system allow you to restrict or extend the usage of cards across multiple portals online?

Must Read: Everything about corporate credit card

A comparative table of Kodo alternatives and competitors

|

Name |

Distinguishing Feature |

Price |

Forex Mark-up |

Reward Types |

Customer Support |

|

Merchant Locking |

Joining fee: 0 Card fee: 0 Annual fee: 0 |

Lowest 1%+ GST |

Direct cashback |

Yes (AI and Chatbox) |

|

|

1-day card issuance |

Joining fee applicable |

1.5%+ GST |

Credits and cashback |

limited |

|

|

Unlimited usage cards |

Set-up/service fee applicable |

Not disclosed |

Credits/ |

limited |

|

|

Burner/instant virtual cards |

Fee: $50 to $800/mo |

1.6%+ GST |

Cashback |

limited |

|

|

Easy onboarding process and dynamic credit limits |

Card and annual fees: ₹3000 |

1.99%+ GST |

Credits/ |

limited |

5 Best Kodo alternatives and competitors

1. Happay EPIC

About Happay

Happay was founded in 2012 with the basic idea that payments to others must be as easy as sending a text message. Since then, Happay has successfully brought many products and services to the market.

As a Saas-based company with a goal to revolutionize business expense management, Happay’s EPIC cards push you to look beyond the traditional banks for corporate credit cards. Among other features, EPIC gives you the advantage of collateral-free credit with higher limits.

You get complete control to optimize and improve visibility over spend and freedom to choose the rewards that work for your enterprise.

Card features:

The main features of EPIC cards are

- An unsecured line of credit

- High transaction success rate

- Real-time spend control and visibility

- Simplified and streamlined payments

- Improved liquidity management

- Zero card and joining fee and no forex markup fees

- Superior integration with third-party tools

- Virtual cards for merchant locking

- Lucrative rewards on all spends

How does the Happay EPIC card help your enterprise?

Happay’s EPIC corporate credit cards offer significant advantages as a Kodo alternative. For instance, when you sign up for Happay EPIC cards, you get

- Access to corporate card transactions on one single platform.

- seamless cloud payments with EPIC corporate cards.

- Access to a user-friendly interface.

- end-to-end spend visibility.

Are Happay Epic Cards a great Kodo alternative?

Happay is undoubtedly a solid Kodo competitor. For instance,

- Happay is one of the few to offer merchant locking with virtual cards. You can quickly block or restrict card usage based on specific merchants.

- Happay’s merchant locking feature allows you to restrict the usage of corporate cards to specific merchants.

- Happay offers disposable virtual cards that you can use without worrying about data breaches.

- Happay offers an easy-to-use mobile app (IOS and Android) that gives you accessibility no matter where you are.

- Happay does not charge any additional forex markup fee (just 1%+GST that Visa charges).

2. Karbon Card

About Karbon Cards

Karbon Card is designed to act like a new-age corporate bank. As a financial platform, Karbon offers interest-free Karbon corporate credit cards for VC (venture capital) funded startups and small and medium enterprises.

Karbon Card was founded by Pei-fu Hsieh, Amit Jangir, Kartik Jain, and Sunil Kumar in 2019. Their headquarters is in Bangalore, Karnataka. The card solutions, built especially for Indian companies, are designed to tackle the financial challenges you face as an entrepreneur.

Card features

Signing up for a Karbon Card will give you access to

- Multiple corporate cards and a quick approval process.

- Cashback on all online and offline expenses.

- Ease-of-payments on expenses such as SaaS tools, e-commerce, restaurants, business expenses, and other travel-related expenses.

- A user-friendly dashboard to manage your expenses.

- A customer-centric support system to tackle issues you may face.

How do Karbon Cards help your organization?

As a Kodo alternative, Karbon Card performs well. Apart from features that allow you to streamline your expense management, here are some other ways that Karbon can help your organization.

- With a business account, corporate cards, and other payment instruments, Karbon hopes to offer corporate cards on the lines of what your bank offers but without all the hassles of fees or wait time.

- With Karbon corporate cards, you can easily manage your liquidity (as employees swipe cards instead of using cash advances) and improve your control over spend. Visibility also improves as you can view the data easily in one central location.

- You can choose between cashback (immediate approval without financial proof with up to 1% uncapped cashback), booster (5-10x higher credit limit than traditional business credit cards), and standard cards (30-day credit period to optimize company cashflow) for conveniences that suit your enterprise.

- Expense reviews and approvals are easy and quick

Are Karbon Cards a great Kodo alternative?

Karbon Card has a slight edge over Kodo cards, as certain features work better. Here’s why they are a good Kodo alternative.

- Karbon offers virtual cards with a merchant lock feature.

- About Forex markups, Kodo charges 2.25%, whereas Karbon charges only 1.5%.

- Finally, Karbon cards offer effective control over spending limits.

Quick read: Travel and expense management software

3. Enkash Corporate Card

About Enkash

Enkash was founded in 2017 and began its operations in 2018 with the aim of disrupting the commercial payments space.

Enkash’s commercial payment solution enables organizations to digitize their payments, making it frictionless and straightforward. Enkash hopes to offer next-gen enterprises an all-in-one commercial payments platform.

Enkash offers a centralized expense management platform and combines it with access to multiple cards. Besides offering savings, control, and visibility, Enkash’s products enhance productivity and operational efficiencies.

Card features

- You can choose from a range of purpose-based corporate credit cards that work for travel, subscriptions, procurement, marketing, etc.

- A flexible billing cycle allows you to manage card payments and cash flow efficiently.

- A user-friendly DIY platform allows you to create, track, and manage cards. You can set limits on your corporate credit cards too.

- You can restrict the usage of cards by pre-defining the limits or the purpose.

How do Enkash corporate cards help your organization?

As a Kodo competitor, Enkash proposes to ease your spend management with cards that can optimize, track, and manage your spend more effectively.

Here’s how it can help you improve the expense management process for the better.

- Enkash helps reduce out-of-pocket expenses and expense fraud.

- Enkash Cards help you to track and record your expenses easily. Further, it simplifies and speeds up the reconciliation process.

- Unlike corporate cards issued by banks, Enkash allows you to sign up and use collateral-free cards.

Are Enkash Cards a great Kodo alternative?

Enkash offers an additional feature as compared to Kodo. Single-use burner cards are a significant advantage, as they are secure and quick to generate and use.

Quick read: Spend analytics in procurement

4. Volopay Corporate Card

About Volopay

Volopay combines several solutions on a single platform with the goal of building a financial management platform for growing companies across teams and locations. Volopay offers corporate card solutions to manage spend, save money, and automate accounting.

As a Kodo alternative, Volopay corporate cards can help you and your team track card usage in real time.

Card features

- You can easily track expenses in real time, whether through web software or a mobile application.

- You can generate and use instant virtual cards for online transactions. You can use burner cards for single payments or recurring payment cards to manage your subscriptions.

- Volopay cards promise to improve spend transparency by allowing you to track and control every aspect of the spend in real-time.

How do Volopay corporate cards help your organization?

Volopay corporate cards help you streamline corporate payments to reduce the painful admin work associated with expense management. Whether it is business travel, online advertising, or any other payouts, Volopay’s card solutions are built to handle it for you.

Are Volopay corporate cards a great Kodo alternative?

When considered as a Kodo alternative, the virtual cards for merchant locking and single-use burner cards that Volopay offers are a level-up.

Future read: Best Volopay alternatives and competitors

5. RazorpayX Corporate Card

About RazorpayX

RazorpayX was founded to tackle money management challenges while enabling frictionless transactions. RazorpayX offers several products to provide clean, developer-friendly APIs and hassle-free integrations.

RazorpayX offers a suite of products that allow organizations to receive, process, disburse, and manage payments. Offering complete automation, RazorpayX corporate credit card promises streamlined business payments

Card features

- Using RazorpayX corporate cards, you can simplify your business and travel expenses- domestic or international.

- To use the corporate cards from Razorpay, you do not need to provide any personal guarantees or security deposits.

- You can enjoy high credit limits on corporate cards, especially if you are an existing Razorpay or RazorpayX user.

How do RazorpayX Corporate Cards help your organization?

As a Kodo competitor, RazorpayX corporate cards offer a clear step up from the basic features. For instance, here are a few factors that work in their favor.

- Employees can use Razorpay X cards across online platforms and at other brick-and-mortar stores too.

- RazorpayX corporate cards feature either the company’s or employer’s name.

- RazorpayX features a card lock/unlock feature that allows you to stop/allow usage of a specific corporate card.

- So, whether it is running online ads, or using AWS or other cloud infrastructure, RazorpayX corporate cards can ensure you pay for these services easily.

Are RazorpayX Corporate Cards a great Kodo alternative?

RazorpayX corporate cards offer more conveniences as compared to Kodo. High credit limits, easy integrations, and zero hidden charges are just some of the conveniences which make it a great Kodo alternative.

Future Read: 5 Best RazorpayX alternatives and competitors

How to choose the best Kodo alternatives?

1. Ask about the Kodo competitor corporate cards and their benefits.

If you are going to pick one of the Kodo alternatives for your corporate cards, then you must understand the benefits that come with the cards. For instance, Happay stands out as one of the best Kodo competitors.

Here are a few reasons for the same.

- You need not worry about personal guarantees, fixed deposits, or collateral. On approval, Happay issues the cards collateral-free.

- You can enjoy seamless payments for web hosting, Saas subscriptions, digital ad spends, travel, government, or other expenses.

- You can access unlimited virtual cards without the hassles of requesting cards manually.

- You can enjoy exclusive rewards with direct cashback.

- Happay offers a 10 times higher credit limit than most banks in the market.

- You can access and use the mobile app (Android and IOS) to make management easy and quick.

2. What will it cost you to sign up for these corporate cards?

While most Kodo alternatives charge a signing fee, Happay’s EPIC cards are completely free. So, you do not have to pay a card, platform, loan processing, or SaaS fee to sign up for these cards. You must consider the cost of signing up for such corporate cards before you pick a suitable Kodo competitor.

3. Do the Kodo alternative corporate cards offer merchant locking?

Do you know if the Kodo alternative you are considering offers merchant locking? For instance, Happay’s EPIC cards allow you to place restrictions on the merchants. The merchant-lock feature is available on virtual cards too. With this feature, your employees spend only through pre-approved merchants.

4. Evaluate the “forex markup fees” of the Kodo alternatives and competitors.

Happay does not charge any forex markup fee on their corporate cards, and therefore, you bear only what Visa charges (1%+GST). Compared to other corporate cards in the market, these charges are among the lowest.

So, forex markup fees should be an important factor in your decision about the best Kodo alternative.

5. How easy is the card application process?

One of the most important considerations for anyone planning to invest in corporate cards is the application process. The cumbersome process of application and the paperwork can dissuade anyone.

Happay as a Kodo alternative impresses as

- All funded startups and enterprises are eligible to apply for corporate credit cards.

- All you need to provide are KYC documents, cash balance information, and organization details.

- Thanks to minimal paperwork and quick processing times, Happay activates virtual cards within a few hours, and you will receive the physical cards within a few business days.

- Once the onboarding process is complete, you can avail of credit within 5 hours.

Kodo overview

1. About Kodo

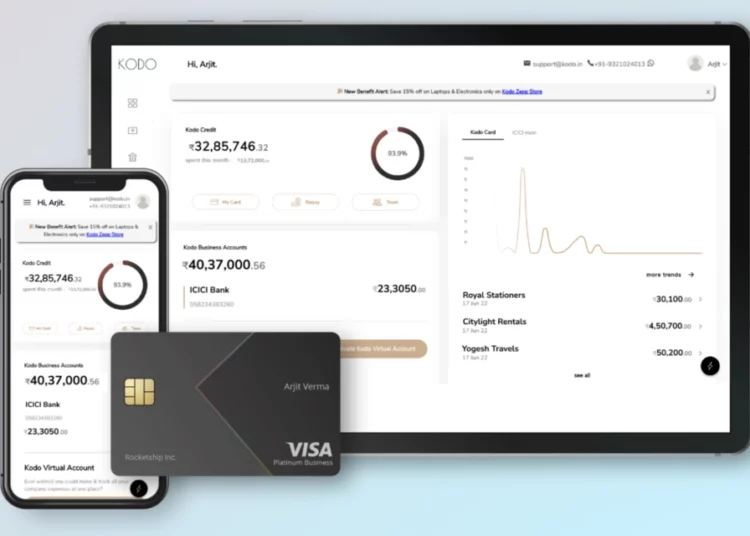

Kodo is a fintech company offering corporate credit cards to ease enterprises’ B2B payments process. They provide credit cards to startups and small businesses so they can use the same to process expenses such as money transfers, travel expenses, and online and offline purchases.

2. Features

Here are the features of Kodo corporate credit cards.

- You can access unlimited virtual and physical cards and issue multiple cards to your employees.

- You can use these cards across multiple locations globally.

- You can control the use of the cards in real-time, as you can block, unblock, or manage international transactions any way you like.

- You can enjoy cashback on the amount you spend through corporate credit cards.

- You can use tags to customize, organize, and sort transactions.

- One of the features of the Kodo corporate cards allows you to mark any of the corporate card expenses as personal.

- You get access to advanced filters and automated expense reports.

- You can offer multiple virtual cards to single users for a more granular spend limit. For instance, you can allocate spend limits per subscription too.

3. What are the benefits of using Kodo?

Kodo corporate cards offer several benefits, including access to limit-based collateral-free cards, cards with monthly limitations, and duration-based interest-free credit. Further, Kodo also provides access to top-ups and cards that you can manipulate according to the usage patterns of the employees.

Whether it is real-time receipt management, advanced filters that help in better spend analysis, or custom tags that can help streamline your expense management, Kodo offers great corporate card solutions.

4. Are bank cards better than Kodo alternatives?

Some of the biggest challenges you face with bank cards

- High forex markups.

- The technology that comes with it may be less modern and user-friendly than Kodo or any other SaaS-based solutions.

- Both control and visibility over your spend may still be lacking, leading to a solution that may not be comprehensive.

- You may not be able to optimize your cash liquidity.

FAQs

Happay, Volopay, RazorpayX, Karbon, and Enkash are some of Kodo’s alternatives and competitors.

Kodo’s corporate credit card integrates with your expense management system through a mobile application. The system allows you to use multiple cards for business and travel expenses.