Quick TL;DR Summary

1. This blog highlights the top SAP Concur alternatives and competitors in India for 2026, helping businesses find the right travel and expense management software beyond Concur.

2. It explains why some companies look for alternatives due to feature needs, pricing, integrations, or scalability that better align with their growth plans.

3. The article lists solutions like Happay, Expensify, Zoho Expense, Fyle, and ITILITE, each offering unique strengths in automation and expense workflows.

4. Key comparison criteria include automation of approvals, real-time spend visibility, travel booking capabilities, and integrations with financial systems.

5. Readers learn how alternatives can provide enhanced policy compliance, efficient workflows, faster reimbursements, and better financial control compared to traditional platforms.

6. Overall, the guide helps finance and operations teams evaluate and choose the best T&E solution based on business needs and strategic priorities.

Introduction

The travel and expense management industry has seen revolutionary changes in the past decade. With AI becoming more intelligent and automation becoming more advanced, travel and expense management solutions are becoming smarter, more efficient, and more diverse. This means that CFOs and technology officers have various options to choose from. They can either go for the popular options like SAP Concur or choose from its many alternatives. If you are looking for SAP Concur alternatives and competitors, this is the perfect guide for you.

Looking for alternatives to SAP Concur?

SAP Concur is a popular travel & expense management platform that offers automating solutions to small & medium-sized businesses.

If you are a founder or a CFO looking to reduce your T&E expenses and streamline them, you should consider looking into all the market players before making a decision.

TOP 5 SAP Concur alternatives – Comparative table

Alternatives of SAP Concur

Managing travel & expenses (T&E) manually is a complicated affair for businesses. Picking the right automated T&E management solution can be a game changer for businesses.

Automating and streamlining these processes can give the management more visibility and control over these spends while offering a smooth, seamless experience to the employees.

In this article, we will compare the most popular T&E management platforms to help you pick the right one for your business.

Here’s an in-depth look at the best alternatives of SAP Concur to help you pick the best travel & expense management software for your business.

TOP 5 SAP Concur alternatives and competitors – Detailed explanation

1. Happay

Happay combines travel, expense, and payments in a single integrated platform. It offers end-to-end automation of T&E by seamlessly integrating with the various accounting and ERP systems you already use. It is one of the most robust platforms in the industry, solving T&E problems.

See how Happay improves the employee experience and data accuracy in the expense management process.

Using Happay, business owners & CFOs can control travel & expense costs, automate compliance checks, fast-track expense reports, and gain real-time insights into travel spending with its intelligent AI platform. The macro and micro levels of visibility and control make it easier for the management to streamline internal operations.

Its state-of-the-art analytics engine converts spend data into compelling reports that CFOs can use to drive cost savings, improve policy compliance, simplify complexity, and optimize internal processes.

At the same time, it is very intuitive for users, making it a breeze for employees, admins, and finance team members to use on a day-to-day basis.

It comes with plug-and-play enterprise solutions for growing businesses and the option of easy customization for the ones that want more.

Features of Happay

- End-to-end automated business expense management system

- Integrated travel, expense & payment platform

- Mobile-first self-booking platform for flights, hotels, cabs, visas, and advance requests

- Simplified, automated GST compliance

- AI-powered expense report and filing

- Seamless integrations with enterprise systems

- Real-time spend visibility and extensive expense analytics

- AI-driven Smart Audit to identify policy violations

- Integrated transparent approval workflow

- Best-in-class 24/7 customer service

Features in common with SAP Concur

- Accounting integrations

- Activity dashboard

- Expense claims and tracking

- Corporate credit cards

- Receipt capture and mobile receipt upload

- Fraud detection

Pros of Happay

- Designed to save the finance team’s time & effort through auto GST compliance, strict expense policy controls, and ease in generating reports

- Cloud backup for 7 years makes audit trials easier

- Auto expense data capture from SMS, emails, WhatsApp, and more.

- Automated multi-level workflows

- Highest travel partner penetration in India

Cons of Happay

- No dark theme is available

- According to some users, a longer credit cycle would be welcomed

- The app has trouble supporting languages such as Chinese and Japanese

Happay pricing

Happay’s pricing depends on the number of users, tools opted for, integrations and customizations. Happay’s pricing is highly flexible and customizable. Contact the Happay team to know more about their prices.

Happay feature rating

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

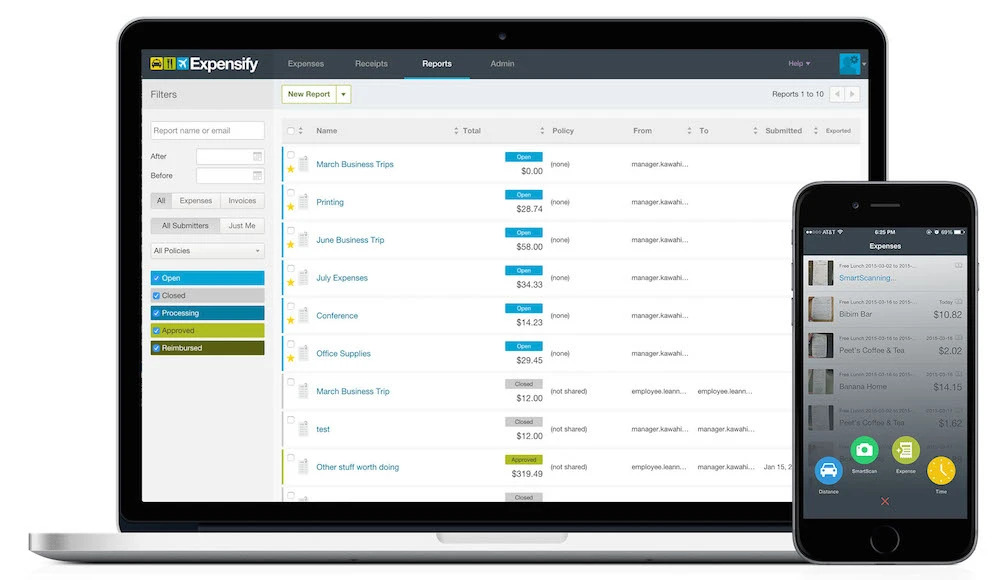

2. Expensify

Expensify is another tool in the market that helps businesses automate expense management and receipt tracking. It integrates seamlessly with Xero and QuickBooks, saving your business hours of data entry and expense coding. It also offers multi-level approval workflows to make big-ticket approvals easier for the employees.

Employees can use the mobile app to take pictures of business expenses as receipts or handwritten bills with their mobile phones. They can even compile and submit an expense report with just one click. It makes for a hassle-free expense-submitting experience for employees and allows the business to go paperless.

Expensify card lets you do away with the paper clutter and makes managing receipts a breeze.

Expensify offers free & paid numerous plans for businesses, offering smarter features than the more expensive plans.

Image Credit: techcrunch.com

Features of Expensify

- One-click receipt scanning

- Import credit card statements for expense tracking

- Multi-level approval workflows

- Corporate card reconciliation

- Accounting, HR, and Travel integrations

- Delegated access

- PCI-compliant security

Features in common with SAP Concur

Pros of Expensify

- Free plan for small businesses

- Pricing is set per user, per month. This makes Expensify cost-efficient for businesses with fewer people.

- Easy bill payment through the app

Cons of Expensify

- According to a TrustRadius user review, configuring the approval workflows is a long, complicated process

- According to a TrustRadius user review, expense categorization is subject to errors

- According to a TrustRadius user review, the price model is complicated that keeps changing

- According to a TrustRadius user review, there have been multiple incidents of duplicate reports causing confusion

- According to a Capterra user review, there is no dedicated account manager

Expensify pricing

Expensify’s pricing is also flexible. It ranges from $5 per user per month to $9 per user per month. Contact the Expensify team to know their pricing plans in detail.

Expensify feature rating

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

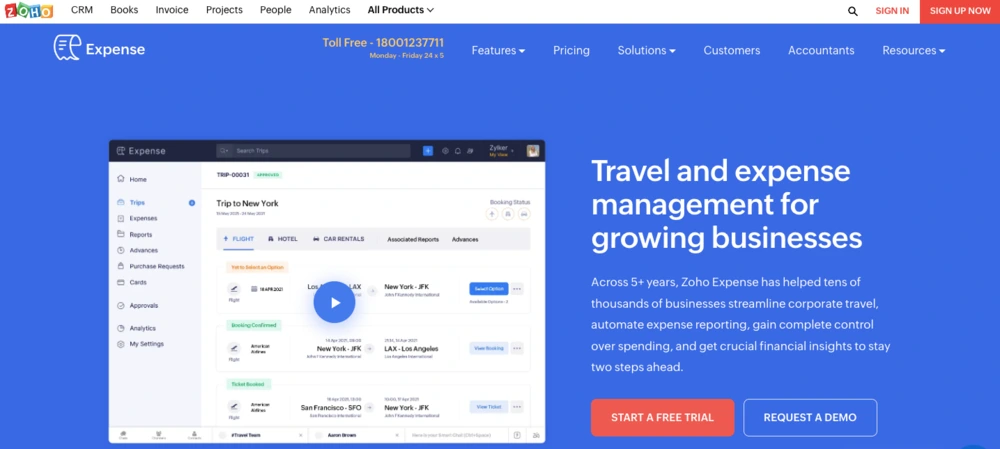

3. Zoho Expense

Zoho helps you manage all the aspects of expense reporting and business travel on the same platform. It helps set controls to avoid overspending by enforcing policies within the platform and helps the business stay prepared for the tax season by offering AI-driven fraud detection and simplifying audit trails.

Travel, HRMS, accounting, and ERP integrations make it easier to use Zoho with your existing third-party software. A mobile app ties it all together for a smooth user experience.

The best part is that you don’t have to use Zoho Books in order to use Zoho Expense. This makes it easier for enterprises to adopt and use Zoho.

Image Credit: zoho.com

Features of Zoho

- Easier compliance with local tax laws

- Automation of employee’s business expense

- Syncing of credit cards with the Expense Software

- Integrates well with ZOHO’s CRM

- Swift approval process

- Travel-friendly expense management

- Simplifies purchase approvals

Features in common with SAP Concur

- Approval process control

- Corporate credit card

- Expense tracking

- Expense claims

- Fraud detection

Pros of Zoho

- Good pricing models for smaller businesses, making it more affordable for business owners

- Tracking the travel expenses of employees is easy and practical

- The expense tracking software works seamlessly with ZOHO accounting software

- The dashboard is highly interactive and user-friendly

Cons of Zoho

- As per a user review on G2, when expenses may be slightly similar, the software throws up notifications of a compliance issue.

- Smart categorization of expenses is not available, making it hard to find the real reasons behind higher costs.

- Integration with TMC happens through third-party software, ITILITE. Many other platforms, like Happay, have direct partnerships with TMCs, thus giving them the best prices on flights and hotel bookings.

- Auto-capturing expenses are not very strong and don’t cover WhatsApp and SMS. This leads to a lot of manual work at times.

Zoho pricing

Zoho has four different pricing plans: free, standard, premium, and enterprise.

The free plan allows up to 3 users per month. The standard plan costs ₹99 per active user per month, the premium plan costs ₹199 per active user per month, and the enterprise plan costs ₹299 per active user per month. All these plans are billed annually.

Zoho feature rating

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

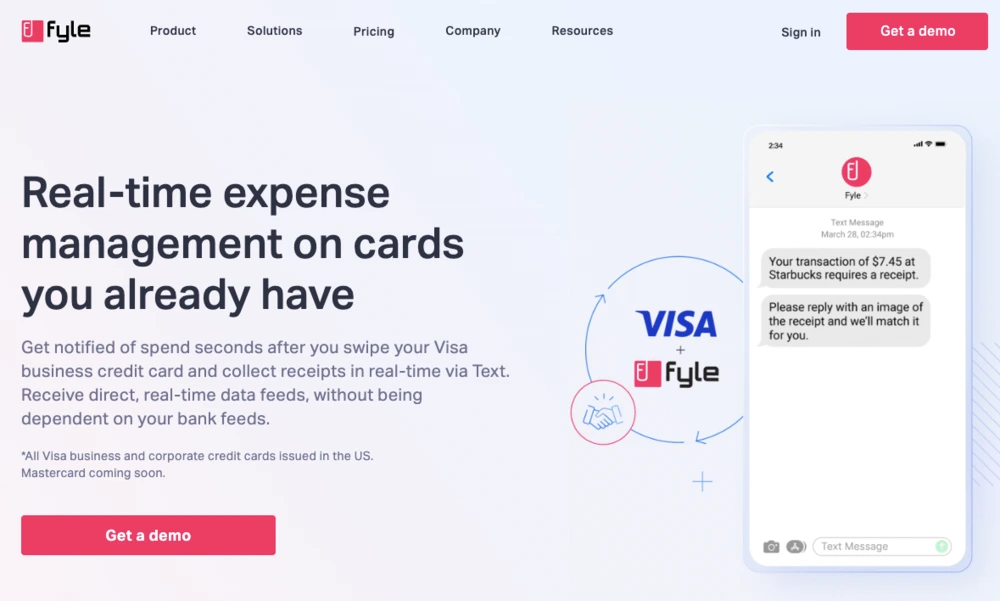

4. Fyle

Fyle is an expense management platform that offers an entirely automated solution to manage travel and expenses. It offers real-time expense management and instant notifications.

Employees can submit expense receipts by clicking a photo of up to 20 paper bills. Integration with Gmail, Outlook, Slack, and Teams is easy to set up. The intuitive app also catches policy violations before they occur, making expense policy compliance a breeze.

Fyle automatically reconciles expenses with live feeds of bank statements and expenses flowing into a central place. This avoids the need for manual credit card reconciliation.

Fyle is more of a spend management platform than a travel and expense management platform. So, for businesses that don’t have a lot of corporate traveling for employees, it might be the better option at least in the short term.

Image Credit: fylehq.com

Features of Fyle

- Offers real-time report updates and notifications

- Allows approval/rejection of expense reports

- Software completely automates policy checks and compliances

- Advanced analytics offers benefits for finance teams

- The software supports and ensures a secure login

- The Mobile app offers access on the go, speed, and an intuitive user experience

Features in common with SAP Concur

- Expense claim creation

- Data import/export

- Mobile receipt upload

- Fraud detection

- Real-time analytics

Pros of Fyle

- Submit expense reports easily and quickly through such as Gmail, Slack, Text Messages or Outlook.

- Stakeholders get real-time notifications when expenses are submitted. These may be approved/rejected while on the go.

- It is easy for finance teams to monitor and act on expense reports through digital audit trails. This also makes tax compliance easier.

- Bulk reimbursement payments to different banks are possible.

- Integrations with Visa and Mastercard.

Cons of Fyle

- As per user reviews posted on G2, users cannot edit a report before approval has been given.

- According to a user review on G2, the email import feature is a hit or a miss. There were instances when incorrect transactions were associated with receipts forwarded by email.

- Limited HRMS integrations

- Phone app crashes very often

Fyle pricing

Fyle has three pricing plans- standard, business, and enterprise.

The standard plan costs $6.99 per user per month, and the business plan costs $11.99 per user per month when billed annually. The enterprise plan’s cost differs based on the number of users and the volume of usage. You can contact the Fyle team to know more about their enterprise plan.

Fyle feature rating

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

5. ITILITE

ITILITE is an integrated travel and expense management software platform that eliminates the manual processing and accounting of travel expenses. Promising an improvement in the financial productivity of your business, ITILITE reduces the time taken to file the costs; track and process them.

ITILITE T&E software system enhances the analytical capabilities while enabling automated audits on receipt compliance and submission of proof of travel. The ITILITE mobile app claims to help you manage everything- from recording and tracking expenses, travel booking, expense filing, and claiming reimbursements.

Image Credit:

Features of ITILITE

- Incentivises cost predictors for employees’ business travel

- Trip approvals based on integrated dynamic policies

- Book multi-stop trips and personalized bookings

- The mobile app allows users to book upgrades and self-fund the same

- Conveniently manages complete travel bookings.

Features in common with SAP Concur

- Expense tracking

- Expense filing

- Fraud detection

- Digital receipt management

Pros of ITILITE

- Its self-booking tool supports personalized booking options

- Dynamic policy integrations with custom-built policies

- Real-time data visibility into travel expenses

Cons of ITILITE

- Basic configurations & no customizations

- The mobile app does not have the OCR facility

- No integration can be done with other TMCs

- No card integration is possible

ITILITE pricing

ITILITE has not made its pricing information publically available. Please contact the ITILITE team to know about their prices.

ITILITE feature rating

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

Importance of T&E management for different stakeholders

When it comes to picking any SaaS solution for your business, it helps to remember the stakeholders and their expectations regarding the specific problem that the software will solve.

Here is a brief outline of the stakeholders and their respective expectations when it comes to a travel & expense management platform:

It helps employees save time & effort while making it easier for them to be policy compliant. They can also track approvals, understand who to chase if they are stuck, and have a reasonable expectation of when they can expect reimbursements. While they are not the primary stakeholders of such a platform, it definitely affects their day-to-day life quite a lot.

A good integrated T&E platform can take off a lot of things from the finance team’s table. Lion’s share of the tasks gets automated, including policy compliance and ITR filing. It is almost like a new AI member of the finance team that can automate the manual processes and detect fraud, thereby leaving the team to deal with the problems and tasks that require human intervention.

It enables a CFO to do more with their budget by giving them better visibility of the budget and offering smart insights. They can make better decisions on the basis of accurate analytics derived from the platform.

Now that we have looked at how the various entities within an organization are affected by a T&E solution, let us dive into the competitive landscape.

What are the major pain points in T&E management?

1. Manual data entry

One of the biggest pain points in T&E management is the need for manual data entry. This can be time-consuming and error-prone, leading to delays in processing expenses and potential mistakes.

2. Lack of visibility

Businesses often struggle to get a clear picture of their travel and expense spending, making it difficult to identify areas for cost savings and optimization.

3. Policy compliance

Ensuring compliance with company travel and expense policies can be challenging, as employees may not always follow the rules, leading to higher costs and potential fraud.

4. Inefficient approval workflows

Inefficient approval workflows can lead to delays in processing expenses and can also make it difficult for managers to quickly identify and address potential issues.

5. Expense report tracking

Tracking and managing multiple expense reports can be a time-consuming process, especially when dealing with large amounts of data or multiple currencies.

6. Lack of integration

When T&E management systems are not integrated with other financial systems, it can be difficult to get a complete picture of overall spending and financial performance.

7. Difficulty reconciling expenses

Reconciling expenses can be challenging when there are discrepancies between receipts, credit card statements, and expense reports, which can lead to errors and delays in processing.

What can SAP Concur and its alternatives do to solve T&E problems for companies?

SAP Concur, and its alternatives offer several solutions to help companies solve their travel and expense (T&E) problems, such as:

1. Automated expense reporting

SAP Concur and its alternatives automate the expense reporting process, which saves time and reduces the risk of errors. Employees can easily submit expenses via mobile or web applications, and the software automatically captures data from receipts and credit card transactions.

2. Policy enforcement

These solutions help companies enforce their T&E policies by setting up customized workflows for approvals and monitoring employee compliance.

3. Real-time spend tracking

SAP Concur, and its alternatives provide real-time visibility into T&E spending, which helps companies track expenses and identify areas for cost savings.

4. Integrations with accounting systems

These solutions integrate with accounting systems such as QuickBooks, Xero, and NetSuite, which streamlines the accounting process and eliminates the need for manual data entry.

5. Travel booking

Many of these solutions offer integrated travel booking capabilities, allowing companies to book flights, hotels, and rental cars directly through the software.

6. Data analytics

SAP Concur and its alternatives provide powerful analytics tools which enable companies to analyze T&E data and identify trends and patterns that can inform decision-making.

7. Mobile accessibility

Many of these solutions offer mobile applications that enable employees to manage their expenses on the go, from anywhere, at any time.

Overall, SAP Concur and its alternatives can help companies streamline their T&E processes, improve compliance, reduce costs, and gain better insights into their spending patterns.

Things to consider while choosing the best SAP Concur alternatives for your business

1. Ease of integration

Your travel & expense management software should integrate seamlessly with your HRMS, ERP, accounting software, and the travel management companies that you prefer.

If the T&E platform you’re considering offers very expensive data transfer or if there is a risk of loss of data while transferring, put it in the cons list. Check how seamlessly the integration can happen, and make your choice accordingly.

Few alternatives to SAP Concur offer seamless integration at an additional cost while guaranteeing proper transfer. This is a good option as you can continue working with the same HRMS or ERP and still get the advantages of an integrated T&E platform.

The best idea is to find a T&E partner that uses APIs to create prebuilt integrations that streamline the data flow between systems, as they offer maximum flexibility and data security.

2. Ease of tax compliance

Your finance team spends a lot of time and effort in collecting the right info and accordingly filing GST returns. It should make it easy for you to collect both vendor GST data and integrate with travel companies at the time of booking to fill in your company’s GST details.

These micro details regarding tax compliance add up in the long run and save a lot of time. Come tax season, your company will be ready with detailed, custom GST reports for the money spent from the travel & expenses budget.

3. Security of data

Make sure that your choice of T&E platform protects your sensitive data and takes all possible steps to avoid any data breaches. This should be one of the most important decision-making factors while picking the right T&E.

What data security certifications does the platform have? Are the IT servers located within India or somewhere overseas? What level of encryption is applied?

These are some of the questions you should be asking while making your decision.

4. Intuitive, user-friendly interface

A travel & expense management platform is no good if your employees take weeks and months to get used to it, or if it has too many bugs that make it difficult to use it for the intended purpose.

Clean user experience, self-explanatory configurations, etc. are some of the key features to look for in any T&E platform.

It might be a good idea to simply take a demo of the intended platform and see how simple the most often repeated processes are to perform. Also, make sure to check the reviews of the mobile app on the Google Play Store and App Store.

5. Ease of access on-the-go

Always make sure to pick a travel & expense platform that has a robust, powerful mobile app for Android and iOS.

If employees can log their expenses efficiently & on the go, and have them approved in real-time, it will end up saving a lot of time and effort for them.

6. Ease of policy compliance

Successfully enforcing your travel & expense policies can help you achieve major cost savings for your business. Several T&E platforms are robust enough to enable you to enforce policy compliances through inbuilt commands and configurations.

Before you close on a T&E platform, keep your T&E policy documents ready and updated. Check with the POCs whether the platform can help you enforce all or most of your policies.

This will not only help your business save on costs but also help your employees and finance department save a lot of time and effort. Win, win!

About SAP Concur

SAP Concur is legacy software that provides an integrated online and mobile business travel and expense management software solution to automate your company’s travel expenses.

It offers travel, expense, and invoice solutions to businesses. It results in a better expense management experience for employees, travel admins, finance teams, and CFOs.

Integrated travel & expense management helps save time & effort by allowing them to capture spending from multiple sources, plan and make spending decisions based on accurate data, reimburse employees more quickly, and simplify the expense reporting process for everyone.

Concur Expense, Concur Travel and Concur Invoices integrate seamlessly to provide businesses with an effective T&E solution.

Features of SAP Concur

- Automated, faster processes

- One view of spend, available on the cloud

- Integrated spend data

- Transparent travel data

- Intuitive online booking

Pros of SAP Concur

- Easy booking for trips

- Integrate the platform with calendaring systems for notifications

- Mobile app to capture, categorize and submit expenses for approval

- The app allows users to find the best price for flights

- Inbuilt foreign currency conversions

Cons of SAP Concur

- Delays in sync across the app and the software

- GST compliance has to be done manually

- Limited customization in time periods for temporary policies (specific to calendar periods, one-off trips, etc.

- Limited partner travel company penetration in India

SAP Concur pricing

G2 states that SAP Concur offers three pricing options, which are: automate, insights, and optimize. The automate plan costs approximately 9 USD per report to automate expense reporting processes, while the other plans have varying prices.

The actual cost of SAP Concur services is determined by factors such as the monthly report volume and the number of users. If you want to know the exact price based on your expense management needs, you can reach out to the SAP Concur team to receive a personalized quote.

SAP Concur feature rating

- Ease of use –

- Value for money –

- Expense fraud prevention –

- Spend visibility –

- Analytics and insights –

- Customer support –

FAQs

SAP Concur is a T&E management platform that helps businesses of all sizes manage their travel, expense, and invoice processes from anywhere. It helps businesses get more visibility and control over travel and expenses in order to save T&E costs and improve customer experience.

SAP Concur offers 3 pricing models: Automate, Insights & Optimize, in the order of increasing prices and features. You can start automating spending processes for more visibility and control starting at $9 USD per report per month.

Most enterprises choose alternatives to SAP Concur for affordable prices. For example, Happay offers a transparent pricing model according to your business requirements with no hidden charges, billed at X amount per user, per month.

After you file the expenses on SAP Concur, some of them may reflect immediately, while those expenses made from a corporate card or credit card may take ~3 days to be reflected.

It is usually easier for the stakeholders (employees and the manager) if the expenses are all reflected at the earliest as it helps streamline the overall expenses.

In order to get in touch with customer care at SAP Concur, fill out the form on their website filling in details about your issue or blocker. Alternatively, if you are in India, call on 1800-1020-650 to get in touch with the Customer Care representative.

SAP Concur is one of the leading travel and expense management solutions available in the market. Nonetheless, there are many alternatives that may be better suited for your organization, depending on your needs and budget.

Happay, Expensify, Zoho Expense, and Fyle are a few of the many expense management alternatives to SAP Concur.

A few of these also offer a payments stack along with the travel and expense solution, making it easier and more streamlined for your business to manage T&E.