Quick TL;DR Summary

1. The article lists the top 10 expense management software solutions in India based on analysis of a number of helpful tools, helping businesses choose the right platform for managing spend.

2. Happay ranks first in the list and is highlighted as the only platform with fully automated expense capture including receipt capture, corporate card data, auto SMS and email parsing, giving it an edge over others.

3. The article includes:

- A comparative table showing features such as automation, integrated travel, support and pricing across solutions like Happay, Fyle, Expensify, Zoho Expense, SAP Concur, and others.

- Descriptions of each tool’s key strengths and target users.

4. It outlines what expense management software does, such as reducing manual errors, speeding up approvals and reimbursements, ensuring policy compliance and integrating expenses with ERP/HR systems.

5. The guide also covers benefits, feature checklists, how to choose and implement the software, and FAQs.

6. Happay’s own platform is described as providing a complete travel and expense ecosystem that combine expense capture, travel booking, corporate cards, analytics dashboards and policy compliance in one system.

Introduction

We give you our list of the top 10 expense management tools from an in-depth analysis of 50+ market players. You will find a comparative table for a quick glance and a detailed analysis of each software, its features, pros, and cons to help you make the right choice for your company.

A quick pick of the TOP 10 expense management software

Expense management affects your organization’s bottom line, and expense management software gives companies the tools needed to track and control business expenses. Let’s understand more about the software.

TOP 10 best expense management software: Comparative table

|

Expense Management Software |

Mkt Seg |

Auto GST Cal |

Smart Audit |

24*7 Suppt |

Integrated Pmt, exp & travel |

Exp Cap Auto |

Integrated Petty Cash Module |

Pricing *User/per month |

|

Small, Mid-market, and Enterprise |

Yes |

Yes |

Yes |

Yes |

Fully automated* |

Yes |

Contact for pricing |

|

|

Mid-market |

No |

No |

Yes |

No |

Partial automation |

No |

*Starting- $6.99/ -custom pricing |

|

|

Mid-market |

No |

No |

No |

No |

Partial automation |

No |

*$5/- -$18/- |

|

|

Small Businesses |

No |

No |

Only 5 days |

No |

Partial automation |

No |

*upto $12/- |

|

|

Mid-market and Enterprise |

No |

No |

Yes |

No |

Partial automation |

No |

Starting at $9/- per report |

|

|

Mid-market |

NA |

No |

Only 5 days |

No |

Partial automation |

No |

*Starting price- $9.76/- |

|

|

Mid-market |

NA |

No |

Yes |

No |

Partial automation |

No |

$4.99 p.m, $7.99 p.a |

|

|

Mid-market |

No |

No |

Yes |

No |

Partial automation |

No |

Essential- €8.00, Pro- €10. Ent-custom |

|

|

Mid-market |

No |

No |

Yes |

No |

Partial automation |

No |

Contact for pricing |

|

|

Small Businesses |

No |

No |

Yes |

No |

Partial automation |

No |

Contact for pricing |

Happay is the only expense management software with a complete automated Expense Capture module with receipt capture, corporate card, auto SMS capture, and email plugin. It offers a complete Travel & Expense ecosystem on a single platform, ensuring that your travel and expense management is entirely streamlined.

What is expense management software?

Expense management software is an end-to-end solution to manage expenses. It’s a boon for employees, finance and accounting teams, and CFOs, from filing expenses and faster reimbursements to making data-driven decisions.

Here are 6 things that expense management software can do for your company:

- Eliminate manual errors and paperwork

- Enhance employee experience with faster TAT

- Ensure transparent approvals across the organization/Set up complex approval workflows easily

- Improve compliance and complete control over expenses

- Integrate all processes, namely, filing, reporting, approvals, reconciliation, and the ability to transfer between ERP and HRMS

- Fetch accurate data from policy violations to category-wise expenses, and make the right decisions

The best expense management tools ensure businesses can efficiently process employee expense claims, track business expenses, and approve employee reimbursements/payments.

There are several expense management software vendors in the market, and choosing the right one for your organization may be challenging. That’s where we come in as we take you through the options, features, prices, and other things that truly matter.

List of 10 best expense management software for your business

1. Happay

Happay offers a complete Travel & Expense ecosystem on a single platform, ensuring that your travel and expense management is entirely streamlined.

It also offers solutions for petty cash management, invoices, corporate payments, and corporate cards. Happay’s end-to-end integration, security, complete visibility, and control allow you to manage multiple workflows on a single platform.

Happay’s expense management software offers a complete solution

Happay’s features help you overcome the below challenges

Expense

- The traditional manual data capture process

- Policy non-compliance challenges

- Delayed approvals

- Lack of spend visibility

Travel

- Cumbersome manual travel planning

- Limited travel options

- Lack of choice and frustrating travel experiences

- Painful and prolonged expense reimbursement processes

Cards

- Annual, interest, or hidden charges for cards

- Disbursement of cash/funds to users

- Policy non-compliance

- No visibility and control

Happay’s complete, integrated platform provides prepaid and post-paid credit cards, a robust mobile app, helps to plug cash leakages and ensures complete policy compliance, assuring real-time visibility into spending behaviors.

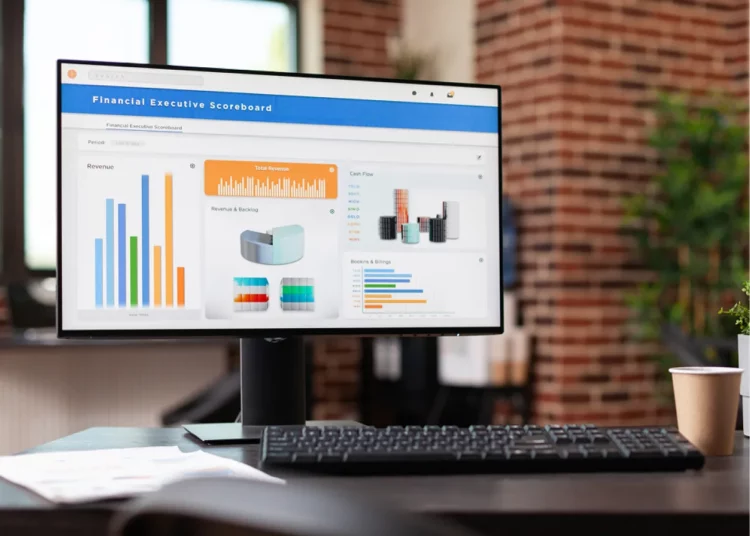

Intelligent business analytics dashboards offer the advantage of customizable MIS reports, allowing finance chiefs and teams to make critical business decisions effortlessly.

End-to-end expense management solutions make it easy for enterprises to manage business expenses and reimbursements, petty cash, payments, credit cards, and so much more.

Stand-out features of Happay

1. Self-booking tool

A state-of-the-art self-booking tool allows travelers to book flights, hotels, and cabs and even raise VISA requests without emailing their travel desk or admin.

2. Prepaid Cards

Prepaid cards can help manage corporate payments easily and effectively. When combined with a well-designed software solution, it can ensure compliance and control of payments.

3. Xpendite

Xpendite allows quick and easy automatic capture of invoices. The error-free and accurate capture of relevant invoice information offers better visibility and control over expenses and a great employee experience.

4. DeepAnalyze

Happay’s DeepAnalyze offers 360o visibility in travel and expense. Your regular data becomes insightful information as you list the top spenders, Identify the top violators, or calculate the time taken for approvals, reconciliations, or reimbursements.

5. Smart Audit

Smart Audit assures savings in time and effort for finance teams while ensuring 100% policy compliance and 0 violations.

6. ApproveNow

ApprovNow offers real-time updates that transform your approval cycles. So, this feature can easily manage customized approval workflows, soft/hard blocks, or the inclusion of ad-hoc approvers.

Pros of Happay

- Happay’s Xpendite is an integrated engine that records expenses at the source (from credit card bills, emails, SMS, WhatsApp, Uber, etc.). This singularly takes care of accuracy and minimizes employee efforts.

- Happay’s Route Tracker automatically calculates mileage expenses for field staff, ensuring policy compliance.

- The DeepAnalyze feature is another pro in the long list of impressive features. It offers real-time views of expenses, policy violations, and budget utilisations.

- One of the most significant plus points with the Happay software is the GST compatibility, where you can capture state-wise GST details, saving the finance team a lot of time and effort.

- Happay saves data on the cloud for seven years, giving you access to a complete audit trail of everything, all the time.

- Regarding expense capture (on the go), Happay offers WhatsApp Integration and can intelligently capture expense data from multiple sources.

- Happay’s high travel partner penetration in India makes it a market differentiator.

Cons of Happay

- The app has trouble supporting languages such as Chinese and Japanese

Suitable for

Mid-market, and Enterprise

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Happay |

|

|

|

|

|

*Check the user ratings, reviews and other details below

Case Study

See how Parijat Industries transformed their expense filing experience:

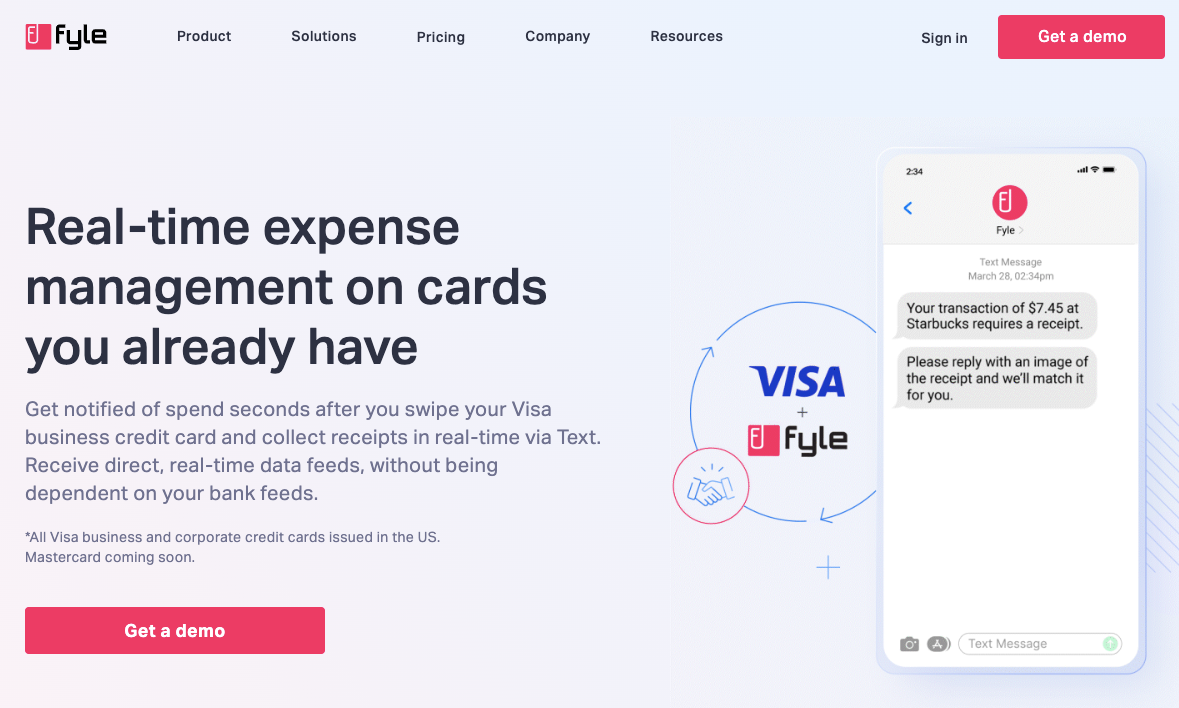

2. Fyle

Fyle is an expense management platform that offers an entirely automated solution to manage travel and expenses. It empowers finance teams and employees with an intuitive and flexible platform, as it accommodates expense submissions through regular apps such as Outlook, Slack, Teams, or Gmail. On the other hand, you could use their mobile app, which prevents policy violations even before they occur.

Supplemented by their credit card capabilities, Fyle offers real-time automatic reconciliations when transactions are processed.

Image Credit: fylehq.com

Fyle features

- Offers real-time report updates and notifications

- Allows approval/rejection of expense reports

- Software completely automates policy checks and compliances

- Advanced analytics offers benefits for finance teams

- The software supports and ensures a secure login

- The mobile app offers access on the go, speed, and an intuitive user experience

Pros of Fyle

- Expense reports can be put together by picking up information directly from Gmail, Slack, Text Messages, or Outlook

- Even as expenses are submitted, they may be approved/rejected on the go

- It is easy for finance teams to monitor and act on expense reports through digital audit trails

- Bulk reimbursement payments to different banks are possible

Cons of Fyle

- As per user reviews posted on G2, users cannot edit a report before approval has been given

- According to a user review on G2, the email import feature is a hit or a miss. There were instances when incorrect transactions were associated with receipts forwarded by email

Pricing

- Standard: At $6.99 per user per month, the standard version of the product is excellent for small, growing companies. The features include unlimited travel receipt scanning, Unlimited expense tracking, and personal credit card management

- Business: The price of the business version of the product costs $11.99 for one active user per month. This product is perfect for medium-sized companies offering features such as approvals at multiple levels, corporate cards, and their management, and a policy engine to overlook complex expense policies

- Enterprise: This version suits large businesses with complex/dynamic requirements. Apart from several customized features, the software can be scaled up so up to 2,50,000 users can use it

Suitable for

Mid-market

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Fyle |

|

|

|

|

|

*Check the user ratings, reviews and other details below

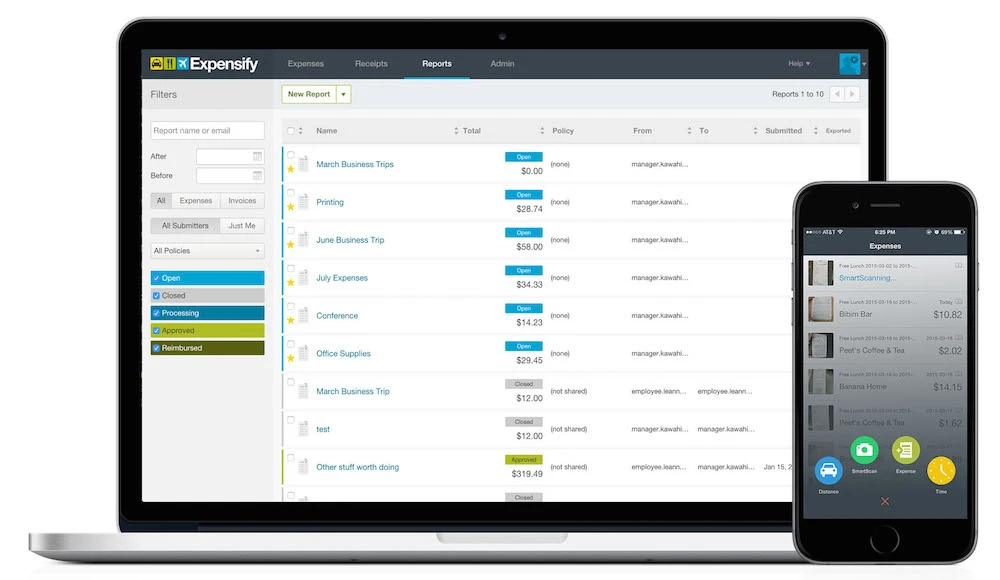

3. Expensify

Expensify is another tool in the market that helps organizations to automate their expense and travel management. The user-friendly expense software offers an app available for Android and Mac.

You can use the mobile app to take pictures of business expenses as receipts or handwritten bills with your mobile phone. You can compile and submit an expense report with just one click. Not only does this make the process hassle-free for employees, but companies can save costs by lowering the use of paper.

Expensify offers several plans that suit small, medium, and large firms. However, they are more suited for larger companies that require bespoke solutions.

Image Credit: techcrunch.com

Expensify features

- SmartScan feature

- Customized business expense management software

- Integrates across all Enterprise Resource Planning (ERPs)

- The convenience of delegated access

- Relevant GL codes may be imported so they can be tagged

- Accurate foreign exchange rates

- Detecting duplicity

Pros of Expensify

- A categorized and automated business expense management system

- Users of this product rate their mobile app (iOS and Android) highly

- Some categories of businesses can take advantage of the free plans they offer

Cons of Expensify

- A user review on G2 indicates that the software could do with improvement in the “per diem” section. The user claims that the app does not include an option for HST (harmonized sales tax in Canada). users must enter it manually.

- As per a user’s review on G2, there seems to be a learning curve as the technology may be sophisticated for many. Also, first-time users may take more time to understand the process as there is no visual guiding tool to walk them through it.

Pricing

- Free trial version – Under the free trial, users can use the Expensify Card, Reimburse travel expenses, Pay bills and send invoices.

- Expensify collect – Starts at $10 per month (depending on features). With everything in the free version, users can take advantage of SmartScans (automatic receipt collection), auto-export to accounts systems, and automatically categorize expenses.

- Expensify Control – Starting at $18 a month, Expensify control offers all the features in Collect. Additionally, you get the advantage of expense reporting, card management, approval automation, and reimbursements. The reconciliation capabilities improve significantly with this option.

Suitable for

Mid-market

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Expensify |

|

|

|

|

|

*Check the user ratings, reviews and other details below

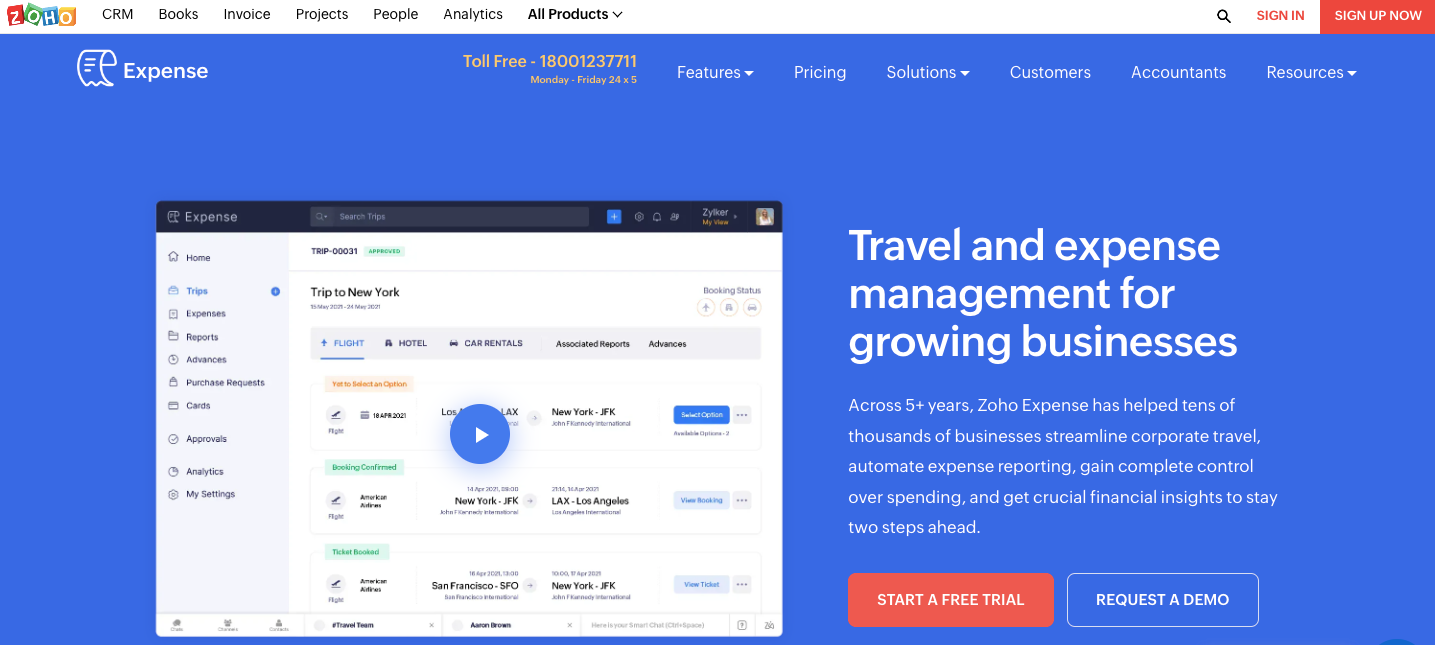

4. Zoho Expense Software

Zoho is another expense software that automates the travel expense management process. The goal is to help businesses avoid manual expense claims and employee reimbursement processes.

While the software allows employees to quickly scan and store images of receipts and other proof of travel, expense approvals and reimbursements are where enterprises find the most benefit. The Zoho advantage is that they also feature accounting software allowing both systems to communicate efficiently.

Image Credit: zoho.com

Zoho Expense features

- Automation of employees’ business expenses

- Syncing of credit cards with expense software

- Integrates well with Zoho’s CRM

- Swift approval process

- Travel-friendly expense management

Pros of Zoho Expense

- Tracking the travel expenses of employees is easy and practical

- The expense tracking software works excellently with Zoho accounting software

- The dashboard is highly interactive and user-friendly

Cons of Zoho

- As per a user review on G2, when expenses may be slightly similar, the software throws up notifications of a compliance issue.

Pricing

- Free Plan: Their free version is available for up to 3 users. Small businesses can easily use this version to track their business expenses and mileage claims. You may also use the mobile app to capture and track costs in this version. Some of the features available in the free version are:

- Mileage expenses

- Customer tracking

- 5GM receipt storage

- Integration with existing accounting software

- Standard Plan: This plan is available for $3 per month and per active user (minimum of 3 users). This plan is designed for growing businesses to manage corporate cards and streamline end-to-end expense reporting. The premium plan offers 20 receipt scans per user, unlimited users, and corporate card reconciliations among other features.

- Premium Plan: This plan is available for $5 per month and per active user (minimum of 3 users). For global businesses with high volume of expenses, in need of powerful controls and robust workflows, the premium plan offers robust controls, efficient workflows, advanced functions in approval, corporate cards, automated per diem, and advanced customizations.

- Enterprise Plan: Available at $8 per month per active user (minimum of 200 users), this plan is built for businesses that need bespoke solutions to integrate with existing software. Some of the program’s features include everything offered in the free and premium plans, integration with ERP systems, single sign-on (SSO), and a dedicated account manager.

Suitable for

Small business

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Zoho Expense |

|

|

|

|

|

*Check the user ratings, reviews and other details below

5. SAP Concur

SAP Concur offers a business expense management tool that allows you to streamline manual expense tracking and management systems. These software systems give businesses better control over finances as complex processes are executed seamlessly.

A business management software system saves time and effort, improves compliance with travel policies, and results in a better employee experience.

Apart from offering a time-efficient way to record and process employee spending, you can track expenses even before they incur. The software gives finance teams access to extensive analytics, which can lead to valuable insights.

Image Credit: concur.com

SAP Concur features

- Automated receipt management

- Intelligent categorization

- Foreign currency conversions

- Great integration for credit cards

- Itinerary management includes more straightforward booking and travel notifications

- The mobile app features mileage tracking and travel updates

Pros of SAP Concur

- Software is intelligent and flexible to create itineraries based on bookings

- Booking for trips is easy and integrates with calendaring systems for notifications

- The mobile app is intelligent as it captures, parses, and categorizes it into the appropriate expense report

Cons of SAP Concur

- According to a user review on G2, if an expense report does not match exactly, the transaction is rejected without any specific error message

- A user review on G2 seems to feel that when bills are attached to any report, it only allows a single bill per entry and a pdf must be created for multiple pages

Pricing

- Free trials: The free trial offers prospective customers an opportunity to experience the SAP Concur expense management software for a limited period

- Automate: At an average charge of $9 for each report, Automate offers features such as dashboard reporting, corporate and personal credit card integration, and quicker travel expense reimbursement

- Insights and optimization: Price varies for these products as it depends on the features signed up for, the level of customization, and the customer

Suitable for

Mid-market and enterprises

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Sap Concur |

|

|

|

|

|

*Check the user ratings, reviews and other details below

6. Webexpenses

Webexpenses is Signifo Ltd.’s flagship expense management software and offers invoice processing and expense management software. It eliminates the error-prone, manual, time-consuming expense recording and tracking process. With a global presence, Webexpenses provides cloud-based travel and expense management software.

They also feature a mobile travel and expenses app that not only eases expense recording but benefits finance teams as they now have better control and visibility over expenses. They also feature other solutions such as audit, invoice processing, and payments which may be used in conjunction with the expense management system.

Image Credit: webexpenses.com

Webexpenses features

- An integrative expense management software system

- Their mobile app allows you to record, track, and manage expenses on the go

- Travel expense policies are built into the software system

- The intelligent technology matches receipts with the correct credit cards

- They feature a user-friendly petty cash management system

- Carbon tracking features track your travel carbon footprint

Pros of Webexpenses

- The workflow and compliance management platform is easy to use

- Digital receipt management offers several ways to capture and sort receipts into appropriate expense reports

- Employee reimbursements are quick and convenient. The credit may be posted to the appropriate bank accounts or the employee’s payroll

- Offers easy compatibility with most finance, payroll, HRMS, and CRM systems

Cons of Webexpenses

- One of the users on G2 seems to feel that the mileage tracking map is not intuitive. For instance, where users must cover several pin codes and choose to cover them optimally, the information must be keyed in manually to avoid red flags

- Users on G2 feel that the app asks you to repeatedly key in some information that must be made default. Such as the person filing the report. Further, saving and using the addresses often visited is impossible

Pricing

Customers interested in Webexpenses products may choose from a bundle or stand-alone pricing from small businesses to large ones. Starting at $7 per active user per month, the pricing may vary depending on the complexity of the solution that you require for your business.

Suitable for

Mid-market

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Webexpenses |

|

|

|

|

|

7. ITILITE

ITILITE offers an integrated travel and expense management platform that hopes to enrich the employee travel experience while eliminating the human element in processing travel expenses. Promising a substantial improvement in the financial productivity of your business, ITILITE reduces the time taken to file the costs; track and process them.

The Travel and Expense (T&E) software system also enhances analytical capabilities while enabling automated audits on receipt compliance and submission of proof of travel. The ITILITE mobile app claims to help you manage everything- from recording and tracking expenses, travel booking, expense filing, and claiming reimbursements.

Image Credit: itilite.com

ITILITE features

- Incentivized cost predictors for your business travel

- Trip approvals are based on integrated dynamic policies

- The software accommodates booking multi-stop trips and personalized bookings

- The mobile app allows users to book upgrades and self-fund the same

- Conveniently manages complete travel bookings.

Pros of ITILITE

- An integrated approval matrix provides a great way to reduce complexity in travel operations.

- Business trips are customizable, making it easy for users to plan a trip according to their preferences.

- Users appreciate the convenience of complete travel booking (hotels, airlines, and cabs ) within a single app

- The tailored reports and advanced MIS Analytics offers insights into vital areas such as segment and vendor spend

Cons of ITILITE

- According to a user review on G2 users are unable to book expenses in an excel format so the approver can see all related expenses on a single page

Pricing

ITILITE offers three pricing plans for their T&E software.

1.Travel ($9.99 per trip)

- Inventory of flights and hotels

- Customized search

- Virtual AI assistant

- Multi-level, customizable approval process

- Flight re-shopping when prices drop and more

2.Expense ($4.99 per active user per month (Annually))

- Credit card integration

- One-click reimbursements

- Multi-level approvals

- Automatic receipt scanning and more

3.Travel and Expense (9.99 per trip $4.99 per active user per month (Annually))

- An Integrated T&E solution

- Combined travel and expense insights

- Visibility into unified expenses and more

Suitable for

Mid-market

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

ITILITE |

|

|

|

|

|

*Check the user ratings, reviews and other details below

8. Rydoo

Rydoo originally started under the name of Xpenditure Small Business. It has gained recognition as an expense management software that functions as an expense tracker and a travel service. For instance, you can use the service to book flights, hotels, and cabs, simultaneously putting together your expense report.

Rydoo’s expense tracker app has been well-received as it integrates well with third-party accounting software and ERP. The easy adaptability of the software makes it popular for small and medium-sized firms.

Image Credit: rydoo.com

Rydoo features

- It works great for those who prefer a detailed expense management app

- It supports and works great for companies that have expenses in multiple currencies

- Organizes expenses based on several categorizations so you can conveniently view, access, and analyze the information

- Offers real-time approval flows

Pros of Rydoo

- The app has several features that make expense management and processing and travel easy

- It is designed to record mileage and Per Diems

- It integrates well with other accounting and ERP systems

Cons of Rydoo

- Some users that reviewed the product on G2 feel that the expense status (whether it is awaiting approval or settled) is not visible in the mobile app. They must check a pdf version saved on the desktop to track the status of an expense claim

- According to a user on G2, the app has an interface issue with QuickBooks (the accounting platform)

Pricing

- Essentials: Rydoo offers a free trial for customers. The basic plan called Essentials starts at € 8.00 ($7.75) for a minimum of 10 users.

- Pro: Their Pro Plan costs € 10.00 ($9.75) for a minimum of 10 users, including features available with the Essentials plan and additional advanced features.

- Enterprise: This is their top-level plan which includes all the above features and any customization required by the customer.

Suitable for

Mid-market

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Rydoo |

|

|

|

|

|

*Check the user ratings, reviews and other details below

9. TripActions (Formerly Navan)

TripActions (formerly Navan) began in the year 2015 after the founders were frustrated by legacy travel solutions. Using data science, a user-friendly design, and exceptional services, they began to create better travel experiences for customers and their employees.

The launch of TripActions Liquid and Lemonade saw them enter into the big leagues of expense management software. Offering corporate cards and integrated expense and travel management solutions, TripActions combines technology and a great user experience.

In February 2023, TripActions was officially rebranded under the new name of Navan. The Co-founder and CEO Ariel Cohen felt that this was the next stage in the company’s evolution to unify travel, corporate card, and expense platforms. In April of 2023, the decision was turned back to its previous name- TripActions.

Image Credit: tripactions.com

TripActions features

- Navan’s software offers an intuitive dashboard that gives finance teams and users a clear and complete picture of expense data

- The expense reports are intuitive allowing employees using Navan to create expense reports effortlessly

- The software makes it possible for you to reimburse their employees directly to the bank

- TripActions offers the convenience of using physical and virtual cards that come with in-built controls

Pros of TripActions

- The booking options offered by TripActions include prices and rewards. This makes it a great experience for personal travel too

- What makes this software solution a popular choice is the support system. Customers and their users can seek help and get prompt services

- The policy check at booking time saves employees and employers time as most policy violations are addressed at the earliest

Cons of TripActions

- Most users say that calls to airlines to confirm the booking is an inconvenience

- Users also claim that adding companions to mobile apps is difficult

Pricing

- Travel: You can sign up for their travel management solution for free. Some of the features that are included in this free package.

- Travel booking and management

- Rewards for booking airlines and hotels

- customizable travel policies

- 24/7 live agent support

- upto 50 monthly active users, and more.

- Travel and Expense: If you would like to sign up for travel and expense solutions, then you must schedule a call for customized pricing options.

Suitable for

Mid-market

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

TripActions |

|

|

|

|

|

*Check the user ratings, reviews and other details below

- G2

- Capterra

10. Zaggle

Zaggle is a travel reimbursement software designed to relieve you from the hassle-filled, time-consuming, and error-prone traditional processes of recording travel expenses. Zaggle’s expense management software hopes to ease the conundrum of the travel expense process.

The software can help record, track business expenses, and submit expense claims while eliminating non-compliance with travel policies. Zaggle hopes to tackle the most common issues of tedious workflows; no real-time visibility of business expenses and the number of man-hours required to process expense claims.

Image Credit: zaggle.in

Zaggle features

- Zaggle expense management tools help in data extraction (printed receipts and bills) and expense report submission

- Zaggle Save offers mobile phone compatibility, ensuring that expense reporting and approval are seamless

- The expense management software offers complete and easy centralized access since the information is stored on the cloud

- Zaggle’s well-designed platform checks for policy violations in real-time

Pros of Zaggle

- Real-time analytics offers visibility about expenses based on custom categories such as projects, geography, past expenses, currency, etc

- Offers an intuitive analysis of overall spending, submitted and unsubmitted reports, and unreported expenses

- The software is capable of making intelligent recommendations to compile a travel expense report (based on previous data)

- Integration with TMCs so you can easily pull expenses into the report

Cons of Zaggle

- The platform architecture- customization capabilities, UI, and configuration is limited

- Integration with accounting software and HRMS is limited

- The TMC integration is limited, not offering too many options for users

Pricing

- Zaggle Save Pricing: If you would like to sign up, then you must schedule a call for customized pricing options.

Suitable for

Small Businesses

Ratings and Review

|

Name |

Product features |

Ease of Use |

Ease of Set-up |

Support |

ROI |

|

Zaggle |

|

|

NA |

|

|

*Check the user ratings, reviews and other details below

Ways to track expense management?

Organizations worldwide use different ways to manage their expenses. It could be broadly classified as follows:

1. Traditional, paper-based tracking

Don’t you recognize this method of tracking expenses?

As employees travel, they bring back receipts and other handwritten notes as proof of expenses. Then, you put them together and submit the expense report to the accounts department periodically (per the company’s policy) for reimbursement.

Studies suggest it takes 30 days for a single expense report to go from filing to payment! There are numerous enterprises that are still stuck in this archaic way of managing expenses.

2. Spreadsheets

An image that pops up when you say spreadsheets is the finance team switching between sheets, analyzing them to identify that single error that seems to be taking up hours!

Spreadsheets become popular since computers came in and accounting systems were adopted. Most finance professionals are partial to maintaining and using spreadsheets for numerous calculations (including travel expenses).

While this may be an improvement over the earlier method, it still is tedious and prone to human error.

3. Expense management software

Estimates suggest that the expense management software market size will be valued at $10.56 Billion by the year 2027, growing at a CAGR (Compound Annual Growth Rate) of 12.8%.

An integrated and automated expense reporting software system simplifies the entire travel and expense management system, from recording expenses to the final reimbursement.

Why use expense management software?

Expense management software can help move your organization to the next level. Removing errors, digitizing the expense management process, and making your firm cost-effective, it promises to improve control over your expenses while offering financial insights.

Simplify your expense management process by completely automating the reporting, approval, tracking, analytics, and reimbursements.

You have the best ERP, CRM, and HRMS software across your organization. So, doesn’t it makes sense to switch to a completely automated expense management system?

Benefits of expense management software

Among other things, the benefits of expense management software are:

1. Cost efficiency

Cost is always one of the most significant factors in automation. In this case, sticking to traditional managing methods may cost your business even more. While the cost of automation is a genuine concern, the benefits will undoubtedly outweigh the expense.

You can choose from several versions of such management software to suit your business needs and budget. Some simple versions will even offer features without needing an IT team (where the vendor offers online support whenever required).

While most of the benefits come in the form of better employee experience, better analytics, and smoother workflows, the cost of processing does come down quite dramatically (manually to complete automation).

2. Spend visibility

Specific departments spend more than others, and visibility will allow finance leaders and teams to budget more effectively. In fact, with the correct data, you can increase the efficiency of your organization and optimize business processes such as vendor management, procurement, or travel expense management.

Automation of expense management in your company will give you that advantage of visibility.

Robust analytics can give you a quick/detailed breakdown of buying and spending activities, department-wise spending, sector-wise travel numbers, and so much other information that will make perfect sense to your finance teams.

3. Management of risk and fraud

In a study conducted on business expense fraud, 48% believed that it is alright to over-expense or ignore company expense policies

This is one of the most significant disadvantages of manually processing expenses. Wouldn’t you want to address this at the earliest?

Additionally, data entries, manually collating information from handwritten notes and receipts, and verifying the report are also prone to errors.

Expense management software removes the guesswork and the possibility of human errors by ensuring that systems cross-verify information against other data (For instance, information in expense reports is cross-verified against credit card bills/statements linked to the data).

4. Ensure compliance

Irrespective of how complex or multi-layered the policies and approval processes are, policies and rules can be easily built into the architecture of the expense management system.

For instance, if you operate in multiple countries with employees traveling to and from such places often, you are bound to be worried about the regulations related to the same. Automated expense management systems can remove this stress by ensuring adequate checks are in place, so employees can only claim what is well within the rules.

5. Flexible and scalable processes

Growing organizations must consider moving from traditional business methods to automated expense management processes as soon as possible. Cloud-based software will support your business growth and ensure the security of your data.

Further, since these systems are flexible and can scale up easily, it gives your organization the freedom to scale up effortlessly.

TOP 7 features to look for in the best expense management software

There are a whole host of options regarding the best expense management software. However, before you begin scouting for the best option, you must learn and understand the available features. List your requirements and then, evaluate them against the attributes.

While individual needs may differ from organization to organization, here are some features you must ask about before you sign on the dotted line.

1. Dashboards

Remember the image of Captain Kirk from the Star Trek series sitting in front of his console? A dashboard can make you feel like that.

In simple terms, a dashboard is a visual display of all relevant data. In this case, the more intuitive your dashboard is, the better it is for you. Intuitive dashboards will help managers and finance teams to sort through piles of information quickly and effectively. For instance,

- You can categorize expense receipts under each report on a single screen as you reconcile those numbers.

- To help establish better expense budgets, you may choose to access real-time data on expenses constantly on your screen

- You may customize a set of reports detailing a particular department’s expenses or deep dive into specific spending in a particular project.

Finance teams must look for dashboards as they are a vital weapon for fighting inefficiencies, identifying areas for tighter controls, and so on.

2. Mobile app

By far, claiming travel expenses is one of the most painful tasks for any employee. The sheer amount of work involved in saving receipts, creating an expense report, submitting the claims, and waiting with bated breath for the reimbursement can put anyone off.

While the overall employee experience suffers, there is always the problem of several man-hours lost in processing these claims.

Look for automated expense reporting software that offers intelligent and intuitive mobile apps. They can automate the capturing process and dramatically speed up the review, submission, and approval process.

If you choose wisely, the app may be ‘smart’ enough to offer custom reminders and notifications.

3. Stay on top of your compliances

You must stay on top of your internal control regulatory requirements in a dynamic business environment. Well-designed and customized expense management software can answer all your worries.

Based on data recorded by the software, you can quickly respond to changes in the business environment by making appropriate policy and process changes.

Customized software can take care of regulatory requirements, including the vendor’s GSTIN as expense entries are being made, HSN/SAC codes of goods and services during classification, and setting up GSTINs(based on the states you operate in) that may apply to your business.

4. Always ask about integrated corporate credit cards

Ask about prepaid corporate credit card options in the best expense management tools. Your employees can access prepaid spending cards that may be integrated into your system. This helps prevent fraud or misuse of corporate funds and removes bottlenecks.

These cards offer several benefits such as budget tracking, control over issuance and usage of cards, spend visibility, online payments, and easy integration with your accounting platforms.

5. Compatibility with other platforms

Make sure you ask about compatibility with your existing software and platforms. If the expense management system offers hassle-free and easy integration, it will further streamline your process.

While most challenges may be overcome with the best expense management software, you may have to understand how it will work with your existing setup, so all your concerns are addressed.

6. Does it tackle foreign currency?

If there is much overseas travel, you may want to know how the automated expense software handles expenses in foreign currency.

7. Categorisation and allocation of cost-centers:

The best expense management software and tools provide options to ensure that expenses are categorized automatically. Approval hierarchies, multi-level approvers, and other unique policy requirements can be easily incorporated into the system’s architecture.

This offers you better control over the expenses allowing you to make quicker and more effective decisions.

How to choose the best expense management software?

Let’s say you have decided to buy a new car. Would you buy the first car that impresses you? It is obvious, you must do some background work to understand the features, mileage it offers, and other factors that will influence your decision.

Expense management software is the same. There are numerous vendors, but you must pick what suits your organization.

Let us help you with some pointers on what to look for in the best expense management software for your business.

1. Existing challenges

What challenges should my firm address? This should be the starting point for anyone beginning this journey.

Putting together a list of potential problems may help you find the ideal solution.

- Expense frauds

- Ease of travel for employees

- Man-hours spent in processing travel expenses

2. Budget

William Feather said, “A budget tells us what we can’t afford, but it does not keep us from buying it.”

Based on your business needs, size, growth rate, and availability of funds, you must decide if you would like to consider a cloud-based system or any other option. However, this will depend on the kind of budget you have.

So, bring all stakeholders together and arrive at a number that will allow you to include features that you need.

Generally, smaller and mid-sized companies prefer to stick to SaaS-based applications as they are easy to work with, customizable, and scale up quite well. There is no need for hardware setup; they integrate seamlessly with all your existing third-party apps.

Similarly, larger enterprises may consider customized systems as this will allow them to design something that suits their requirements.

3. Technology and mobile capabilities

“Investing in tomorrow’s technology today is more critical than ever” – Bill Gates

It is almost impossible to imagine functioning without mobile phones, so it is essential to consider those options that offer mobile compatibility. Understand how your employees travel while learning about the conveniences that would improve their experience while making the process simpler for you.

Mobile-based, cloud expense management systems make it easy for employees to scan their receipts and compile their expense reports on the go.

This not only elevates their travel experience but also leads to better productivity at work.

How to implement an automated expense management platform?

Implementing an automated expense management platform can greatly streamline your organization’s financial processes, reduce errors, and enhance overall efficiency. Here’s a step-by-step guide on how to implement one:

1. Study your existing process

Understanding your existing process and identifying issues you want to address is essential. This will also help you to pick solutions that will handle all the significant problems you may highlight at this stage.

Here are a few ideas on how to go about it.

- First, ensure you get data to understand your problems. This could be the number of travelers in a certain period, the number of expense reports filed, the kind of expenses claimed (fuel, per diem, etc. ), a record of fraudulent behavior, travel desk issues such as multi-currency claims, and turnaround time for reimbursements

- Think about the security of your data and information. Understanding the existing setup, make sure you ask how it may improve the safety of your information while preventing the risk of fraud, cyberattacks, etc

- Functionality is an important consideration. Always ensure the solution you are considering works well with your existing applications and workflows

- While budgetary considerations are a must, the two most important questions are: How much will you spend on automating the expense reporting and management process, and what do you expect to save from the process?

2. Get your team onboard

Before you move your company from the traditional ways of handling your expenses to an automated system, you must prepare the employees in your company.

The four teams that will be affected most by such as automation are

- Accounting/finance teams

- HR Team

- IT Teams

- Traveling employees

While the actual implementation stage will require some more coordination, use frequently used channels of communication (emails, messaging boards, word-of-mouth, and any other means) to prepare employees for the change.

3. Evaluate and shortlist the most suitable products

Finding the perfect solution for your expense management woes may sound challenging. However, it does not have to be so.

All you need to do is present your challenges to your vendor and allow them to give you a product that works for you. What you can do is come up with a list of categorized requirements.

- No-compromise features

- Added features that would be a plus for your growing company

Based on what the vendors offer,

- Compile a list of vendors that satisfy your criteria

- Come up with questions you and your stakeholders may have about the product (scalability, integrations, security, and so on)

- It is a considerable cost, so it may be worthwhile to entrust someone with the responsibility to compare and rate important features of shortlisted vendors

- Most vendors will be more than happy to give you a demo of the product. Ensure all critical stakeholders are present for such demos

- Testing the product and talking to existing customers (of shortlisted products) may help make the right choice

4. Implement

Several factors determine how long the implementation stage lasts. For instance, the size of your company and the complexity of expense policies play an essential role in this stage as they will determine the scale of operations during this stage.

Proper and planned communication with employees, vendors, and stakeholders will ensure that the implementation is hassle-free.

5. Post-implementation

A review post-implementation allows you to analyze and evaluate the decision objectively. It is typically undertaken about three-six months after such an implementation. The goal is to understand if the solution addresses your business challenges effectively.

Some questions that the review must answer:

- Does it address all the expense management-related challenges?

- Do you see improvement in expense submissions, approval, and turnaround times?

- How does the system work with your other existing applications? If there are issues, can the vendor address these?

- What is the feedback on the analytics from the software?

How much does expense management software cost?

On average, prices of expense management software start from $4.99 per user per month. However, this will vary based on what you need from the solution. The price for the product will increase with customizations and the features you need.

You must contact the vendors for demos and free trials that will give you a clearer picture of the features you will need in the product.

Why is Happay the Best Software for Expense Management in India?

1. Enterprise-Grade Compliance Built for India

Happay combines global T&E capabilities with deep India-specific GST compliance and ITC automation, helping finance teams capture maximum input tax credit and eliminate manual GST reconciliation.

2. End-to-End Automation

From receipt capture to approval, reimbursement, and reporting, Happay automates every stage of the expense lifecycle, reducing manual effort and errors significantly.

3. SmartAudit AI Policy Engine

Happay’s AI-based SmartAudit engine enforces company policies in real time, flags duplicates and tampered receipts, and prevents out-of-policy claims before approvals, thereby reducing leakage.

4. Multi-Source Expense Capture

With OCR scanning, email ingestion, WhatsApp bill uploads, corporate card sync, and cab integrations, expenses are auto-captured and auto-categorized without manual entry.

5. Configurable Approval Workflows

Multi-level, role-based, and threshold-driven workflows ensure faster approvals and enforce spend controls that align with organizational structures and policy requirements.

6. Real-Time Analytics and Dashboards

Finance leaders get deep spend visibility with insights on spend patterns, budget utilization, top spenders, and policy violations to drive informed decisions.

6. Seamless Integrations

Happay integrates with ERPs, HRMS systems, corporate cards, and travel partners, ensuring seamless data flow and reconciliation across financial systems.

Some of the benefits of using Happay’s expense management system

- Your employee experience improves dramatically as Happay’s system provides a seamless and easy interface.

- An important advantage is a significant improvement in the efficiencies and accuracy of your financial team. You can save hundreds of man-hours as you settle claims faster, increase compliance, and reduce fraud.

- CFOs will see a positive change in the predictability of business spending and will undoubtedly appreciate the 100% visibility of expenses that the system offers.

Conclusion

Choosing the right expense management software is essential for businesses that are looking to improve financial control, compliance, and operational efficiency. The right platform simplifies expense tracking, approvals, reimbursements, and reporting while reducing manual errors and processing time. With multiple expense management software solutions available in the Indian market, organizations must evaluate tools based on scalability, automation capabilities, GST compliance, integrations, and user experience. A well-chosen expense management system not only streamlines finance operations but also improves transparency, governance, and employee satisfaction across the organization.

FAQs

Investing in automated expense management software is the best way to track business expenses. It will save your business cost; time and streamline your processes seamlessly.

Small, medium, and large businesses can benefit immensely from the expense management software. Companies can lower turnaround time for reimbursement claims, the number of errors, and a dramatic improvement in employee experience.

There are three ways that businesses manage expenses. First, entries of manual expenses are done in ledgers (cross-verified against physical documents provided by employees). The second method is the use of spreadsheets to record and process expenses. Finally, there are automated expense management systems that process everything automatically.

Automated expense recording and approvals on the go; integration with ERP, HRMS, and CRM applications, digital audit trails, and advanced analytical functions are some of the most common features of expense management software.

Small, medium, and large businesses with expenses and employees claiming business expenses regularly use expense management software.

The biggest challenges with expense management software are the budget, finding the right solution for your business process, and seamless implementation of such automation across your business.

There are several expense management software vendors. Make a list of challenges with your existing process, review and shortlist vendors, ask for a demo, and finalize the vendor.